Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 28 Nov, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Finding Energy Security Somewhere Between Sharm el-Sheikh and Kyiv

As the crow flies, it is approximately 2,515 kilometers from Egypt’s Sharm el-Sheikh to Ukraine’s Kyiv. Yet, there have been times during the month of November when they have appeared to occupy different planets. In Sharm el-Sheikh, government representatives, climate activists, and corporations convened for the 2022 United Nations Climate Change Conference, or COP27, in an Egyptian resort town on the shores of the Red Sea to discuss carbon credits and a just energy transition. In Kyiv, a cold snap and renewed Russian missile attacks on Ukraine’s energy infrastructure left residents shivering in unheated apartments.

As with past meetings, COP27 was a mix of both genuine progress and frustrated expectations. Despite the increased severity of the global climate crisis, there were largely inconclusive debates on who should be paying for climate impacts, how to finance the energy transition, and how carbon credits should be traded. While there were notable points of agreement, including a commitment to establish a loss and damage fund designed to help developing countries after devastating climate events, participants bemoaned a lack of progress on the most challenging issues related to the energy transition.

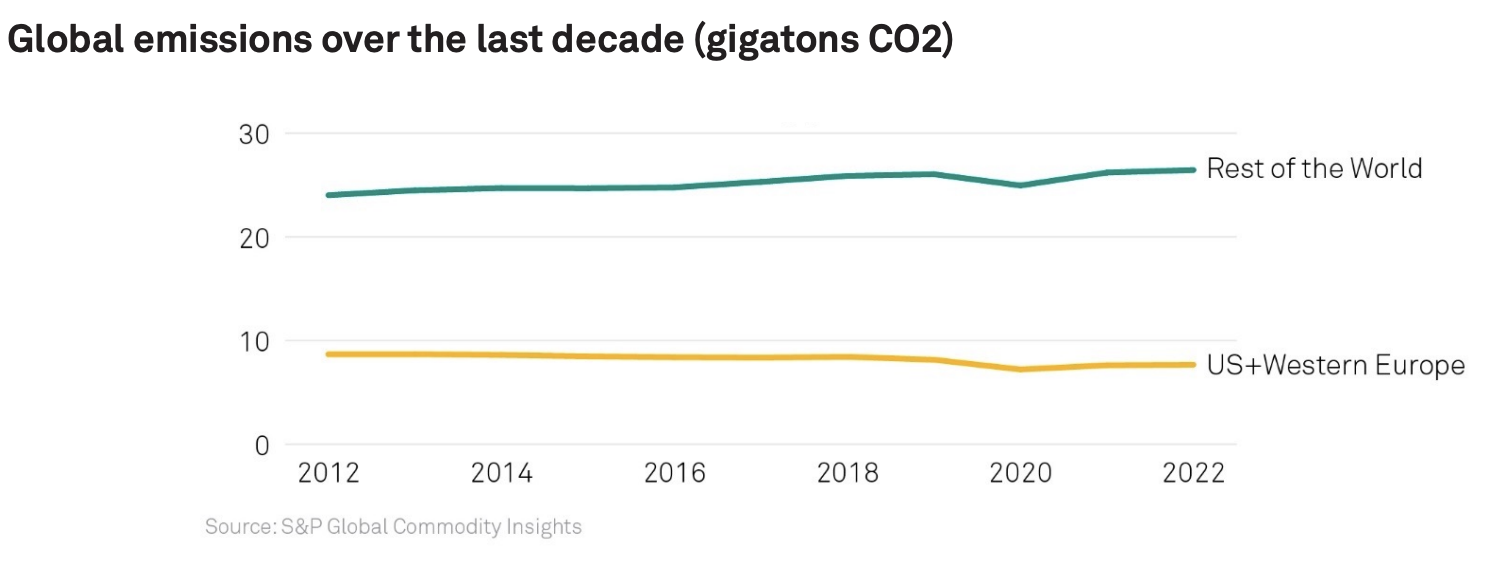

Away from Sharm el-Sheikh, rising inflation, geo-political enmity and a looming global recession threaten the modest progress the COP series of meetings has achieved thus far. The Russian invasion of Ukraine has severely disrupted the energy supply around the world and has forced many countries to make difficult choices between energy transition and energy security.

Even as Russia launched its invasion in February, European economies were struggling with tight natural gas supplies. Reserves were already in decline in countries such as the U.K. While limited supply was driving up prices, natural gas was taken for granted as a lower-carbon “bridge fuel” to transition from other sources, including coal and nuclear. However, the slow progress on developing renewables left the European market dependent on Russian natural gas.

After the invasion began, it became clear that the apparent security of Russian natural gas supplies wasn’t reliable. While it looks like Europe will have sufficient supplies to last this winter, the three-year outlook isn’t positive. The best-case scenario is Europe accelerates the adoption of green technology; the worst-case scenario is rapid de-industrialization as high gas prices force fertilizer, steel, and aluminum facilities to shut down.

“Failure to manage this balance will create economic and political tensions that will disrupt or even explode the capacity of the transition,” wrote Carlos Pascual, senior vice president for Global Energy and International Affairs at S&P Global Commodity Iinsights, in a recent opinionrecent opinion piece. “The war in Ukraine and its impact on Europe is the most profound illustration yet of the potential economic and social dislocation and political risks.”

In countries such as Germany and Poland, the search for energy security is leading to the increased use of coal, one of the most carbon-intensive fossil fuels. In other countries, the decision to move away from nuclear energy is being rethought. But attributing the use of carbon-intensive or controversial energy sources to the Russian invasion is a convenient fiction. The world was adding to its energy burden long before February. The addition of renewables was just that — additive. Wind and solar power exist in many countries alongside coal and natural gas to meet ever-increasing consumer demand.

The one point of agreement is that renewables offer much more energy security in the long term than fossil fuels imported from countries under autocratic governments. In the short term, energy security is a competitive advantage for countries such as Russia. It seems doubtful that a nation without substantial energy reserves would risk invading a neighbor in these fraught times.

Today is Monday, November 28, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

Inflation Pass-Through Poses Greater Risks For LatAm Toll Roads And Mass Transit Than For Utilities, Airports, And Ports

