Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Dow Jones Indices — 27 Apr, 2021

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

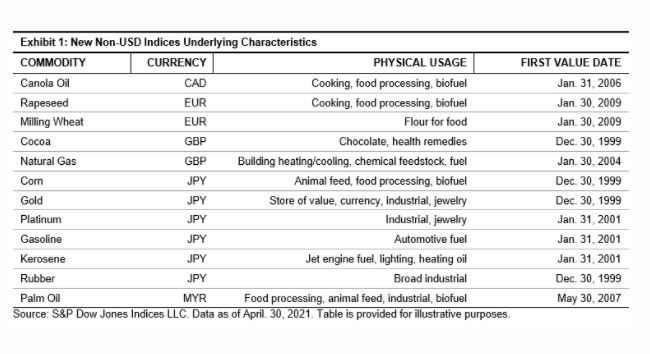

Concerns of a rising U.S. dollar may pose a hindrance to initiating commodity exposure from outside the U.S. Most commodities around the world are priced in U.S. dollars, so when the value of the U.S. dollar rises, the value of commodities typically falls. The launch of new non-U.S.-dollar-denominated S&P GSCI Single Commodities Indices could help commodity exposure seekers gain access while alleviating the external currency risk. Exhibit 1 shows the newly expanded universe of the S&P GSCI Single Commodities Index offerings. These indices are designed to track commodities from exchanges outside of the U.S. and are priced in currencies of the home countries.

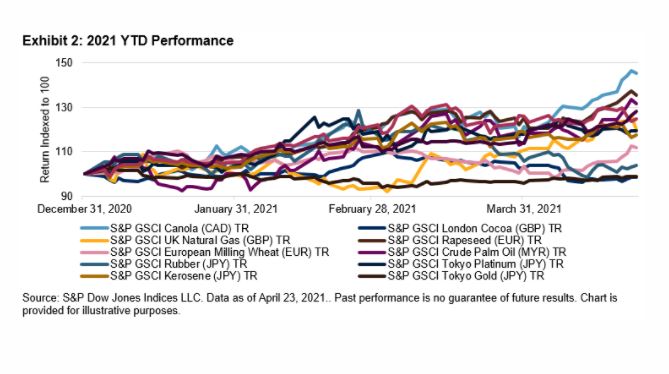

These indices not only offer a non-U.S. dollar exposure to natural resources, but also assist with the financialization of alternative commodities markets, some of which are completely new, and others that are alternatives to more-established futures markets. Exhibit 2 illustrates the 2021 YTD performance of many of these commodities.

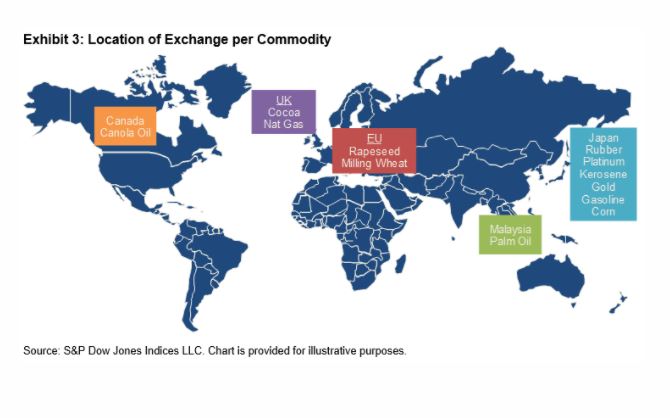

There are good reasons for the recent excitement around these commodities. Several of these commodities are used in renewable diesel applications. Fiona Boal, Head of Commodities and Real Assets at S&P DJI, wrote a two–part blog series discussing the expanding interest in these non-fossil-fuel inputs to renewable energy. Several other of these indices expand the geographic footprint and offer alternatives to the more well-known commodities like gold, corn, and natural gas that are traded on U.S. exchanges. The Tokyo-, London-, Saskatchewan-, Paris-, and Kuala Lumpur-based futures offer commodity participants exposure outside of traditional U.S.-based markets.

Tactically allocating to individual commodities when conditions are ripe has historically only been within the realm of a small group of domain expert traders. But as the broad cohort of market participants becomes more sophisticated and access to alternative asset classes improves, it is possible that the tactical allocation to commodities will expand. Commodities can be used as building blocks to express thematic macro plays and can easily be traded due to highly liquid and robust markets. Commodities also benefit from being equally tradeable, in both long and short positions. Single-commodity indices tracking front-month futures contacts provide the opportunity to access this market on the long or short side.

Check out our new website celebrating 30 years of the S&P GSCI and our newly published thought leadership paper looking at what the next 30 years might have in store for commodities.

The posts on this blog are opinions, not advice. Please read our Disclaimers.