Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 4 Nov, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Although the victor of the U.S. presidential election isn’t yet determined, as millions of ballots across the country will be counted in the coming days, the intense contest that has gripped the world wasn’t the referendum on the Trump Administration’s actions during the past three and a half years that Democrats had hoped for.

This morning, President Donald Trump held 213 electoral votes, behind former Vice President Joe Biden’s 238. While the majority of states were too close to call on Nov. 3, the Republican leader won the key states of Florida and Texas early in the evening. The Democratic nominee took strongholds California and New York, and is leading in typically Republican Wisconsin and Arizona.

Democrats had a net gain of one seat in the Senate so far. Democrats would need three more wins to have outright control of the Senate that Republicans have presided over for six years. In the House of Representatives, Republicans have thus far won four seats in the Democrat-controlled congressional body.

The future of U.S. energy and climate policy depends on the outcome of the presidential election and several tightly contested Senate seats, according to S&P Global Platts.

Several pro-fossil fuel candidates for local and state elections are leading across the country. Gov. Eric Holcomb (R-Indiana), an outspoken advocate of fossil fuel generation, was re-elected on Nov. 3. Sen. Dan Sullivan (R-Alaska), who pushed to open the Arctic National Wildlife Refuge to oil and gas drilling during his first term, held a strong lead in early election results.

Many candidates who support the transition to renewable energy sources also made gains. Gov. Jay Inslee (D-Washington), who has been described as "the greenest governor in the country" for his aggressive climate actions, was re-elected on Nov. 3 after comfortably leading in the polls for months before Election Day. Sen. Joni Ernst (R-Iowa), who defended the Renewable Fuel Standard as part of a key role in White House negotiations over the country’s biofuel mandate, maintained her seat following a tight race that tested her support of biofuel makers. Gov. Roy Cooper (D-North Carolina), who spent his first term working to cut carbon emissions and create infrastructure for extreme weather, was re-elected in the Southern state to narrowly defeat his pro-oil competitor.

States also saw the passage of ballot measures that could significantly affect energy policy, according to S&P Global Market Intelligence.

The preliminary results of state elections aren’t showing the Democratic "blue wave to easily sweep in national U.S. climate policy," Amy Myers Jaffe, a research professor and managing director of the Climate Policy Lab at Tufts University's Fletcher School, told S&P Global Platts.

The continuing uncertainty sent global markets spinning.

Gold, which is typically a safe haven during periods of volatility, was flat at $1,907 per ounce—seen as low below the highs of $2,000 per ounce seen earlier in the year. "I would have expected that the tight race and prospect of this election dragging over the next days and potentially in courts would drive prices higher like it did in 2000," Natixis Global Markets Research senior commodities analyst Bernard Dahdah said in an interview with S&P Global Platts.

After experiencing highs and losses overnight, U.S. equity futures advanced this morning. Now, “markets seem to be comfortable with where the presidential race is currently: S&P 500 futures [were] up 0.5% in pre-market trading after a wild night, while European benchmarks [were] generally positive to start the day,” S&P Dow Jones Indices director of index investment Chris Bennett said in a Nov. 4 note to clients.

Although the next U.S. president won’t likely be named for days—if not weeks—the benchmark S&P 500 index’s historical performance over the three months preceding polling day points to a tight outcome. In the 76 years since 1944, the party controlling the White House won the election 82% of the time if the S&P 500 rose from July 31 to Oct. 31, and if the index declined during that three-month period, the opposition party won 88% of the time, according to S&P Dow Jones Indices.

Today is Wednesday, November 4, 2020, and here is today’s essential intelligence.

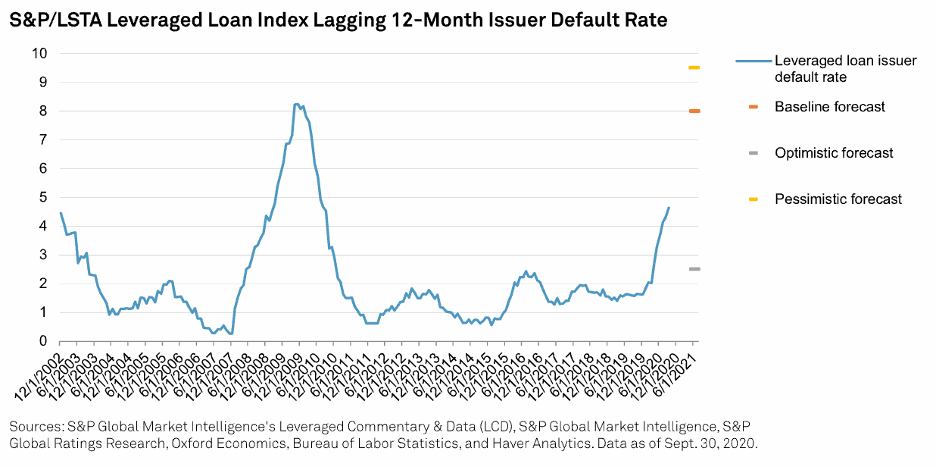

Default, Transition, and Recovery: The S&P/LSTA Leveraged Loan Index Default Rate Is Expected To Reach 8% By June 2021

S&P Global Ratings Research expects the S&P/LSTA Leveraged Loan Index lagging twelve-month default rate (by number of issuers) to increase to 8% by June 2021 from 4.6% as of September 2020.

—Read the full report from S&P Global Ratings

U.S. Leveraged Loan Weakest Links Decline as Downgrades Stabilize

The pace of credit ratings downgrades has stabilized in recent months and, as a result, the count and share of U.S. leveraged loan Weakest Links retreated in the third quarter, after hitting the highest level in at least eight years in the second quarter of 2020.

—Read the full article from S&P Global Market Intelligence

U.S. Bankruptcy Count Picks Up Momentum Amid Pandemic, Grows by 29 in Last 2 Weeks

Corporate bankruptcies in the U.S. continue to pile up amid the coronavirus pandemic with the pace of filings picking up extra momentum in the last two weeks, according to an S&P Global Market Intelligence analysis.

—Read the full article from S&P Global Market Intelligence

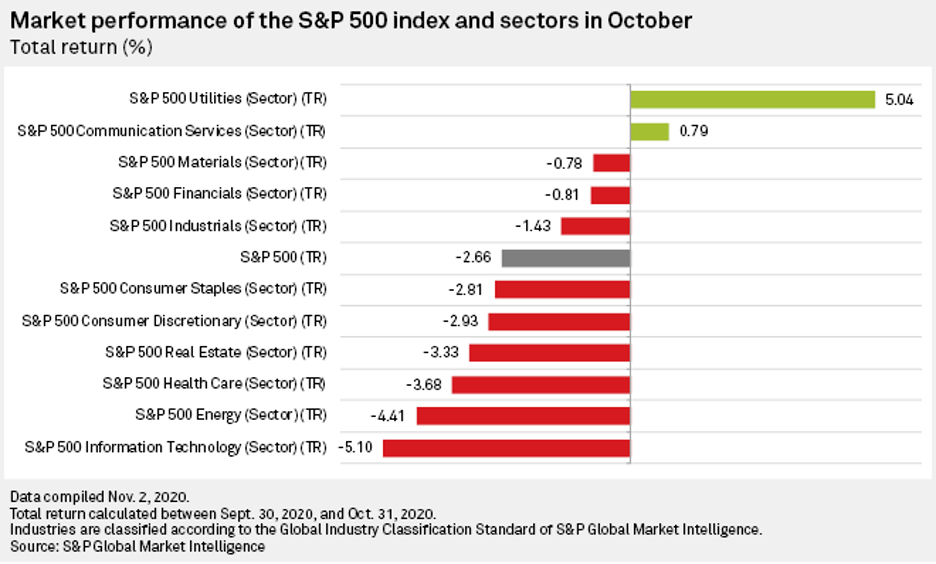

Tech Stocks Lead S&P 500 Lower for Second Month, Trimming YTD Gains

The S&P 500 fell for a second straight month in October as investors fretted about an uncertain election outcome, the rising prevalence of COVID-19 cases and valuations of tech companies.

—Read the full article from S&P Global Market Intelligence

S&P 500 Points to Tight U.S. Election, If History Is A Guide

Since 1944, the outcome of the U.S. presidential election could be predicted with a high level of confidence by looking at the performance of the S&P 500 over the three months preceding polling day. If the S&P 500 rose from July 31 to Oct. 31, the party controlling the White House won the election 82% of the time, according to calculations by S&P Dow Jones Indices. If the S&P 500 declined during that period, the opposition party won 88% of the time.

—Read the full article from S&P Global Market Intelligence

Energy Drags Commodities Lower in October

The headline S&P GSCI fell 3.6% in October. Energy was responsible for the bulk of the declines in October, while agriculture continued to benefit from the return of demand from China, as well as weather-related supply issues.

—Read the full article from S&P Dow Jones Indices

Three-Way Islamic Bank Merger Set to Create Indonesia's 7th Largest Lender

Indonesia's plan to merge the Islamic banking units of three state-owned banks is set to create the seventh-largest bank with 214.746 trillion rupiah ($14.64 billion) in total assets and more than 137 trillion rupiah in total net loans as of June 30, according to data compiled by S&P Global Market Intelligence.

—Read the full article from S&P Global Market Intelligence

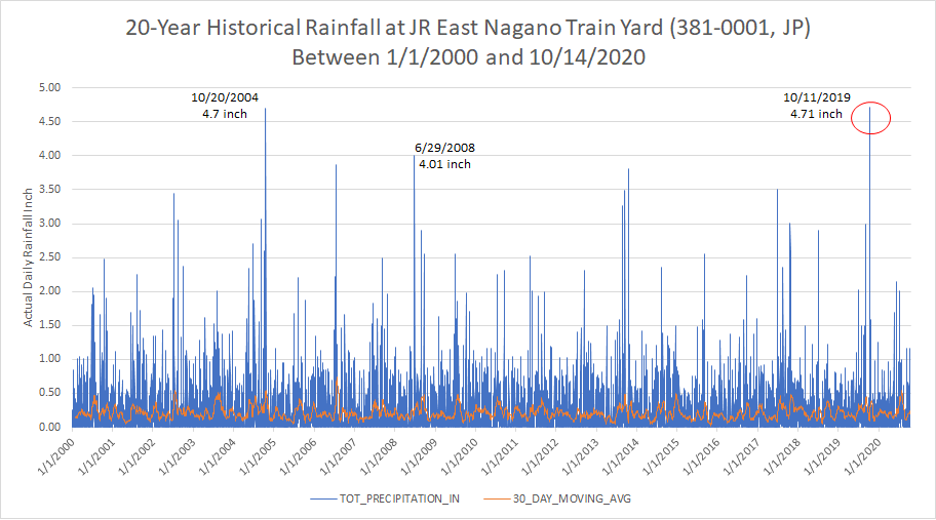

Leveraging Extensive Global Weather Data to Help Minimize Financial Disaster

Assessing asset vulnerability should be a responsibility that each company takes seriously in order to help avoid costly damage to company resources and a negative impact on financial results. According to the U.S. Climate Resilience Toolkit, there are three steps that can be taken to assist with resilience: evaluate potential climate impacts on your assets; assess each asset’s vulnerability; and estimate the risk to each asset. To assist with this, Weather Source data available via Snowflake on the S&P Global Marketplace enables quantitative evaluations of various weather events on operating/physical assets. This helps users calculate both the likelihood of catastrophic weather events, as well as the severity of the damage each weather event may cause.

—Read the full article from S&P Global Market Intelligence

Interview: La Nina to Delay Wheat Harvest in Australia, May Raise Concerns About Grain Quality

The arrival of La Nina remains a concern to the wheat harvest in the eastern states of Australia, with fears of harvest progress getting delayed by a few weeks and raising worries about grain quality, said James Maxwell.

—Read the full article from S&P Global Market Intelligence

Electric Ferraris Will Need to Growl, but Gasoline Models Here to Stay – CEO

Italian sports-car maker Ferrari NV on Nov. 3 said it is working hard to develop a seductive sound from future battery-electric models as its research shows the throaty roar of its engines is a feature that customers are reluctant to forgo in the shift to cleaner vehicles.

—Read the full article from S&P Global Market Intelligence

Listen: Oil Market Stakes in U.S. Election: Middle East, Venezuela, Climate Policy

Yesterday was Election Day in the U.S., and at a lot is at stake in the energy sector for the next four years. S&P Global Platts is revisiting three key policy areas that could shift direction depending on today's vote: U.S. policy in the Middle East and Washington's relationship with OPEC; U.S. oil sanctions toward Venezuela and Washington's so-far failed attempts to remove the Maduro regime from power; and expected climate policy in the next presidential term.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Platts

China Slows U.S. Agriculture Purchases Ahead of Election: Analysts

China has slowed down its buying of U.S. agriculture products in recent weeks and remains in a wait-and-see mode ahead of the outcome of the US presidential election, but the country's grain buying is expected to continue in the long run as it looks to diversify its sources, amid uncertainty clouding the scope of the Phase One trade deal before the new administration takes the office in January.

—Read the full article from S&P Global Platts

OPEC+ May Consider Deeper Oil Cuts if Coronavirus Lockdowns Squeeze Global Economy: Sources

Cloudy global economic prospects, along with a recent slide in oil prices, could prompt OPEC and its allies to ratchet back their production cuts to historic levels, sources told S&P Global Platts Nov. 3, as the market's recovery stalls.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language