Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 21 Dec, 2020

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

The COVID-19 pandemic has placed much of the hope of returning back to normal on the pharmaceutical industry to develop effective treatments and vaccines. While the first round of vaccinations has begun worldwide, the next big steps toward a new normal and economic recovery are predicated on the vaccine’s widespread availability, distribution, and administration.

In the U.S., which has the highest national total of coronavirus cases and deaths, a panel of prominent health experts advising the U.S. Centers for Disease Control and Prevention recommended on Dec. 20 that frontline workers and Americans aged 75 years and older be slated first to receive the coronavirus vaccine. The day prior, the CDC authorized Moderna’s vaccine for emergency authorization usage. This follows the CDC’s approval of the Pfizer/BioTech vaccine in the U.S. on Dec. 11.

Global markets have rallied to record highs on the news of successful vaccine development and deployments. The stability of this positive momentum is dependent on the viability of the vaccine, according to S&P Global Market Intelligence. Nearly all of the emerging-market currencies tracked by S&P Global Market Intelligence (20 of the 21) posted gains in November alongside the MSCI International Emerging Market Currency Index, which measures the performance of 26 emerging-market currencies relative to the U.S. dollar. The optimism also pushed down short interest in all sectors of the S&P 500 benchmark equity index in the first half of November and propelled commodities futures on the S&P GSCI index, which tracks futures for 24 raw materials, up 13.2% to a six-month high during the overall month.

However, the vaccine won’t erase all risks—whether in the U.S. or around the world.

