Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 18 Jun, 2020

By Rachel Du

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

On April 13, 2020, the Dow Jones REIT Index Series welcomed a new index—the Dow Jones Equity All REIT Capped Index. The strategy is a subindex of the Dow Jones Equity All REIT Index, which was launched in January 1997. Although both indices were designed to measure the performance of all publicly traded REITs, the newly launched Dow Jones Equity All REIT Capped Index has some unique features.

The Dow Jones Equity All REIT Capped Index seeks to represent the largest and most liquid REITs. To be eligible for inclusion in the index, a REIT company must have a minimum float market capitalization (FMC) of USD 200 million. An existing constituent becomes ineligible if its FMC falls below USD 100 million for two consecutive quarters. In addition, all index constituents must have a median daily value traded (MDVT) of at least USD 5 million over the prior three months. The MDVT for any existing constituents is USD 2.5 million.

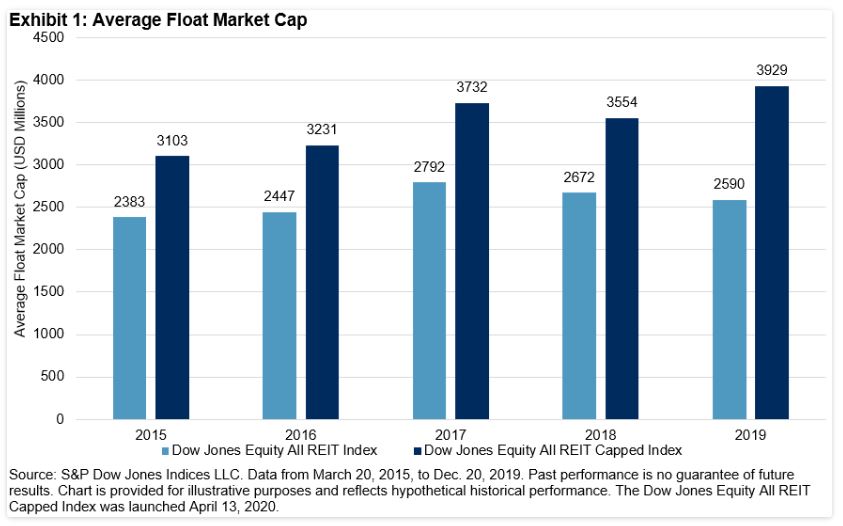

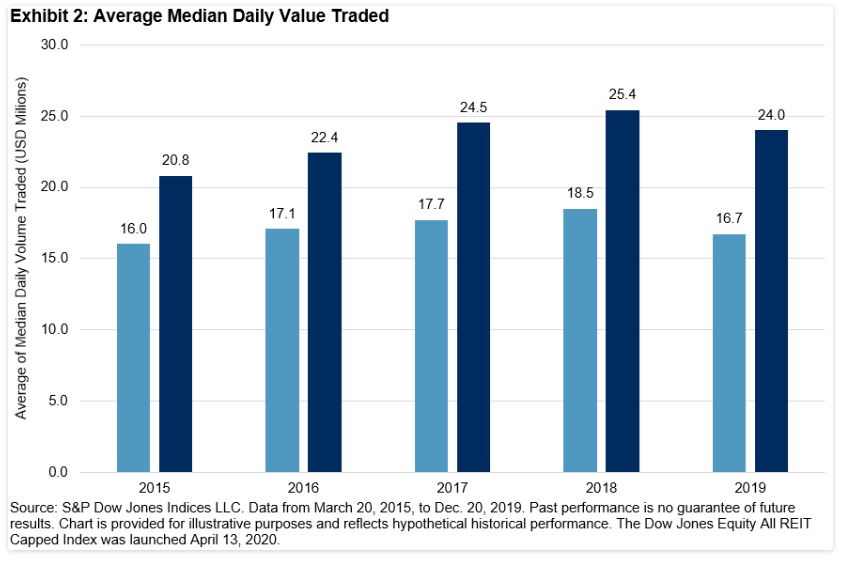

The additional market cap and liquidity criteria can potentially improve the tradability of the index. Exhibit 1 and 2 compare the FMC and MDVT[1] between the Dow Jones Equity All REIT Index and the Dow Jones Equity All REIT Capped Index. Over the past five years, the size and liquidity of the Dow Jones Equity All REIT Capped Index were higher by about 30% over its benchmark index.

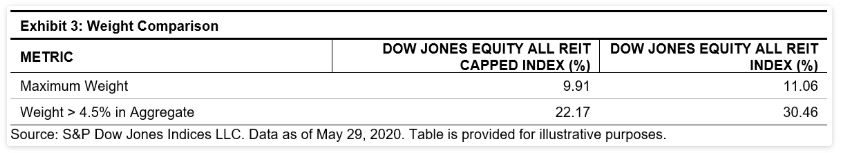

The multiple capping rules historically helped the Dow Jones Equity All REIT Capped Index reduce concentration and improve diversification. At each rebalancing, the weight of an index member is capped at 10%, and all constituents that have a weight greater than 4.5% in aggregate are limited at 22.5% of the index. Exhibit 3 shows the weight comparison as of May 29, 2020. The total weight of all constituents with a weight above 4.5% in the Dow Jones Equity All REIT Capped Index is 8.29% less than that of the uncapped version.

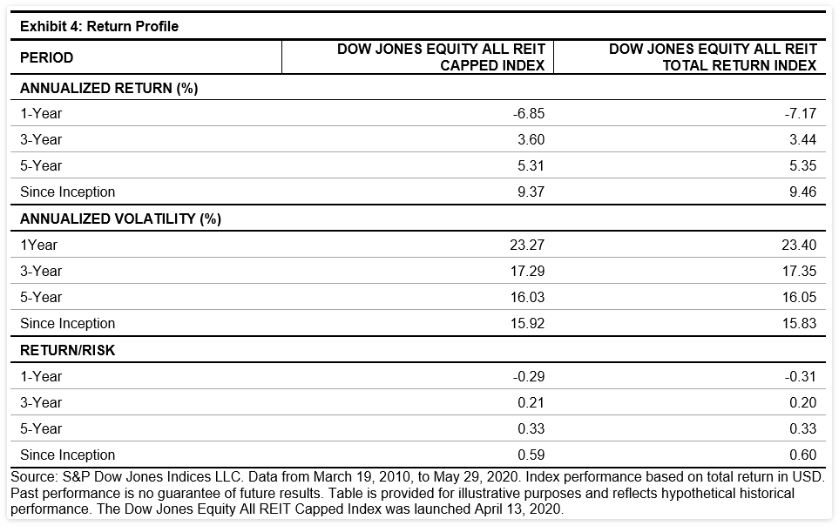

With improved tradability and diversification, the index has had a comparable performance with the Dow Jones Equity All REIT Index. Exhibit 4 illustrates that the performance of the Dow Jones Equity All REIT Capped Index is not compromised by the additional rules for size, liquidity, and diversification. While the index outperformed over the short term (one- and three-year periods), both indices had similar absolute and risk-adjusted returns over the long term (since the Dow Jones Equity All REIT Capped Index’s inception date of March 19, 2010).

[1] The FMC and MDTV data is calculated as follows: At each quarterly rebalancing, the median values of the FMC and MDTV are calculated. The average of the median values for each year are used for comparison.