Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 26 Feb, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

Warmer weather may have returned to Texas, but the frigid storm—that left millions in the state without heat or electricity as temperatures plunged into freezing territory; forced oil, gas, and petrochemical production offline; sent gas prices soaring into the thousands; and nearly caused a system-wide energy grid failure—is likely to disrupt the nation’s largest energy-producing and -consuming state over the long-term.

The future of the Electric Reliability Council of Texas (ERCOT), which operates the majority of the Lone Star state’s power grid, is uncertain. Outrage from lawmakers and civilians alike at the grid operator has swelled, most recently with Republican Gov. Greg Abbott advocating on Feb. 24 that "ERCOT must be overhauled." Bill Magness, ERCOT’s president and CEO, said in a Feb. 24 emergency board meeting that the energy provider “saw this storm coming” and adequately prepared for the blast by taking measures that prevented blackouts from lasting weeks or months. But the council’s inability to maintain operations during the polar plunge has spurred investigations into its handling of the crisis, and resignations of its board members.

Texas’ power grid relies on natural gas generation, and half of the homes in the state are heated by that energy source. Natural gas accounts for nearly 60 GW of ERCOT's winter capacity, according to S&P Global Market Intelligence data. As the extreme weather froze gas pipelines and caused compressors to lose power, ERCOT lost nearly half of its generation capacity.

Some energy executives interpret the outages as supporting evidence for using natural gas as a complement to renewable energy, while other market participants are urging for further diversification of Texas’ energy makeup.

The state has already established itself as the fastest-growing renewables market in the nation, according to S&P Global Market Intelligence. Approximately 35 GW of combined solar and wind capacity is expected to be developed for Texas’ primary transmission system, which is operated by ERCOT, by 2024. Texas features the largest amount of wind capacity in the nation, with more than 30 GW, which could play a pivotal role in making the state a hydrogen hotspot. The state already has more than 900 miles of dedicated hydrogen pipelines, or nearly 56% of the U.S.’s entire hydrogen pipeline system, according to S&P Global Platts.

"We can decarbonize our own energy system, but also ship across the globe," Brett Perlman, executive director of the Center for Houston's Future, said at a Feb. 18 virtual event hosted by the organization, according to S&P Global Platts. "We can take a system we have now for refining oil to create a Houston hydrogen hub, which we believe would be one of the leading global hydrogen hubs going forward."

Today is Friday, February 26, 2021, and here is today’s essential intelligence.

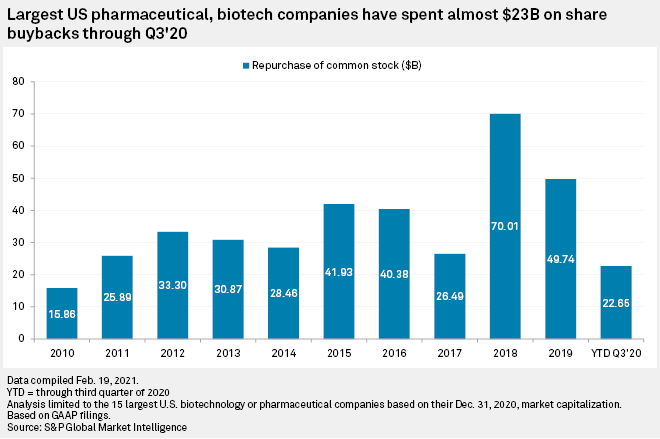

Big Pharma Rallies on Share Buybacks as Most Companies Cut Back During Pandemic

Most U.S. companies shied away from share repurchases during the height of the COVID-19 pandemic in 2020, although the technology and healthcare sectors — drugmakers and big biotechs in particular — showed greater resiliency and a willingness to splash out on their own stocks.

—Read the full article from S&P Global Market Intelligence

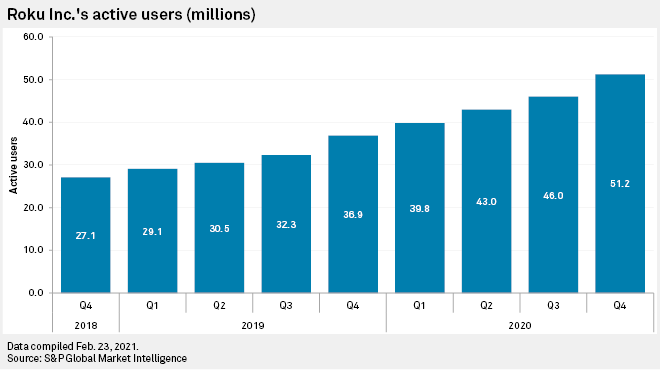

Roku Investors Rethink Streaming Darling Following Record Earnings

Roku Inc. had what was perhaps its best year ever in 2020, but Wall Street is starting to feel a bit cautious on the stock.

—Read the full article from S&P Global Market Intelligence

Social Audio a ‘Goldilocks Medium' for Boosting Usage at Facebook, Twitter

A new year has sparked a new internet obsession, and tech giants are taking notice. Influencers and celebrities have been flocking to Clubhouse, an invitation-only voice-chat social networking app launched in March 2020 that allows users to interact in live conversations on various topics.

—Read the full article from S&P Global Market Intelligence

Is The New Ad Tax Threatening Media Sector In Poland?

Last week in Poland, the newly proposed ad tax caused the protest of leading commercial broadcasters and other media outlets. However, it is rather unlikely that this new regulation could threatened the existence of media companies in Poland.

—Read the full article from S&P Global Market Intelligence

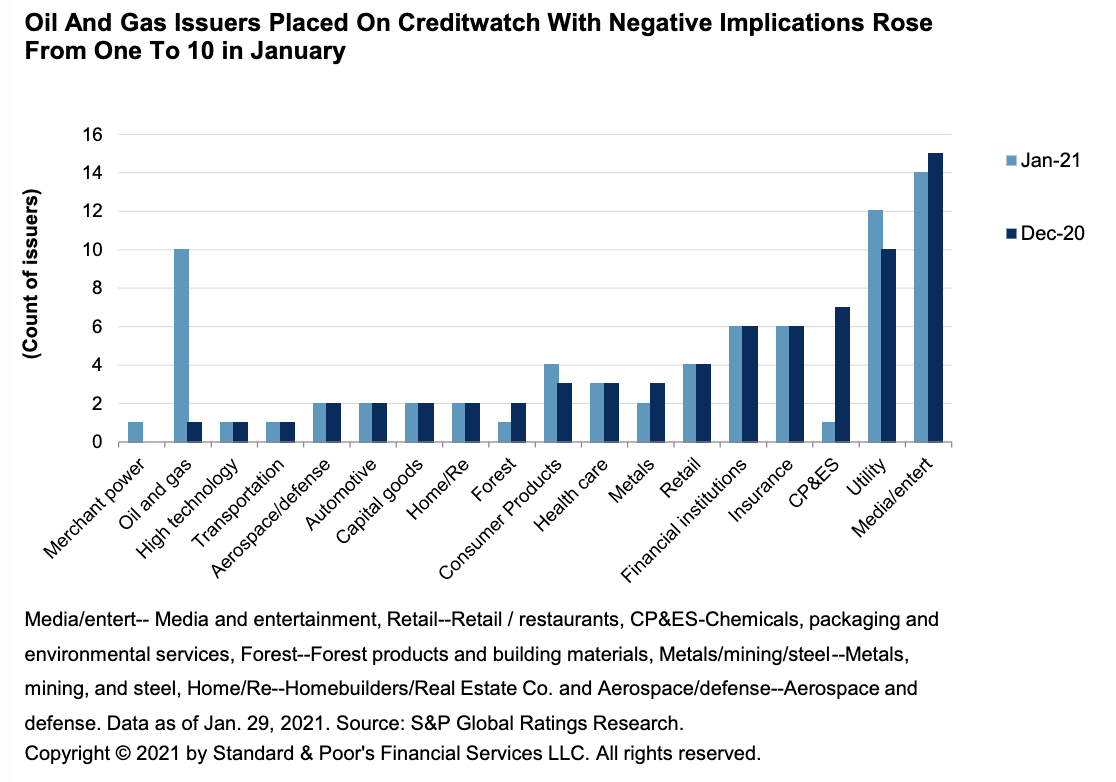

ESG Concerns In Oil And Gas Sectors Led To A Surge In Downgrade Pressure In January, Which Was Realized By Mid-February

The count of potential bond downgrades decreased for the sixth consecutive month to 1,137 in January, from 1,178 in December 2020. This points to further deceleration in the pace of downgrades this year.

—Read the full article from S&P Global Ratings

Energy Treaty Reform Could See Investors in Fossil Fuels, Renewables Lose Cover

In 2015, German utility RWE AG completed a new €3 billion coal power plant in the small Dutch seaport of Eemshaven, firing up two highly efficient boilers among a smattering of wind turbines that dot the gusty coastline.

—Read the full article from S&P Global Market Intelligence

Fuel For Thought: For Green Hydrogen to Catch Up with Blue, It's a Long Ride in India

India has unveiled a national hydrogen mission to accelerate plans to generate the carbon-free fuel from renewables, but analysts said that green hydrogen will struggle to compete with fossil fuel derived hydrogen at least until the end of the decade on cost, potentially creating challenges in lifting demand.

—Read the full article from S&P Global Platts

Biden Signs Order Aimed at Improving Semiconductor, EV Battery Supply Chains

US President Joe Biden signed an executive order Feb. 24 aimed at addressing vulnerabilities in the US supply chain for essential goods, including semiconductors and large capacity batteries for electric vehicles.

—Read the full article from S&P Global Platts

Japan Sets Sights on Another Record Year of Green Bond Issuance

Japan's green bond issuance will likely rise to a fresh record in 2021 as the coronavirus pandemic appears to be subsiding and corporate issuers could rush to raise funds for green projects ahead of a potential rebound in borrowing costs as soon as later this year, analysts say.

—Read the full article from S&P Global Market Intelligence

Market Movers Americas, Feb 22-26: Commodity Markets Feel the Impact of Winter Storm

In this week's Market Movers Americas, presented by Jeff Mower: Winter freeze downs oil refineries and output, MEH/Midland WTI crude spread tightens, lack of natural gas delays Mexican steel exports, regulatory meetings to address ERCOT and the winter storm.

—Watch and share this Market Movers video from S&P Global Platts

Slow Steel Mill Ramp-Ups Fuel Europe's Steel Price Rally

Blast furnace ramp-ups have been staggered due to an uncertain economic outlook and technical limitations. A demand pickup starting mid-2020 has outpaced production since Q3 2020 and the resulting steel shortage has driven some European steel prices to 13-year highs.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language