Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 10 Nov, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

On Monday, markets started the day up on the news that Joe Biden had won the presidential race, before jumping to more substantial gains on reports that Pfizer and BioNTech have a vaccine that has proven in late-stage clinical trials to be more than 90% effective at preventing COVID-19.

“We’re in a position potentially to be able to offer some hope,” Dr. Bill Gruber, Pfizer’s senior vice president of clinical development, told the Associated Press. “We’re very encouraged.”

Dr. Scott Gottlieb, a former commissioner for the U.S. Food and Drug Administration and member of Pfizer’s board appeared on CNBC and cautioned the public on the timing of a widely available vaccine. “You could have a vaccine broadly maybe the end of the second quarter, maybe into the third quarter. You’re looking at having the vaccine available in time for the fall 2021 COVID season.”

Following the news, both the benchmark S&P 500 index and the Dow Jones Industrial Average hit record highs before settling for more modest gains of 1.6% and 3%, respectively. Pfizer’s stock price rose 7% on the day. The rally was concentrated in sectors hurt most by the coronavirus, including airlines, hotels, and the oil and refining industry. Meanwhile, pandemic proof-stocks, particularly in the technology sector may not do as well after months of outperformance.

"Pandemic-proof stocks are likely to underperform as those that have been battered over the last eight months come back into favor," Craig Erlam, a senior market analyst with OANDA, said in a Nov. 9 note. "This means the Nasdaq will likely underperform the other indices after spending most of 2020 massively outperforming."

Gold, which has been considered a safe store of value during the tumult of the past year, was down 5.5% in the spot market.

Last Thursday, markets rallied based upon preliminary results in the U.S. elections, which seemed to indicate a split result in which neither Republicans nor Democrats would control both the executive and legislative branches. Traditionally, markets believe that gridlock in Washington is good for business because it brings stability. The VIX volatility index has fallen for the last six days, indicating a low level of concern on the so-called “fear gauge.”

Today is Tuesday, November 10, 2020, and here is today’s essential intelligence.

.

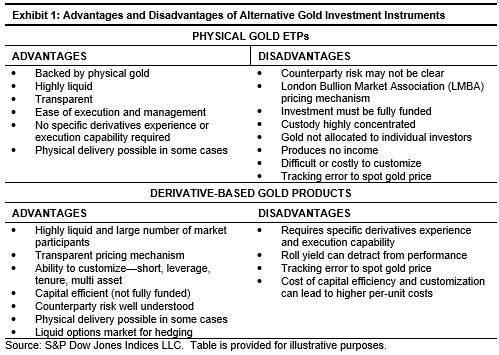

Physical Versus Synthetic Gold: Know Your Gold Exposure

The focus of this paper is to compare the advantages and disadvantages of investment instruments backed by physical gold versus those based on gold derivatives, not on holding physical gold bars and coins.

—Read the full article from S&P Dow Jones Indices

European banks stocks jump on positive COVID-19 vaccine trial results

Many big European bank stocks booked double-digit increases Nov. 9 upon news that Pfizer Inc. and BioNTech SE's COVID-19 vaccine has proven 90% effective in phase 3 trials.

—Read the full article from S&P Global Market Intelligence

Gold Spot Dives 5.5% on Vaccine News

Gold sank 5.5% in the spot market on Nov. 9 as investors rushed to liquidate their long position on positive coronavirus vaccine news.

