Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 26 May, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

In the past 125 years, the U.S. economy has weathered market disruptions, recessions, depressions, and expansions against the backdrop of 23 U.S. presidencies, two world wars, and two global pandemics. Through it all, the Dow Jones Industrial Average—celebrating its quasquicentennial anniversary today—has evolved and grown from being an index of 12 stocks in 1896 to 20 listings by 1916, before the addition of 10 companies in 1938, when it became the broad barometer measuring 30 companies that reflect how the market is performing.

Considered the grandfather of all indices, “The Dow” was created by journalist Charles Dow and statistician Edward Jones, who co-founded Dow Jones & Co. and published The Wall Street Journal. While the index’s popularity was initially confined to Wall Street, it’s now a household name as it evolves with investors and the U.S. economy.

“The Dow is the snapshot of the economy by looking at key selected, publicly traded issues to give you a high-level view of how things are going on in the market,” S&P Dow Jones Indices’ senior index analyst Howard Silverblatt told S&P Global’s Essential Podcast this week. “It's simple and straightforward, and those simple results give you an informative and useful tool about what's happening in the market.”

“It became a tool for investors to use and a benchmark to be measured against. Did you beat The Dow, did you not? And if so, why?” Mr. Silverblatt said. “The reason that it was created back then is the same reason today. You need to know what's happening in a market and you need to have a reliable, methodology-based way to measure that.”

While often compared, S&P Dow Jones Indices’ benchmarks—the DJIA and younger S&P 500, which both track large-cap equities—are markedly different. The S&P 500 is float-market-cap weighted and measures the performance of 500 companies, in contrast to the price-weighted DJIA and the 30 companies it tracks. Both cover the energy, materials, industrials, consumer discretionary and staples, healthcare, information technology, communication services, financials, and real estate sectors. The S&P 500 provides additional coverage for real estate and utilities. All of the stocks in The Dow are typically included in the S&P 500, where they generally make up between 25% and 30% of its market value.

“Overall, the Dow remains a key indicator to the average person on the street, which is also important. It's easy to understand if you name the issues to someone on the street—and I don't mean just Wall Street, I mean Main Street, anywhere—they would know the company and probably be able to tell you what they do,” Mr. Silverblatt said. “From an investment point of view, I'd have to agree. It's not as extensive or diversified as the S&P 500, so it doesn't attract as much investment or benchmarking. But it's worked for investors and the general public for 125 years and done a good job. Otherwise, it wouldn't be here.”

For inclusion in the DJIA, blue-chip companies must achieve sector balance and have sustained growth, wide investor interest, and excellent reputations. The S&P 500 requires companies to maintain market capitalizations above $11.8 billion and achieve sector balance with sufficient liquidity, public float, and financial viability and earnings.

“The DJIA’s stock selection is not governed by quantitative rules. Instead, the Averages Committee makes constituent changes on an as-needed basis .... Eligible companies must be incorporated and headquartered in the U.S., and most of their revenues should come from the U.S. as well,” Hamish Preston, a director of U.S. equity indices at S&P Dow Jones Indices, said in a commentary this week. “The resulting DJIA index levels offer a glimpse into U.S. equity market trends over the past 125 years. Such a lengthy history can be extremely useful for contextualizing today’s market movements, especially as it allows for comparisons across a range of market environments.”

While there’s no crystal ball that can see what’s to come in the next 125 years, understanding forthcoming short-term market movements may be as simple as looking to the past.

“In 1884, it was all about railroads. That's when The Dow Transportation started. Then, 125 years ago, it was the industrials which came into play, and now it's technology and communication. So it's hard to say, you know, what will be in 25 years, much less, 125 years. But shorter term a lot easier to say,” Mr. Silverblatt said. As the U.S. economy recovers and re-opens into a new normal, “I would expect more membership changes in the short run. Change is constant … The index needs to reflect what the market is doing and in order to do that, it needs to change its membership. Since the market is changing so quick, I would expect membership change to increase.”

Today is Wednesday, May 26, 2021, and here is today’s essential intelligence.

The Essential Podcast, Episode 37: Happy Birthday to The Dow — 125 Years of the DJIA

S&P Dow Jones Indices Senior Index Analyst Howard Silverblatt joins the Essential Podcast on the occasion of the Dow Jones Industrial Average's 125th birthday. The conversation covers the changing structure of The Dow over time, the history of the index, and the perceived competition with its younger sibling: the S&P 500.

