Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 17 Dec, 2021 — Global

By S&P Global

The S&P Global Daily Update will be on a holiday hiatus from Monday, Dec. 20 through Friday, Dec. 31. Subscribe and share this newsletter to start every business day after the break with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The second year of the once-in-a-century pandemic that has infected nearly 273 million individuals, killed 5.3 million worldwide, and seen 3.67 billion fully vaccinated marked a substantial transition for the global economy.

2021 brought hope for global economic growth following 2020’s coronavirus-caused downturn, largely tied to the development and widespread deployment of COVID-19 vaccines and despite the rise of new variants. Nonetheless, the recovery has unfurled unevenly. Countries’ aggressive demand-centered fiscal policies, development and distribution of COVID-19 vaccines, and labor market connectivity bolstered the global economic recovery this year—while global supply chain pressures and inflation soaring above expected targets have held the rebound back, according to S&P Global Economics.

Emerging market economies like India, which have experienced higher rates of both contagion and inflation, endured a particularly difficult year while advanced economies like the U.S. embodied resiliency. Overall, the global healthcare industry may be unrecognizable in a post-pandemic world due to the crisis’ acceleration of disruption.

The global economy lost billions of dollars from trade delays in March after the mega container ship Ever Given got stuck in and blocked the Suez Canal—one of the world’s busiest and most important trade channels. Separately, global supply chains have continued to face pressures from pandemic-prompted changes in consumption patterns, surging demand for goods, shortages of workers, and pre-existing political pressures that have created high shipping volumes and freight costs.

This year continued to reinforce the importance of environmental, social, and governance engagement after, with an emphasis on forging collaboration toward achieving the energy transition to renewable sources and net-zero emissions globally.

In February, Arctic temperatures froze Texas, plunging millions of Americans unaccustomed to frigid cold into darkness with neither heat nor electricity, forced oil, gas, and petrochemical production offline, sent gas prices soaring, and nearly caused system-wide energy grid failures. Power grid operators’ struggle to prevent outages during extreme weather brought the potential long-term problems of accelerating physical effects of climate change to the forefront, and prompted calls to modernize energy grids across the U.S.

2021 saw China start to push its carbon neutrality plans forward by adapting its economy to new factors including green spending, emission targets, and carbon market trading. By November, when the 26th U.N. Climate Change Conference took place over two weeks of deliberations between political and corporate leaders on how to best combat climate change, conversations covered commitments for billions of investment in climate finance and how to phase-out fossil fuels in the coming decades to control global warming below 2 degrees Celsius.

The coronavirus crisis in the U.S. in particular exacerbated the country’s major challenges: decades-long trends toward greater inequality of income, wealth, and opportunity; climate change; systemic racism; and a highly polarized political environment.

Across financial markets, global investors saw the private debt market surged into the spotlight, meme stock mania overtook fundamentals in the equities market, and the transition from the London Inter-Bank Offered Rate (LIBOR) take shape.

Looking beyond 2021, the macroeconomic focus of the global recovery will largely be focused on controlling inflation next year. Today is Friday, December 17, 2021, and here is today’s essential intelligence.

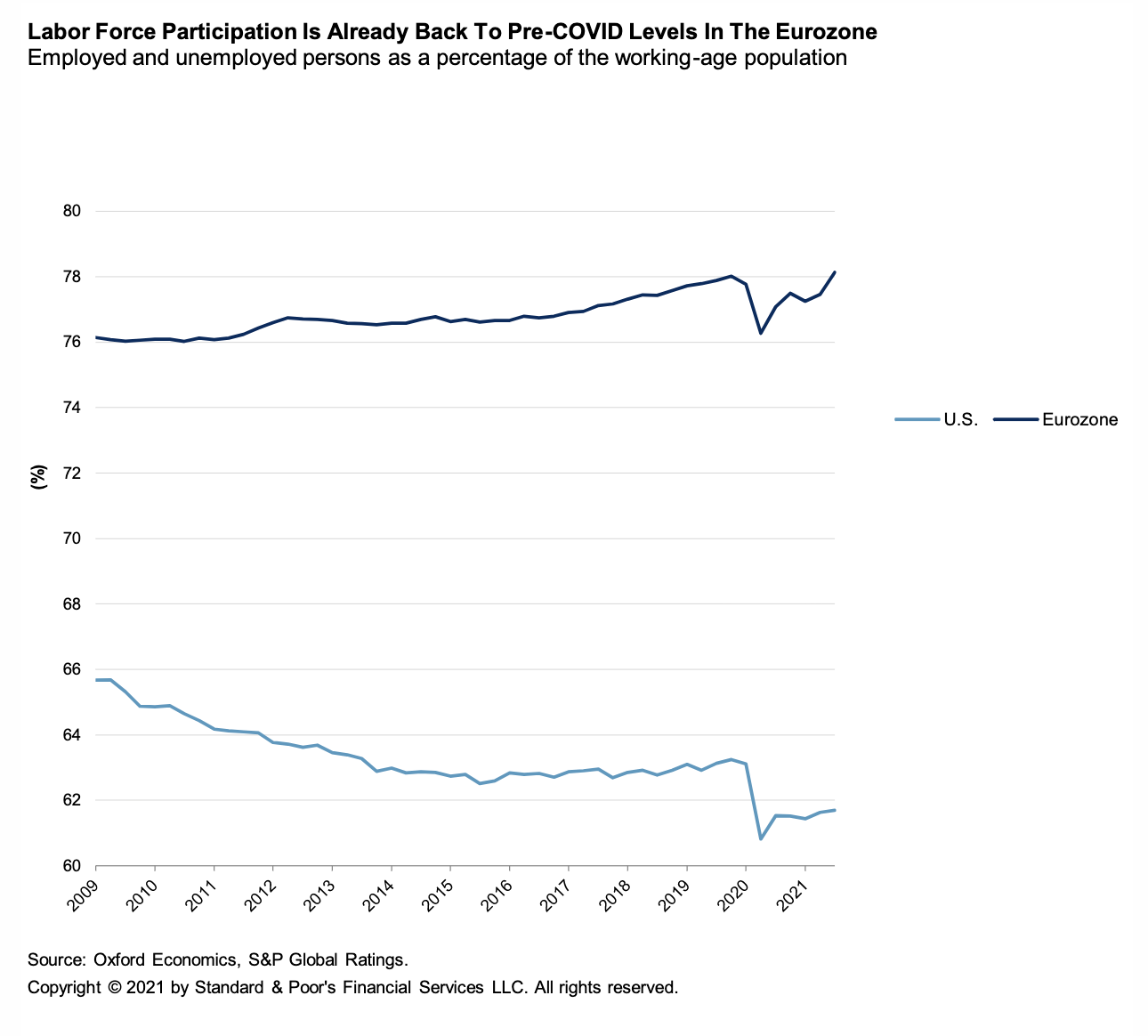

Economic Research: Where Is The Wage Inflation? Not In Europe

Wage growth will not outpace productivity next year in the eurozone, and therefore will not exert inflationary pressure soon. European workers do not sense the same resignation as U.S. workers. The furlough schemes here have enabled a smooth recovery in labor force participation, which has already returned to pre-crisis levels.

—Read the full report from S&P Global Ratings

Mobility Hits New High Outside Europe In Key Oil Consumers Despite Omicron Fears

Register Now Mobility indicators in major Asia and Americas oil-consuming countries improved to within just 2% of pre-COVID-19 levels in the week, according to adjusted data from Google, the highest since the pandemic devastated global oil demand in early 2020.

—Read the full article from S&P Global Platts

Steel Supply, Prices Could Stall U.S. Construction Recovery: Chamber Of Commerce Commercial construction recovery in the U.S. could stall in the coming year as contractors struggle with steel supply and pricing, among other issues, the U.S. Chamber of Commerce said Dec. 16. In a survey conducted by the Chamber, about 95% contractors said they are experiencing at least one product shortage in the fourth quarter, with steel representing the most-reported product shortage by 27% of respondents, according to a statement.

—Read the full article from S&P Global Platts

Commodities 2022: Tanker Owners Eye Change In Trade Lanes To Raise Ton-Mile Demand, Americas Freight

As tanker markets continue to endure the impact of the global pandemic and the recent omicron variant of the coronavirus, which offset expectations of a bullish fourth quarter, tanker owners anticipate changing trade lanes and increasing ton-mile demand could turn spot freight north after a year of breakeven-to-negative time charter equivalent earnings.

—Read the full article from S&P Global Platts

No Decision On Certifying Nord Stream 2 Operator In First Half Of 2022: Regulator

There will be no final decision on the certification of the operator of the Nord Stream 2 gas pipeline from Russia to Germany in the first half of 2022, the head of the German energy regulator said Dec. 16. Speaking at a press conference, Bundesnetzagentur President Jochen Homann said the certification process remained suspended pending the submission of documentation from Switzerland-based Nord Stream 2 AG on the transfer of assets to a new German company.

—Read the full article from S&P Global Platts

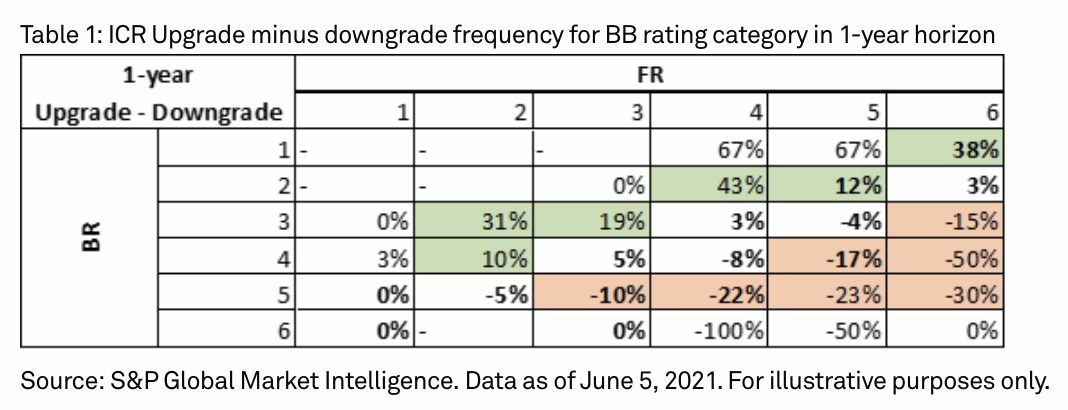

Giving Credit To New Alpha Strategies

Factor-based investing techniques have become popular among equity investors, due to their potential to generate higher risk-adjusted-returns. Stock portfolio selection usually requires a trade-off between performance and risk and can be influenced by multiple investment preferences and constraints.

—Read the full article from S&P Global Market Intelligence

U.S. E-Commerce Sales Set To Maintain Pandemic-Fueled Heights Into 2022

U.S. e-commerce sales are on track to exceed $1 trillion for the first time next year, as sales growth plateaus but total purchases remain far above pre-pandemic levels, according to a recent forecast by eMarketer. E-commerce sales grew by 32.4% between 2019 and 2020, reflecting the abrupt shift to online shopping, working, and learning during first waves of the pandemic.

—Read the full article from S&P Global Market Intelligence

Listen: The Essential Podcast, Episode 52: Elements of the Energy Transition #2 — Iridium

Terence Kooyker, founder and CEO of the commodity hedge fund Valent Asset Management, joins the Essential Podcast to talk about the market and uses for the platinum group metal iridium, which is lucky element #77 on the Periodic Table.

—Listen and subscribe to The Essential Podcast, a podcast from S&P Global

New York City Will Prohibit Natural Gas Hookups In New Buildings

The New York City Council on Dec. 15 voted to prohibit the use of natural gas in most new buildings, joining dozens of towns and cities along the East and West coasts that have embraced the climate policy since 2019. With the vote, lawmakers in the key battleground city also narrowed the prospects for the gas industry's chief alternative to building electrification: displacing natural gas with low-carbon fuels.

—Read the full article from S&P Global Market Intelligence

Path To Net-Zero: Progress By U.S. Utilities 'Too Slow'

Virtually all major U.S. utilities have turned net-zero emissions targets into a corporate mantra, reflecting a major shift for the country's once coal-heavy power sector. Still, groups tracking the utilities' progress warn that the industry is not transitioning fast enough, slowing the broader economy's shift away from fossil fuels.

—Read the full article from S&P Global Market Intelligence

Australian Critical Mineral Deals A Prelude To Vast South Korean Investments

South Korean President Moon Jae-in's visit to Australia on Dec. 14 will unlock investment by the east Asian country into Australia's critical minerals mining sector, an executive in the meeting told S&P Global Market Intelligence. South Korea is one of Australia's largest customers for metals, and the country, a major global battery maker, is looking for new sources of critical minerals outside of China.

—Read the full article from S&P Global Market Intelligence

Losses From Tornado Outbreak In Central U.S. May Hit Historic Levels

A convective storm system that sparked a major outbreak of tornadoes across eight U.S. states on Dec. 10 and Dec. 11 could generate losses in the tens of billions of dollars when the final figures are tallied. Total economic losses from the storms could reach $18 billion, AccuWeather CEO Joel Myers estimated, which would make this the costliest tornado outbreak in U.S. history.

—Read the full article from S&P Global Market Intelligence

Texas Regulators Order Power Market Reform Phase I, Analysis Of Bigger Changes

Texas regulators on Dec. 16 approved a first phase of Electric Reliability Council of Texas market changes to be implemented quickly and directed regulatory staff to work with ERCOT to develop the "specifications" and "decision points" needed to implement a load-serving entity capacity obligation and backstop reliability ancillary service.

—Read the full article from S&P Global Platts

Watch: Data And Technology Will Fuel The Energy Transition

S&P Global Platts President Saugata Saha discusses how data and technology can help bridge the gap between old and new fuels, accelerating the energy transition. Saugata's feature is also available to read on the Insight blog or in the latest Insight magazine.

—Watch the full video from S&P Global Platts

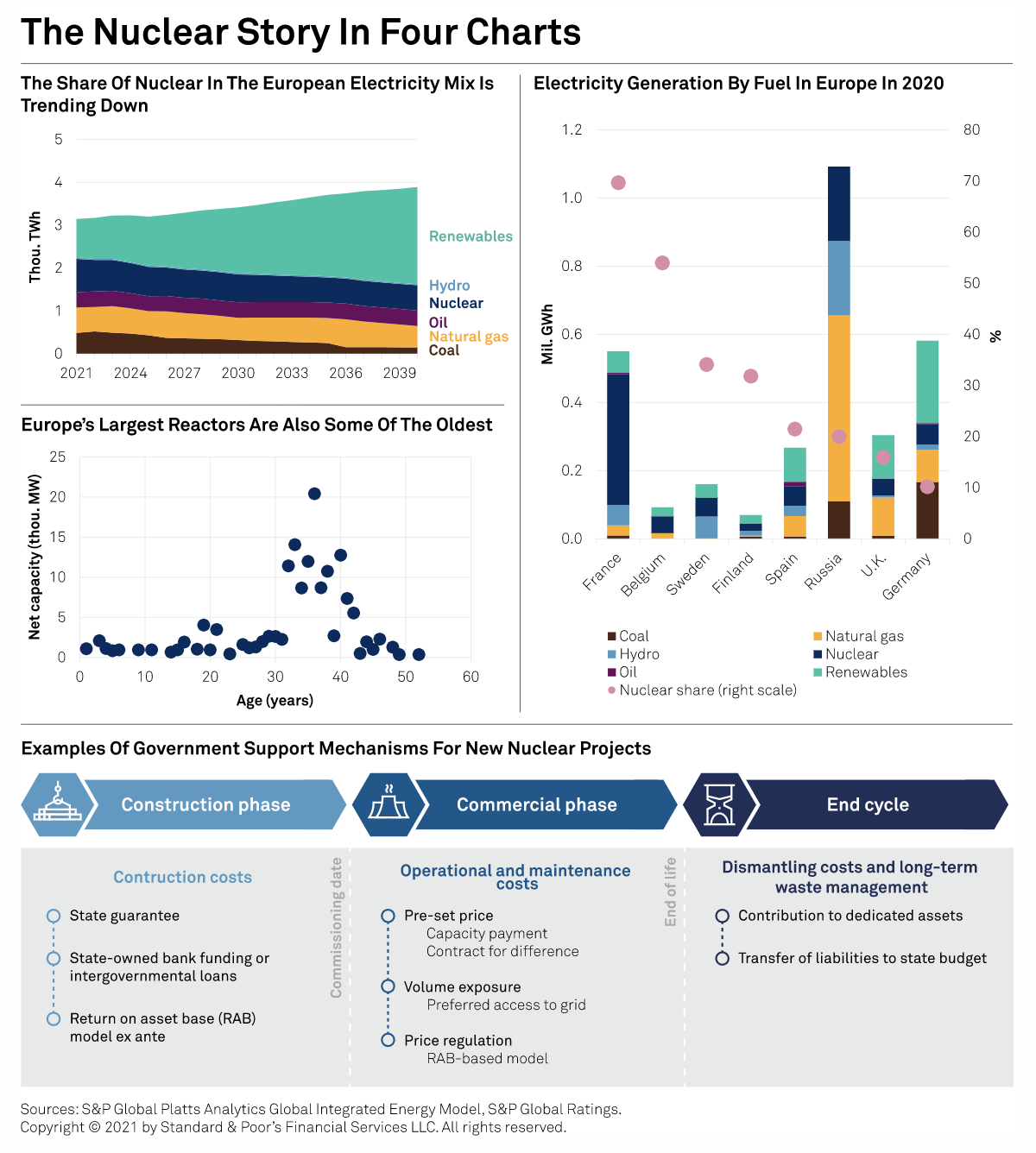

Nuclear In Europe: Lessons Learned And Ways Ahead

After decades of opposition by governments and public unease after the Fukushima disaster in 2011, Europe may be changing its mind about nuclear energy. The U.K. government considers nuclear as part of its decarbonization strategy, and the technology could be included in the European green finance taxonomy, a key milestone to attract private capital.

—Read the full report from S&P Global Ratings

Amid China Vacuum, Australian Coal Finds New Homes In India, Japan

For Australian coal, which has faced restrictions in the Chinese market since late 2020, new windows of opportunities have opened up. Many other Asian markets—such as India, Japan, South Korea, and Taiwan—have witnessed sharp rises in Australian coal inflows.

—Read the full article from S&P Global Platts

China's Steel Output May Rise Further On Healthy Margins, Stimulus Policies

China's steel output rebounded on a monthly basis for the first time in seven months in November, and this upward trend is likely to continue in December and beyond as steelmakers ramp up after completing 2021 output cut requirements in November and see an improvement in margins.

—Read the full article from S&P Global Platts

West Tracker: Higher Gas Prices Drive Up Power Prices, Despite Milder Weather

Higher natural gas prices drove up U.S. Western wholesale spot power prices an average of 63% year on year in November despite lower demand and milder weather, as winter power forwards are about double year-ago packages on higher gas forwards. California Independent System Operator peak load dropped 12% year on year to average 27.923 GW in November, according to CAISO data.

—Read the full article from S&P Global Platts

U.K. Power Balancing Costs Hit Record High In November On Stronger Winds

U.K. power system balancing costs hit record levels in November as stronger winds led to high constraint costs amid a gas crisis, data from the National Grid Electricity System Operator showed Dec. 16. Monthly balancing costs of GBP541.2 million ($718.8 million) in November outstripped the previous record (set in October) by GBP226 million—a month-on-month increase of 72%.

—Read the full article from S&P Global Platts

India's Crude Buying Moves Into Top Gear As Refiners Maximize Runs

Indian refiners are accelerating crude purchases as they lift run rates closer to 100% on expectations of a sustained upward trend in products demand, while keeping a close eye on the omicron coronavirus variant. The threat from the new virus variant has not been severe enough to dent the country's oil demand recovery, trade sources and analysts said, although it has subdued the sentiment to some extent over the past weeks.

—Read the full article from S&P Global Platts

Interview: Challenges Ahead For The U.K. Plastics Industry

The U.K. plastics industry faces numerous challenges, from short-term supply chain disruptions to a changing landscape with how the public—and governments—view plastic in a world looking to go green and fight climate change. There is, of course, also the U.K.'s changing relationship with its closest trading partner—the EU. Indeed, Brexit has become all too easy to forget during the global COVID-19 pandemic and wider supply chain issues.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language