Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 9 Nov, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

After being declared the winner of the U.S. presidential election on Nov. 7 by all of the major newspapers and media networks, Joe Biden and Kamala Harris immediately signaled plans for significant policy changes. The president- and vice president-elect are expected to name nominees for cabinet positions as early as today.

"Our nation is grappling with a pandemic, an economic crisis, powerful calls for racial justice, and the existential threat of climate change. President-elect Biden and Vice President-elect Harris know we can't simply go back to the way things were before. The team being assembled will meet these challenges on Day One and build us back better," the Biden-Harris transition team said on its website.

On Saturday, the president-elect said in his victory speech that he will “spare no effort—or commitment—to turn this pandemic around," and will bring together a “group of leading scientists and experts" to build “an action blueprint” to help the country gain control of the pandemic with a plan “built on a bedrock of science.”

Mr. Biden and Ms. Harris will today announce the members of the COVID-19 taskforce, which will be led by former U.S. Surgeon General Vivek Murthy and former U.S. Food and Drug Administration head David Kessler, according to Biden deputy campaign manager Kate Bedingfield.

Another pillar of the transition will be energy and climate policy. During his campaign Mr. Biden repeatedly said that he would rejoin the multilateral Paris Agreement on “day one” of his presidency. His $2 trillion climate plan prioritizes investments in renewable energy, green infrastructure, and additional sustainable initiatives that will supplant fossil fuel generation, but doesn’t fully forbid fracking. If the Biden Administration bans new federal drilling permits, 1.1 million barrels per day of oil output and 3.7 billion cubic feet per day of gas output will be at risk by 2025, according to S&P Global Platts Analytics.

The outcome of the country’s Senate elections will dictate what Democrats are able to accomplish in their legislative energy agenda and increase the importance of Mr. Biden’s executive actions. Two Senate runoff races in Georgia that will occur in January will shape whether Republicans maintain their majority control of the congressional chamber.

"Energy remains a powerful wedge in an increasingly divided America," Katie Bays, managing director of FiscalNote Markets, told S&P Global Platts.

The potential for a partisan battle over climate policy will likely delay, rather than entirely block, new legislation.

"There is ample opportunity for significant benefits moving forward, and you can do that without a consenting authority of the legislature," Gina McCarthy, president and CEO of the Natural Resources Defense Council, told reporters on a Nov. 5 media call, according to S&P Global Market Intelligence. "You can do it under the authorities that are given to the executive branch, and I expect [Biden will] use and consider all of those."

The Biden Administration also promises the possibility of reshaping the U.S.’s foreign energy policy.

Hindustan Oil Corp. Chariman M.K. Surana, who oversees India's third-biggest state-run refiner, told S&P Global Platts on Nov. 8 that Mr. Biden’s presidency “will propel the policy framework towards more stability as far as energy is concerned" and will promote trade between the U.S. and India of crude oil and liquified natural gas.

Iranian President Hassan Rouhani signaled that the U.S. and the Middle Eastern country could re-negotiate terms of the Iran nuclear deal, designed by the Obama Administration when Mr. Biden served as vice president to release Iran from some sanctions in return for reduced nuclear activities. “Now, a chance has turned up for the future U.S. government to compensate past mistakes and return to the path of commitment to international obligations by respecting global norms,” Mr. Rouhani said on Nov. 8.

"The markets believe that the Biden administration will be more positive for international trade and could bring the U.S. back into that framework, lifting global economic growth and providing a boost to global oil consumption," OANDA senior market analyst Jeffrey Halley told S&P Global Platts today.

Today is Monday, November 9, 2020, and here is today’s essential intelligence.