—Read the full article from S&P Global Platts

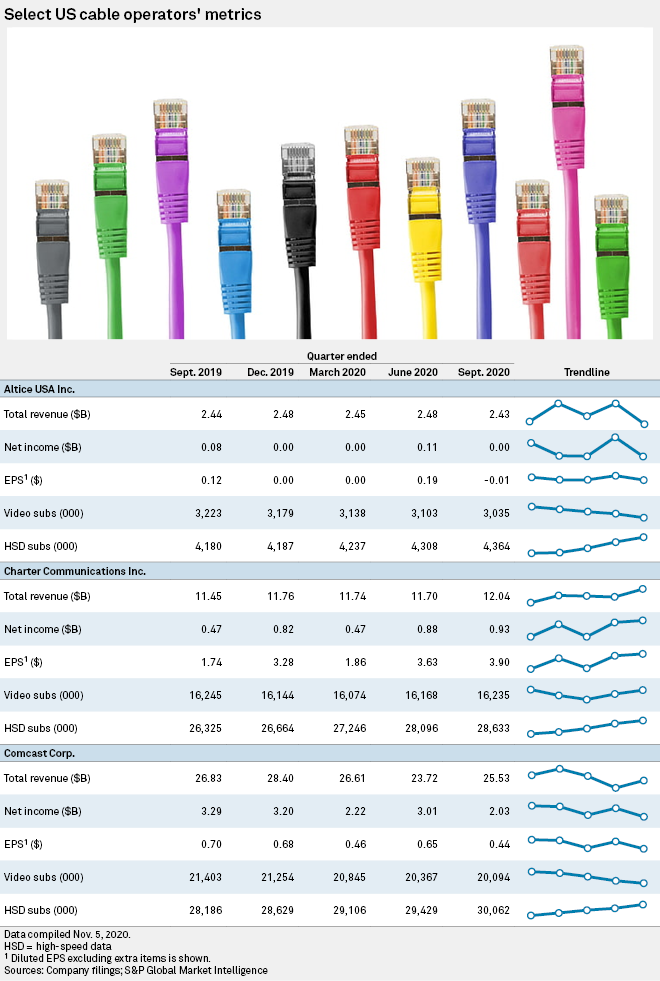

Some Cable Analysts Fear 2020's Strong Broadband Growth Could Harm 2021 Numbers

While some of the largest U.S. cable operators posted strong net broadband additions for the third quarter, certain industry analysts believe the growth may have come at the expense of pulling forward projected gains for 2021.

—Read the full article from S&P Global Market Intelligence

Pandemic Insurance, Coming to a Screen Near You

The insurance and bonding business around filmmaking can be as complex as the production itself, but COVID-19 is making matters even more complicated.

—Read the full article from S&P Global Market Intelligence

Building a Sustainable Core with the S&P 500 ESG Index

S&P Dow Jones Indices’ Maggie Dorn and State Street Global Advisors’ Brie Williams take a closer look at the potential benefits of putting this index to work in purpose-built portfolios.

—Watch and share this video from S&P Dow Jones Indices

Market Movers Europe, Nov 9-13: Utilities Up Their Renewables Game

In this week's highlights: Libyan output surge, Uniper challenges German LNG plans, power giants update renewable energy plans.

—Watch and share this video from S&P Global Platts

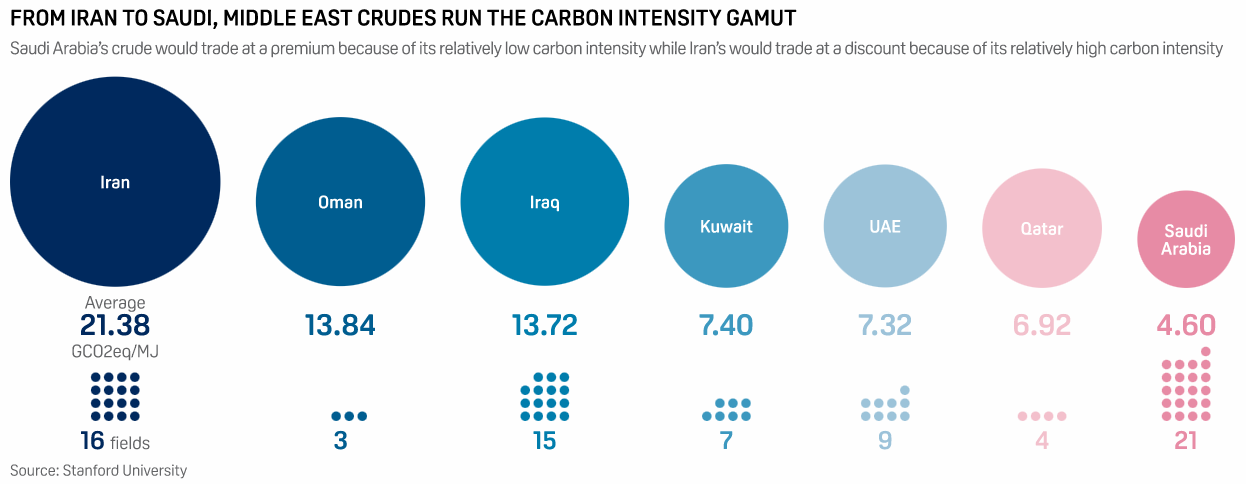

Middle East is a Mixed Bag as Investors Weigh Oil's Role in Climate Change

With investors increasingly concerned about climate change, OPEC kingpin Saudi Arabia is promoting its crude oil reserves as some of the world's least polluting hydrocarbons.

—Read the full article from S&P Global Platts

Crude Futures Surge as U.S. Election Uncertainty Eases

Crude oil prices surged during the mid-morning trade in Asia Nov. 9, shadowing the movement in other risk assets, as uncertainty subsided over the US presidential election result.

—Read the full article from S&P Global Platts

Energy Giants' Scale to be Key Strength in Transition from Oil and Gas: CEOs

Scale is going to remain a key strength for major producers and traders in the energy and commodity sectors as "pure" renewables companies suffer from a lack of diversification, industry chiefs told the ADIPEC conference Nov. 9.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language