Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 16 May, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Metals Markets Moving Forward In War

As the war in Ukraine continues to complicate metals markets, temporary disruptions may become more permanent problems.

Both Russia and Ukraine are major global metals producers, and both have been hurt by sanctions and the war. Metals markets have watched prices move sharply higher as the Russian invasion of Ukraine weigh on the availability of nickel, steel, graphite, and other key commodities. The geopolitical shock of the war has exacerbated inflationary pressures , in part from higher metals prices, and analysts already expect the conflict to have demonstrable long-term effects on the global metals market.

"Inflation is a very real concern," Cormark Securities Analyst Stefan Ioannou told S&P Global Market Intelligence in an interview. "The first quarter was buffered by high metal prices, and the second quarter is off to a great start. But metal prices are starting to show a little bit of fragility. They're still good relative to historic numbers. But, nevertheless, inflation is a lot higher than it was ... so the margin squeeze is coming on."

After a $100,000 per tonne price spike for nickel triggered trading chaos on the London Metals exchange in March, participants are keeping an eye on market movements. Prolonged high nickel prices could drive up electric vehicle costs, because the metal is a key component of the multiple types of lithium-ion batteries used to power them.

International efforts to align with net-zero pathways is set to bring a surge of EVs onto the market, which will require large amounts of graphite. Ukraine had planned to be a global super-provider of graphite prior to the war. More projects will need to materialize in the coming years to avert a deficit in the raw material graphite market by mid-decade on rising EV demand, according to S&P Global Commodity Insights.

"Ukraine holds pretty significant potential to be a large-scale graphite supplier … Some of the materials that we would have normally procured in Ukraine aren't there anymore, like re-agents and grinding media from the east, which is where Ukraine's industrial hubs are mainly based. Fuel is also in short supply," Trevor Matthews, managing director of the Australian mining company Volt, which has operations in Ukraine, told S&P Global Commodity Insights. "We can sell the product, but how do you get it across the border? No EU trucks will come across the border because they're uninsured as it's a war zone.”

To mitigate volatility in the metals market and ensure stable supply, the U.S. has moved to lift Section 232 tariffs on Ukrainian steel imports and allocate $600 million for the country’s mining industry under the Defense Production Act. But the measures taken by the world’s largest economy and other nations may not be enough to resolve the challenges brought forth by the war.

"The war in Ukraine and the worldwide uncertainty does not help the markets to resume their normal business mode," the International Rebar Producers & Exporters Association said May 10, according to S&P Global Commodity Insights. "The situation is very challenging when trade is very intermittent and so competition is not very intense."

Today is Monday, May 16, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

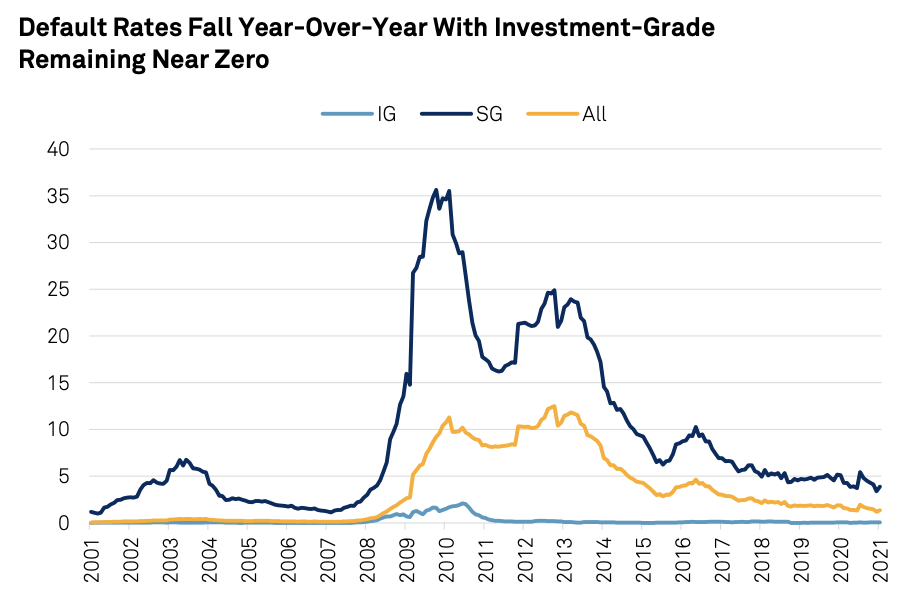

Default, Transition, and Recovery: Global Structured Finance Defaults And Downgrades Eased In 2021 As The Sector Recovered From The Pandemic

Following a year in which a global pandemic plagued economic growth and broader market performance, 2021 proved to be a remarkable recovery year for global structured finance. The sector's default rate more than halved to 0.6% from 1.4% in 2020.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

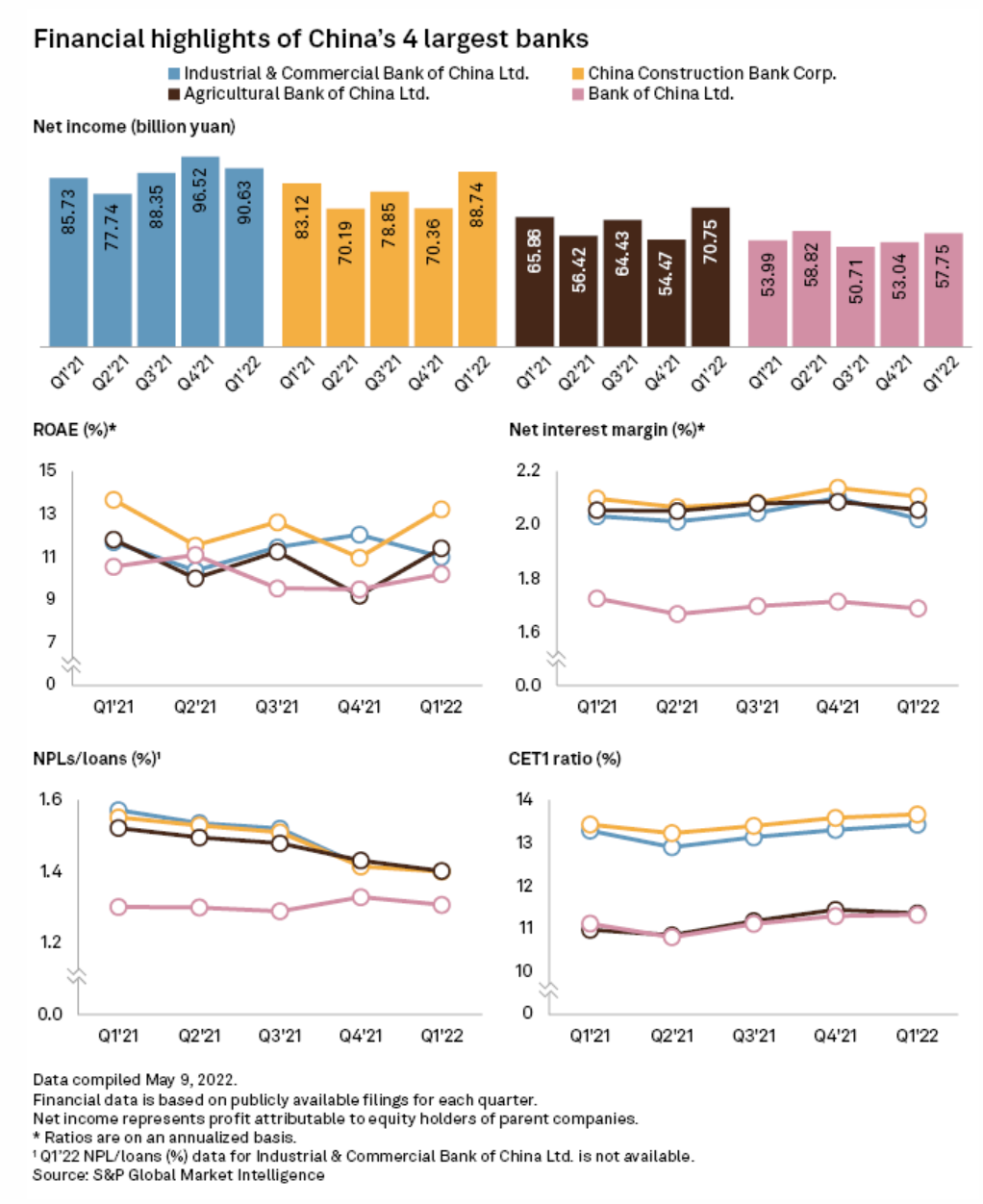

Stable Interest Margins To Underpin Chinese Bank Earnings In 2022

Chinese banks' earnings will likely stay steady in 2022 despite economic uncertainties facing the world's second largest economy, as the central bank's calibrated easing will help ease pressure on margins. Industrial & Commercial Bank of China Ltd., China Construction Bank Corp., Agricultural Bank of China Ltd., and Bank of China Ltd.—the biggest four lenders by assets—reported mid-single-digit earnings growth in the first quarter of 2022, buoyed by steady net interest margins and an average 5% growth in loans with stable asset quality.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

Listen: The Essential Podcast, Episode 61: Quite A Bit More Disruption — Supply Chains Under Stress

John Anton, Peter Tirschwell, and Nathalie Wlodarczyk join the Essential Podcast to talk about supply chains, what's gone wrong, and what—if anything—can be done to get them back on track. The Essential Podcast from S&P Global is dedicated to sharing essential intelligence with those working in and affected by financial markets. Host Nathan Hunt focuses on those issues of immediate importance to global financial markets—macroeconomic trends, the credit cycle, climate risk, ESG, global trade, and more—in interviews with subject matter experts from around the world.

—Listen and subscribe to The Essential Podcast from S&P Global

Access more insights on global trade >

Lawmakers Mull U.S. Carbon Import Fee As Part Of Bipartisan Energy Bill Talks

Talks among U.S. lawmakers on a potential bipartisan energy and climate bill have included a possible fee on carbon-intensive products entering the U.S. Such a tariff could cut emissions globally and make domestic manufacturers more competitive against less carbon-efficient companies abroad. The consideration also comes as the European Union is working to implement a planned carbon border adjustment mechanism.

—Read the article from S&P Global Market Intelligence

Listen: Evolving LNG Trade: Will Demand For Cleaner Gas Spread To Asia?

As the U.S. and Europe move to cut methane emissions, will the demand pull for cleaner LNG spread to price-sensitive Asia? Ben Cahill, a senior fellow at the Center for Strategic and International Studies, published a report this month looking at how concerns about methane emissions might spread elsewhere in the world, and how the focus on methane could reshape the LNG market. Cahill argues that it will take some time before the market—and Asian buyers in particular—start paying a premium for cleaner gas. But he does believe demand for this so-called differentiated LNG will develop eventually.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

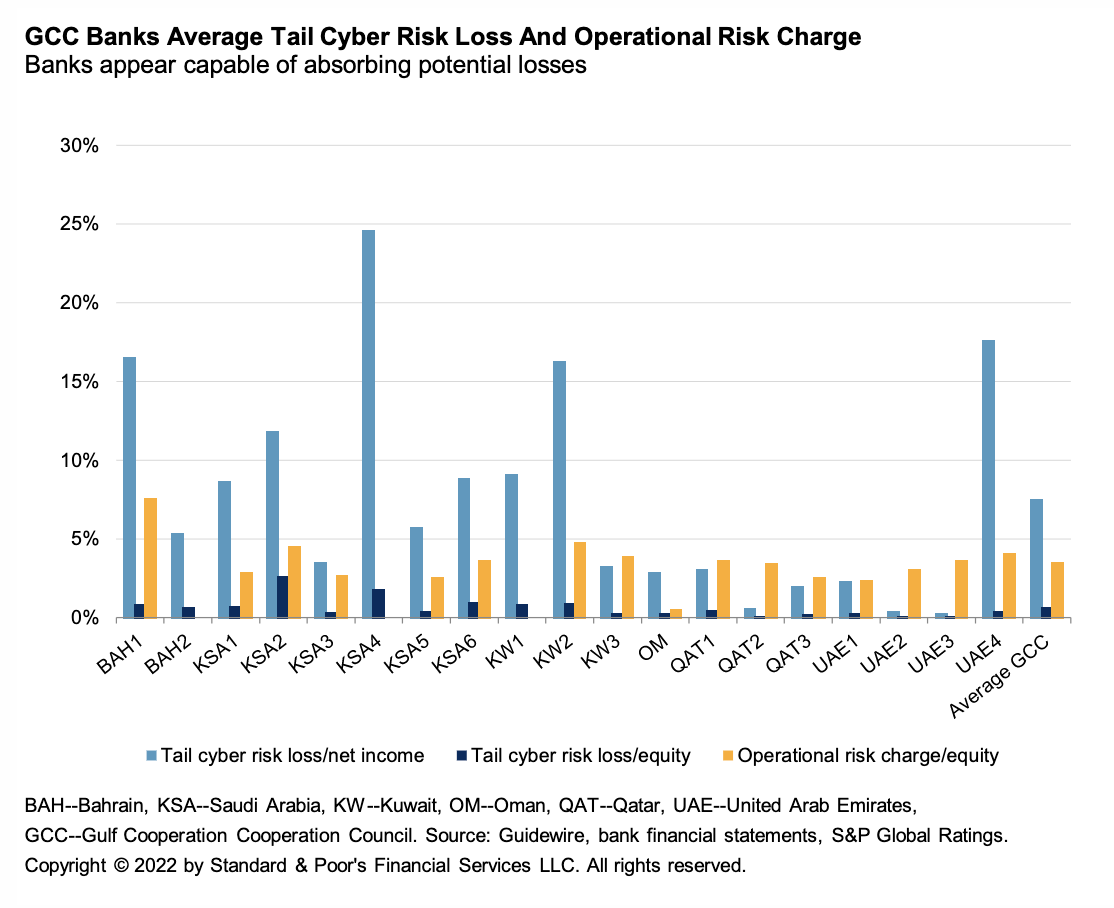

Gulf Banks' Strong Capitalization Supports Resilience To Cyber Risk

Banks in the Gulf Cooperation Council (GCC) have reported only a handful of minor cyberattacks over the past decade. They have moved their activities to online platforms during the pandemic, with minimal disruption, thanks to years of investment in infrastructure and systems. S&P Global Ratings believes GCC banks are managing their exposure to cyber risk effectively, including through investment in digital security, and that their strong profitability, capitalization, and liquidity provide a financial buffer against potential incidents.

—Read the report from S&P Global Ratings

Access more insights on technology and media >

Declining global growth on the back of the Russia-Ukraine conflict and a slowdown in China are weighing on the domestic debt-carrying capacity of frontier markets in Africa. Sizable nonresident positions in some local bond markets, such as in Egypt, Ghana, and South Africa, boost liquidity, but often at the expense of increased sensitivity to current shifts in global monetary policy. Where nonbank financial institutions are well developed (most clearly in South Africa), some sovereigns possess additional buffers against external volatility. Many African sovereigns enter this challenging post-pandemic period with high existing domestic debt stocks and large refinancing requirements.