Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 3 Nov, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Venezuela Oil May Reshape Market Amid US Sanctions Pause

The temporary easing of US sanctions on Venezuela may alter global crude flows, even with the South American country unlikely to significantly increase production.

There has also been some impact on independent Chinese refineries, which previously had little competition when buying Venezuelan crude, according to S&P Global Commodity Insights. Demand for Russian and Mexican crude could also weaken, and there could be a marginal decline in the cost of gasoline production in the US.

The sanctions pause will redirect global crude shipments in a “more efficient manner,” David Goldwyn, chairman of the Atlantic Council Global Energy Center's Energy Advisory Group, told S&P Global Commodity Insights. Venezuelan crude could compete with Canadian heavy barrels in US Gulf Coast refineries.

The impact on global oil prices may be limited because uncertainty about future sanctions will deter investments needed to upgrade creaking production facilities in Venezuela. President Joe Biden only approved a six-month halt to the US embargo as part of efforts to encourage free elections in the South American country, home to the world’s largest oil reserves.

“[Companies] will likely be hesitant to reinvest their money and manpower in Venezuela given the likelihood that sanctions could be reimposed,” Ellen Wald, a nonresident senior fellow with the Atlantic Council Global Energy Center and president of Transversal Consulting, told S&P Global Commodity Insights. “[T]here is no quick or easy fix for Venezuela's oil industry."

Venezuela produced about 770,000 b/d of crude in September, according to data from state-owned oil company Petróleos de Venezuela. Production was above 3 million b/d in 1997. Output was expected to hold steady until about the end of 2024, according to S&P Global.

More than half of September’s production went to independent refiners in China, particularly operators in Shandong province, S&P Global data showed. The refineries import Venezuelan crudes as bitumen blend for producing asphalt for road-paving. They also use Venezuelan 380 CST fuel oil as feedstock for oil products.

These independent refineries may face new competition for Venezuelan crude because state-owned PetroChina will likely return to the market, according to S&P Global Commodity Insights. The oil giant was the biggest supplier of Venezuelan barrels to China before the introduction of US sanctions in 2019. New buyers could also emerge in the US, Europe and India, S&P Global Commodity Insights said.

The sanctions pause quickly had an effect in Shandong, with suppliers either suspending offerings of Venezuelan barrels following Biden’s announcement or raising their offers. Uncertainty about whether Venezuela will boost, maintain or redirect exports following the sanctions relief will likely hang over the market, according to Sijia Sun, a China oil analyst at S&P Global Commodity Insights.

“Prices of those crudes will fluctuate as Venezuela's overall exports recover," Sun said. "Both national oil companies in China and nonstate enterprises will keep a close eye on prices before deciding on any buying strategy.”

In the longer term, China could boost oil-related investments in Venezuela, which would eventually lift production. The two nations agreed to form a deeper strategic partnership in September.

Today is Friday, November 3, 2023, and here is today's essential intelligence.

Written by Neil Denslow.

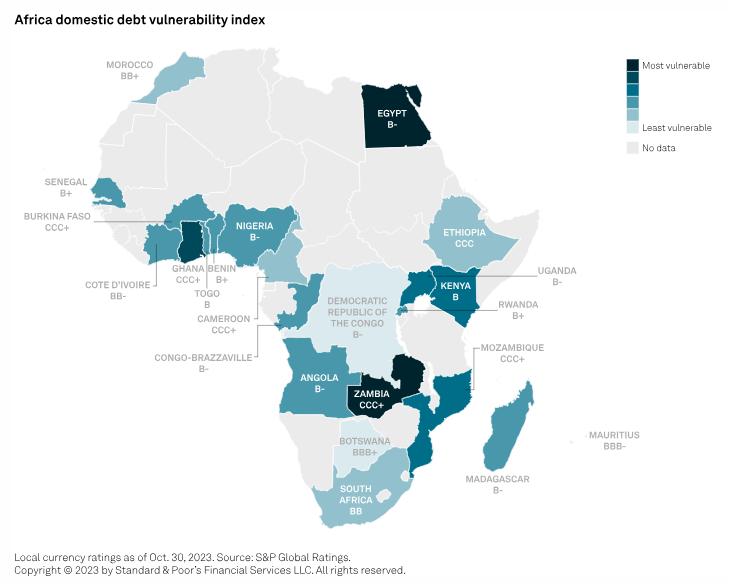

African Domestic Debt: Reassessing Vulnerabilities Amid Higher-For-Longer Interest Rates

Attracted by Africa's enormous economic potential, vibrant demographics and rich financial returns, between 2015 and 2021 foreign creditors invested an estimated $140 billion in African sovereign foreign and domestic debt, according to IMF data. This increased African general government debt to GDP levels by an average of 20 percentage points of GDP during the five years before the 2020 global pandemic, leading to a series of African sovereign downgrades.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Which Emerging Market Banking Sectors Are Vulnerable To Property-Related Losses?

Downside property-related risks for emerging market (EM) banks are diverse and differentiated across the various markets. Property stress in China and Vietnam will weigh on the asset quality of banks. The ongoing turmoil could weaken homebuyers' confidence and further curb home sales. China banks have sufficiently diverse lending and adequate capitalization to absorb these strains. S&P Global Ratings also expects quantitative easing and regulatory forbearance in Vietnam to blunt property headwinds

—Read the report from S&P Global Ratings

Access more insights on capital markets >

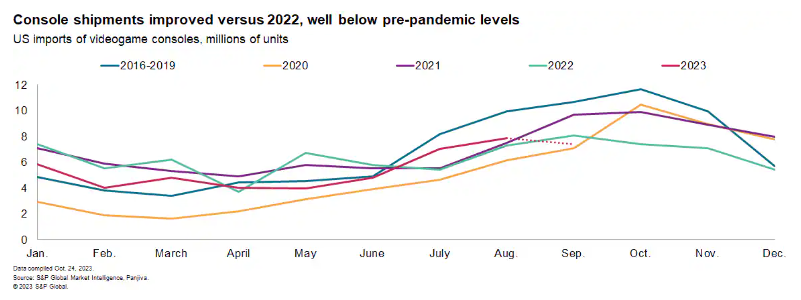

Time To Level Up: Videogame Console Supply Chains

Videogame consoles have highly seasonal supply chains, with product launches and peak buying typically occurring in the fourth quarter each year due to holiday gift-giving. The seasonality can be seen in historical US import shipping patterns. An average 54% of US imports of games consoles have arrived in the August through November period each year, S&P Global Market Intelligence data shows, with a peak in September and October. During the pandemic, shipping patterns were disrupted by a mixture of component availability and logistics network disruptions. An absence of major new systems in 2022 may explain the apparent lack of a peak season. Shipment patterns in 2022 and early 2023 also were distorted by pent-up deliveries resulting from supply chain shortages.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

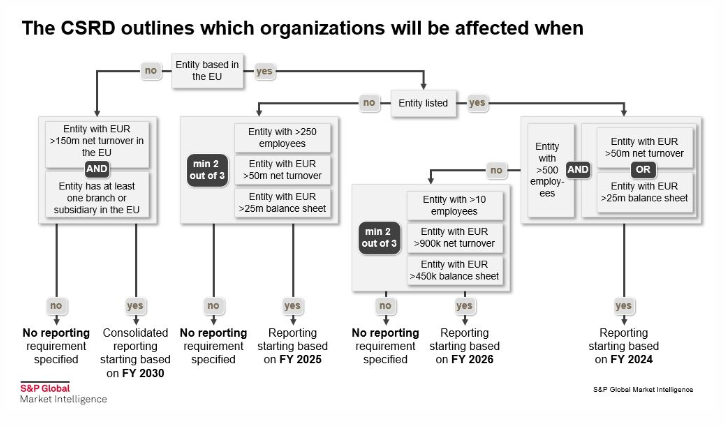

New CSRD Sustainability Reporting: Covering More Companies And More Disclosures

Climate change continues to take center stage on the European regulatory agenda, with the EU committing to achieve climate neutrality by 2050. New regulations and initiatives to stimulate the sustainability transition continue to emerge, including the Corporate Sustainability Reporting Directive (CSRD) that entered into force on January 5, 2023. The CSRD proposes to modernize and strengthen the EU rules concerning all three pillars: the environmental, the social and the governance-related information that companies must report.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

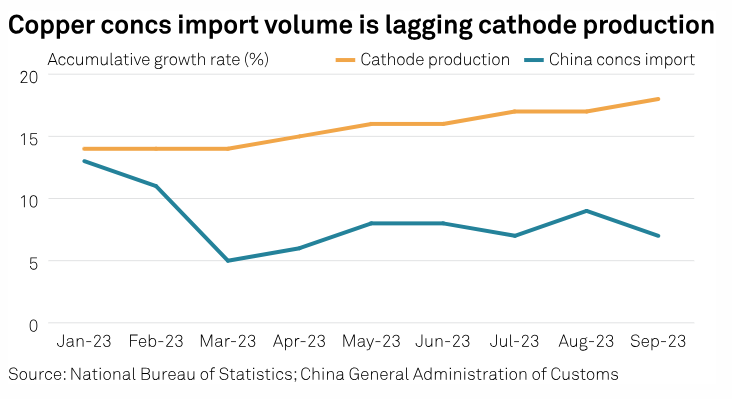

Copper Concentrate TC/RC Hits 6-Month Low On Demand Spurt, Decline May Slow

Market participants expect the treatment and refining charges (TC/RC) of copper concentrate are unlikely to fall much after they plunged 8% in October following a surge in Chinese smelters' demand for the fourth-quarter loading shipments coupled with limited spot availability. Platts Clean Copper Concentrate treatment charge fell to $82.20/mt CIF China Oct. 31, down 14% from the peak on July 31, and the lowest since April 11.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next in Tech: Episode 140 - The Great Data Migration

With the ebb and flow of workloads to and from cloud, data doesn’t get the attention it should as a critical resource. Research director Henry Baltazar joins host Eric Hanselman to discuss the need for better data intelligence and results from the recent Voice of the Enterprise study. Gaps between data and storage infrastructure and the applications using it can lead to problems with application performance or increased costs with egress or retrieval fees. Better planning can prevent pain.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence