Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 14 Feb, 2024 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Balancing Decarbonization Against Growing Energy Demand in India

Advocates for a transition away from carbon-intensive energy sources have expressed concern about India for a long time. India is the world’s most populous country and is undergoing rapid economic growth on its way to becoming the world’s third-largest economy. Indian government officials, including Prime Minister Narendra Modi, insist that India will not restrict economic growth and rising living standards to meet externally mandated decarbonization goals. If, however, economic growth in India leads to similar energy consumption patterns as in China or the US, scientists believe that catastrophic climate change is a virtual certainty. This places India in the delicate position of balancing very long-term decarbonization targets with growing demand for electricity and mobility. At the inaugural session of India Energy Week in Goa last week, this tension was a frequent topic of discussion.

Speaking at India Energy Week on Feb. 6, Modi addressed the balance of energy security and energy transition. Modi warned that India's energy demand is set to double from current levels by 2045, which would require supply growth in both fossil fuels and clean energy. However, Modi also pushed back against more aggressive decarbonization targets, pointing out that despite being home to 17% of the world's population, India's share of carbon emissions is only 4%.

"India is the world's third-largest energy, oil and LPG consumer. It is also the fourth-largest LNG importer and refiner along with the fourth-largest automobile market. Demand for EVs is rising sharply. Our annual refining capacity will grow from 254 million metric tons to 450 million metric tons. Therefore, there is a need to ensure affordable fuel to everyone," Modi said.

According to S&P Global Commodity Insights, India is the world's third-largest emitter of CO2 behind China and the US, with emissions not expected to peak before the 2040s. According to the International Energy Agency, India will become the largest source of global oil demand growth between now and 2030, while growth in developed economies and China is expected to contract on a similar timeline. India has set a target to reach net-zero by 2070, decades after the US target of 2050 or China’s 2060 target.

India’s abundant coal reserves are part of the reason for this target date. As other countries move away from coal as an inexpensive but emissions-intensive energy source, India is choosing to address decarbonization through coal use, with large-scale carbon capture, utilization and storage. To meet this need, Indian government officials have been advocating for funding and technology from developed nations to help developing nations' energy transition.

Indian companies have stepped forward to invest in renewable energy generation. Indian Oil Corp. plans to invest over 2 trillion rupees ($24 billion) in mitigation efforts, including renewable hydrogen, biofuels, renewable power and natural gas. India’s 10 largest companies are already responsible for about a third of available renewable energy generation, including solar photovoltaic and onshore wind. Plans for further biofuels development and a National Green Hydrogen Mission have also garnered support.

Today is Wednesday, February 14, 2024, and here is today's essential intelligence.

Written by Nathan Hunt.

2024 World Economic Forum: Key Themes To Watch

The 2024 World Economic Forum (WEF) that took place at Davos-Klosters in mid-January attracted over 60 heads of state and government leaders. There was a consistent emphasis on AI and cybersecurity risk governance, a renewed focus on the energy transition for environmental concerns and a noticeable discussion around prioritizing women’s health for social advancement. In this article, S&P Dow Jones Indices highlights the key takeaways.

