Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global Ratings — 12 Jun, 2020

By Ali Karakuyu, Mario Chakar, and Kai Mirza

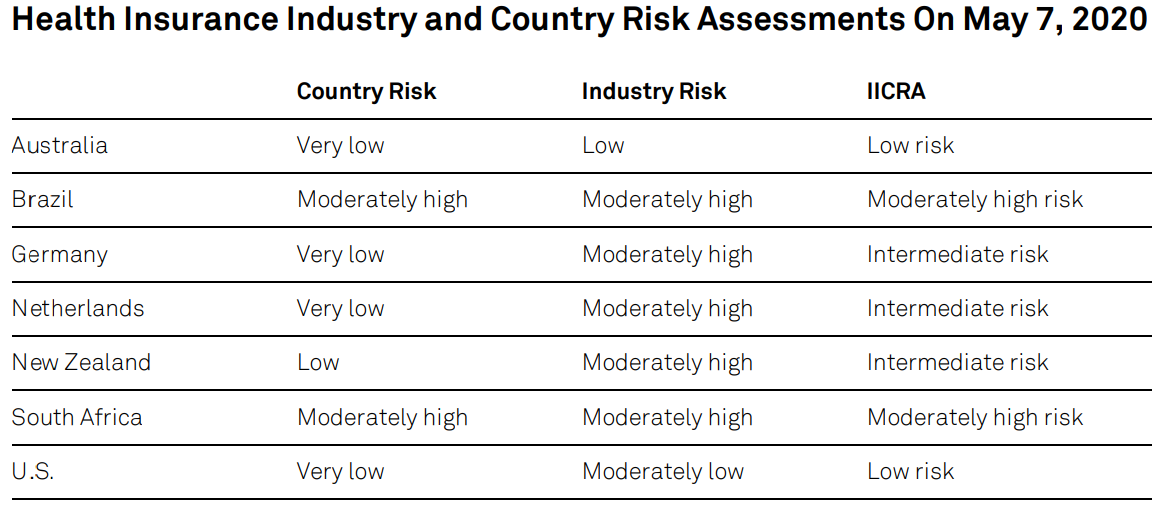

S&P Global Ratings' presents its insurance industry and country risk assessments (IICRAs) for 103 insurance sectors covering 52 countries and four global sectors. We review these IICRAs by applying our criteria "Insurers Rating Methodology," published on July 1, 2019.

Latest Actions

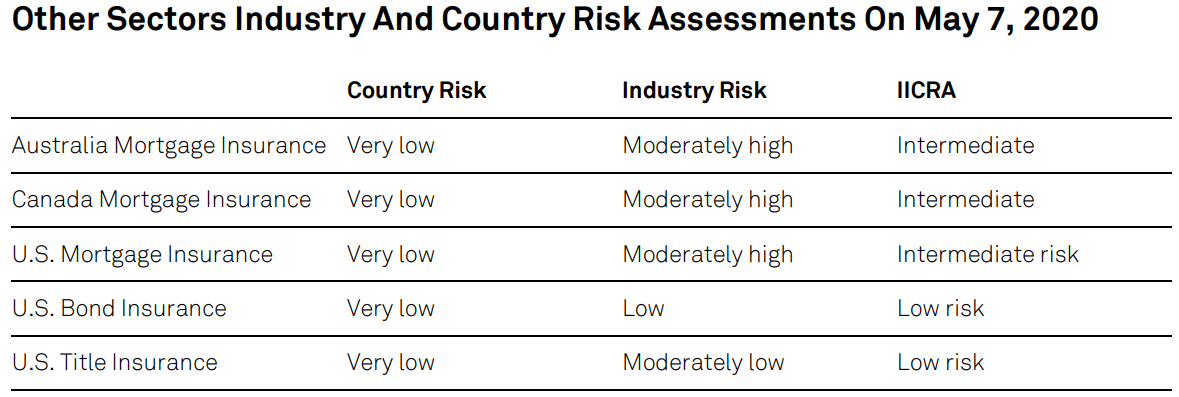

Since our most recent publication ("Insurance Industry And Country Risk Assessment Update: January 2020," published Jan. 28, 2020), we have assigned IICRAs on Azerbaijan’s property and casualty (P/C) sector. We have also revised the Canada and Australia Mortgage Insurance IICRA assessment to intermediate risk from low risk, and revised the Austria life industry risk assessment to moderately high from moderately low.

In this report, we also publish our assessment of the country and industry risks to which insurers are exposed.

About Insurance Industry And Country Risk Assessments

An insurer's business risk profile forms one of the key components of our rating analysis. It measures the risk inherent in the insurer's operations, which affects the sustainable return that may be derived from those operations. The business risk profile is based on our analysis of an insurer's competitive position, modified to incorporate the industry and country risks to which a specific insurer is exposed.

Each IICRA addresses the risks typically faced by all the insurers that operate in a specific industry and country. To determine the IICRA, we apply our "Country Risk Assessment Methodology And Assumptions," published on Nov. 19, 2013, to assess country risk, and then modify it according to our view of industry risk. We assess country risk on a scale from strongest (very low risk) to weakest (very high risk).

We assess industry risk on a four-point scale from low to high. Our analysis of industry risk addresses the level, volatility, and sustainability of profitability in a given industry sector. The primary factor in our industry risk analysis is an assessment of prospective profitability, supplemented by a holistic analysis of factors that, in combination, are likely to either support or threaten industry profitability prospects, such as barriers to entry, market growth prospects, product risk, and the institutional framework.

The impact of IICRAs on our ratings varies according to the degree of risk. The higher the risk, the greater the adverse impact on the business risk profile. The risks are categorized as 1-very low, 2-low, 3-intermediate, 4-moderately high, 5-high, or 6-very high.

Within each country, if applicable, we separately assess the life sector and the P/C sector. Where it has a distinct legal and regulatory framework, we also assess the health sector separately. In addition, in certain countries, we assess the insurance industry and country risk for the bond, mortgage, and title insurance sectors.

Some sectors are more naturally global, because insurers in those sectors typically write business in multiple countries around the world. Consequently, we assess IICRAs on a global basis for life reinsurance, P/C reinsurance, trade credit insurance, and marine protection and indemnity insurance.

Insurance Industry And Country Risk Assessment: Property/Casualty

Source: S&P Global Ratings.

Copyright © 2020 by Standard & Poor's Financial Services LLC. All rights reserved.

Very High Risk High Risk Moderately High Risk Intermediate Risk Low Risk Very Low Risk No Assessment

Insurance Industry And Country Risk Assessment: Life

Source: S&P Global Ratings.

Copyright © 2020 by Standard & Poor's Financial Services LLC. All rights reserved.

Very High Risk High Risk Moderately High Risk Intermediate Risk Low Risk Very Low Risk No Assessment

This report does not constitute a rating action.