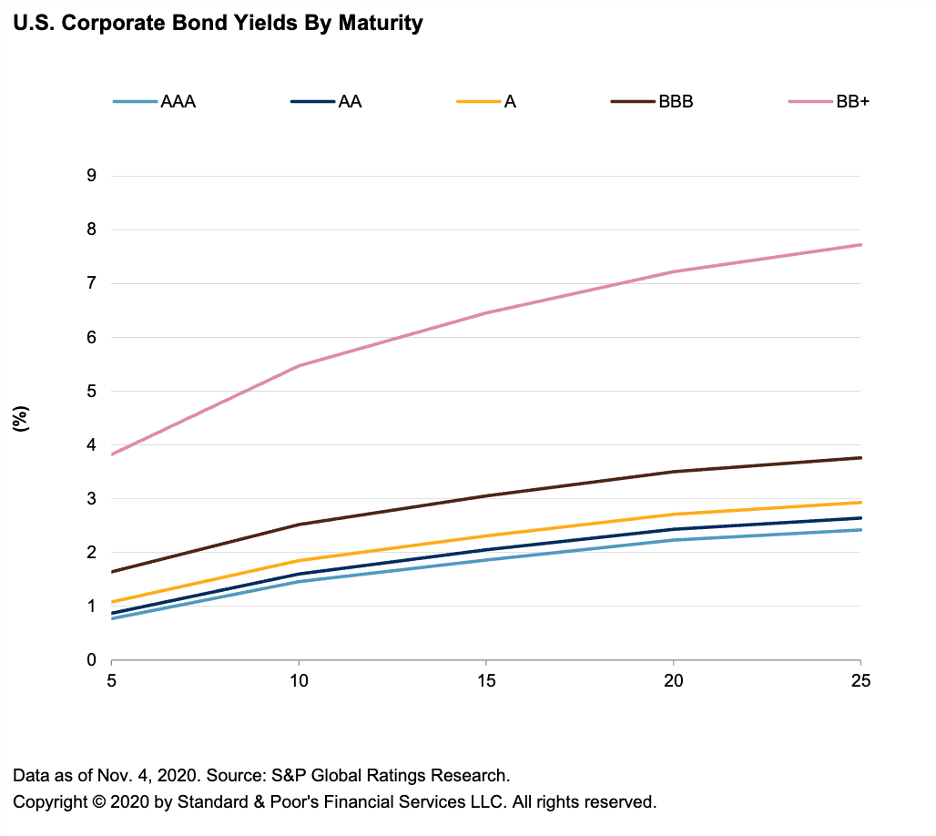

Credit Trends: U.S. Corporate Bond Yields As Of Nov. 4, 2020

This article contains data compiled by S&P Global Ratings Research, provider of analytical and timely information on S&P Global Ratings' secondary market yields for investment-grade and high-yield corporate bonds.

—Read the full report from S&P Global Ratings

The U.S. Lodging Sector: A Slower Recovery Could Take Until 2023

he coronavirus pandemic upended the U.S. lodging sector this past year, and S&P Global Ratings doesn't think a recovery will take hold in earnest until there's a widely disseminated medical solution--likely in the second half of 2021.

—Read the full report from S&P Global Ratings

Scenario Analysis: Japanese RMBS' Credit Enhancements Tolerate Pandemic Stresses

The pandemic's path remains uncertain, as Europe is now learning. This could mean more upheaval for Japan in the future, and possibly pressure the performance of securitizations in the country, if the COVID-19 infection rate rises.

—Read the full report from S&P Global Ratings

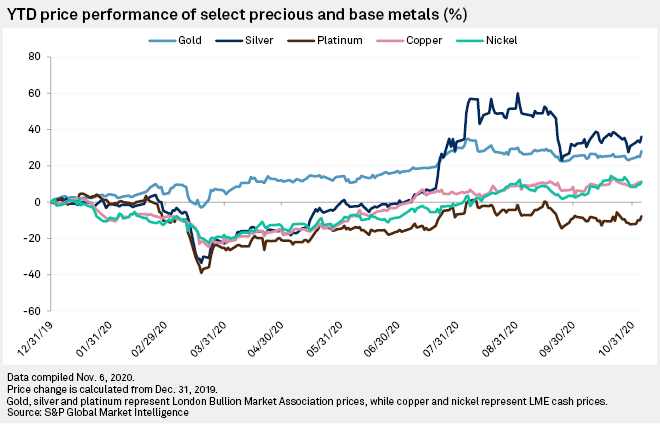

Gold May Rally on Prolonged U.S. Election Uncertainty, Push to Discredit Votes

What was already a turbulent period in metals markets due to the coronavirus pandemic could become even more topsy-turvy if the U.S. presidential election becomes mired in a prolonged attempt by President Donald Trump to discredit the results.

