Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 14 Apr, 2020

By Fiona Boal

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

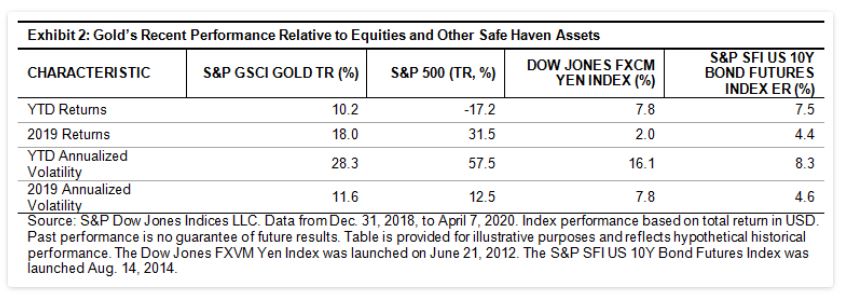

Much has been made of the relative performance of gold since the start of the global COVID-19 pandemic. The S&P GSCI Gold gained 10.2% YTD through April 7, 2020, highlighting its safe-haven status; however, it is worth reviewing this performance and considering what demand drivers may influence gold prices over the coming months.

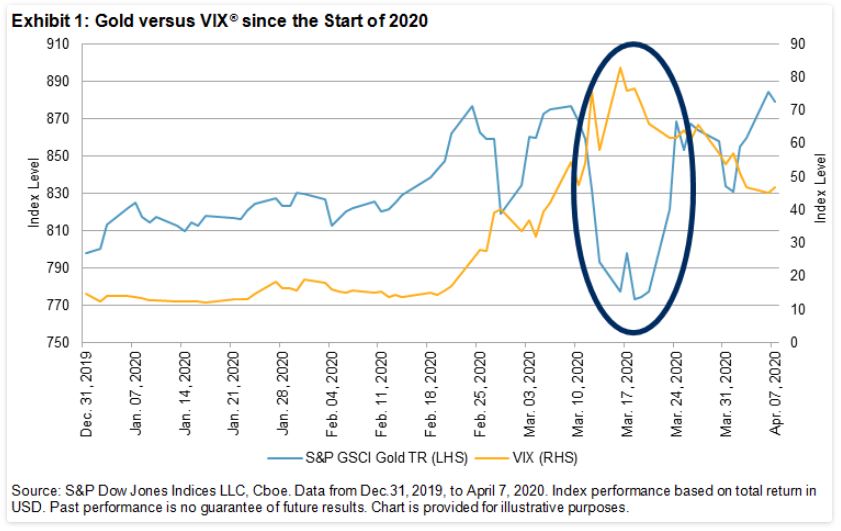

The generally held belief is that gold is negatively correlated to equities during extended bear markets, but it is not unusual for gold, and other putative safe havens, to retreat in unison on big down days in the broader market. Gold’s high liquidity makes it an attractive component of a portfolio to sell in times of urgent need for cash, such as when meeting margin calls. This is what occurred in March 2020. The spike in volatility would also have forced investors to cut the overall size of risk-adjusted positions.

It is worth remembering that gold had already enjoyed a surge in investor interest prior to the current crisis, on the back of low to negative interest rates across the globe and a myriad of geopolitical flare-ups.

As for the demand side of the equation, there is plenty of uncertainty in the near term. Jewelry demand, which accounted for approximately 50% of all demand for gold in 2019, has undoubtedly fallen since the start of the year, but it is too early to say by how much. The World Gold Council estimated that Chinese consumer demand fell 30%-50% year-over-year in Q1 2020. Many also expect that jewelry demand in the West will not perform as strongly in the current economic climate.

Central bank buying is even more uncertain, with oil-rich nations negotiating the impact of a collapse in energy prices, and other global sovereigns looking to fund large stimulus packages to mitigate the impact of the current economic downturn.

Investor demand for gold is expected to remain strong, although from a portfolio construction and diversification standpoint, there will be a point at which large investors choose not to add to their gold holdings. The massive fiscal and monetary response by governments to manage, and hopefully lessen, the financial impact of the pandemic has triggered inflationary concerns among some investors. As a hedge against inflation, gold is still viewed by many market participants as the “currency of last resort.”

The supply-side implications should not be ignored. Disruptions to the flow of physical gold between London and New York has already caused some disturbances to the usually stable differential between London Spot and COMEX futures price and led to the launch of a new futures contract that allows for the delivery of a wider choice of gold bars. There has also been a notable disruption to mine supplies that will flow through to the market.

S&P Dow Jones Indices offers a variety of gold-related indices, including the S&P GSCI Gold, S&P WCI Gold, S&P Commodity Producers Gold Index, and S&P GSCI Gold Dynamic Roll 70/30 Futures/Equity Blend (USD).