Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 24 Mar, 2020

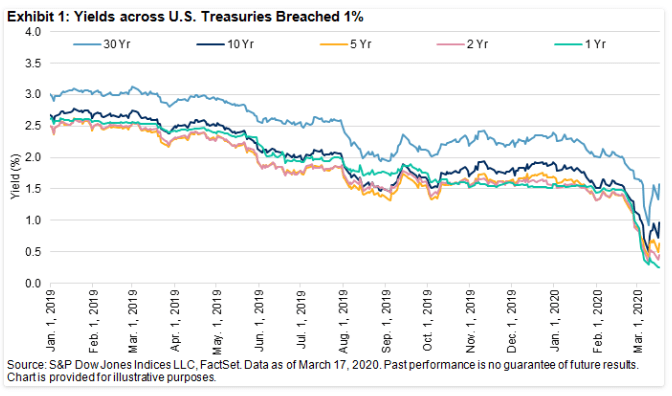

One of the most significant characteristics of the post-financial crisis world has been the global persistence of low, or even negative, interest rates. The entire U.S. Treasury curve yielded below 1% for the first time in history on March 9, 2020, in the wake of the COVID-19 pandemic, before the long end reverted recently on fiscal stimulus reports. Investors seeking exposure to income-generating strategies may first consider extending into high-yield corporates or leveraged loans, but viable alternatives exist in other asset classes.

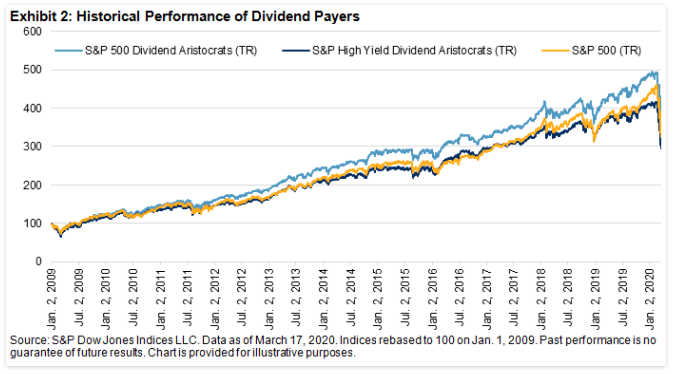

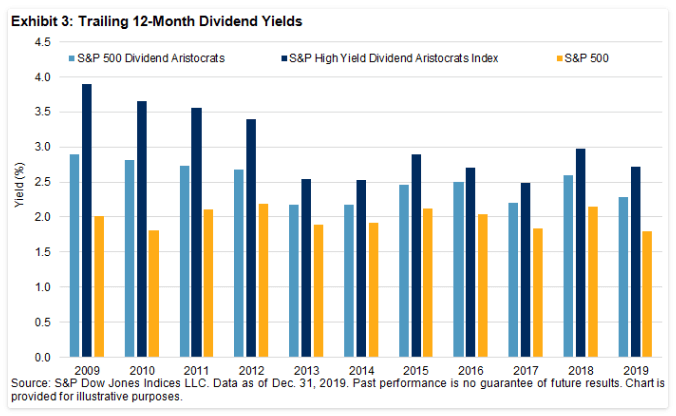

The traditional equity standbys of high-dividend-paying stocks and preferreds are the easiest expansion. U.S. companies have taken advantage of low interest rates to borrow extensively and return cash to shareholders through dividends and buybacks. The economic expansion of the past decade has provided a tailwind to the long-term and steady dividend payers of the S&P 500® Dividend Aristocrats® and the S&P High Yield Dividend Aristocrats, without sacrificing price appreciation.

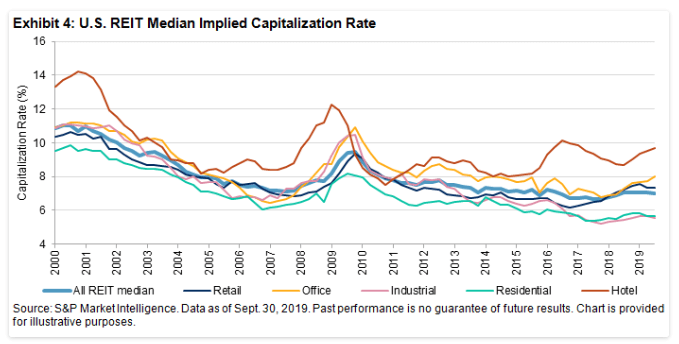

Structured finance products (ABS, CLO, CDO, etc.) can offer further income diversification and higher yields. The variety of products, underlying assets, and tranches allows for specific credit exposures or risk targets. Real assets (real estate, agriculture, commodities, and infrastructure) can provide income and act as a type of hedge to other financial instruments, as the underlying returns are often driven by practical usage rather than daily market movements. REITs and MLPs generally offer the easiest exposure to a wide array of real estate properties and locales. Mortgage-backed securities potentially offer more customized exposures, although with increased refinancing and convexity risk.

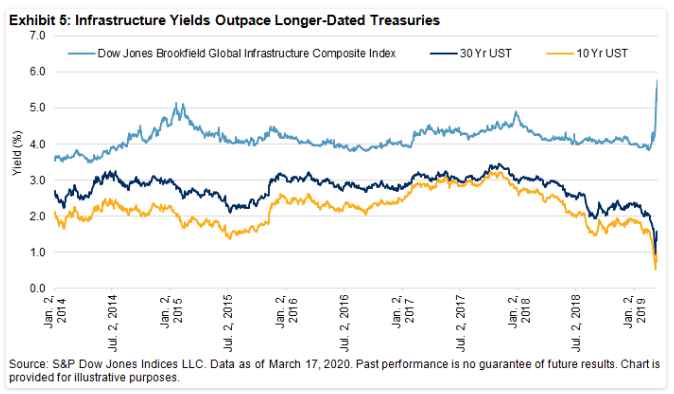

When it comes to infrastructure, many indices or funds target the cyclical construction and service-oriented firms associated with infrastructure, rather than truly offering exposure to the underlying cash flows from ownership of the assets. Shaun Wurzbach (S&P DJI) and Simeon Hyman (Proshares) discussed this last month in their Index TV video Uncovering Yield with Infrastructure, addressing the ownership and yield issue in the context of the Dow Jones Brookfield Global Infrastructure Composite Index.

Income-generating volatility strategies are another possibility. Option buy-write strategies to collect premiums can offer an extra source of income, and timing the expirations to other cash flows (asset- or liability-driven) can even reduce volatility. As an overlay, this strategy also works well in conjunction with pre-existing assets (whether intended to be income generating or not), with multiple alternatives for the option leg: