Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 2 Mar, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Car Companies Look to Women for Sales and Loyalty

Car companies are reexamining long-standing practices to attract female customers. Women are more likely than men to be car-brand loyalists, according to S&P Global Mobility, but they have little patience for or interest in the in-person dealership negotiation process. While some car companies have been successful in attracting female customers with a safety message and a broad product range, electric vehicle manufacturers are struggling to connect with women.

According to S&P Global Mobility, Buick received 55.0% of personal new vehicle registrations, ranking the highest for women's share of brand. Other brands that earned a significant amount of market share and loyalty from women were Mitsubishi, Mini, Lexus, Infiniti, Mazda and Kia. In absolute volume, Toyota sold more cars to women than any other brand, but women did not disproportionately buy Toyota cars compared with men. Truck brands tended to do significantly worse with women consumers. Only 17% of Ram vehicles were sold to women, followed by GMC at 28.7%, Ford at 31.1% and Dodge at 33.9%.

According to the latest U.S. census, women make up 50.5% of the population, and market research shows they influence most vehicle purchases. Women buyers are also 4 percentage points more likely than men to be loyal to a single brand of car, S&P Global Mobility’s data showed.

Loyalty is vital to any car brand’s profitability. While many brands concentrate on “conquesting” market share against their competitors, earning repeat purchases from a customer is easier and less costly than winning over new customers. Approximately 58% of car buyers in the 12 months ended July 2022 changed brand. This is an unusually high number, brought on, in part, by low inventory due to supply chain issues. Customers who own a brand once and leave are known as “nomads” in the automobile industry.

"Loyalists have an average 13-point advantage on a brand's loyalty rate than nomads," said Erin Gomez, associate director of consulting for S&P Global Mobility. "Brands that fail to transform nomads into loyalists not only lose out on the immediate sale to the nomad, but also the future loyalty benefit they could have provided as loyalists."

To earn the loyalty of women, car companies may need to reexamine their approach to business. According to an S&P Global Mobility survey, 70% of U.S. customers are willing to select a dealership further away from their homes if the retailer allows for more online purchase and comparison options. Female shoppers are especially likely to participate in alternative test drive options such as home delivery, virtual reality or test drives at experience centers versus in-dealership test drives. Women appreciate having more of the transaction process online. General Motors, which has the U.S. auto industry's only female CEO, has instituted a Women's Retail Network that includes all-female dealer principals and department managers to provide training and best practices.

Unfortunately for advocates of the energy transition, EVs have struggled to make headway with female car consumers. Tesla has the greatest gender diversity, with 33.1% of Tesla vehicles registered in 2022 belonging to women. Other EV brands, such as Polestar, Lucid and Rivian, had far smaller percentages of women owners. The relative strength of Tesla was driven by the company’s Model Y compact SUV. However, even in this case, 35% of Model Ys being registered to women is well below the industry average. Clearly, there is work to be done across the board to earn women’s car-buying dollars.

Today is Thursday, March 2, 2023, and here is today’s essential intelligence. The next edition of the Daily Update will be Monday, March 6.

Written by Nathan Hunt.