—Read the article from S&P Dow Jones Indices

Access more insights on the global economy >

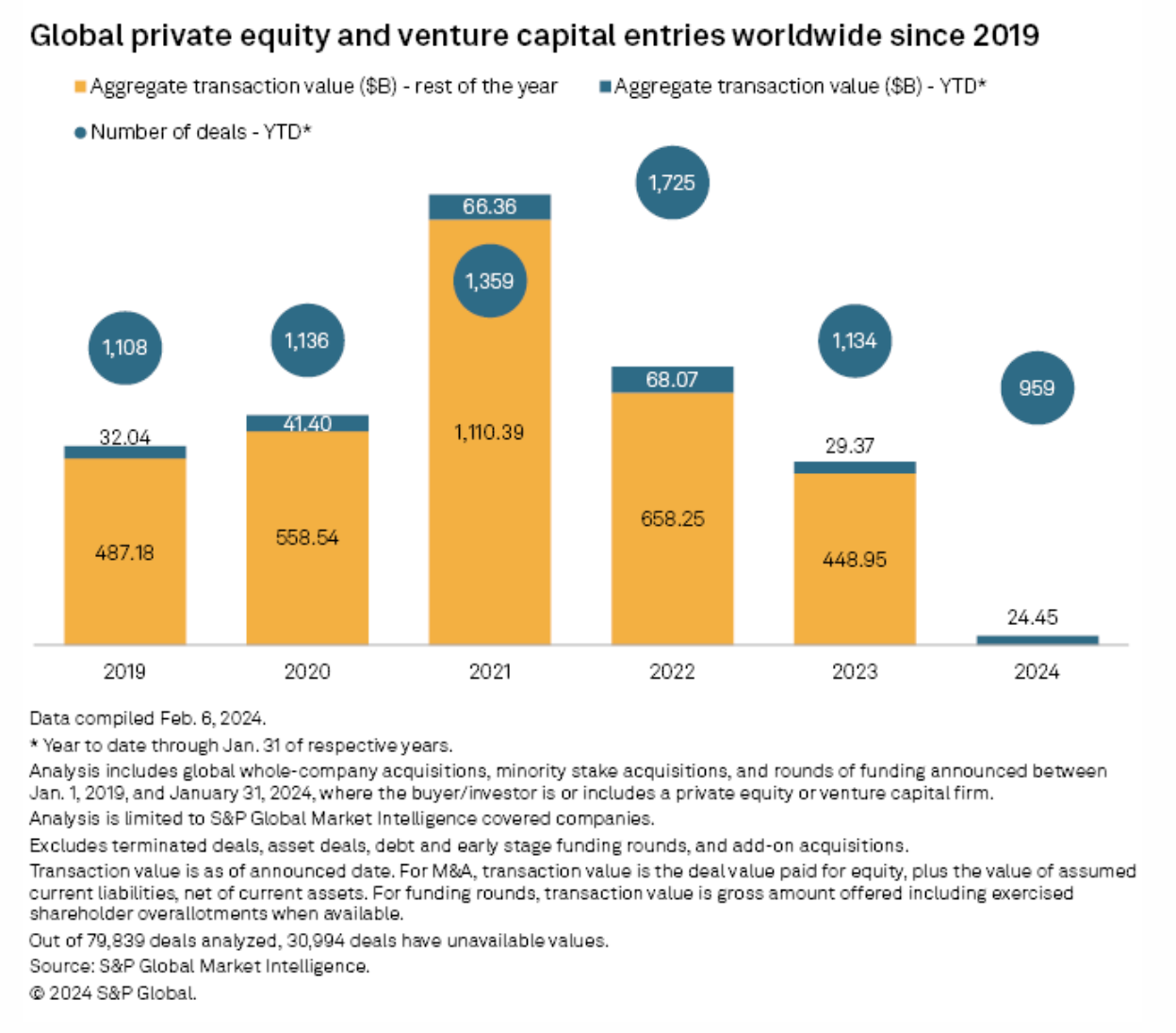

Global Private Equity-Backed Investments Down 17% In January

In January, the total value of global private equity and venture capital entries decreased 16.8% to $24.45 billion compared to $29.37 billion during the same period a year prior, according to S&P Global Market Intelligence data. It was the lowest January total in at least five years. The number of deals also declined to 959 from 1,134 a year prior.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

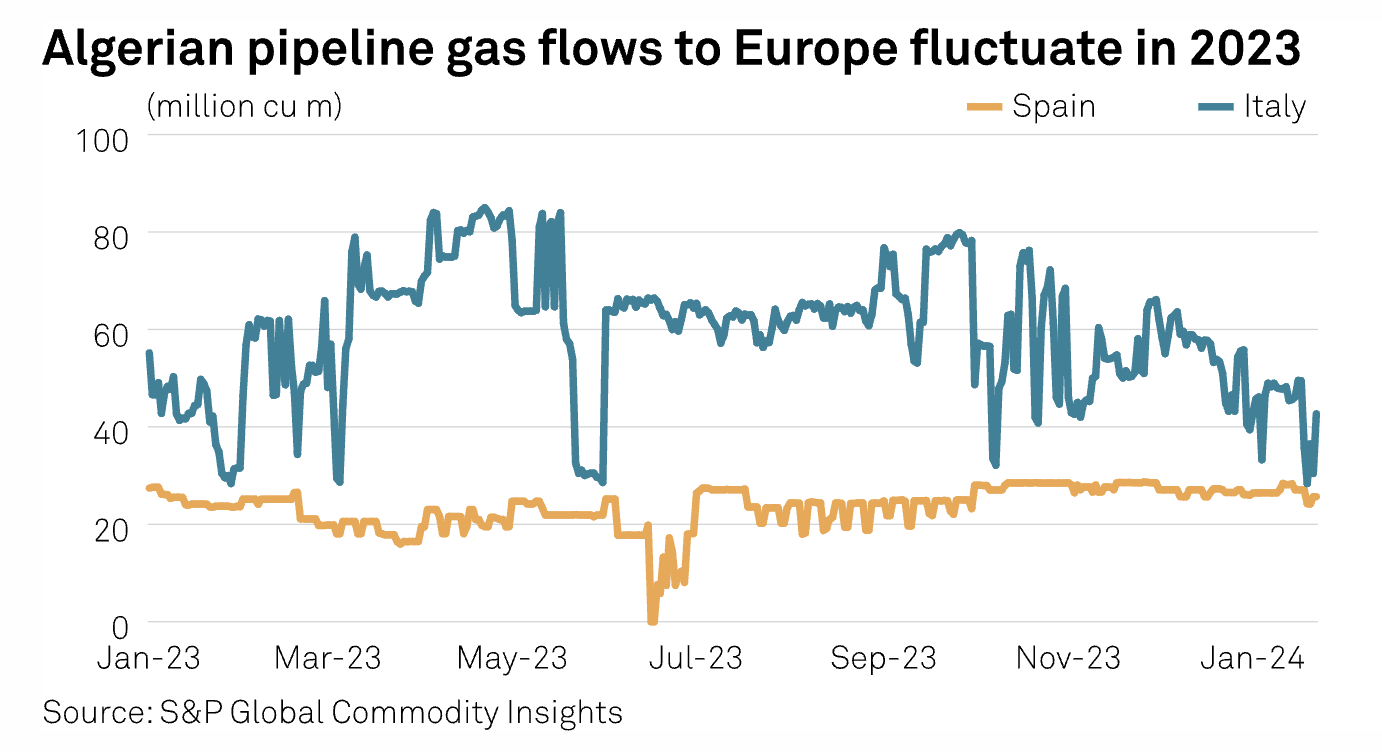

Germany's VNG To Begin Algerian Gas Imports Under Mid-Term Deal With Sonatrach

German gas importer VNG is to begin importing gas from Algeria under a new medium-term deal with state-owned Sonatrach, becoming the first German company to buy Algerian pipeline gas, the companies said late Feb. 8. The contract was signed between the companies in Algiers during a German delegation visit led by economy minister Robert Habeck.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: Breaking Down Silos: Balancing The Role Of Policy And Private Sector In The Energy Transition

At the ESG Insider podcast, we’ve been hearing one key theme on repeat: Solutions to big sustainability challenges like climate change and biodiversity loss require collaboration across silos. This idea is coming across loud and clear at the global events we cover, from Climate Week NYC to COP28 in Dubai to the World Economic Forum’s annual gathering in Davos, Switzerland.

—Listen and subscribe ESG Insider, a podcast from S&P Global Sustainable1

Access more insights on sustainability >

Listen: Push For Organized Phasedown Of Oil, Gas Leasing On Public Lands Turns To RMP Legal Fights

Under settlement agreements with environmental groups and Colorado, the Bureau of Land Management is taking another look at that the Uncompahgre Resource Management Plan, which guides the management and use of nearly a million acres of public lands and mineral estate in western Colorado. Among the amendments it is considering to the Trump-era plan are alternatives that would reduce the number of acres open to oil and gas leasing. Melissa Hornbein, senior attorney at the Western Environmental Law Center, joined the podcast to discuss the RMP amendment process, including how it came about and what environmental groups want to see happen.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

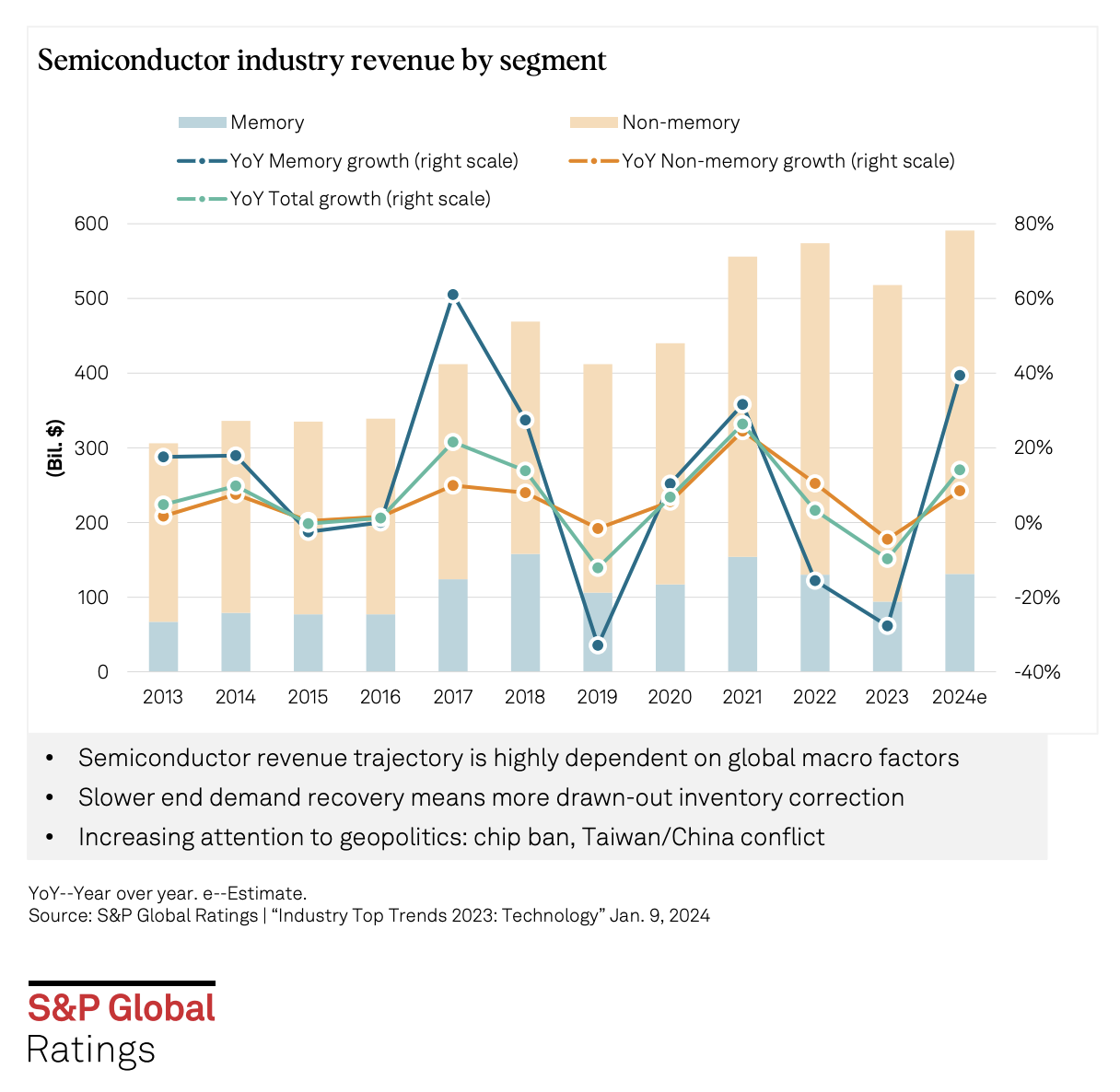

US Technology Sector: Magnitude Of Cyclical Rebound Key To Watch In 2024

S&P Global Ratings expects IT spending to grow due to AI demand and cyclical recovery in the US technology sector in 2024. In addition, the semiconductor industry is poised for a strong rebound after a decline in 2023. However, key risks include supply chain diversification, elevated interest rates and pent-up demand for mergers and acquisitions.

—Read the report from S&P Global Ratings