Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 8 Jun, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Dual Agenda of the Russian Oil Price Cap

From the beginning, the oil price cap imposed by Group of Seven countries on Russian oil was designed to serve a dual mandate. The first goal was to deprive the Kremlin of the oil revenues it requires to meet the cost of its continued invasion of Ukraine. The second was to maintain a steady oil supply to avoid a price spike that could undermine support for sanctions or tip some economies into recession. So far, the dual mandate appears to be working: Russian oil revenues and oil prices are down. But other countries have benefited economically from the oil price cap and sanctions, especially those that have declined to support the sanctions regime. A reorientation of global supply lines for oil, it seems, will have a range of winners and losers.

During a recent episode of S&P Global Commodity Insights’ “Capitol Crude” podcast, a range of experts from across the energy industry weighed in on the sustainability of the global price cap on Russian oil. While the consensus was that the dual mandate of the oil price cap has been met, there were differing opinions on if this was due to normal market behavior or if the price cap’s efficacy could be maintained in the second half of the year.

“The existence of that price cap has enabled China and India, who are the primary buyers of Russian crude, to negotiate very significant discounts,” David Goldwyn, chairman of the Atlantic Council's Energy Advisory Group, said on the podcast. “The range of those discounts seems to vary anywhere from $12 to $35 or $40 a barrel. … The question is how well will it work in the second half of the year, if the OPEC and [International Energy Agency] and [Energy Information Administration] projections of increased demand in the second half of the year come to fruition. Most of those forecasts are based on China having more significant growth in the second half of the year than the first half of the year, with the return of industrial demand in particular.”

The benefits of the G7 price cap on unaligned nations such as India, China and others might appear to be an unintended consequence of the sanctions regime. However, recent statements by US Treasury Secretary Janet Yellen indicate that bargain shopping in oil markets by unaligned countries is a necessary ingredient for the success of the oil price cap. At a May 11 press conference held ahead of the G7 Finance Ministers and Central Bank Governors Meeting in Niigata, Japan, Yellen encouraged buyers of Russian crude to negotiate deep discounts. New customers such as Pakistan have entered the market for discounted Russian crude, and countries such as Kazakhstan have identified how to profit from reorientations in the global crude market.

At the G7 meetings, member states reaffirmed their commitment to implement new sanctions and export controls in consequence of the invasion. Russian companies have grown increasingly sophisticated at evading sanctions, creating a shadow fleet of tankers under the ostensible ownership of holding companies based in India or the United Arab Emirates to hide Russian crude shipments. G7 countries have agreed to step up enforcement methods, but they have stopped short of proposing secondary sanctions against countries that help Russia subvert the price cap. The calculation seems to be that the cost Russia pays to subvert the price cap is money that comes directly out of the Kremlin’s pocket.

While the oil price remains important to the geopolitical calculus of the war in Ukraine, the war will not ultimately be decided by price caps or sanctions. Rather, it is the war that will determine the oil price.

According to Carlos Pascual, senior vice president of geopolitics and international affairs at S&P Global Commodity Insights and a former US ambassador to Ukraine: "The outcome of this summer's battles in the Donbas will bring the international order of politics and energy to an inflection point."

Today is Thursday, June 8, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

European Air Travel Defies Economic Pressures On Robust Demand

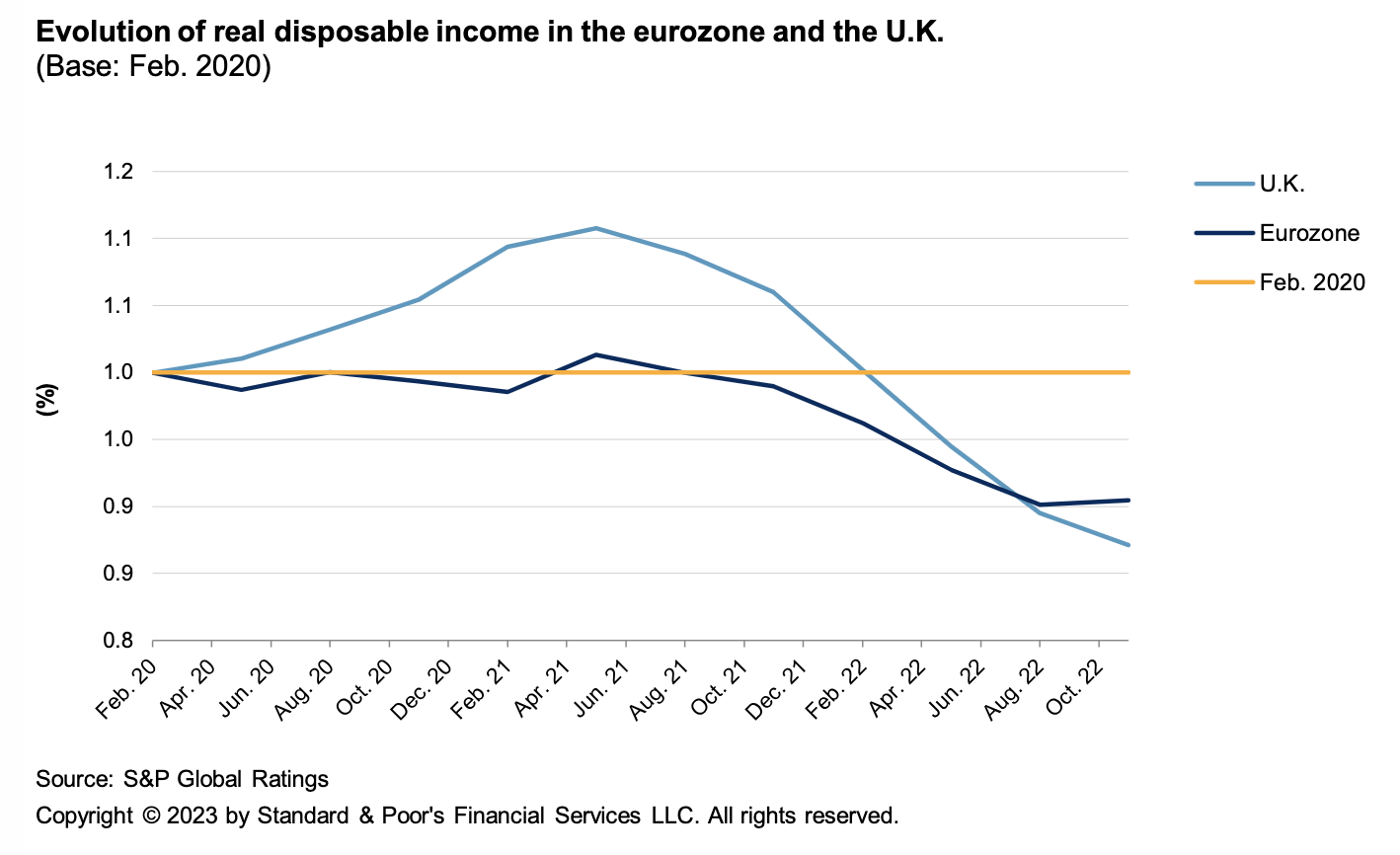

S&P Global Ratings raised its European air passenger traffic forecasts ahead of the key summer season in expectation that travel demand will continue to resist economic pressures. Its conviction that traffic growth will resist high ticket prices underpinned the recent upgrades of S&P Global Ratings’ five strongest-rated European airlines, though it sees less benefit for airports and maintain a negative outlook on several airport ratings. Economic, political, and environmental challenges could weigh on longer-term demand.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