Factory Activity Revives In Mainland China As Economy Reopens

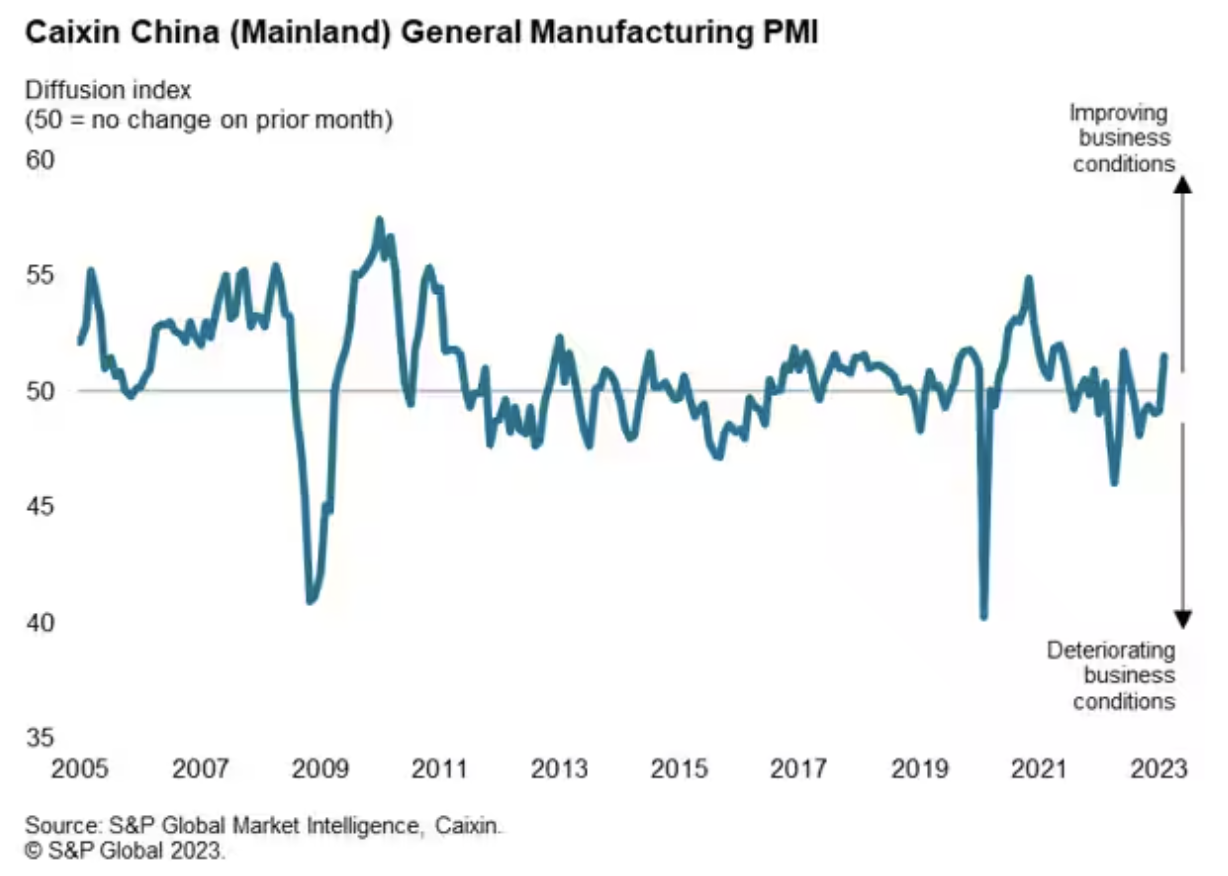

While there were some uncertainties as to whether looser COVID-19 restrictions will boost the economy or lead to more disruption amid rising illness rates, the early evidence from the PMI surveys is encouraging. The Caixin China General Manufacturing PMI, compiled by S&P Global, rose to 51.6 in February, up from 49.2 in January to register the first overall improvement in factory business conditions since prior to the Omicron wave, last July.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

