Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 15 Oct, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

All was not well on Madison Avenue and elsewhere across the global advertising industry during the second quarter of this year. Advertising agencies suffered its biggest single-quarter revenue drop in history, and the biggest global advertising groups—Interpublic Group of Cos. Inc., WPP PLC, Omnicom Group Inc., and Publicis Groupe SA—shrank. All four agencies cut staff in order to compensate for lost revenue.

While many companies and sectors reduced their ad spending or eliminated it entirely during the coronavirus-related lockdowns, some increased their outlays to reflect changing conditions. Businesses in the healthcare, retail, food and beverage, and technology and telecom sectors generally increased their spending, while the auto and travel sectors saw the sharpest cuts.

The effects of declining revenues for the ad industry are reverberating across the media landscape. Ad-supported video-on-demand (AVOD) platforms were squeezed between increased viewership and declining ad budgets during lockdowns. Industry observers remain bullish on the long-term outlook for AVOD and its place in the advertising mix beyond the COVID-19 crisis.

Roku CEO Anthony Wood told S&P Global Market Intelligence that he doesn’t expect traditional TV advertising to return to pre-pandemic levels before next year.

"All advertising is going to switch to OTT [over-the-top, or streaming] for video, and we're just still in the very early days," Mr. Wood said. "COVID ultimately pulled forward a bunch of cord-cutting that was going to happen anyway. Linear television was already experiencing double-digit ratings declines year-over-year."

Globally, COVID-19 lockdowns seem to have benefited digital platforms over traditional forms of entertainment. In India, where TV advertising has dipped 15 to 20% this year, live content on Instagram has increased 60% since lockdowns began.

Cable networks and cable providers are also feeling the pinch of declining ad revenues. NBCUniversal saw revenues fall over 25% year-on-year. This drew the attention of activist investor Trian Fund Management, which bought 20 million shares of Comcast, the parent company of NBCUniversal. Trian has historically created value by encouraging its investment targets to break up or divest certain assets. NBCUniversal has announced plans to reduce the company's cable-network business, cut jobs, and re-evaluate entire networks.

While advertising has suffered through an undeniable annus horribilis, the industry continues to look to the future. Digital, contextual, and influencer marketing are bright spots for growth, according to the industry publication AdAge. Programatic buying of video content has also increased during this challenging year. The industry that once wished to “buy the world a Coke” continues in different media, with different tools and methods, accelerated by the year of the coronavirus.

Today is Thursday, October 15, 2020, and here is today’s essential intelligence.

COVID-19 Vaccine Trust, Scalability are Front of Mind at HLTH Conference

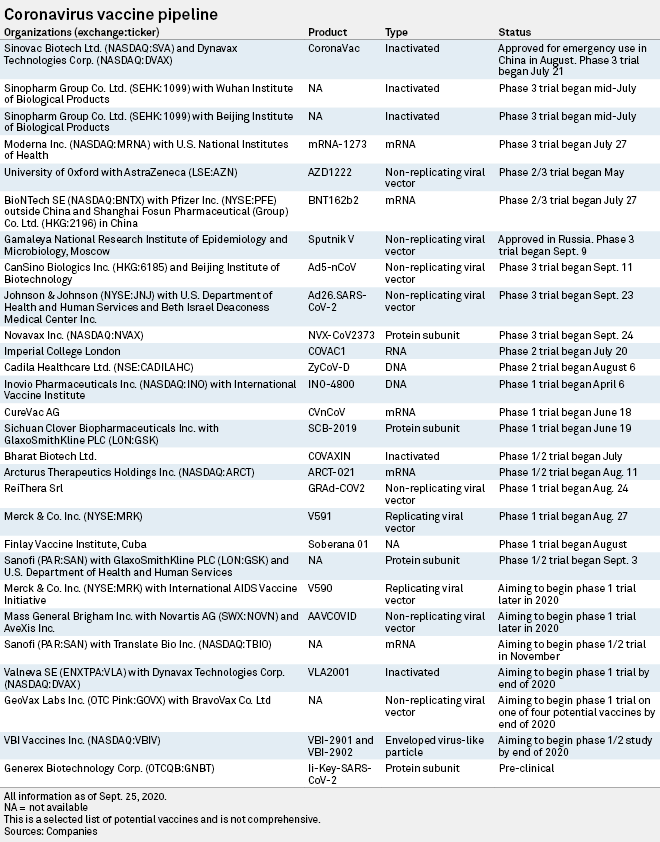

As pharmaceutical companies edge closer to an effective coronavirus vaccine, healthcare executives say building trust with the public is the next hurdle in combating the pandemic. While Merck & Co. Inc. is not leading the race — its vaccine candidate is still undergoing phase 1 trials, while the likes of AstraZeneca PLC, Johnson & Johnson and Moderna Inc. are already in phase 3 — executives told a virtual conference that the company's slower strategy will hopefully lead to an easily accessible and effective treatment.