—Read the full article from S&P Global Market Intelligence

A Volatile Week for Renewable Stocks Reflects Biden Presidency Prospects

After initially plummeting amid an early vote count in the U.S. presidential election that leaned toward a second term for President Donald Trump, renewable energy stocks roared back along with the prospects of Democratic challenger Joe Biden.

—Read the full article from S&P Global Market Intelligence

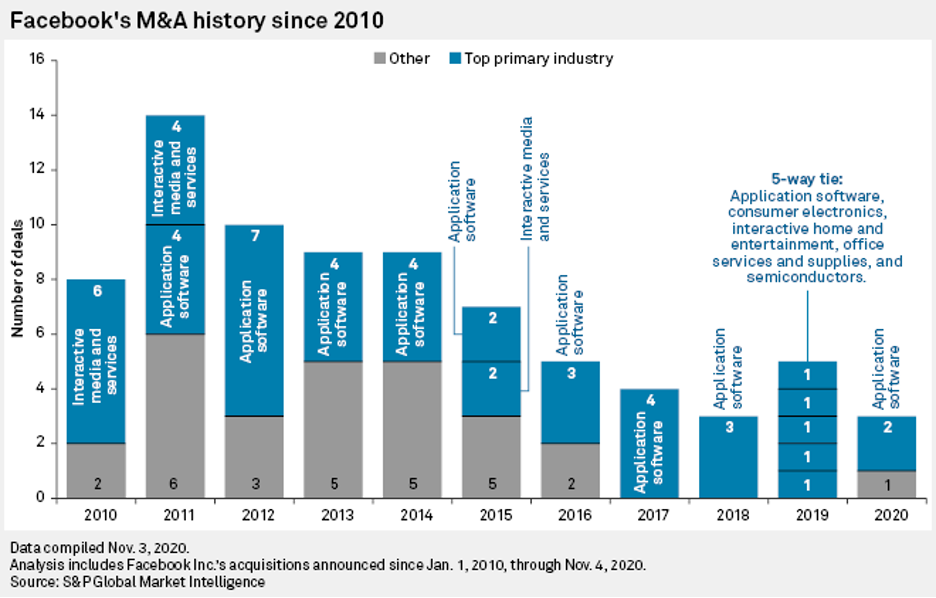

UK's Facebook, Giphy Deal Scrutiny Is Sign of M&A Challenges to Come — Analysts

Scrutiny of Facebook Inc.'s acquisition of animated-picture database Giphy Inc. in the U.K. suggests the country is taking a harder line on the social media company's deal-making.

—Read the full article from S&P Global Market Intelligence

Merck & Co. Gains Blood Cancer Focus With $2.75B Velosbio Deal

Merck & Co. Inc. has taken another step to bulk up its pipeline and complement the Keytruda franchise with the $2.75 billion acquisition of cancer drugmaker VelosBio Inc.

—Read the full article from S&P Global Market Intelligence

Bristol-Myers Looks Beyond Revlimid's 75% Revenue Boost for Next Big Thing

A blockbuster acquisition brought Bristol-Myers Squibb Co. its new best-selling drug in Revlimid and with it the need to build out a pipeline full of drug candidates that can make up for a future loss of sales.

