Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 14 Jun, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Europe Finds New LNG Partners Fast

In response to the geopolitical shocks that are disrupting global energy markets—particularly the war in Ukraine and corresponding sanctions on Russian oil and gas, alongside global decarbonization efforts to combat climate change and actualize a path to net-zero— economies are establishing new energy trading relationships and collaborate on future energy initiatives. The European Union is at the epicenter of these changing dynamics, materializing new agreements and relationships.

While Russia is likely to continually reap economic gains from its oil and gas exports by selling to countries outside the sanctions realm, the EU’s plans by year-end to reduce its reliance on Russia for gas by two-thirds, maintain minimum gas storage obligations, and ban Russian oil imports by sea has sent the bloc seeking supplies of liquified natural gas (or LNG) from other partners as a key source of flexibility for the European market.

S&P Global Ratings believes that the EU’s efforts to secure alternative energy supplies and policy calls for more LNG could reshape Europe's energy market. The bloc’s significant dependence on Russian gas is likely to gradually decrease and be replaced by existing regional gas suppliers from Norway to Algeria and the world's largest exporters of gas, including the U.S., Qatar, and Australia, with the potential for Europe’s reshaping energy security to incentivize emerging markets to export natural resources to the bloc, according to S&P Global Market Intelligence.

Industry groups from the U.S. and EU today called for their respective governments to implement policies to support their LNG trade, according to S&P Global Commodity Insights.

This week, Qatar announced that it has chosen the French energy firm TotalEnergies as a partner to develop its massive offshore North Field East project, marking a new frontier for one of the world’s biggest exporters of liquified natural gas into the European market, according to S&P Global Commodity Insights.

Egypt, Israel, and the EU are in the process of establishing a trilateral agreement to allow for Israeli gas to be exported to Europe, according to S&P Global Commodity Insights. Because no existing infrastructure can transport LNG from Israel directly to Europe, this new partnership could allow for Israeli gas to be exported to Egypt’s two liquefaction plants and from there shipped to Europe to be gasified again.

Azerbaijan officials are aiming to export gas to new European customers, and have this month already discussed growing gas demand with representatives from Romania, Serbia, Hungary, and Italy, according to S&P Global Commodity Insights.

However, the scramble for new supply risks reversing Europe and the world’s ambitious climate action.

"Although there is pressure to hurry up approvals of these LNG projects, government regulators should be careful and thoughtful in considering their significant environmental impacts," Alexandra Shaykevich, co-author of a June 9 report from the U.S.-based Environmental Integrity Project on the climate implications of rapid LNG growth, said in a statement, according to S&P Global Commodity Insights. “A dramatic increase in global dependence on LNG could be risky, from a climate perspective."

Today is Tuesday, June 14, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

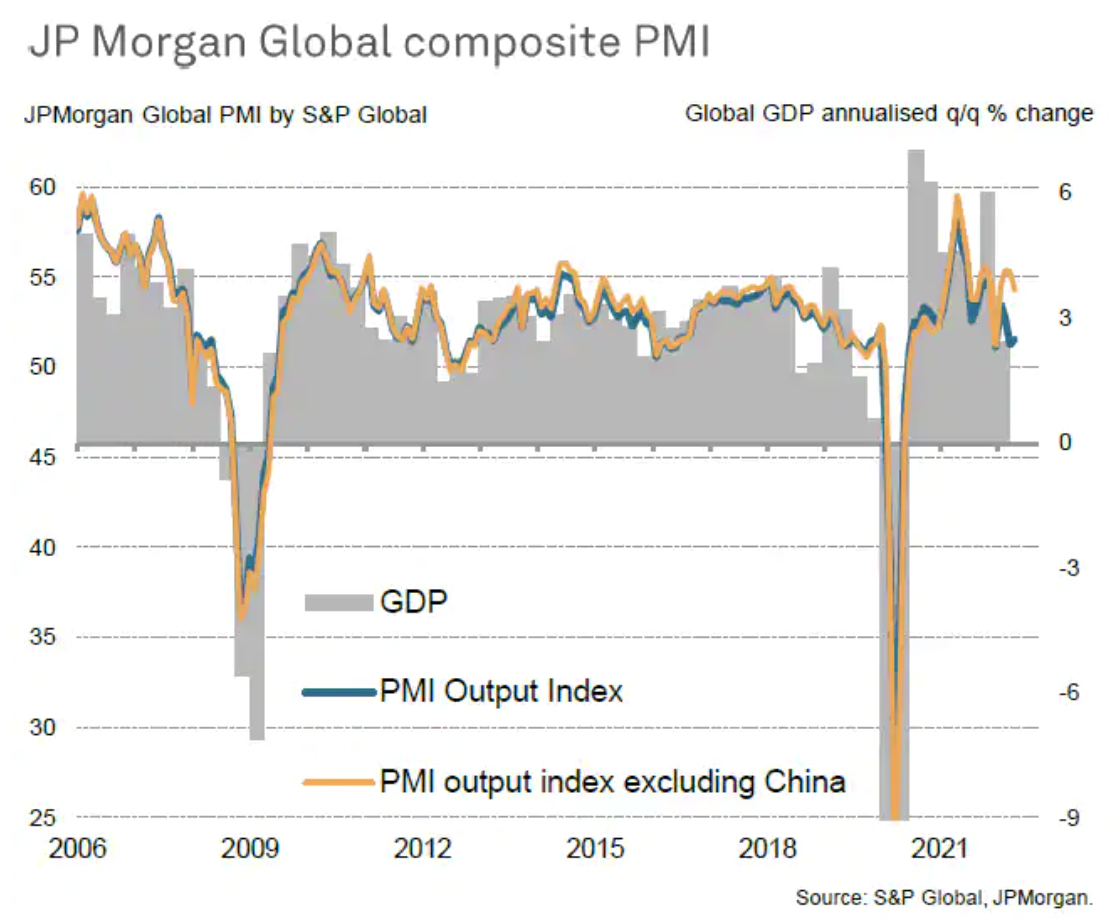

Global PMI Special Report: Russia-Ukraine War Update

Global economic growth remained stuck close to post-pandemic lows in May and inflationary pressures held near all-time highs amid the twin headwinds of the Russia-Ukraine war and COVID-19 related lockdowns in mainland China. Supply chain delays showed only modest signs of easing, exerting further upward pressure on prices for many goods, through May also saw inflationary pressures spread further to the service sector, where input cost inflation now exceeds that of manufacturing.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

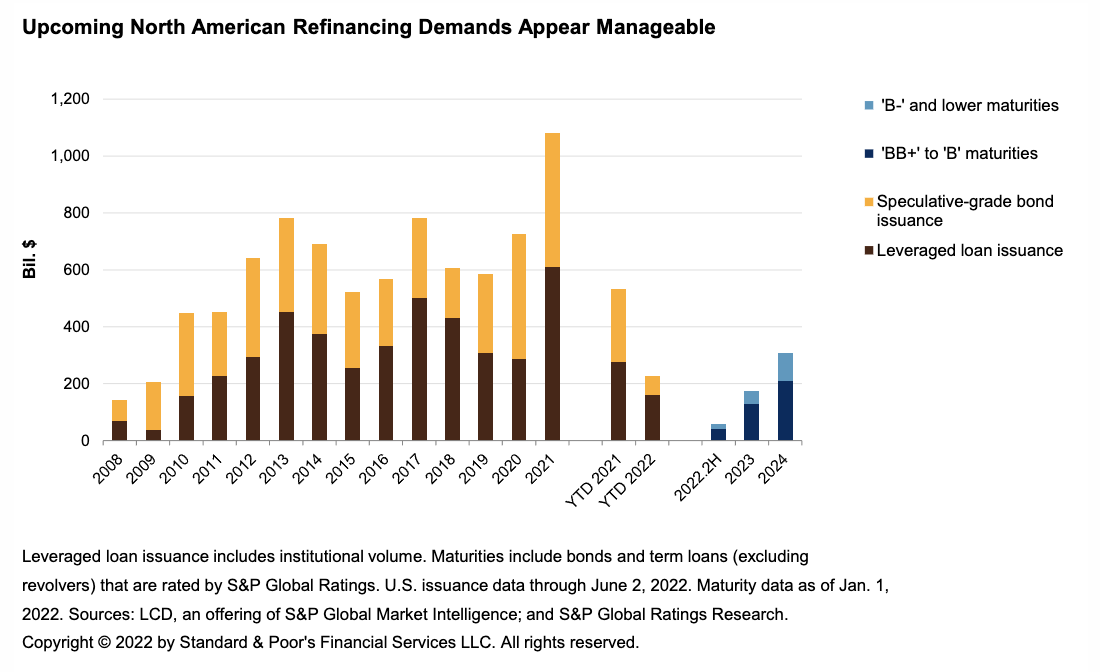

Credit Trends: Where To Look For Refinancing Vulnerabilities Through 2023 Amid Market Turmoil

