Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 25 Jan, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Stung U.S. Stock Investors Can Find Optimism in Bear Market History

Investors nursing losses from 2022’s U.S. stock sell-off can draw comfort from how equities have performed following previous bear markets.

The S&P 500 has gained an average of 15% over three years after entering a bear market, according to an S&P Dow Jones Indices analysis of the 12 such slumps in 1929 to 2019. The gauge entered the latest bear market on June 13, 2022, after dropping 20% from a peak at the start of the year.

“At the end of every bear market, a bull market begins,” Sherifa Issifu, S&P Dow Jones Indices’ senior analyst for U.S. equity indices, wrote in an Indexology Blog post. Still, history “shows the importance of treading with caution in bear markets.”

Stocks have recovered from the worst of 2022’s slump, with the index climbing about 10% from a mid-October low, fueled by optimism that the Federal Reserve may not raise rates as fast as previously feared. The rebound has been curtailed by ongoing economic concerns, including a U.S. manufacturing slowdown and S&P Global’s Financial Fragility Indicator posting its worst reading since the global financial crisis.

“With aggressive policy normalization and a recession expected, financial conditions are likely to weaken further this year,” Beth Ann Bovino, S&P Global Ratings’ U.S. chief economist, wrote in an Economic Research update.

Looking at previous bear markets, the S&P 500 posted positive three-year returns eight times out of 12 after entering a bear market through 2019. Another positive example is on the horizon as March sees the third anniversary of the COVID-19 bear market of 2020.

The biggest three-year bounceback in the research was a 63% surge under President Ronald Reagan through 1985. The worst performance was a 75% plunge after the index entered a bear market in the 1929 Wall Street Crash.

Over a one-year period, stocks have gained 9% on average after entering a bear market, with only five losses out of 13. The rally following the 2020 COVID-19 panic led the way as shares surged 59% in 12 months.

The most recent bear market entrance was in June 2022, so it’s only possible to compare the six-month performance. That is favorable, as the 5% gain surpassed the 1% average across all bear markets since the start of 1929, according to S&P Global data.

Still, the index has dipped since reaching the six-month marker in December amid a dim economic picture. U.S. manufacturing, for instance, deteriorated at the fastest rate since May 2020 in December, according to the JPMorgan Global Manufacturing PMI. The Fed pushing up borrowing costs and continued high inflation have also weighed on recent stock performance.

“Pressures from aggressive central bank rate hikes to fight inflation and recession fears wrapped up a rough year for global markets,” according to December’s S&P Global Research Signals. Markets also started “the new year on negative economic data points.”

Today is Wednesday, January 25, 2023, and here is today’s essential intelligence.

Written by Neil Denslow.

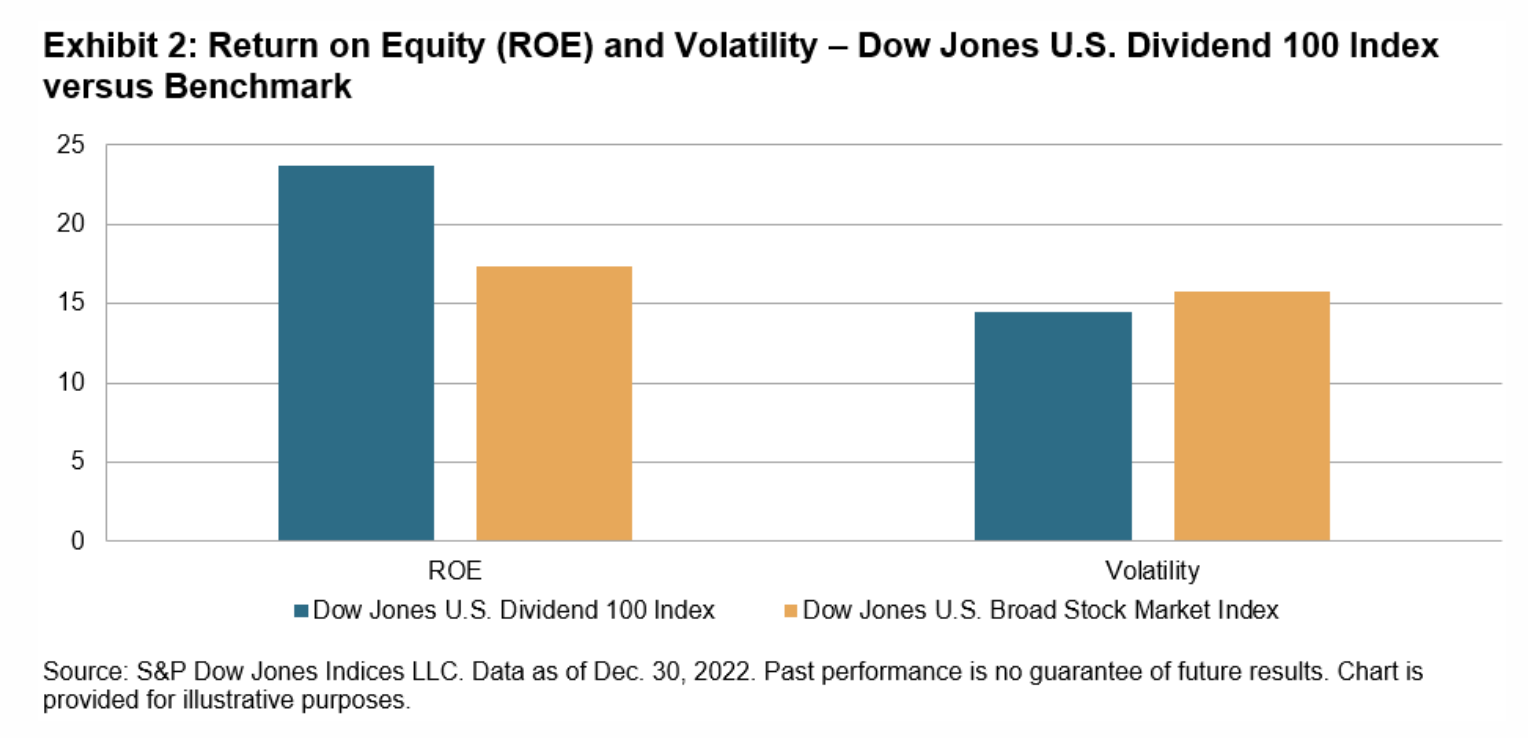

The Dow Jones Dividend 100 Indices Part 2: Strong Fundamentals And The Benefits Of Diversification

In part one of this series, S&P Dow Jones Indices highlighted how the stringent dividend sustainability and quality screens of the Dow Jones U.S. Dividend 100 Index and Dow Jones International Dividend 100 Index may have led to their outperformance in 2022 and other inflationary periods. In this installment, it analyzes the positive effects that these screens had on the fundamentals of both indices, as well as examine examples of combining the U.S. and international indices to harness possible diversification benefits.

—Read the article from S&P Dow Jones Indices

Access more insights on the global economy >

Private Equity’s Evolving Approach To Sustainable Infrastructure Investing

The real asset sector plays a unique role in the sustainable investment landscape, and private investors are important and dynamic players in the asset class. With new regulations related to sustainability-related targets (under various labels including net-zero and ESG) and evolving investor expectations on environmental impact, fund managers must navigate a market poised for significant change. On behalf of S&P Global Market Intelligence, Mergermarket interviewed 30 senior executives from private equity firms focused on real assets, with respondents split equally between the United States and Europe. The questions explored the state of private investment in sustainable infrastructure and real estate and the outlook for sustainability-focused investments.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

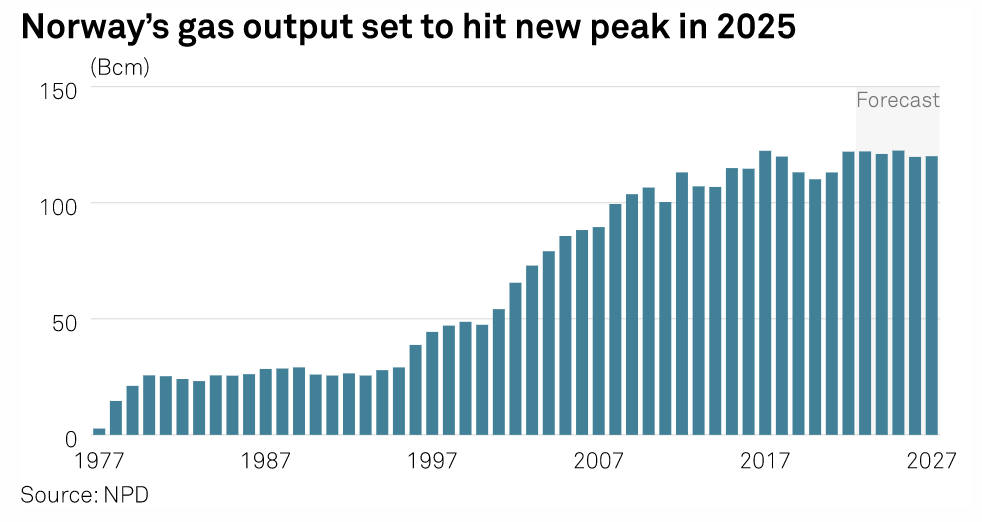

Norway Plans To Include More Barents Sea, Norwegian Sea Blocks In New APA Round

Norway plans to offer significantly more oil and gas blocks in the Barents Sea and Norwegian Sea in the country's next licensing round for mature areas on the Norwegian Continental Shelf, the energy ministry said Jan. 24. Expanding activity in the north is key to the further development of the Norwegian offshore, the ministry said as it announced the public consultation for the Awards in Predefined Areas 2023 round.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

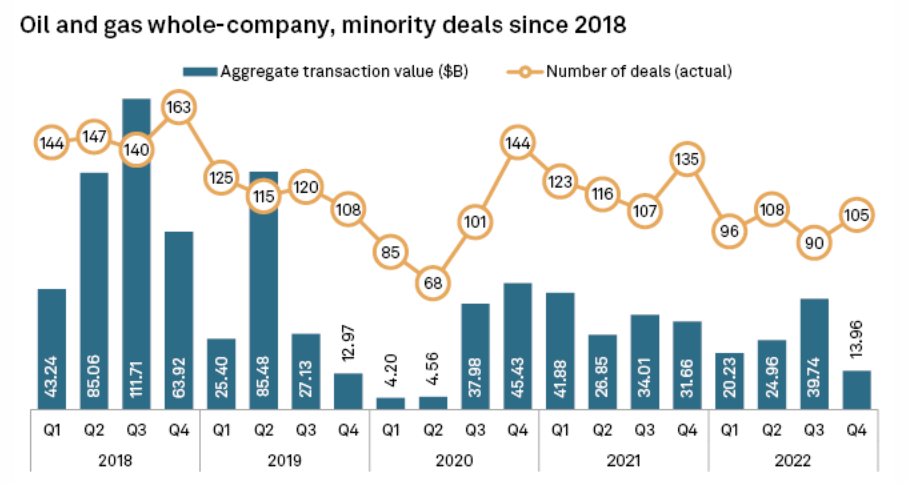

New M&A Guidance Aims To Minimize Climate Risk From Sales Of Oil, Gas Assets

Sellers of fossil fuel assets should require buyers to continue climate change and emissions reduction plans, according to principles devised by environmental investor group Ceres and the Environmental Defense Fund. A quick and dirty method for oil and gas companies to reduce their carbon emissions is to sell heavy-emitting assets to smaller, often privately backed firms, the groups said in a Jan. 19 report. That does nothing to reduce the global carbon count, though, which could even increase if a buyer cancels emissions reduction plans to save money.

—Read the article from S&P Global Market Intelligence

Access more insights on sustainability >

Listen: Braking Ahead: Understanding The Risks To EV Sales And Battery Metals Markets In 2023

Join S&P Global experts from our Commodity Insights and Mobility divisions as they delve into the potential roadblocks facing the electric vehicle market in 2023. From fluctuating lithium prices to the phasing out of government subsidies, learn how these factors may impact EV sales and the battery metals market.

—Listen and subscribe to Platts Future Energy, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Next In Tech | Episode 99: Like Vegas, CES Is Back!

The regular glitz and hype of Las Vegas was kicked up a notch with the Consumer Electronics Show, now just CES, debuting the latest in technology. Analyst Neil Barbour joins host Eric Hanselman to look at what was more of an incremental step up, as the event returned to its pre-pandemic size. The crowds were back, but there were fewer mind-bending innovations, as automotive and industrial collaborations took the spotlight and display technologies improved. And yes, there was a lot of metaverse.

—Listen and subscribe to Platts Future Energy, a podcast from S&P Global Market Intelligence

Access more insights on technology and media >

CERAWeek by S&P Global — Navigating A Turbulent World: Energy , Climate and Security

Join global leaders, policymakers and executives from across energy, climate, finance, technology and industry at CERAWeek 2023 for timely dialogue, shared learning and connection.

—Register for CERAWeek