Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 9 Jun, 2020

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

The emergence of COVID-19 caused sizeable recalibrations in financial markets as investors grappled with the anticipated impacts on people’s lives and on economic activity. Given many companies saw significant drops in market capitalizations amid the recent market sell-off, and in light of expectations for companies’ earnings to suffer from reduced economic activity, some may be wondering if we will soon see elevated S&P 500 turnover.

While I have no knowledge of what (if any) constituent changes may be made going forward – I do not sit on the S&P U.S. Index Committee, which is responsible for the S&P 500, S&P MidCap 400, and the S&P SmallCap 600 indices – the topic of higher potential turnover in the COVID-19 era highlights the importance of understanding index construction.

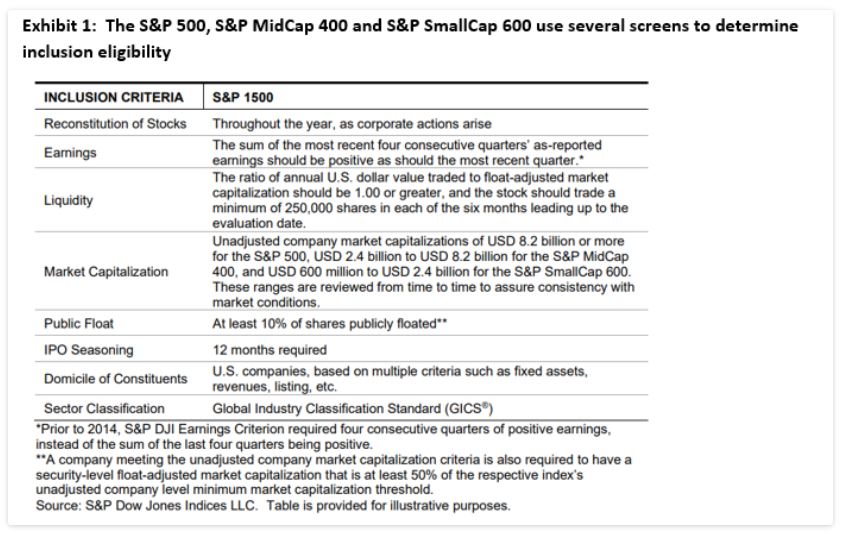

The reason some people may believe higher S&P 500 turnover beckons is that our U.S. Index Committee uses several screens when determining companies’ eligibility for index inclusion. For example, companies must have a history of positive earnings and must meet certain capitalization thresholds.

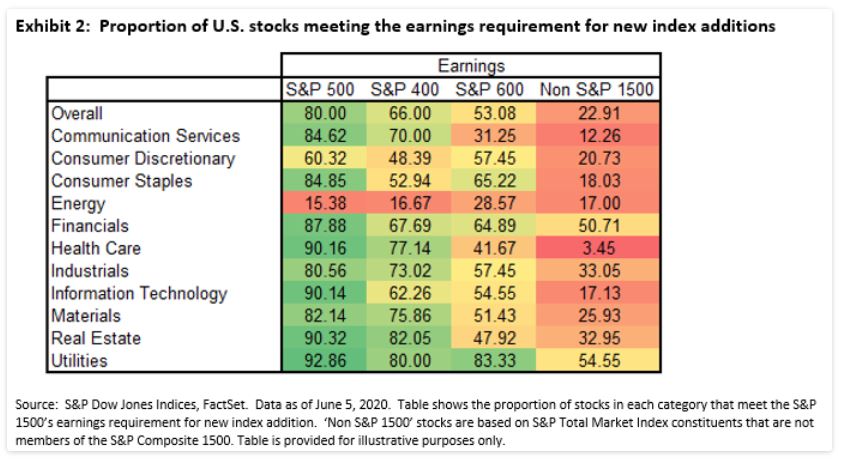

Given the aforementioned anticipated impact on companies’ earnings, it is perhaps unsurprising to see several constituents of the S&P 500, S&P 400, and S&P 600 (collectively, the S&P 1500) would not meet the earnings requirement. Energy companies’ earnings were particularly hard hit from the headwinds in commodity markets earlier this year.

But before anyone uses exhibit 2 to infer substantial turnover in S&P U.S. equity indices lies ahead, it is important to recognize that the inclusion criteria outlined in Exhibit 1 are for NEW additions to the various components of the S&P Composite 1500. It is also worth noting that many U.S. companies that are currently not members of the S&P 1500 do not currently meet the earnings requirement, and so are not currently eligible for index addition.

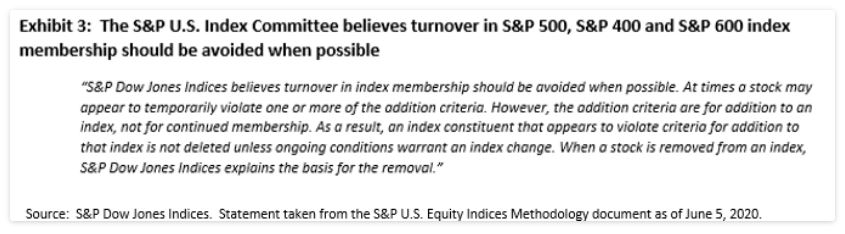

Notwithstanding the fact that many companies are ineligible for index addition, the U.S. Index Committee considers other factors – such as turnover, corporate actions, and market representation – when deciding on constituent changes to the indices. This is highlighted in the S&P U.S. Equity Indices Methodology document; exhibit 3 is a statement from the methodology document outlining the Index Committee’s commitment to minimizing turnover.

As a result, while we will have to wait and see what changes (if any) are made to index constituents, the construction of S&P U.S. Equity Indices’ indicates the recent market environment may not necessarily lead to higher turnover. Combined with the historical benefit of the S&P U.S. Index Committee making constituent changes on an ongoing, as needed basis rather than on a set reconstitution date – S&P U.S. equity indices typically exhibited lower turnover compared to alternative measures of large, mid, and small cap U.S. equities – market participants may wish to remember the importance of index construction.

Content Type

Theme

Location

Language