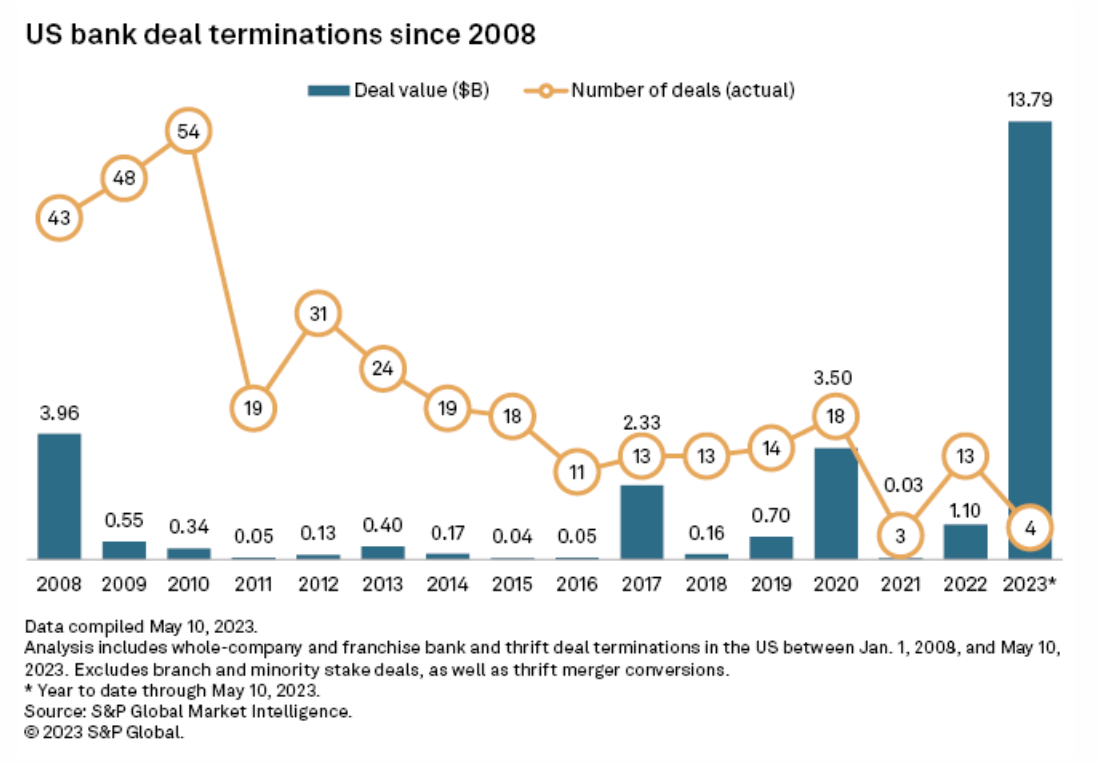

Regulatory Focus On Compliance Sidelines Some US Bank Deals

Regulatory compliance issues are slowing down bank M&A approval processes and sometimes preventing them from closing altogether. The total assets of US bank deal terminations surged this year following the fallout of The Toronto-Dominion Bank and First Horizon Corp.'s blockbuster deal — marking the largest US bank deal termination. Among the four US bank deals terminated so far this year, three cited regulatory issues as the cause.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

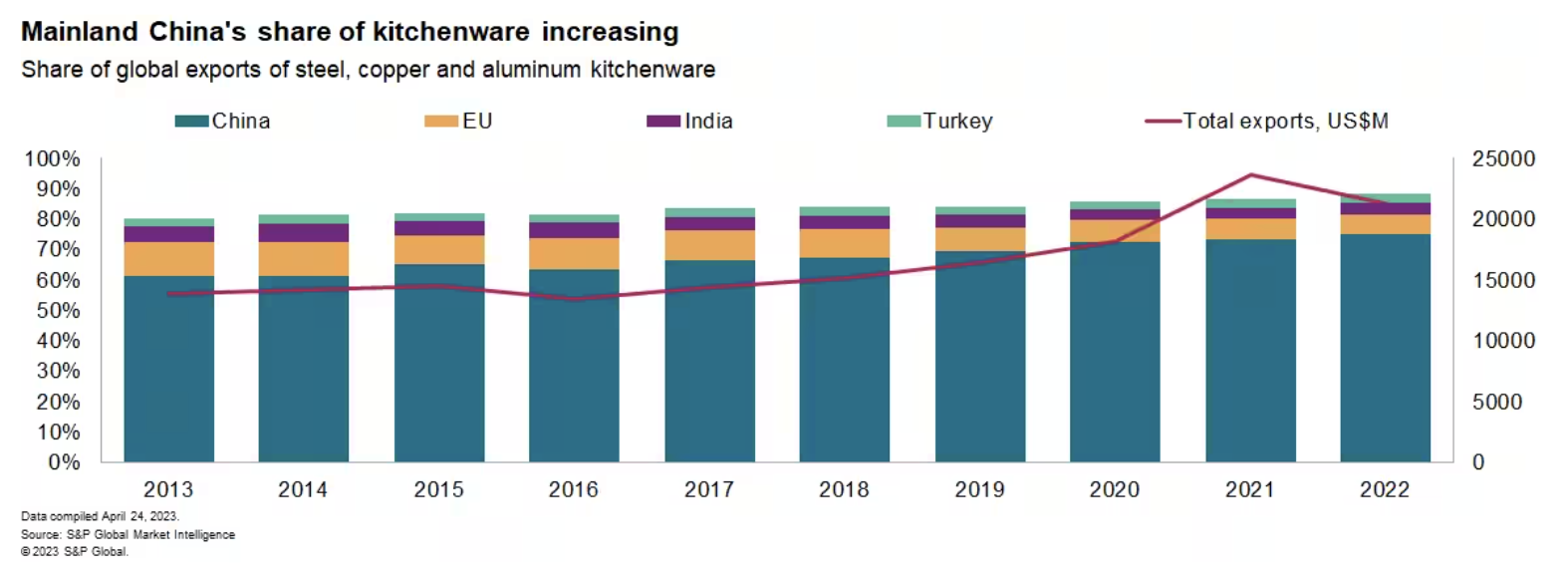

Source Pans: Mainland China Leads Kitchenware Supply Chains

The kitchenware segment is typical of consumer durables in experiencing a decline. EU retail sales by household equipment specialists fell by 8% in January versus their March 2022 peak. The downturn can also be seen in global exports of kitchenware products, which fell by 10% year over year in 2022, according to S&P Global Market Intelligence data. While corporations can offset falling sales in the short term with lower prices, in the long term they need to pursue other routes to build competitive advantage. These can include alternative sourcing strategies.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

Corporate Renewable Procurement Announcements Dip In The First Quarter With Quick Rebound Expected Later In 2023

After a record announcement of more than 50 GW corporate renewable procurement deals in 2022, first quarter 2023 had a lukewarm start. S&P Global recorded about 300 clean energy procurement deals totaling about 8 GW in the first quarter of 2023 and registering a year-on-year decline of about 20% in deal numbers and 40% decline in the deal volumes. The slowed down can be attributed to various regional factors including high price volatility and preparation for higher renewable targets in Europe, and uncertainty due to Inflation Reduction Act's implementation in the United States.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Listen: What To Make Of First Quarter Earnings?

Antoinette Smith, senior editor for Americas chemicals and recycled polymers at S&P Global Commodity Insights, joins CW Editor in Chief Rob Westervelt for a discussion of first quarter results in an environment of slowing demand and growing complexity.

—Listen and subscribe to Chemical Week, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

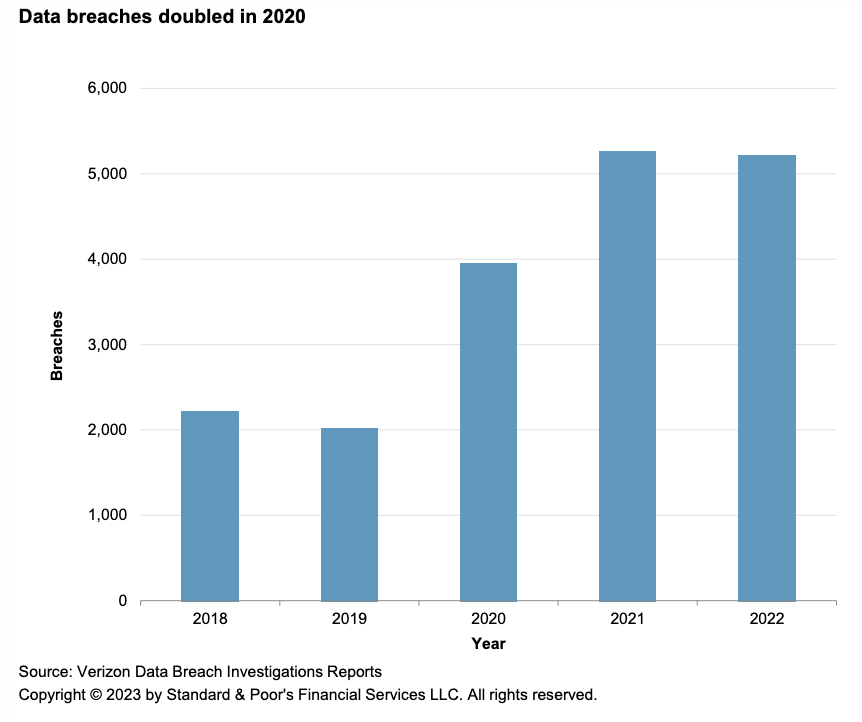

Cyber Risk Insights: Recession Pressures Could Expose More US Public Finance Issuers To Cyber Attacks

Cyber attacks against US entities, including public finance issuers, continue to increase, with the number nearly doubling in 2020. While maintaining cyber insurance does not directly prevent or mitigate cyber risk, S&P Global Ratings believes it serves as a financial safeguard and can help issuers recover from the financial losses and liabilities associated with a successful attack. Amid the increased attacks, insurers have increased their premiums and requirements, potentially pressuring issuers' resources.

—Read the report from S&P Global Ratings