Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 10 Jan, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Hot Market for Coal Confronts Secular Challenges

When Russia invaded Ukraine in February 2022, the slow but steady decline of the coal market was suddenly suspended. With natural gas for electricity and heating prohibitively expensive, many regions reexamined their energy relationship with much-maligned thermal coal. Coal plants slated for closure gained a new lease on life, and some plants even reopened. The question for coal is, was 2022 an indicator of continued relevance, or will the long-term trends that disfavor coal reassert themselves?

The story of coal in 2023 looks different from region to region. U.S. seaborne thermal coal exports are expected to be down this year, according to S&P Global Commodity Insights. Cheaper Russian coal is proving popular in South Asia and Southeast Asia, and China, Indonesia and India are expected to increase domestic production. Europe, cut off from Russian natural gas supplies due to the conflict in Ukraine, remains a buyer of U.S. coal. But domestic consumption of U.S. coal will continue to decline as more renewable sources of energy come online.

China has indicated a willingness to lift its unofficial two-year ban on Australian coal to diversify its supply base. S&P Global Commodity Insights reports that this is unlikely to affect China’s imports of mid-grade coal, which it can purchase for less from Russia. However, high-quality 6,000 kcal/kg coal from Australia will find its way back into the Chinese market, driving up the price for high-calorific-value coal. Such coal is desirable for certain types of furnaces because it provides elevated heat energy.

European demand is expected to remain steady due to the war in Ukraine, which has put many green energy initiatives on hiatus. However, the anticipated recovery of hydroelectric generation after last year’s droughts will keep European coal markets from growing much.

India and Indonesia are focusing on domestic coal production, supplemented by cheap exports out of Russia. Both countries are setting high quotas for domestic coal producers, but environmental concerns and weather difficulties are holding back production.

Ongoing environmental concerns about coal and net-zero benchmarks are an obstacle to market growth. Some coal enthusiasts have dismissed these concerns as “climate hysteria.” Reinsurance and insurance firms such as Swiss Re, Munich Re and Axa have maintained their opposition to underwriting carbon emissions from coal production and coal-powered energy plants. Europe’s willingness to use thermal coal appears to be a transitional strategy on the way toward renewables, and the huge Asian markets have their own net-zero pledges to reckon with. Coal may be cheap, but it isn’t clean. So, for now, the market for thermal coal will be confined to budget-conscious regions or those without viable alternatives.

Today is Tuesday, January 10, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

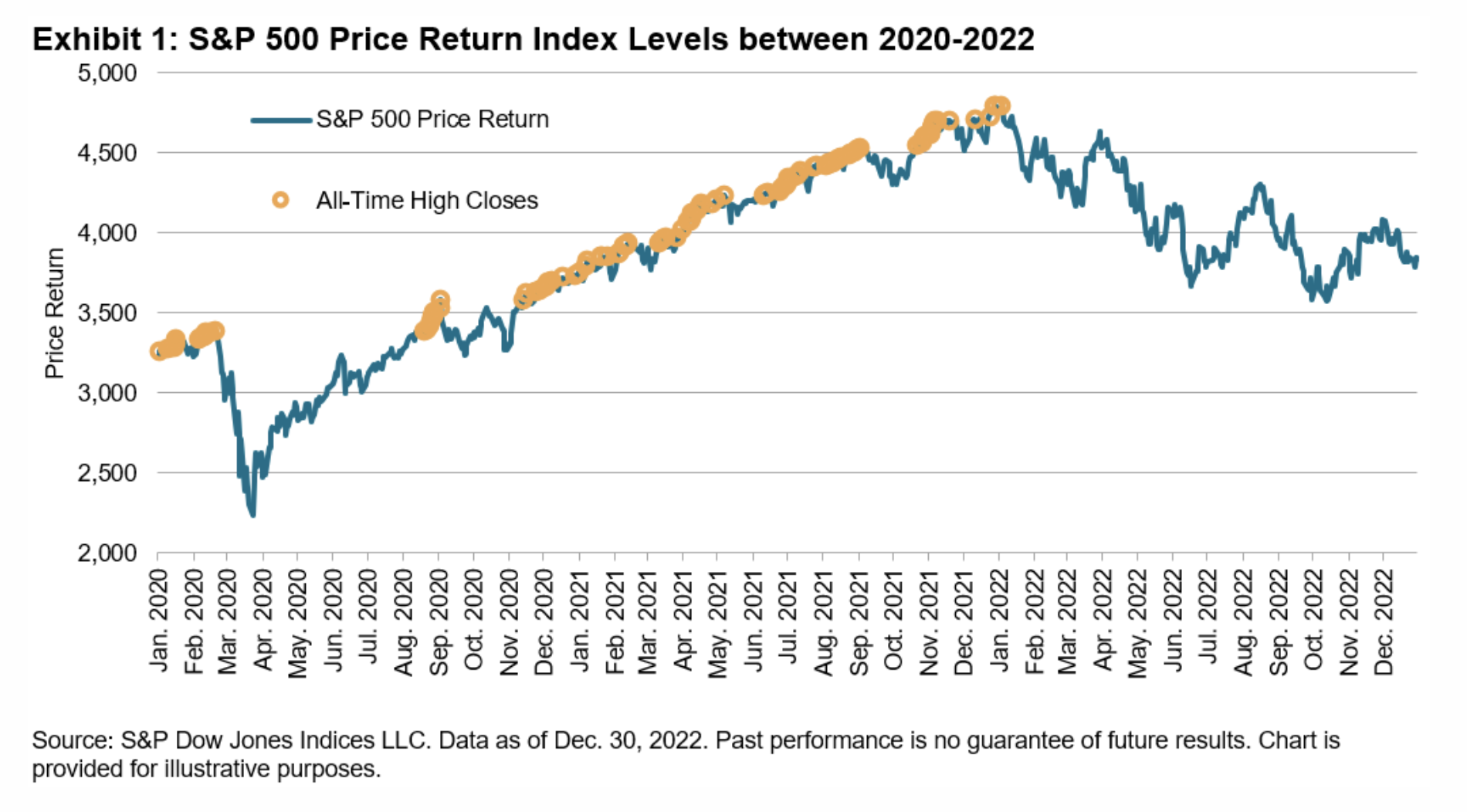

Do Friendly Bears Exist?

On Wall Street, bear markets represent declines of at least 20% from their highs. But on Main Street, bears are anthropomorphized as friendly. Here we look at whether bears can also be “friendly” in financial markets, looking at the S&P 500’s bear markets to assess what periods of pessimism have told us, historically, and whether there may be glimmers of hope.

—Read the article from S&P Dow Jones Indices

Access more insights on the global economy >

This Week In Credit: Early Optimism May Be Short Lived (Jan. 9, 2023)

A lack of global rating actions and the improved market tone at the start of 2023 should not be taken as an early sign of stable future rating performance. On the contrary, the outlook for 2023 remains highly uncertain with risks to the downside. The timing and extent of any U.S. Federal Reserve pivot is still unclear despite recent data releases, while the barrage of 2022 interest rate hikes — with more likely to come in early 2023 — plus slower economic growth will likely have detrimental effects on credit performance.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

The Israeli-Lebanese Border Agreement: A Legal Analysis

On October 27, 2022, after years of difficult negotiations, Israel and Lebanon established their mutual maritime border — and their Exclusive Economic Zones (EEZs) — except for the first 5 kilometers from the coastline. The purpose of the maritime border agreement is to move ahead with petroleum exploration and production close to and on the maritime border. The agreement between the two adjacent countries, which are still technically in a state of war, was brokered by the United States.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Setting The Stage For Sustainability In 2023

In this episode of ESG Insider, hosts Lindsey Hall and Esther Whieldon are looking ahead to sustainability themes that will drive 2023 by revisiting the most popular episodes and some of their favorite interviews from the past year. They hear from one of the world’s largest banks; the chair of the Network for Greening the Financial System, or NGFS; the co-chair of the Taskforce on Nature-related Financial Disclosures, or TNFD; some of the scientists behind reports by the UN's Intergovernmental Panel on Climate Change, or IPPC; and more.

—Listen and subscribe to ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

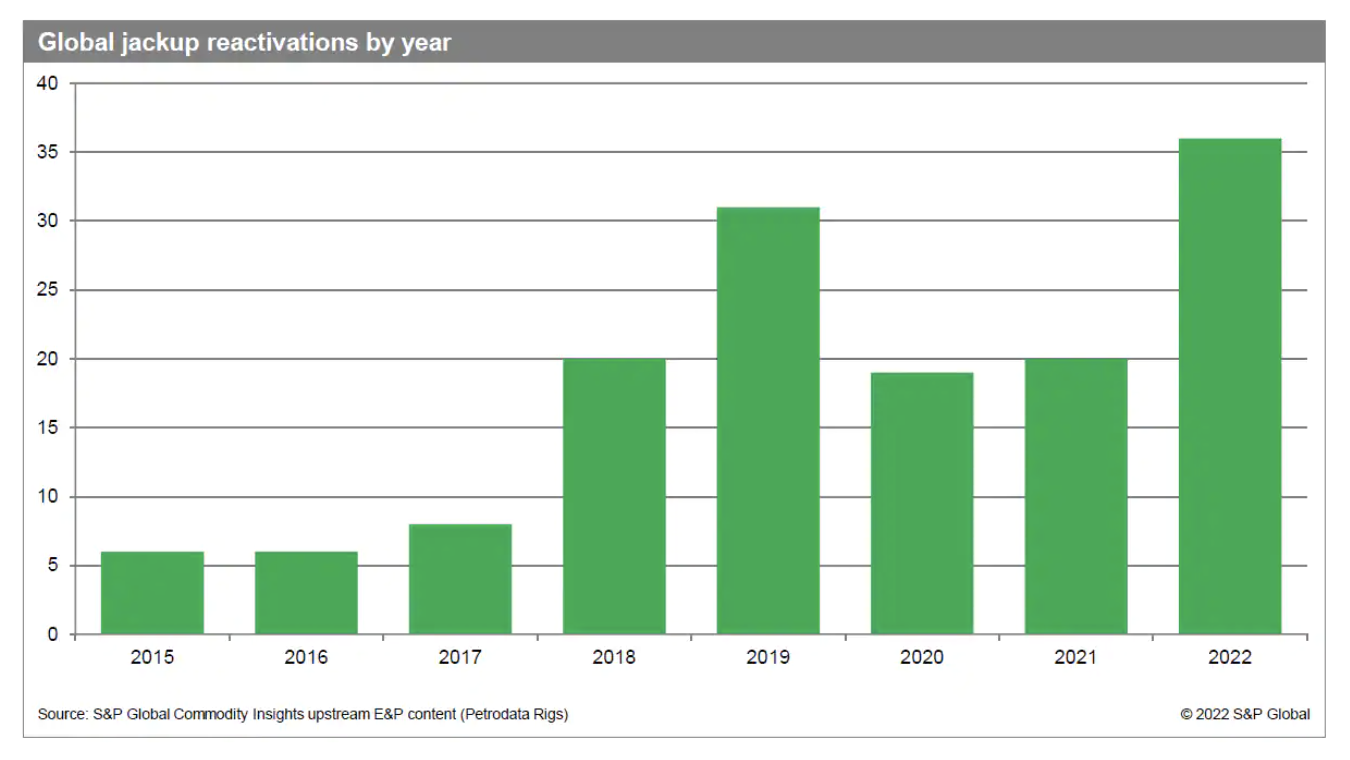

Listen: 2023 Is Shaping Up To Be A Year Of Discipline, Caution And Little Change For The U.S. Upstream

After substantial recovery in 2022 from the low crude prices and oil demand brought about by two years of the coronavirus pandemic, 2023 appears beset with uncertainties. Russia's war with Ukraine, wobbly oil prices and heavy Chinese fuel demand have dampened what was earlier hoped to be a sanguine oil patch in the new year. With inflation gobbling up what are likely to be low-double-digit capital spending increases and E&P operators signaling flattish 2023 activity, U.S. oil and gas producers seem determined to "lay low" while waiting for greater visibility on near-term energy market fundamentals. Rene Santos, manager of North American supply and production for Platts Analytics, joined Starr Spencer on the podcast to share his thoughts on what may be awaiting the U.S. upstream sector in 2023 as it prepares for a new year of drilling and production and waits for the lifting of clouds cast by events beyond its control.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

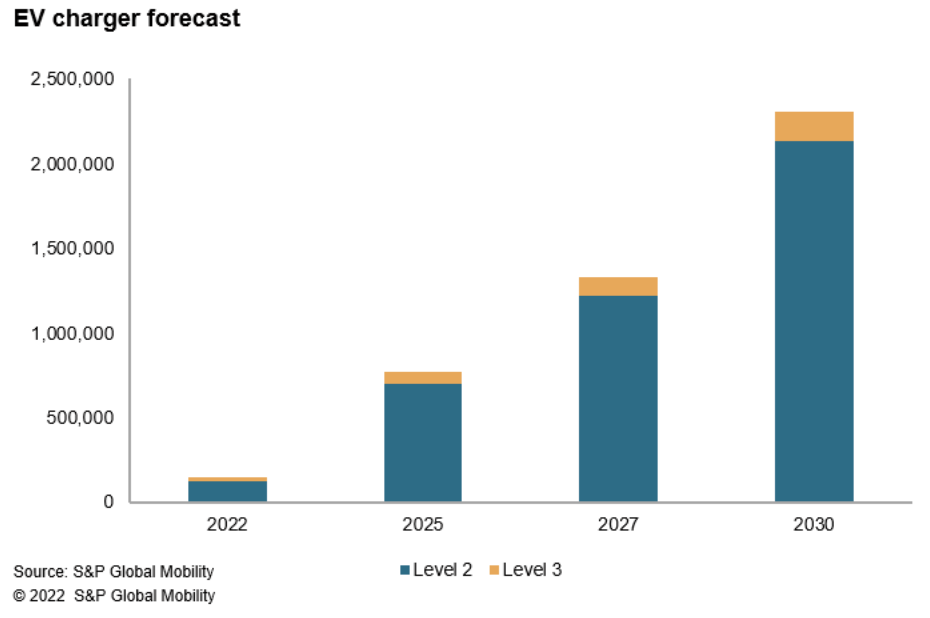

EV Chargers: How Many Do We Need?

Supporters of vehicle electrification point to the more than 140,000 EV charging stations currently deployed across the United States — including Level 2 AC and Level 3 DC fast chargers and both public and restricted access units — as a sign that a budding system to support our transportation transformation is in place. However, S&P Global Mobility data shows that the charging infrastructure is not nearly robust enough to fully support a maturing electric vehicle market.

—Read the article from S&P Global Mobility