—Listen and subscribe to The Essential Podcast, a podcast from S&P Global

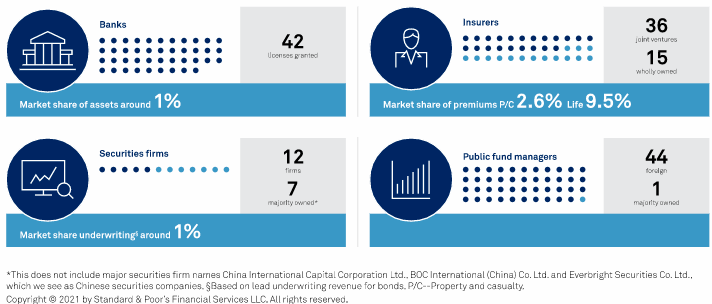

China's Bond Market: As Governance Improves, Foreign Entry Could Grow

China has the world's second largest bond market, and most of this paper is issued locally, underwritten locally, and held locally by banks and other institutional investors. As China's financial markets open wider, foreign financial institutions (FFIs) will be competing for roles in this previously closed ecosystem.

—Read the full report from S&P Global Ratings

U.S. Retailers Face Headwinds from Slowing Online Sales, Inflation

As more U.S. shoppers return to stores this spring, e-commerce-driven services like curbside pickup that provided a lifeline during the early days of the pandemic could become a weight to the margins of major retailers.

—Read the full article from S&P Global Market Intelligence

Fed Mortgage Securities Purchases Draw Fire in White-Hot U.S. Housing Market

Aaron Layman has never seen a more competitive housing market. Layman, a real estate broker and housing analyst based in Denton County, Texas, said homes for sale in the Dallas-Fort Worth area are selling in about six days on average, compared to the typical 45-day average.

—Read the full article from S&P Global Market Intelligence

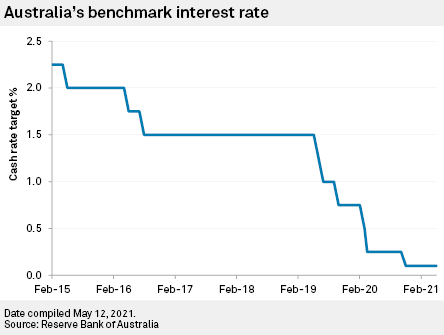

Australian Banks Can Absorb Higher Funding Costs Once Central Bank Support Ends

Australian banks may have their access to the cheapest sources of money reduced if the central bank winds down a special support measure and the pace of deposits slows, but analysts say the ongoing economic recovery will allow the lenders to absorb the possible increase in their funding costs.

—Read the full article from S&P Global Market Intelligence

Calculating the Cost of Lebanon's Bank-Sovereign Doom Loop

More than a year after the Lebanese government defaulted on its foreign currency obligations, pressure on the banking system is still mounting. This is not least because of the COVID-19 pandemic's economic impact, the Beirut port blast last August, Lebanon's ongoing political deadlock, and a run on deposits that's only been partly slowed by Lebanon's ad hoc capital restrictions.

—Read the full report from S&P Global Ratings

Which Banks are Positioned for Low Rates, Digital Adoption Brought by Pandemic

Some U.S. banks are ahead of the pack having taken actions before the pandemic to right-size branch networks, often through M&A. As digital adoption has grown during the pandemic, banks have trimmed their branch networks at an accelerated pace, while investing in new technology to meet changes in customer behavior.

—Read the full article from S&P Global Market Intelligence

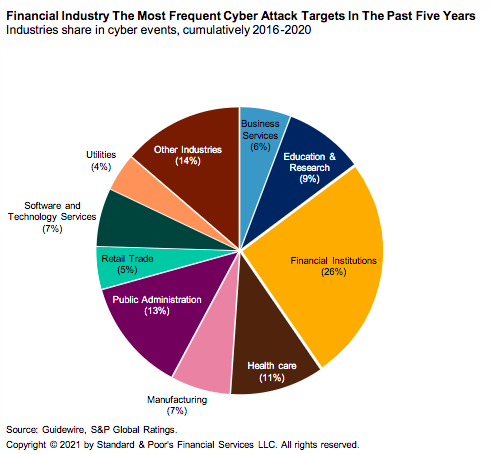

Cyber Risk In A New Era: The Effect on Bank Ratings

Cyber risks present a growing threat to financial institutions. A large-scale cyber attack can potentially have a considerable impact on an institution's ability to service its obligations in full and on time. The financial industry is a key target of cyber criminals because banks and other financial institutions store sensitive personal data and possess valuable information regarding financial transactions.