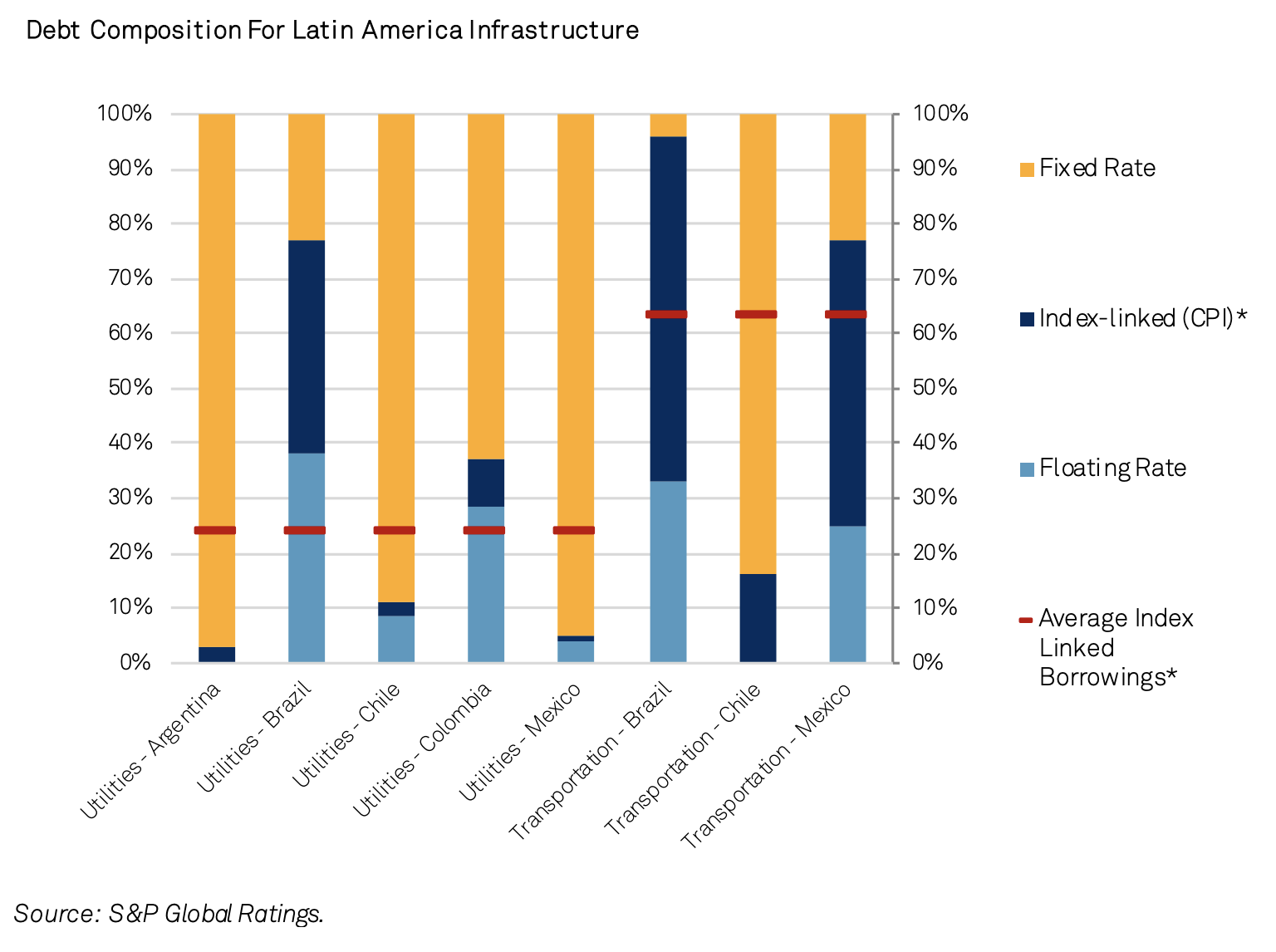

Latin American toll-road operators are sensitive to protests against steep tariff increases. Apart from Argentina, regulatory framework for utilities are generally supportive across the region, but some utilities in Chile and Mexico won't receive higher tariffs to cover costlier expenses. Toll-road operators across the region have a high share of floating debt, which could raise risks, given the time lag of cost pass-throughs amid likely persistence of high interest rates in 2023.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

Listen: The Essential Podcast, Episode 72: "Burn It With Fire" — A Crypto Skeptic's Measured Take On FTX

Nicholas Weaver, senior staff researcher at the International Computer Science Institute, chief mad scientist at Skerry Technologies and known cryptocurrency skeptic, joins the Essential Podcast to discuss the recent news surrounding FTX and today's cryptocurrency landscape.

—Listen and subscribe to the Essential Podcast from S&P Global

Access more insights on capital markets >

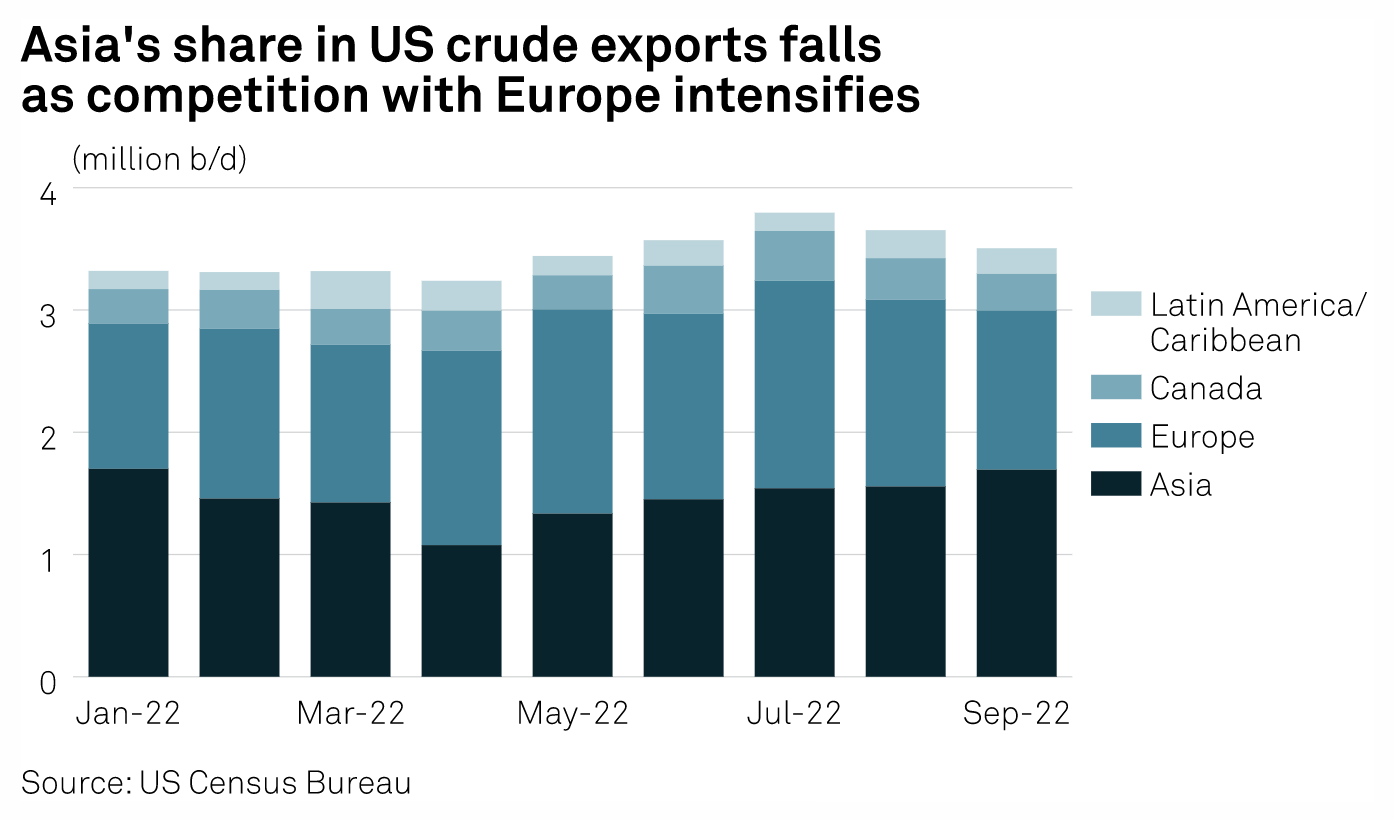

Asia's Share Of U.S. Crude Exports Wanes As Flow Shifts To Europe

The share of U.S. crude in Asia's overall import basket has fallen sharply in 2022 so far as leading buyers shift to attractively priced Russian crudes, as well as supply from other origins, to meet the revival in demand as pandemic restrictions ease, analysts told S&P Global Commodity Insights. Although in absolute terms, actual volumes of U.S. crude flows to Asia in the January-September period showed a modest year-on-year rise of 76,000 b/d to 1.47 million b/d, the market share of U.S. crude in the same period fell to 42% from 48% in the year-ago period, a sign that reflects buyers have looked elsewhere to meet the incremental demand so far this year, data from S&P Global showed.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

COP27: Advancing Climate Objectives Amidst Conflict

S&P Global Commodity Insights reviews the expectations and outcomes of COP27 and our participation in key discussions at the event, on carbon markets and future energy scenarios. It also presents a critical methane roadmap for Egypt, designed as a template for other countries eager to move from climate commitment to climate action.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

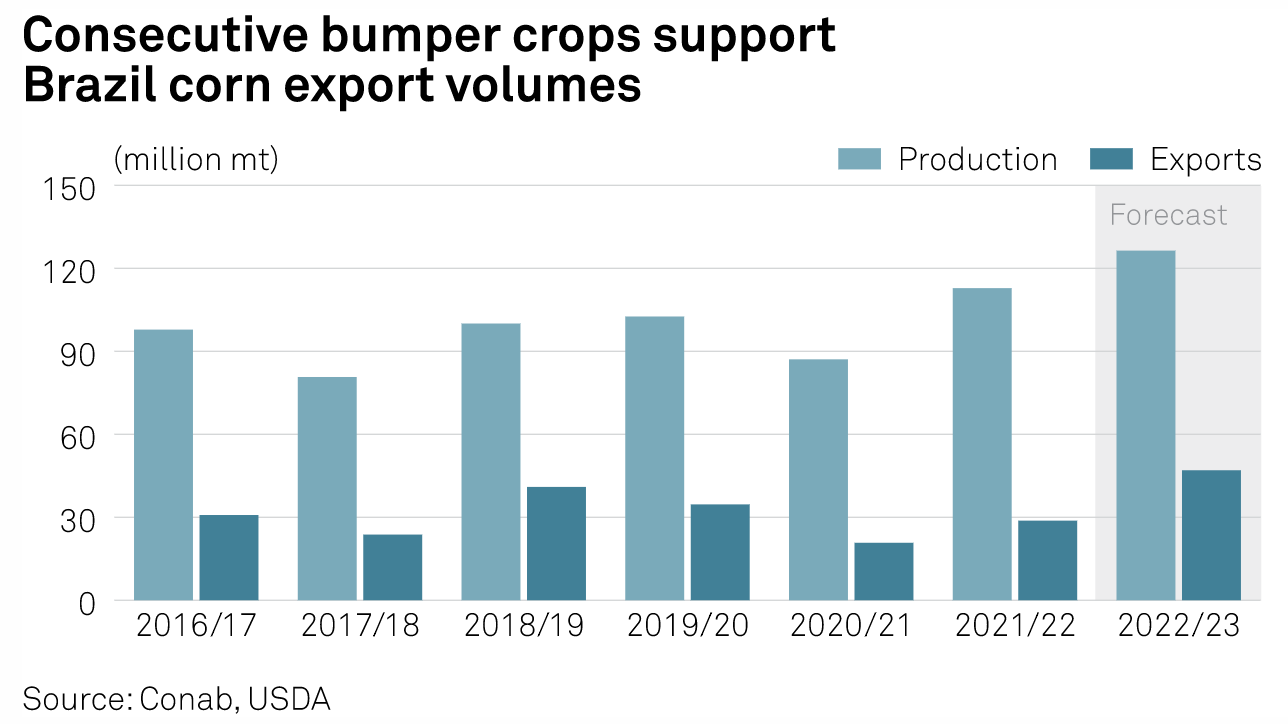

Is There Enough Brazilian Corn To Feed The World With China Lurking?

The demand for Brazilian corn has never been greater as China prepares to enter the market and disrupt the global trade books for the feed grain, raising buyers' concerns on the impact it could have on prices and supplies. Not too long ago, China's corn import demand was merely a rounding error on the global corn trade books as the nation fed its livestock industry with domestically farmed corn.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

U.S. Connected Video Devices On Course To Beat 1.1 Billion Installed Through 2026

The U.S. installed base for internet-connected video devices is on course to rise at a 2.3% compound annual growth rate from 2021 through 2026, falling only slightly behind high-speed broadband household growth. Kagan's forecast anticipates a relatively stable 8.5 devices per broadband household throughout the forecast, reflecting a saturation point for streaming video devices.

—Read the article from S&P Global Market Intelligence