Refinancing needs look manageable for nonfinancial companies rated speculative-grade ('BB+' or lower) by S&P Global Ratings in North America, as well as Europe, the Middle East, and Africa (EMEA) through 2023, after many companies actively reduced upcoming debt maturities. However, risks persist—particularly for lower-rated companies. Not only do these issuers generally have fewer funding options, but growing risk aversion amid market volatility and rapidly shifting financing conditions could exacerbate their refinancing risk and funding costs.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

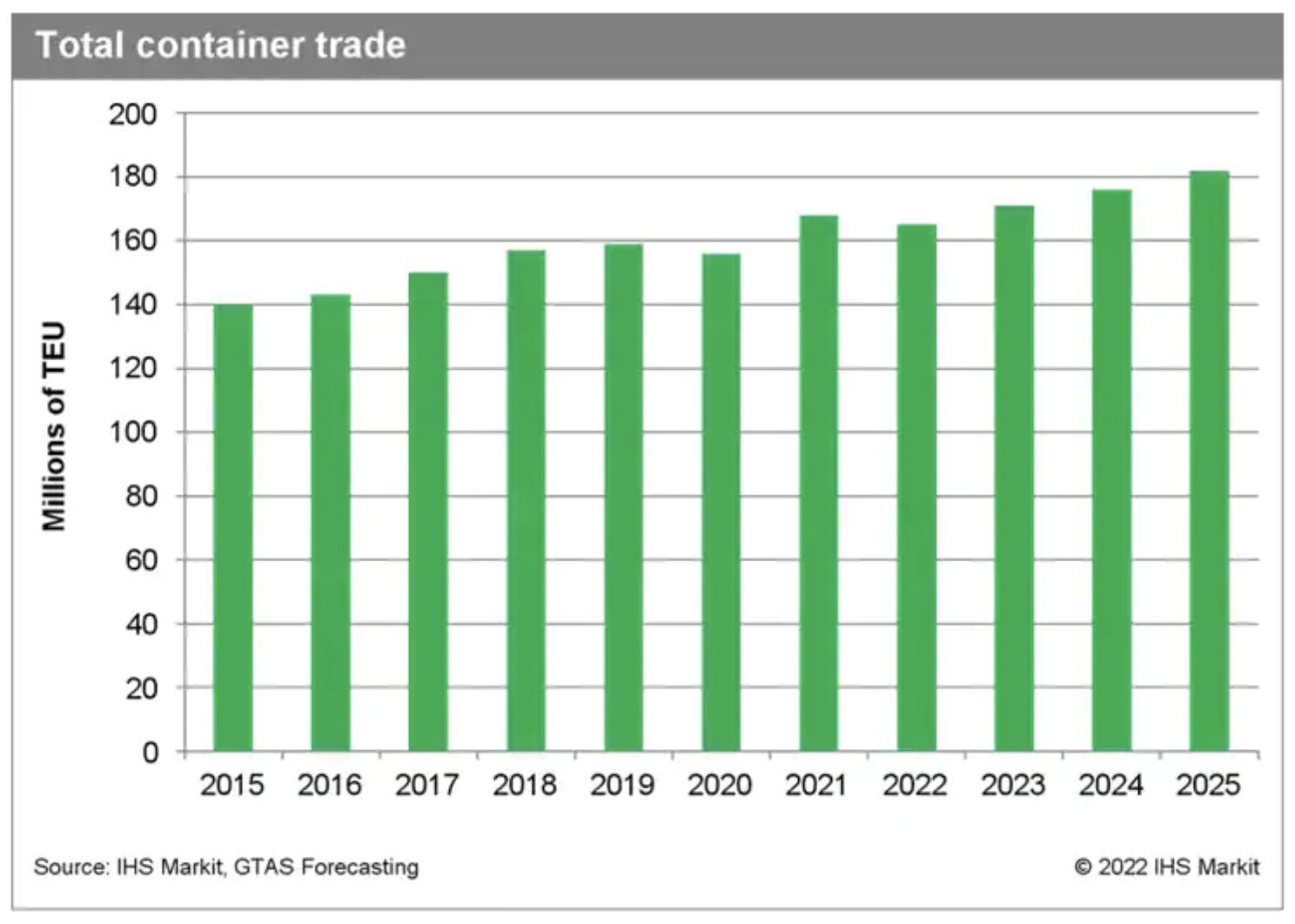

Containerized Trade Outlook By GTAS Forecasting – June 2022

GTAS Forecasting has noted a strong recovery in global container trade during the year 2021 with an annual growth amounting to 7.9%, and the volumes reaching 168.2 million TEU. The first and second quarters of 2021 marked significant increases by 12.8% and 20.6% y/y. Third quarter of 2021 has already brought a milder growth by 6.4% y/y, while in the last quarter of 2021, we have observed a decrease by 5.9% y/y according to GTAS Forecasting data.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