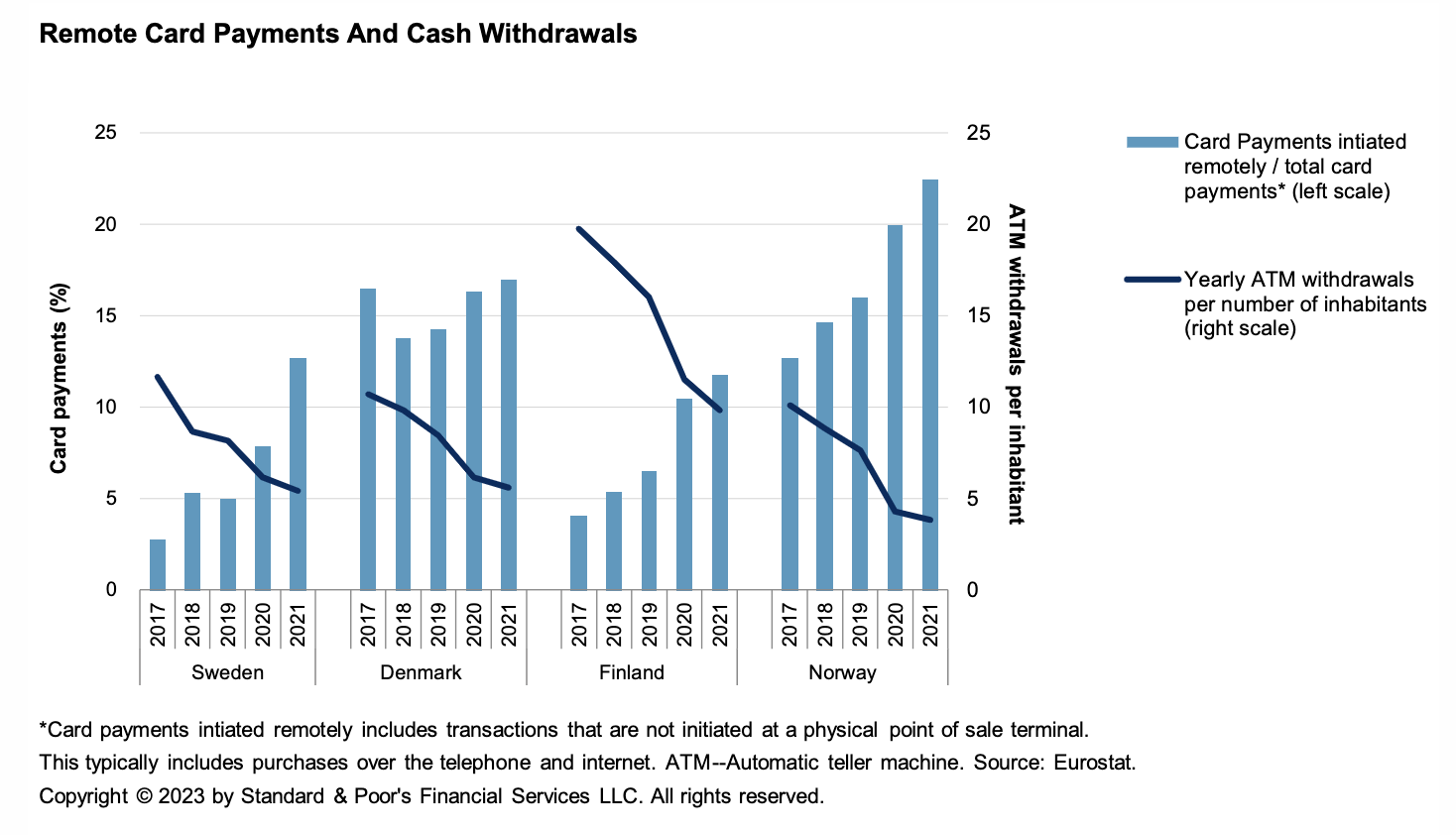

Future Of Banking: E-Krona Will Extend Sweden's Digital Lead

Sweden could be the first European nation to launch a central bank digital currency and, in doing so, accelerate its already considerable progress towards a cashless society. Details remain uncertain, but the Riksbank is likely to issue the e-krona and focus on financial stability, while banks and payment companies will handle end-user relationships and interactions. Large, digitally advanced banks are likely to cope best with the change, though the e-krona could give rise to new risks, including potential vulnerability to cybercriminals and IT system issues.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

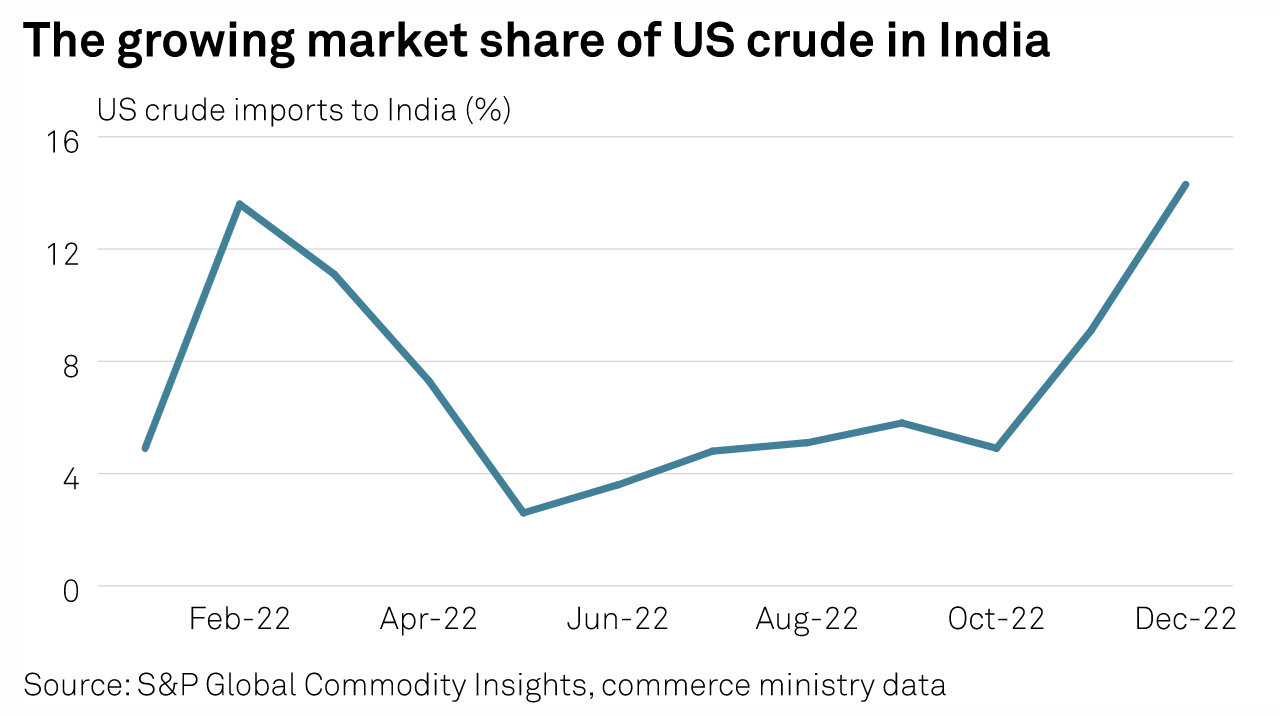

India Intensifies Oil Supply Talks With U.S. Ahead Of Further Russian Sanction Moves

India has intensified discussions with the U.S. to ensure its oil supply strategy does not encounter hurdles or disruptions in the event Russia faces additional sanctions for its war in Ukraine, a sign that New Delhi wants to balance energy ties with both Washington and Moscow, government officials and analysts said. Indian oil ministry officials added that Russian oil offered the country a window of opportunity to boost purchases over the past one year given its attractive price. However, the situation could change in the event more restrictions are implemented on Russia. As a result, it is imperative for India to keep working with alternate suppliers.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

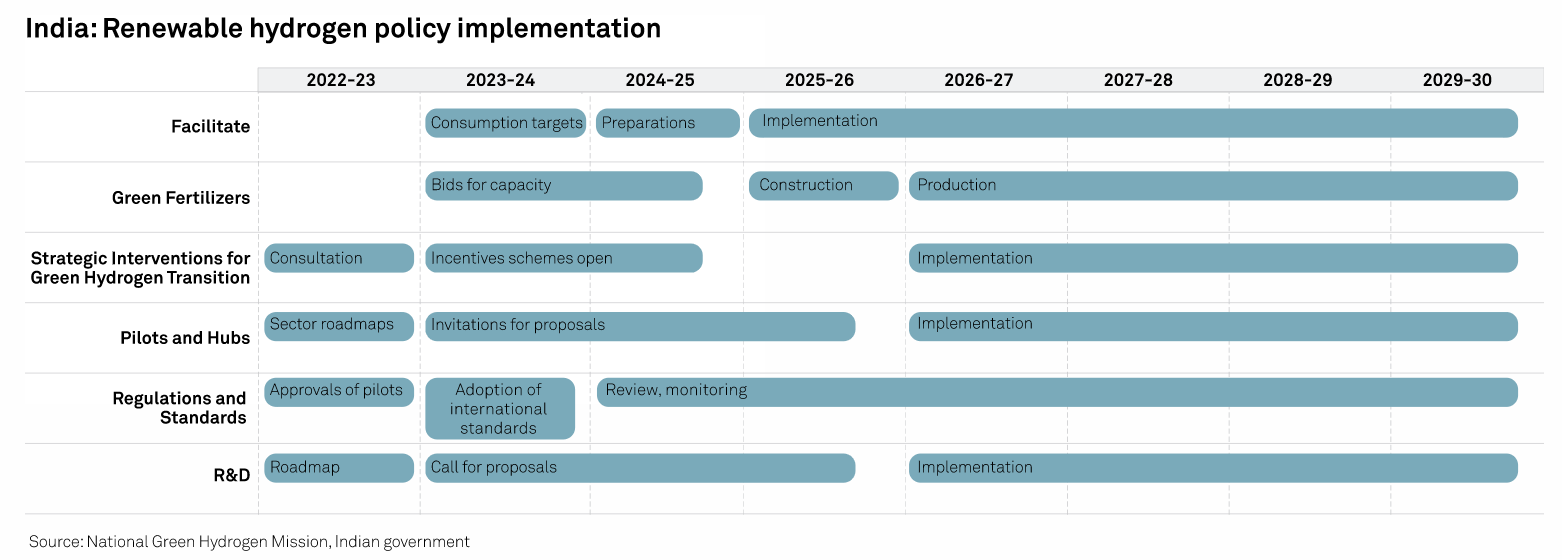

India To Issue Guidelines For Green Hydrogen Subsidies 'Very Soon'

India is close to issuing guidelines for renewable hydrogen producers and tenders for electrolyzer manufacturers to help disburse the government's subsidy, Tarun Kapoor, energy transition adviser to Prime Minister Narendra Modi, told S&P Global Commodity Insights Feb. 27. The country's National Green Hydrogen Mission, released in January, is to provide Rupees 197.44 billion ($2.4 billion) in funding support for renewable hydrogen production and electrolyzer manufacturing, with a goal of delivering 5 million mt/year of green hydrogen by 2030.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

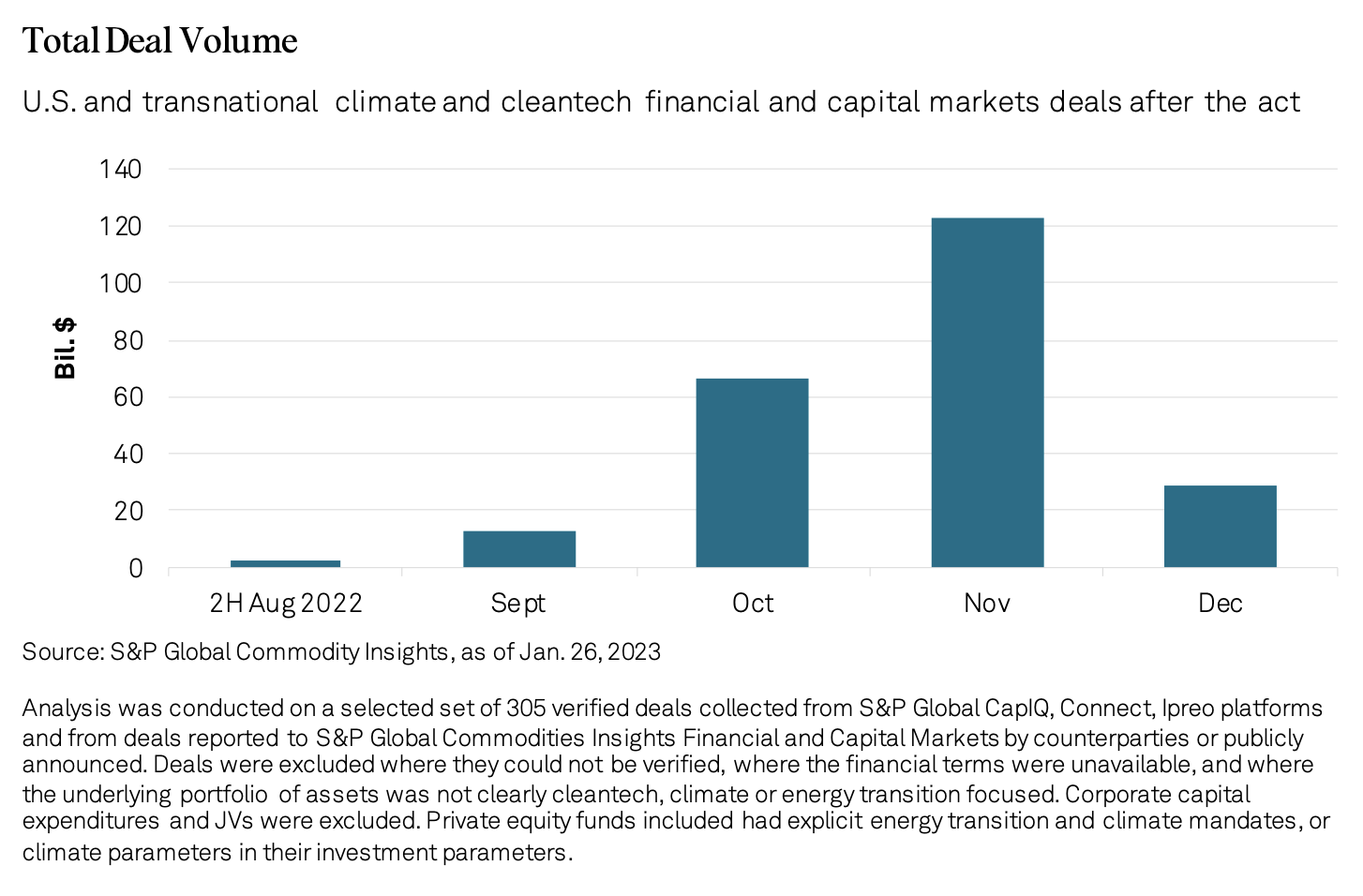

U.S. Inflation Reduction Act Highlights Diverging Approaches With Europe

The U.S. Inflation Reduction Act (the act or law) is proving consequential in the likelihood it will turbocharge renewables development and the broader goal of a net-zero future. The act's subsidies and incentives could shift production to the U.S. for tax reasons, emphasizing the EU’s competitiveness concerns, as it was already under pressure from energy price differentials triggered by the Russia-Ukraine war. Certain segments in the power sector, autos, midstream utilities, agribusiness and health care may experience positive credit impacts from improved cash flows and reduced development and technology costs for renewables and carbon capture.

—Read the report from S&P Global Ratings

Access more insights on energy and commodities >

Listen: Energy And Innovation At CERAWeek

Breaking through boundaries and sparking innovation has been the hallmark of the CERAWeek conference for almost two decades and this year it arrives with a world that’s in much greater turmoil but one where innovation offers greater hope. Analysts Gabrielle Brown, Jonathan Schroth and Johan Vermij are chairing panels at the conference and exploring what they’ll be discussing with host Eric Hanselman.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence

Access more insights on technology and media >

CERAWeek by S&P Global — Navigating A Turbulent World: Energy, Climate and Security

Join global leaders, policymakers and executives from across energy, climate, finance, technology and industry at CERAWeek 2023 for timely dialogue, shared learning and connection.

—Register for CERAWeek