—Read the full report from S&P Global Ratings

WarnerMedia, Discovery Combination Would Create New Cable Network Giant

AT&T Inc. on May 17 announced that it plans to spin off its WarnerMedia Investments division and join forces with Discovery Inc. to form a new company. One result of that spinoff would be to place 32 U.S. basic cable networks under the same umbrella, the largest of any other cable network group, with The Walt Disney Co. in second with 29 networks. Note that this includes partially owned networks and does not include regional sports or premium networks.

—Read the full article from S&P Global Market Intelligence

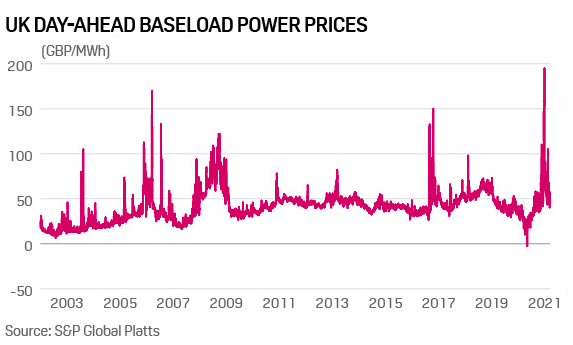

Unlocking Flexibility Key to Decarbonizing UK Power Grid

The UK's energy transition is firmly underway and significant milestones have been reached on the country's path to net zero in the last two years, as renewable output records have tumbled, and the grid recorded its lowest ever carbon intensity in April.

—Read the full article from S&P Global Platts

Private Finance has Work to do on ESG: S&P Global Sustainability1

Boosting private sector engagement in green financing remains an urgent priority, while companies need to improve the quality and consistency of their environmental, social and governance disclosures, panelists said during S&P Global Platts' inaugural Sustainability1 conference May 25.

—Read the full article from S&P Global Platts

Update: Tesla’s Standing in the S&P 500 ESG Index

As discussed in my previous blog, Tesla would not be an immediate addition to the S&P 500® ESG Index following its addition to the S&P 500 on Dec. 21, 2020. Instead, the ever-popular automaker would have to wait until the next annual rebalance of the index.

—Read the full article from S&P Global Dow Jones Indices

Listen: Russia Sanctions Fight Heats up in Congress as Biden Gives Pass to Nord Stream 2

The Biden administration surprised many last week in granting a sanctions waiver to the company building the Nord Stream 2 gas pipeline from Russia to Germany. The move allows work to continue on the almost-finished project, despite long-standing U.S. opposition on the grounds that it will increase Germany's dependence on Russian gas supplies.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Platts

U.S. Coal Jobs Continue to Dwindle in Q1'21 Despite Production Rebound

U.S. coal production in the first quarter of 2021 continued the industry's recovery from a significant drop the previous year, but the sector's employment levels are still suffering as the U.S. moves away from coal and embraces lower emission options.

—Read the full article from S&P Global Market Intelligence

Analysis: Asian Refiners Poised to Heavily Favor Iranian Condensate for Better Product Margins

Asian refiners equipped with condensate splitters will likely favor Iranian ultra-light crude heavily over other similar grades offered in the market when U.S. sanctions against Tehran are lifted, as the companies expect Iranian South Pars condensate's steep price discount to boost their product margins.

—Read the full article from S&P Global Platts

India's May Oil Imports, Crude Runs Likely to Witness Full Impact of Pandemic

India's crude imports and refinery runs remained robust in April as refiners shipped in cargoes contracted earlier and refrained from backing out of deals despite a second wave of COVID-19 triggering demand destruction fears. Analysts, however, said the full impact of the crisis will get reflected only in May numbers.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language