—Read the full article from S&P Global Market Intelligence

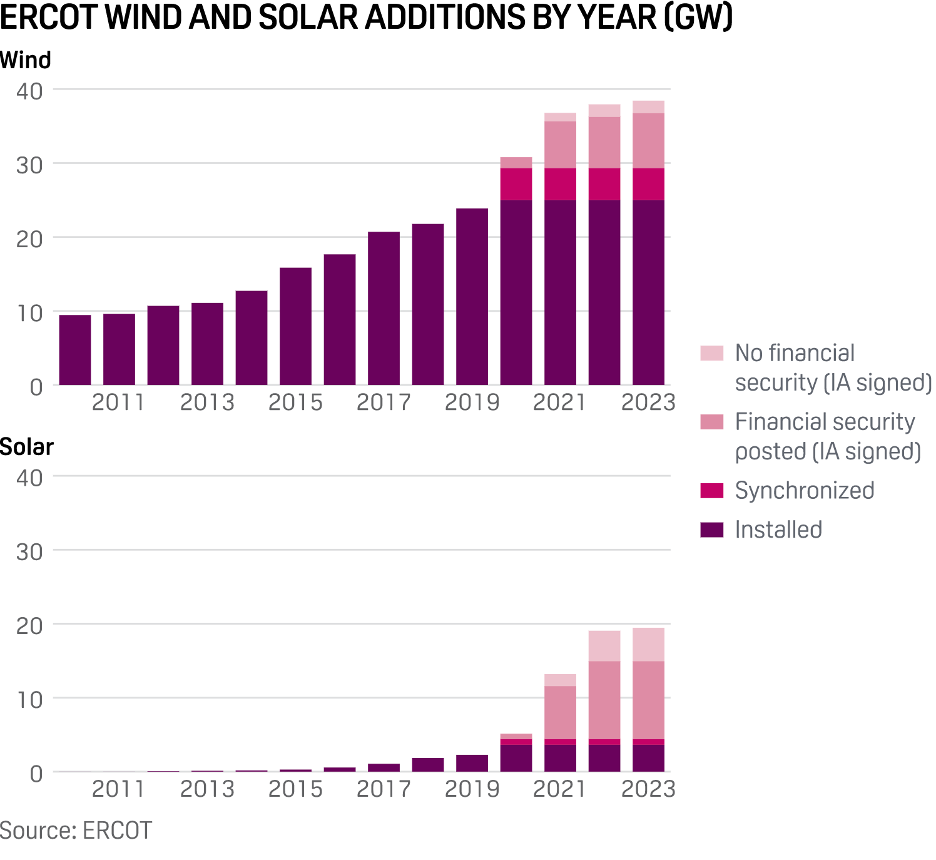

ERCOT Expects Sufficient Resources for the Coming Winter and Spring

The Electric Reliability Council of Texas anticipates adequate capacity to meet a forecast winter peak demand of 57.699 GW with the grid operator expecting to reach more than 30 GW of wind capacity by the end of the year, according to the final Winter 2020 Seasonal Assessment of Resource Adequacy report released Nov. 5.

—Read the full article from S&P Global Platts

Listen: Lockdown 2.0: Products vs Pandemic

S&P Global Platts reporters Chris Ewen, Kieran Hess and Sarah-Jane Flaws discuss with Joel Hanley the state of refined products and the challenges ahead for transportation fuels.

—Listen and subscribe to Oil Markets, a podcast from S&P Global Platts

Normal Winter Conditions to Favor European Coal, Gas Generation: Platts Analytics

Increased European power demand this winter versus winter 2019-2020 would favor gas and coal generation if normal weather conditions prevail, S&P Global Platts Analytics said in a press briefing Nov. 5.

—Read the full article from S&P Global Platts

EU Extends Sanctions Framework Against Turkey Over Gas Drilling by One Year

The EU Council on Nov. 6 extended by one year its framework for sanctions that can be imposed against those responsible for Turkey's gas exploration work in disputed waters of the East Mediterranean.

—Read the full article from S&P Global Platts

Vietnam's Thermal Coal Imports Seen Resilient Through 2021 Despite Funding Challenges Ahead

Vietnam's seaborne thermal coal traders are optimistic the country's fossil fuel consumption will continue to rise through 2021 amid burgeoning demand for electricity production at the lowest cost, despite the funding and regulatory challenges that loom for new coal-fired power plants, market sources said Nov. 6.

—Read the full article from S&P Global Platts

Demoted FERC Chair Sees Himself, Agency Playing Big Post-Election Role

Federal Energy Regulatory Commission member Neil Chatterjee defended his actions on clean energy and climate after President Donald Trump on Nov. 5 unexpectedly replaced him as chair of the independent agency.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language