—Read the full article from S&P Global Market Intelligence

Dramatically Altered Election Stage Set for U.S. Governors', Legislators' Races

On Nov. 3, 11 states will hold gubernatorial elections. Of those 11 states, nine incumbents will be running to keep their position as the chief executive of the state. Montana Gov. Steve Bullock is ineligible to run for reelection due to term limits, while Utah Gov. Gary Herbert has decided to forego reelection. A handful of utility commissioners will potentially be affected by the gubernatorial races.

—Read the full article from S&P Global Market Intelligence

Car Industry Turns Corner in Q3 but COVID-19 Resurgence Means More Hazards Ahead

Automakers are likely to report improved results for the third quarter of one of the toughest years in their history, with rebounding demand for premium and electrified cars shielding manufacturers prominent in those segments from the full force of the unfolding economic downturn. S&P Capital IQ mean consensus analyst estimates show that after a horrendous second quarter blighted by lockdowns that kept both consumers and car factory workers at home, most automakers are expected to return to profit, albeit at a lower level than in the year-ago period.

—Read the full article from S&P Global Market Intelligence

Cherry-Picking Systemic Risks is 'A Path to Run-Off' for Insurers

The insurance industry runs the risk of irrelevance if it chooses to take only the easy-to-manage parts of the systemic risks facing its customers, according to a panelist at a terrorism insurance conference. The industry's response to the coronavirus pandemic and claims disputes have focused attention on its role in helping companies and individuals manage wide-ranging societal risks.

—Read the full article from S&P Global Market Intelligence

Estimating Probability of Default in Project Finance Portfolios

S&P Global Market Intelligence’s most recent case study dissected how a development bank was able to leverage the ESG-enhanced Project Finance Scorecard solution to efficiently track the creditworthiness of their project finance portfolio. The Scorecard provided the bank with a comprehensive evaluation model that could help the credit risk teams to identify issues with Project Finance transactions as well as understand the various factors affecting their creditworthiness.

—Watch and share this video from S&P Global Market Intelligence

Regal Theater Closures Present a 'Very Serious' Problem for Retail Landlords

A potential cascade of movie theater closures presents a major problem for mall and shopping center landlords already contending with an overflow of retailer tenant bankruptcies and anemic space demand, according to an expert in lease restructuring. U.K.-headquartered Cineworld, parent of Regal Cinemas, the second-largest movie theater chain in the U.S., said last week that it would "temporarily suspend operations" at Regal theaters on Oct. 8 in view of the "increasingly challenging theatrical landscape and sustained key market closures" related to the coronavirus pandemic.

—Read the full article from S&P Global Market Intelligence

Copper CBS September 2020 Copper Prices Rise as U.S. Dollar Weakens

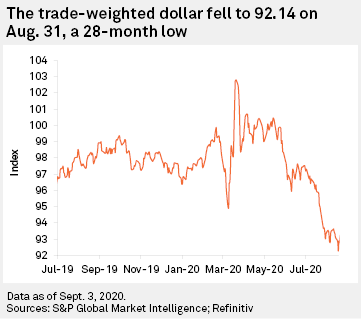

London Metal Exchange copper cash prices rose to US$6,789 per tonne on Sept. 1, the highest level since June 2018, 5.4% higher than the US$6,441/t level on Aug. 3. The price rally is strongly linked to U.S. dollar weakness and the continued ramp-up of Chinese refined copper consumption. As a result, S&P Global Market Intelligence has increased its forecast for the copper price for 2020.

