Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

25 Jan, 2020

By Matt Moran

As we enter the 2020s, here are some key points about the 2010s –

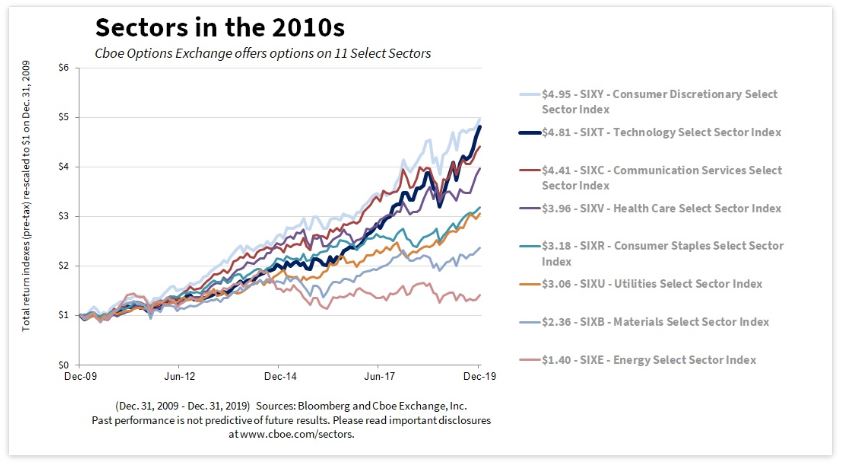

In the 2010s, Select Sector indexes that had strong performance and rose more than 340% included the Consumer Discretionary sector (its largest holdings include Amazon.com, Home Depot, McDonald’s and Nike), Technology (its largest holdings include Apple, Microsoft and Visa), and the new Communications Services sector (its largest holdings include Facebook, Alphabet, Netflix and Comcast). In contrast, the Energy sector (with Exxon Mobil and Chevron) was up only 40% in the 2010s, as the spot price of a barrel of crude oil (WTI) fell 23% (from $79 to $61) during the 2010s.

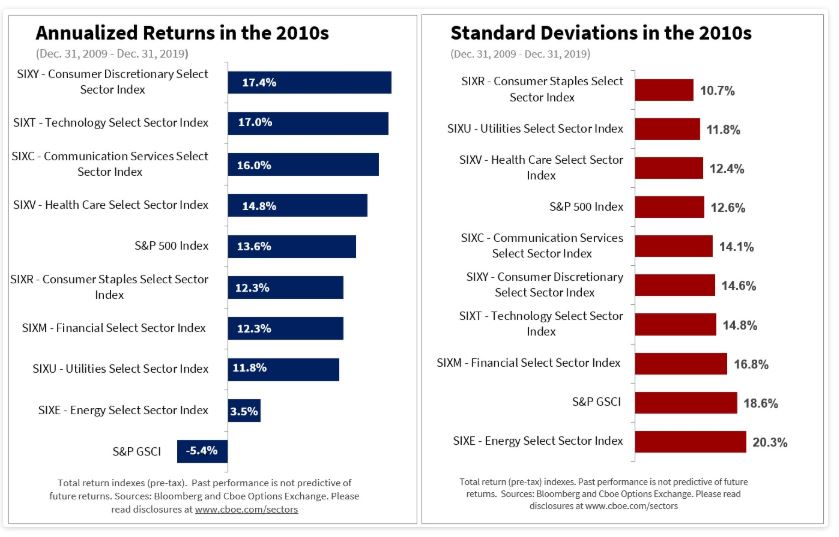

In the right-side chart below, the indexes with the highest standard deviations were the S&P GSCI and the Energy Select Sector Index (SIXE) both of which were impacted by volatile oil prices.

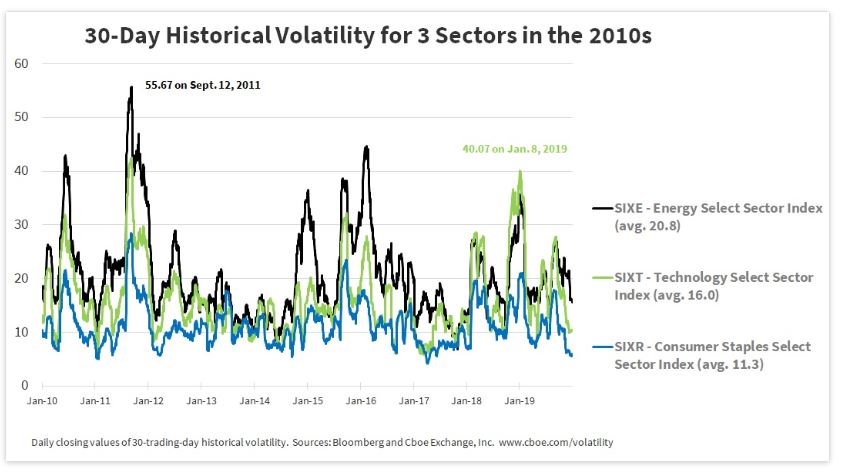

In the final chart below, the averages of the 30-day historical volatilities were 20.8 for the Energy Sector, 16.0 for the Technology Sector, and 11.3 for the Consumer Staples Sector. The peak 30-day historical volatility on the chart was 55.67 for the Energy Sector on September 12, 2011; in 2011 the spot price for a barrel of crude oil (WTI) fell from $113.93 on April 29 to $88.19 on September 12.

While the 2010s generally saw higher-than-average equity growth and lower-than-average equity volatility, a number of analysts have suggested that there may be less growth and more overall volatility in the 2020s. Some sectors had less volatility in the 2010s, and this information may be useful to investors who are exploring ways to dampen their own portfolio volatility.