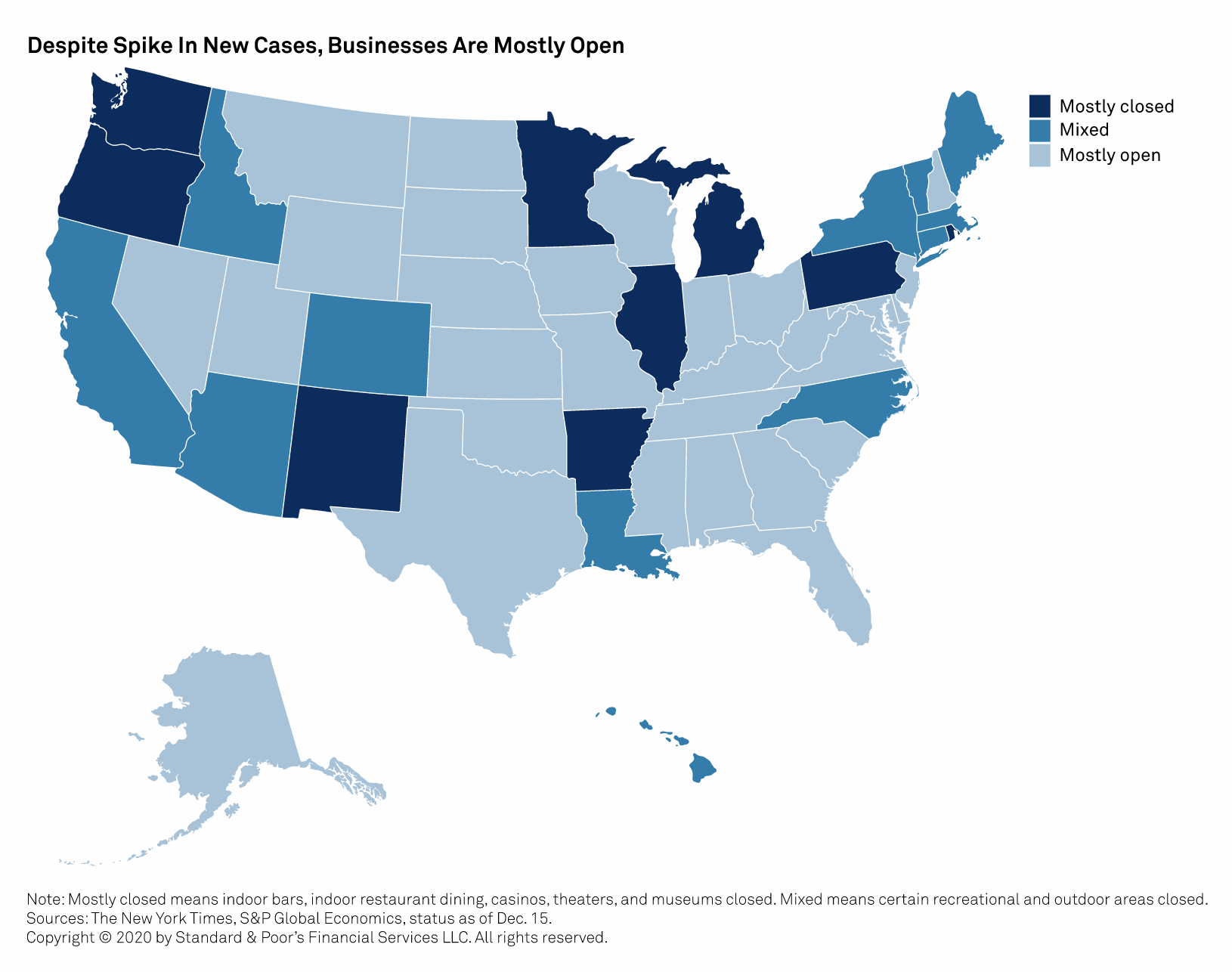

“The vaccines are obviously a very positive development, not least because of the extremely high effectiveness rates. They herald, however, only the first step toward a return to social and economic normality; taking into account approval, production, and distribution hurdles, we continue to assume that effective immunization could be widely available by the middle of next year,” S&P Global Ratings said in a recent report. “On the other hand, the recent surge in cases—bringing about a second wave of lockdowns in Europe and additional restrictions in many U.S. states—is likely to make things worse for certain industries before they get better.”

Emerging markets in particular face exceptional exposure as demand for the vaccine is likely to surpass supply in countries including Brazil, Mexico, and India. Delays in delivering a vaccine across emerging markets could prompt nations to suffer slower economic recoveries and further downgrades, according to S&P Global Ratings. To minimize the likelihood of that outcome, the EU, Japan, and 11 additional developed nations launched an action late last month to minimize protectionist trade measures relating to medical supplies. This efforts is necessary so that global supply chains will be able operate effectively in delivering the coronavirus vaccine worldwide, according to Panjiva, part of S&P Global Market Intelligence.

Today is Monday, December 21, 2020, and here is today’s essential intelligence.

Economic Research: U.S. Real-Time Data: The Recovery Backtracks

The upcoming months look to be a difficult stretch for the economy as new COVID-19 cases per million population have continued to steadily climb.

—Read the full report from S&P Global Ratings

Economic Research: European Economic Snapshots: Policy Is Keeping The Impact Of The Second COVID Wave At Bay

As we enter 2021, Europe's economic recovery is on hold as the region battles a spike in COVID-19 cases. The rebound will be slower than S&P Global Ratings forecasted in October, since some restrictions on economic activity will likely stay in place until second-quarter 2021, when a vaccine should be widely available. Fiscal and monetary policy will likely continue to bridge the gap, with measures easing financing conditions for firms and maintaining a safety net for households.

—Read the full report from S&P Global Ratings

So Different Yet So Alike…

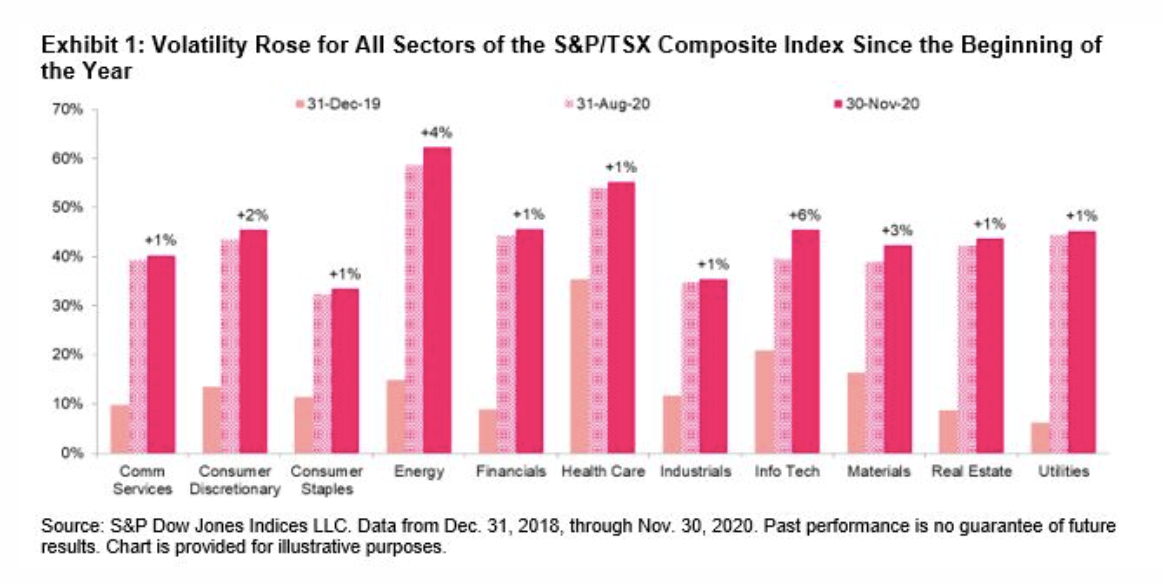

To say that the world is different now than it was a year ago would be an astounding understatement. COVID-19 brought about once unimaginable conditions and changes. In the financial realm, market volatility spiked and remains markedly higher across all sectors compared to the beginning of 2020. Yet, observing the market based purely on performance, it would almost seem as if all was normal. The S&P/TSX Composite Index, after March’s blip, is up 6.8% through Dec. 17 and continuing its uptrend heading into the new year.

—Read the full article from S&P Dow Jones Indices

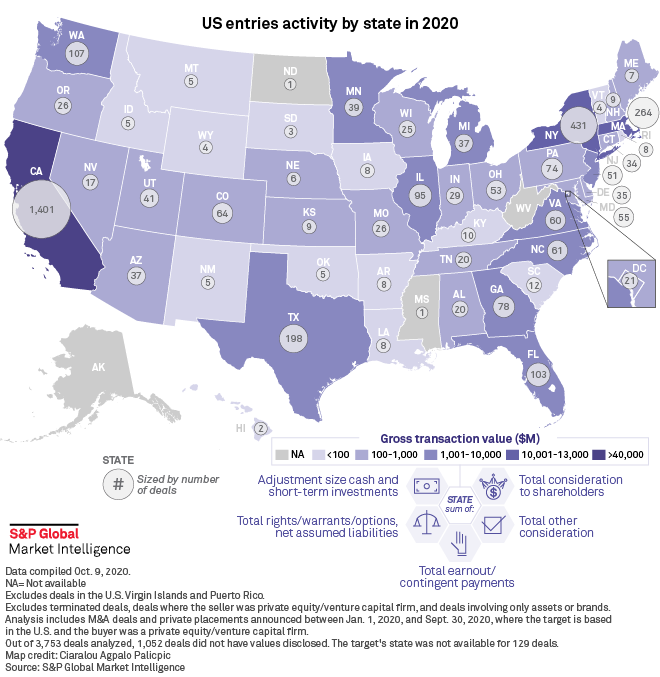

2020 anything but more of the same; track where US PE activity was announced

If you don't laugh, you'll cry. With the benefit of hindsight, the headline of this 2020 outlook piece seems a little comical at this point in the year: "Private equity expects 'more of the same' in 2020 despite ongoing threat of downturn."

—Read the full article from S&P Global Market Intelligence

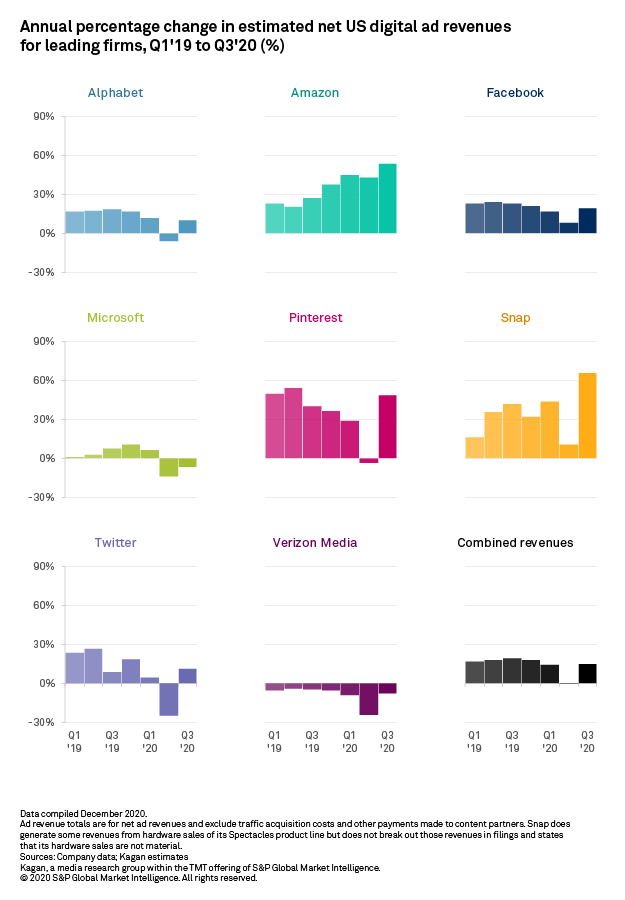

US digital ad market roars back in Q3'20

Most major players in the U.S. digital ad market shrugged off COVID-19-related declines and returned to annual growth in the third quarter of 2020.

—Read the full article from S&P Global Market Intelligence

Disney vs. Warner Bros: Two sides of the exhibition debate for 2021

How to handle theatrical windows in a box office environment still reeling from the COVID-19 pandemic remains a central question going into 2021, and the top Hollywood studios are answering it in different ways.

—Read the full article from S&P Global Market Intelligence

Disney/SEC deal 1st step in moving sports rights from ESPN to ESPN+

S&P Global Market Intelligence believes that The Walt Disney Co.'s 10-year exclusive agreement with the Southeastern Conference, announced on Dec. 10, is just the first in a number of long-term sports rights deals that will fuel both ESPN Inc. and its streaming offshoot ESPN+.

—Read the full article from S&P Global Market Intelligence

S&P podcast: NRG's sustainability-linked bond as a new tool to lower emissions

S&P Global Market Intelligence interviewed Gaetan Frotte, senior vice president and treasurer at NRG, about the company's new sustainability bond and how financial tools can play a role in the energy transition for the latest episode of the Energy Evolution podcast, available on Apple Podcasts, Spotify, and other platforms.

—Listen and subscribe to Energy Evolution, a podcast from S&P Global Market Intelligence

Pandemic Prompts Companies to Ramp Up Forthcoming ESG Initiatives

The COVID-19 pandemic has accelerated engagement with environmental, social and governance factors among forward-thinking companies and investors, but their newfound commitments to sustainability will require tangible data on how they are delivering real world impacts, according to panelists who spoke at an S&P Global webinar on Dec. 10.

—Read the full article from S&P Global

'Time to think big': New gas association chair talks hydrogen, renewable fuels

Renewable gases and zero-carbon hydrogen will play a key role in decarbonizing the US natural gas distribution system and the industry's environmental stewardship, according to David Anderson, president and CEO of Northwest Natural Holding Co. and incoming chair of the American Gas Association, or AGA.

—Read the full article from S&P Global Platts

Watch: Market Movers Asia: China, India to lead post-COVID demand recovery in 2021

The highlights on S&P Global Platts Market Movers Asia, with Mriganka Jaipuriyar, head of news: China, India to lead post-COVID demand recovery; Qatar, US LNG suppliers to battle for Asian market; China's trade relations with the US and Australia to remain in the spotlight; food security concerns likely to remain; and manufacturing will be a major driver of metals demand.

—Watch and share this Market Movers video from S&P Global Platts

Crude oil futures plummet on concerns over new coronavirus strain

Crude oil prices plummeted during the mid-morning trade in Asia Dec. 21, as concerns over a new highly infectious strain of the coronavirus raised fears of tightening lockdown and travel restrictions.

—Read the full article from S&P Global Platts

European mobility slips as new wave of restrictions kicks in

Economic mobility in Europe's biggest economies slipped in the week ending Dec. 13, according to Google data, as regional governments announced a new round of curfews, lockdowns, and travel limits to check surging COVID-19 infection rates ahead of the Christmas holiday.

—Read the full article from S&P Global Platts

Listen: Energy policy poses challenges, opportunities for Biden's first 100 days

Jasmin Melvin and Maya Weber of S&P Global Platts and Ellie Potter of S&P Global Market Intelligence discuss the challenges and opportunities for Biden in his first 100 days and what that could mean for energy markets.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language