Listen: How Automaker GM Is Tackling Climate Change, Social Equity And Supply Chain Risk

In the latest episode of ESG Insider, hosts Lindsey Hall and Esther Whieldon talk with Hina Baloch, executive director for data analytics, sustainability and diversity, equity and inclusion and STEM education communications at General Motors, one of largest auto manufacturers in the U.S. GM has made several low-carbon pledges and is working on ensuring an equitable and just transition as it pursues those goals. The company is also moving to shore up access to new domestic resources for critical minerals after the COVID-19 pandemic and the Russia-Ukraine conflict exposed weaknesses in global supply chains.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Listen: It'll Be A Long, Hot Summer As Energy Prices Supercharge Inflation

Global energy markets have gone through dramatic shifts since Russia's invasion of Ukraine, and the risks around high prices and tight supply are not expected to ease anytime soon. Atul Arya, chief energy strategist for S&P Global Commodity Insights, spoke with senior editor Meghan Gordon about those challenges. They discuss how the war has changed the pace of the energy transition away from fossil fuels, whether the focus on energy security is on the rise, and how today's energy crisis compares to the oil shocks of the 1970s. They also look at the long-term impacts of Europe severing economic ties with Russia and the latest outlook for U.S. oil supply growth.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

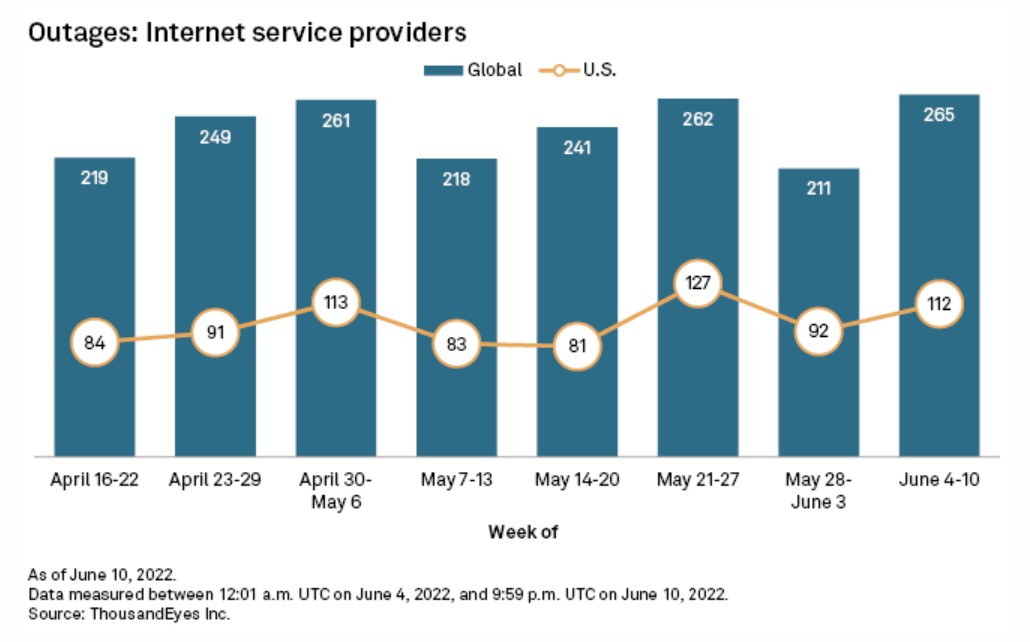

Global, U.S. Internet Disruptions Jump In Early June

The number of global internet outages jumped almost 26% to 265 in the week of June 4, compared to 211 in the prior week, according to data from ThousandEyes, a network-monitoring service owned by Cisco Systems Inc. U.S. outages increased 22% to 112 last week, accounting for 42% of all global disruptions. ThousandEyes detected two notable disruptions last week.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >