Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 4 Mar, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Metals markets have watched prices move sharply higher as Russia’s invasion of Ukraine weighs on the availability of palladium, aluminum, nickel, and other key commodities.

The Russia-Ukraine conflict’s military and economic reverberations shocked markets, pushing major metals benchmarks up significantly by the end of February. The overall S&P GSCI benchmark commodities index swelled 8.8%, the S&P GSCI Industrial Metals index by 7.3%, the S&P GSCI Nickel index by 9%, the S&P GSCI Gold index by 5.8%, and the S&P GSCI Palladium index rose a whopping 30.9%, according to S&P Dow Jones Indices. Palladium and aluminum prices have remained elevated, while other metals prices have stabilized. Russia is a leading producer of palladium, nickel, and steel, and Ukraine is a rare-earth metals powerhouse. Market participants are watching to see how prices respond to the possibility of future sanctions on commodities exports from Russia and how additional supply chain disruptions may affect metals.

"The thing that's really risen sharply is uncertainty," CPM Group managing partner Jeffrey Christian told S&P Global Market Intelligence in an interview. "And that uncertainty is going to be here for a while."

S&P Global Ratings believes the geopolitical shock of the invasion could prompt sustained inflationary pressures across many countries, in part from higher metals prices. Analysts already expect the conflict to demonstrably impact the world’s aluminum supply and prices, according to S&P Global Commodity Insight.

"Besides the hard-to-quantify geopolitical risk premium currently present in the market, we maintain our bullish outlook in the belief inflation will remain elevated while central banks may struggle to slam the brakes on hard enough amid the risk of an economic slowdown," Ole Hansen, head of Saxo Bank's commodity strategy, told S&P Global Market Intelligence about how Russia’s attack on Ukraine is likely to support the prospects of higher precious metal prices.

Disruptions to metals trading could prompt pain for the U.S., according to an analysis this week by Panjiva, part of S&P Global Market Intelligence. Nearly 60% of the U.S.’s imports from Ukraine in 2021 were in the metals category, marking an approximate 62% year-over-year increase. Metals accounted for nearly 14% of U.S. imports from Russia.

If sanctions are imposed on Russia’s metals output, prices could go higher and increase the costs of electric vehicles and other goods. China could, under those conditions, become one of the only buyers of Russian metals, according to S&P Global Market Intelligence. The EU sanctioned the billionaire shareholders of the Russian mining and steel companies Metalloinvest and Severstal, but not the companies themselves, on March 1. Still, Severstal said March 2 that it was redirecting its shipments and commodity flows away from the EU due to the sanctions on its majority shareholder, according to S&P Global Commodities Focus.

"[The invasion] will have an inflationary effect on battery metals and battery costs, which have already been rising strongly this year … It's going to add further fuel to that particular fire,” Stuart Burns, the founder and editor-at-large of the metal pricing and analysis platform Metal Miner, told S&P Global Market Intelligence. "China is going to be Russia's release valve for raw materials … It would just strengthen China's hand in the battery market because they will have almost exclusive rights to the Russian material. China will take whatever the Russians cannot ship into Europe or into North America or to the rest of the world. They will gladly take it, but they'll take it at a discount. We're not at that point yet, though; the Russians are still able to export at the moment."

Today is Friday, March 4, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

Sanctions Against Russia May Prompt Iran-Style De-Risking By Banks

International sanctions against Russia have sparked "overcompliance" and de-risking among foreign banks, which may impact cross-border payments and trade finance far beyond what governments had intended. Sanctions come with exemptions that allow countries to pay for energy from Russia, yet the complexity of the rules and potential risks associated with any breaches mean it will be increasingly difficult to find a European or U.S. bank willing to facilitate even permissible trade with the country, according to experts. They say there is a real prospect of ending up in a situation similar to Iran, where banks continue to exercise excessive caution years after EU sanctions were lifted.

—Read the full article from S&P Global Market Intelligence

Access more insights on the global economy >

Kensho Correlations

Dispersion and correlation provide convenient lenses through which to analyze stock selection conditions. All else equal, active managers should prefer above-average dispersion because stock selection skill is worth more when dispersion is high. The role of correlation is more complex. Active managers, almost by definition, run less diversified, more volatile portfolios than their index counterparts. When correlations are high, the benefit of diversification—i.e., the volatility reduction attendant upon a more diversified portfolio—is less than when correlations are low.

—Read the full article from S&P Global Dow Jones Indices

Access more insights on capital markets >

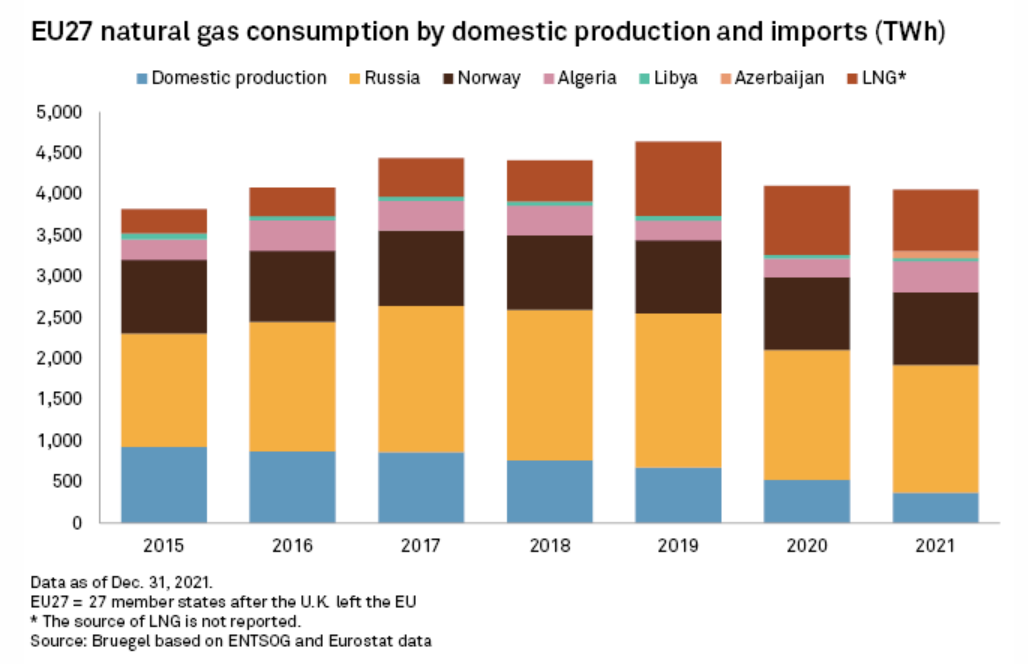

Nord Stream 2 Pipeline Subsidiary Says 'Will Probably Be Wound Up': Website

In an undated message on the home page of its website, Gas for Europe said: "Due to current developments, also at our shareholder Nord Stream 2 AG, Gas for Europe GmbH will probably be wound up." Switzerland-based Nord Stream 2 AG said in late January that Gas for Europe GmbH had been established to operate the 54-km section of the pipeline located in German territorial waters in response to an order from the German regulator as part of the certification process for Nord Stream 2.

—Read the full article from S&P Global Commodity Insights

Access more insights on global trade >

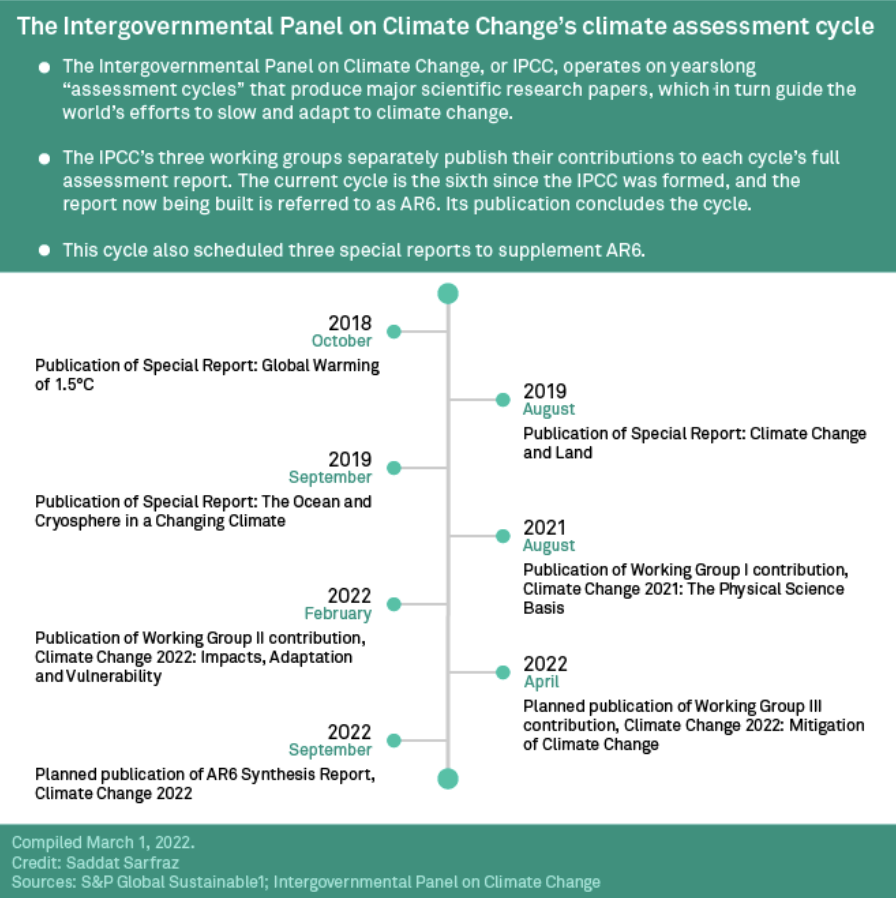

What Companies And Investors Need To Know From The IPCC's Climate Adaptation Report

Companies and governments have a very short time to reduce their exposure to the unavoidable climate risks facing the world, according to the second installment in a series of sobering climate reports by the U.N.’s Intergovernmental Panel on Climate Change, or IPCC. The Feb. 28 report from the IPPC is the most comprehensive study to date of how communities, countries, and companies are exposed to climate change-related physical risks, and how they must adapt to lessen the damage. Past IPCC findings have driven important climate-related policy changes and investor engagement.

—Read the full article from S&P Global Sustainable1

Listen: Russia-Ukraine Conflict Aggravates Oil Supply Worries For Asian Buyers

Russia's invasion of Ukraine has stalled oil supplies to refiners in Asia as buyers remain wary of the fallout of the widespread sanctions imposed on Moscow. Though demand for oil and products continues to grow in the region, buyers are left grappling with stunted supplies and rising crude prices. In the latest episode of Oil Markets, S&P Global Commodity Insights' Ada Taib, Pankaj Rao, Fred Wang, and Vickey Du talk about the impact of the conflict on the Platts Dubai pricing benchmark, Russian Far East crude differentials, and the buying patterns of Asian refiners.

—Listen and subscribe to Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

Nickel Price Spike During Russia-Ukraine Conflict Could Drive Up EV Costs

Nickel prices jumped after Russia, a top global nickel producer, invaded Ukraine on Feb. 24, threatening to drive up electric vehicle battery costs that were already under pressure from rising raw material prices. The London Metal Exchange three-month nickel price increased on the news of Russia's incursion, reaching an 11-year high of $25,575 per tonne in trading on Feb. 24, while LME stocks tumbled in the run-up period, dipping throughout February to 82,314 tonnes as of Feb. 22, according to S&P Global Commodity Insights data.

—Read the full article from S&P Global Market Intelligence

Access more insights on technology and media >

CERAWeek 2022

CERAWeek brings together global leaders to advance new ideas, insight, and solutions to the biggest challenges facing the future of energy, the environment, and climate. Now in its 40th year, CERAWeek is widely considered to be the most prestigious annual gathering of CEOs and Ministers from global energy and utilities, as well as automotive, manufacturing, policy, and financial communities, along with a growing presence of tech. CERAWeek was rated one of the top five overall “corporate leader” conferences in the world.

—Register for the conference from S&P Global