—Read the full article from S&P Global Market Intelligence

Europe's Top Banks Bulk up Capital Cushions, but Market Wary as Virus Resurges

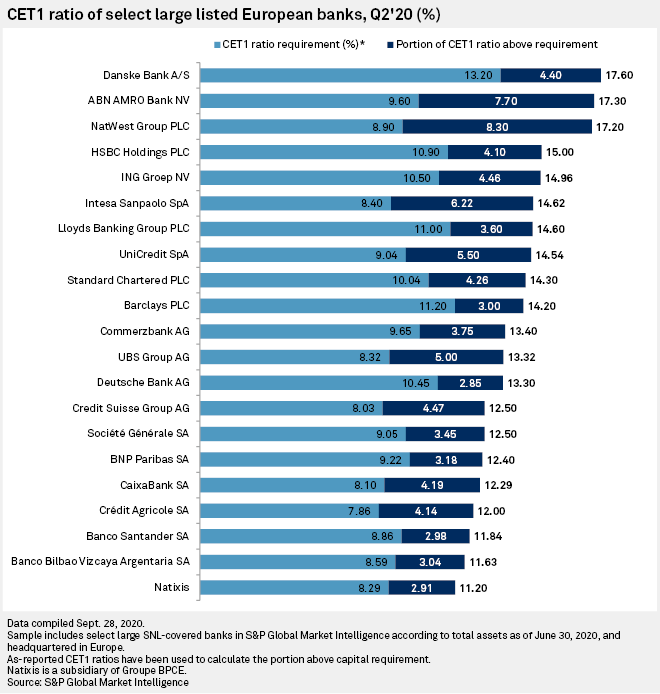

Most of Europe's largest banks posted higher core capital ratios in the second quarter, strengthening their ability to mitigate the negative effects of the coronavirus pandemic, S&P Global Market Intelligence data shows. Nevertheless, the recent resurgence of COVID-19 infections across the continent has cast a cloud over the prospects for an economic recovery and banks' credit losses, analysts said.

—Read the full article from S&P Global Market Intelligence

Urge to Merge Hits Italy as Banco BPM Becomes Subject of Takeover Speculation

Amid expectations that Intesa Sanpaolo SpA's recent merger with Unione di Banche Italiane SpA could be a catalyst for long-awaited consolidation in Italian banking, speculation is growing that Banco BPM SpA, the country's third-largest lender, may soon become a takeover target. But while Italy's crowded market would likely benefit from consolidation, the current climate may make deal-making tricky.

—Read the full article from S&P Global Market Intelligence

Sabadell Faces Consolidation Conundrum as Spanish Banking Market Heats Up

Banco de Sabadell SA may not be the ideal partner for a merger due to weak profits and low capital but remaining a stand-alone bank could be problematic too, analysts said. As merger fever grows in Spain with CaixaBank SA set to take over Bankia SA and Unicaja Banco SA resuming tie-up talks with Liberbank SA, midsize Sabadell could find itself falling behind larger, better-capitalized peers. It currently ranks as Spain's fourth-largest bank in terms of assets and net loans, according to S&P Global Market Intelligence data, behind CaixaBank, and the latter's acquisition of Bankia will leave Sabadell in a much weaker position.

—Read the full article from S&P Global Market Intelligence

In Trading Results, Wall Street's Big Banks find Some Relief from Tumultuous Q2

For Wall Street's biggest banks, 2020 is shaping up to be a heyday for trading. JPMorgan Chase & Co., Citigroup Inc., Goldman Sachs Group Inc., Morgan Stanley and Bank of America Corp. all saw double-digit spikes in trading revenues during the second quarter as financial markets around the world reacted to the continued fallout from the COVID-19 pandemic.

—Read the full article from S&P Global Market Intelligence

Indonesia's 3-way Islamic Bank Merger to Build Scale, Raise Competitiveness

Indonesia's planned merger of three state-owned Islamic banks will create an entity with scale comparable with the biggest local lenders and may give a fillip to Shariah-compliant finance in the world's biggest Muslim nation by population, analysts say. The proposed merger between PT Bank BRIsyariah Tbk, PT Bank Syariah Mandiri and PT Bank BNI Syariah, announced on Oct. 13, will create an entity with between 220 trillion rupiah and 225 trillion rupiah in assets, Hery Gunardi, vice director of Bank Mandiri said at a press conference on October 13.

—Read the full article from S&P Global Market Intelligence

Listen: Building a Global Hydrogen Market from Europe

To date, there is no integrated strategic vision for trading low carbon hydrogen, but European gas grid operator SNAM's VP of Hydrogen Cosma Panzacchi discusses ways that could happen over time with S&P Global Platts Hydrogen Content and Pricing Specialist Jeffrey McDonald. Discussion topics include development of the European Hydrogen Backbone, the formation of local vs. international supply chains, and the need for clear international standards on low carbon hydrogen.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Platts

Hydrogen Witnessing Strong Momentum Despite COVID-19 Challenges: Ministers

The move towards a global hydrogen society is witnessing strong momentum as both governments and private players speed up their plans to embrace the clean fuel despite COVID-19 creating challenges along the path, speakers at the online Hydrogen Energy Ministerial Meeting said October 14. However, scaling up production in order to bring down costs, as well as creating competitive transportation methods and implementing regulations on safety would be crucial for countries to make it a part of their energy mix, according to speakers at the meeting being hosted by Japan.

—Read the full article from S&P Global Platts

Japan Steps up Carbon Cycling Cooperation, Latest with U.S. to Tackle Climate Change

Japan is stepping up its cooperation on carbon recycling as a means of combating climate change, signing the latest memorandum with the US to collaborate in areas including carbon dioxide plus hydrogen to chemicals and fossil fuels or waste to hydrogen technologies. "In response to the climate change issue, Japan and the US share basic principles on responding to it with all kinds of energy and technology," director-general of oil, gas and mineral resources at the Ministry of Economy, Trade and Industry, Ryo Minami, told S&P Global Platts October 14.

—Read the full article from S&P Global Platts

EC to Explore Methane Emission Standards for EU Fossil Gas Use

The European Commission plans to explore all options to reduce methane leaks, including possible binding minimum standards for fossil gas used in the EU, it said in an EU methane emissions reduction strategy published on October 14. Methane is a potent global warming greenhouse gas, and most leaks happen before the natural gas or LNG reaches the EU, so a new EU policy on methane emissions could have far-reaching impacts on the global gas market.

—Read the full article from S&P Global Platts

Global Carbon Capture Hopes May Have To Be Moderated, Total CEO Warns

Expectations of carbon capture and storage (CCS) as a tool for curbing CO2 emissions may have to be moderated, with projects most likely to succeed in major industrial clusters close to offshore storage sites, and currently requiring heavy government subsidy, Total CEO Patrick Pouyanne said October 14. Speaking at the Energy Intelligence Forum, Pouyanne said CCS had a role to play in all current plans for climate change mitigation, and Total was considering a new carbon capture and storage project either in Antwerp or at the Zeeland refinery in the Netherlands, which it owns with Russia's Lukoil.

—Read the full article from S&P Global Platts

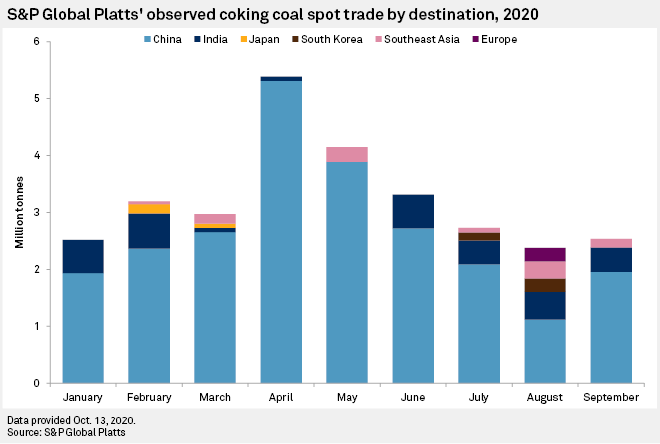

Chinese Ban on Australian Coal Hits Home Amid Confusion over Beijing's Orders

Traders in China are said to be "desperate" to sell their Australian coal cargoes back into the market since S&P Global Platts revealed Oct. 9 that China sought to restrict coal imports from Australia. However, experts suggest it will not be easy to wean Chinese users off Australia's high-quality coking coal amid confusion on the ground in Asia over Beijing's instructions. China's state-owned utilities and steel mills received verbal notice from customs to stop importing Australian thermal and coking coal "with immediate effect," Platts reported, citing several sources close to the matter.

—Read the full article from S&P Global Market Intelligence

Oil Demand Won't Hit Pre-Pandemic Level Before 2022: IEA's Birol

Global oil demand may not recover to its pre-pandemic level of around 100 million b/d until at least 2022 despite signs of it recovering in Asia as many countries are re-introducing restrictions that affect their economies, the head of the International Energy Agency told S&P Global Platts October 14. "It is too soon to know when, or if, demand returns to the 100 million b/d level we saw in 2019, but based on our estimates for 2020 and 2021 it will not happen before 2022 on an annual basis and possibly later," IEA Executive Director Fatih Birol said in a written interview with Platts ahead of the Oct. 14 Hydrogen Energy Ministerial Meeting being hosted by Japan.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language