Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 30 Jun, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Global Energy Crisis Deepens

As Russia continues to wage its war on Ukraine, countries that have imposed sanctions on Russia have yet to determine solutions to the worsening commodities crisis that is destabilizing their energy security and supply.

Roughly five months after the invasion of Ukraine began, many countries have sought new energy trading relationships and collaborations on future energy initiatives. But energy security risks are expanding into a global crisis. Markets are still reeling from increases in energy prices and destabilized trade flows for critical food and energy supplies. The conflict and its spillover effects on commodities are putting pressure on already-slowing global economic growth—and inflation, energy security, and geopolitical uncertainty present substantial risks to global credit conditions, according to S&P Global Ratings’ latest outlooks.

Although Russia’s commodities exports have fallen due to sanctions, more market dynamic shifts are still to come, according to S&P Global Commodity Insights.

Asia-Pacific and European economies are in the midst of a ballooning energy crisis that is expected to deepen further over the coming months due to high energy prices, fuel supply disruptions, and growing shortages of oil, gas and coal. The situation has prompting regulators to introduce energy preservation efforts. Countries like India and China continue to seek supplies from Russia, while major developed economies like the U.S. and EU aim to accelerate their action against it. Russia has deployed countersanctions against and even stopped providing energy supplies to countries that have refused to comply with its terms.

In a statement affirming the collaboration between the U.S. and the European Commission to end reliance on Russian energy, U.S. President Joe Biden and EC President Ursula von der Leyen said June 27 that “Russia continues to use natural gas as a political and economic weapon.” The Group of Seven nations announced this week that they are close to developing a mechanism to cap the price of Russian oil in order to curtail Moscow's oil and gas revenues.

“As the war enters its fifth month, sanctions and financing restrictions may trigger supply-side changes that could affect natural gas, crude, diesel, and grains for years to come,” S&P Global Commodity Insights said in an analysis this week. “As the conflict continues, the likelihood grows of new measures targeting other areas of commodity trading, and Russia's response could include further attempts to change payment terms.”

Today is Thursday, June 30, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

The Essential Podcast, Episode 64: The Rise and Fall of the Neoliberal Order

Gary Gerstle of Cambridge University joins the Essential Podcast to talk about the nature of political orders and the collapse of the political order known as neoliberalism that came to power with Ronald Reagan.

—Listen and subscribe to The Essential Podcast from S&P Global

Access more insights on the global economy >

Global Credit Conditions Q3 2022: Resurfacing Credit Headwinds

Sharp monetary tightening is putting a brake on global growth, with inflation, energy security, and geopolitical uncertainty being the chief risks. Other notable risks stem from governments struggling to balance energy security and affordability in the short term, with long-term decarbonization ambitions.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

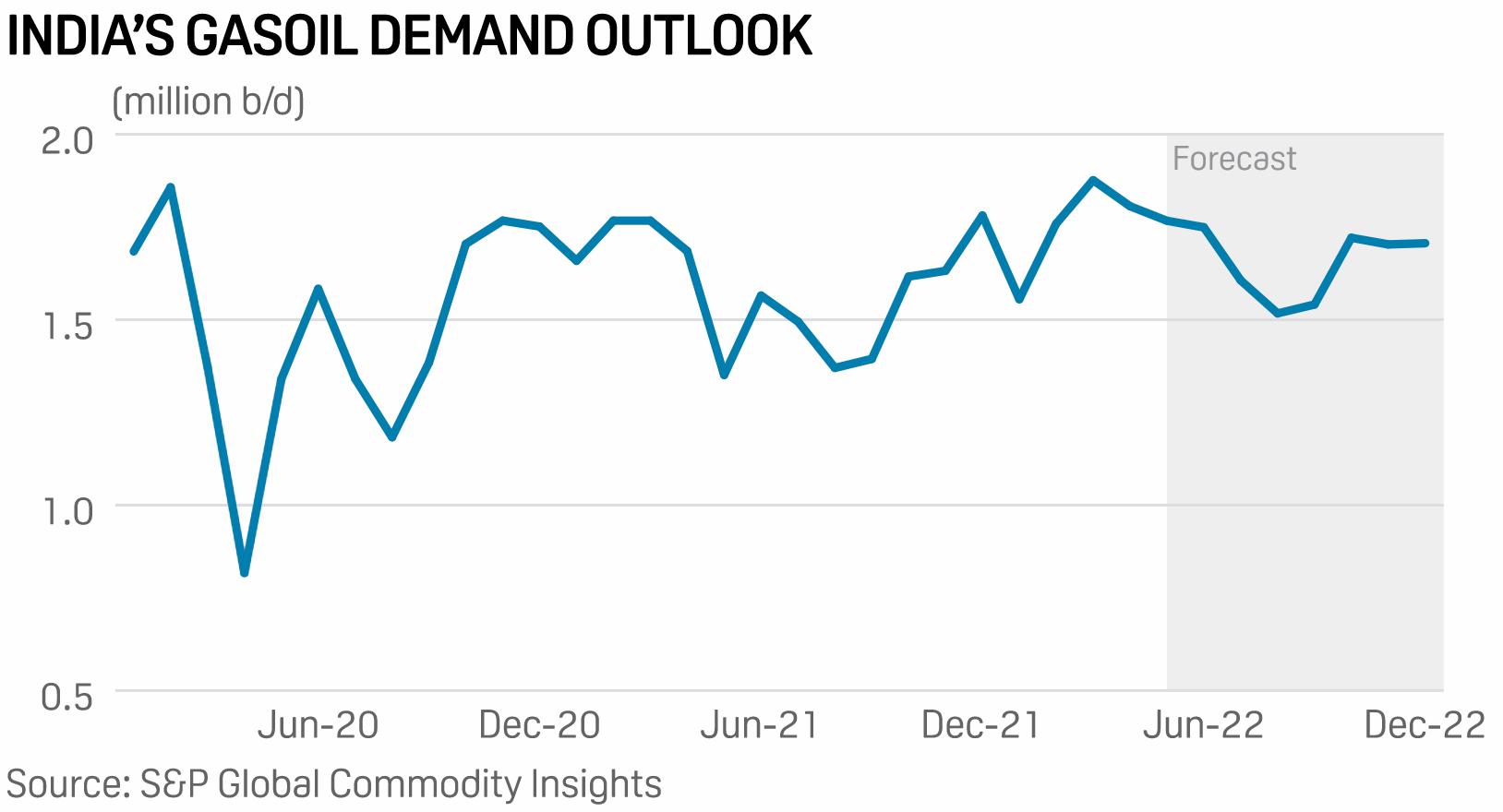

Monsoon Rains, European Demand Set to Keep India's Gasoil Exports Robust

India's diesel exports in May posted a growth of 15.2% compared with the previous month and are set to rise further, as the arrival of monsoon rains is expected to slow domestic construction activity at a time when refiners are reaping rich returns on the back of lucrative refining margins, trade sources and analysts said.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

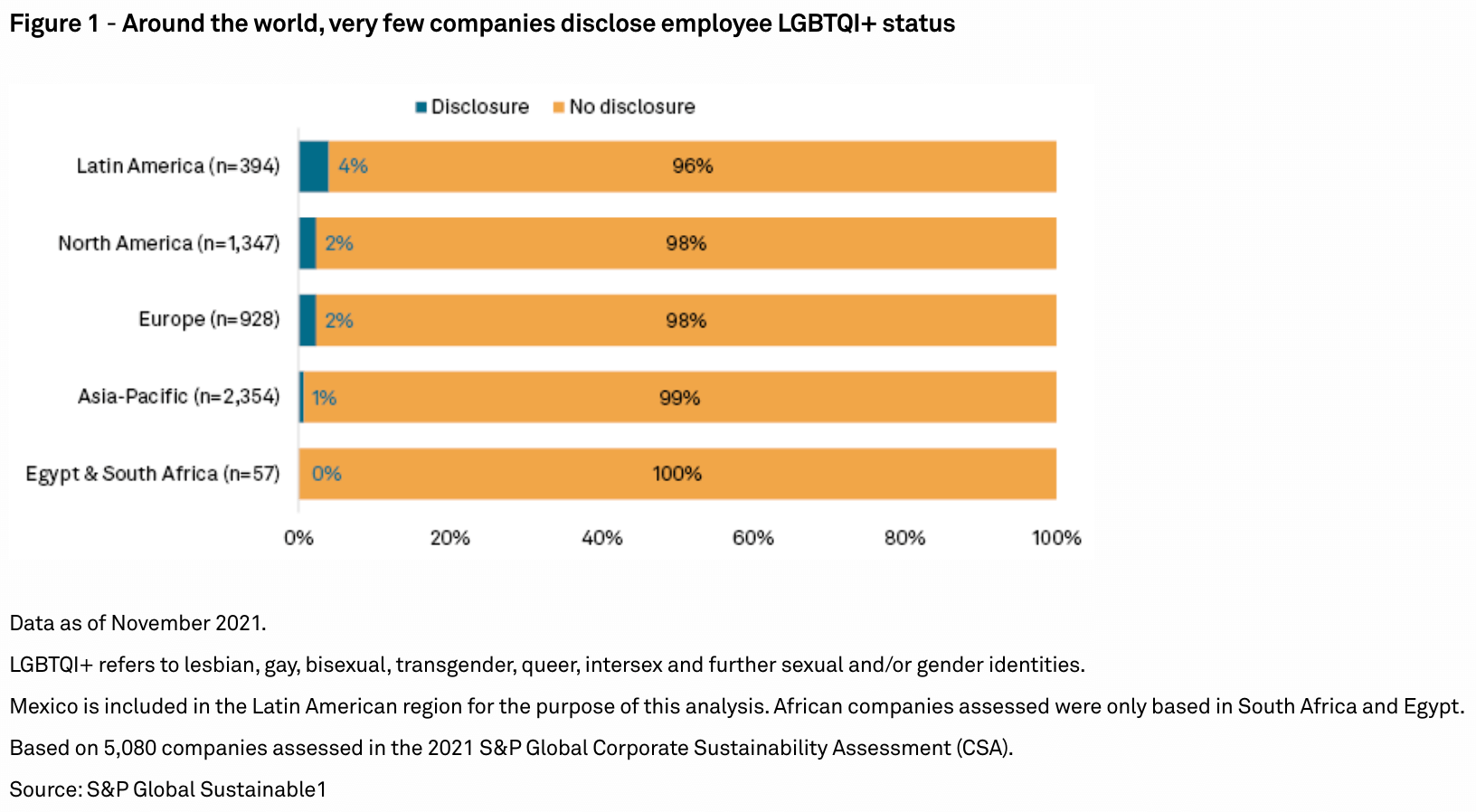

Creating Visibility and Positive Recognition – LGBTQ+ Inclusion in the Workplace

Diversity, equity and inclusion are high on the agenda for many companies. More than a quarter of companies actively participating in the S&P Global Corporate Sustainability Assessment (CSA) 2021 identified diversity and/or inclusion among their top three material issues. However, less than 2% of companies assessed through the CSA 2021 publicly report the number of employees who identify as LGBTQI+. More data collection would help measure LGBTQ+ inclusion in the workplace.

—Read the article from S&P Global Sustainable1

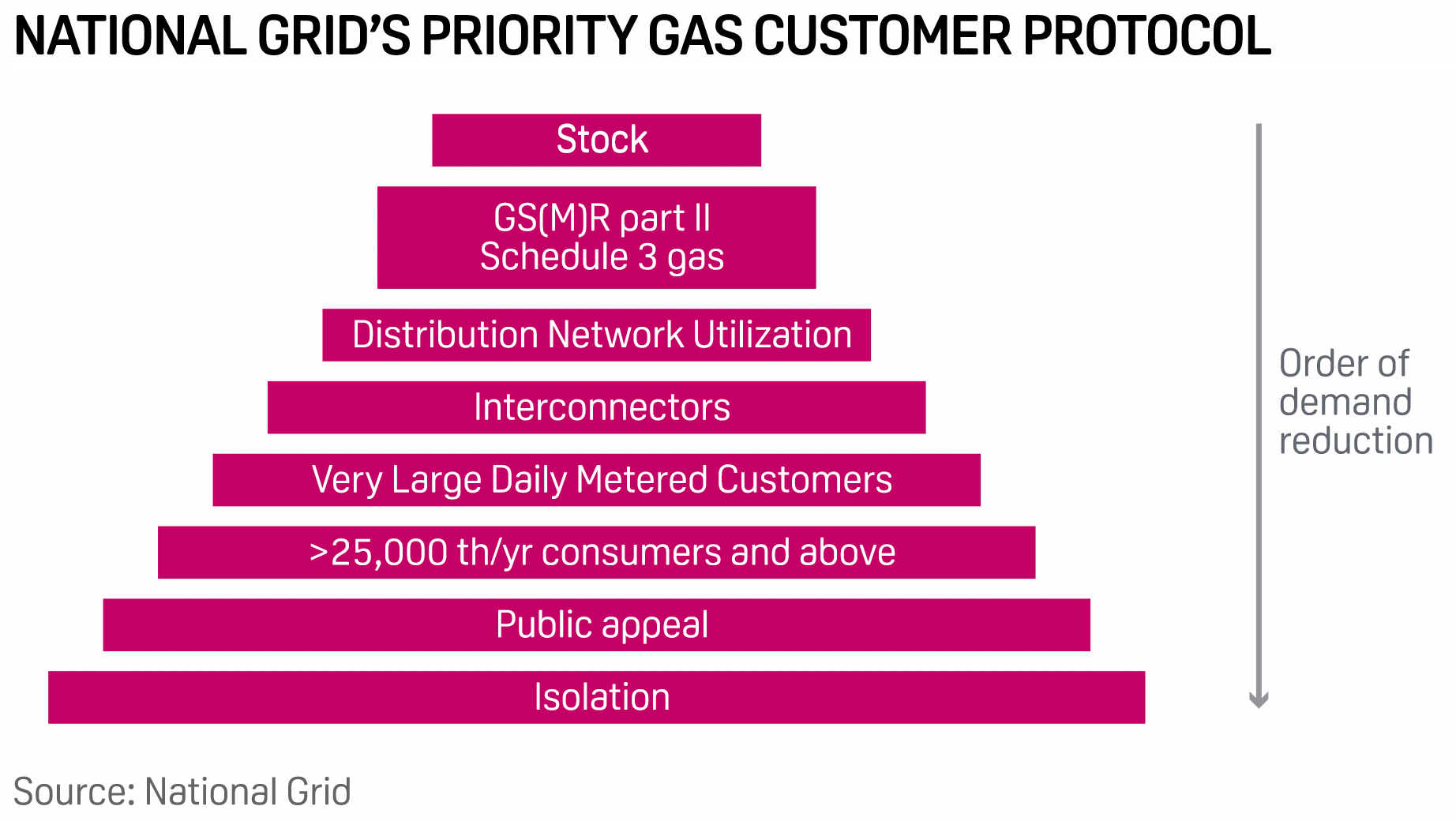

UK Maximizing Gas Export Capacity to Mainland Europe: National Grid

The UK has long-standing gas emergency procedures in place, including load shedding on interconnectors, but for now is maximizing export capacity available to mainland Europe, a National Grid spokesperson told S&P Global Commodity Insights June 29.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

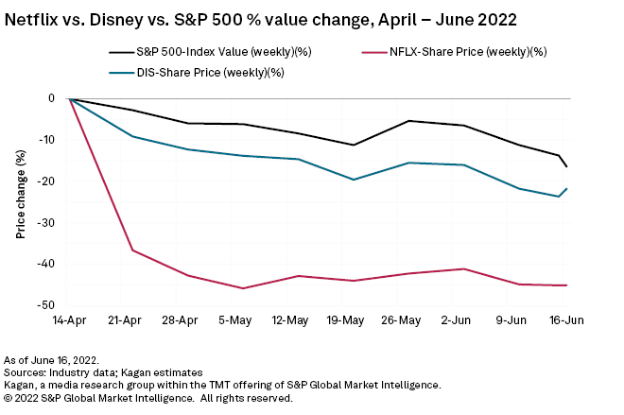

SVOD Players Open to Hybrid Models; Netflix and Disney to Add Ad-Supported Plans

After a decade of rapid growth fueled by the worldwide expansion of subscription-based over-the-top video services, a saturated video entertainment landscape, coupled with a worsening macroeconomic environment, has put many OTT video providers under pressure.

—Read the article from S&P Global Market Intelligence