Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 16 Dec, 2021 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Europe’s energy market is on the cusp of change.

Yesterday marked a turning point for Europe’s energy market. On Dec. 15, the European Commission introduced its highly-anticipated market framework for hydrogen alongside a proposal to support greater gas storage amidst current high energy prices. The same day, the EU Council announced that it had reached a provisional deal with European Parliament negotiators on criteria for funding key EU energy projects.

"Europe has become a proper gas market, driven by fundamentals and connected to the rest of the world," Franco Magnani, Head of Equity Valorization for Gas and LNG at Eni, said at the S&P Global Platts European gas and LNG conference on Nov. 23. "So what happens in Europe is largely driven by what happens in Asia, and what happens in the U.S."

As part of the EU’s "Fit for 55" plan to reduce emissions by 55% by 2030, the European Commission’s Hydrogen and Decarbonized Gas Package proposes lifting cross-border tariffs on hydrogen and implementing new rules for operating and financing hydrogen networks, establishing transparency on the quality of gas and hydrogen blends, and how gas networks can be repurposed for hydrogen transport. The proposal, which will require approval by the EU before its adoption, comes as S&P Global Platts Analytics data shows Europe to be the world’s leader in developing low-carbon hydrogen projects.

"Europe needs to turn the page on fossil fuels and move to cleaner energy sources. This includes replacing fossil gas with renewable and low carbon gases, like hydrogen," European Commission Executive Vice President Frans Timmermans said, according to S&P Global Platts. "We are proposing the rules to enable this transition and build the necessary markets, networks and infrastructure.”

Market sources told S&P Global Platts that elevated energy prices seen in Europe in recent months are likely to persist into the medium-term. Against this backdrop, Europe is working to ensure continued gas supply while suffering from emptier-than-normal gas storage sites—signaling the potential for issues ahead as Europe uses storage to guarantee supply security. Gas Infrastructure Europe data showed that as of Dec. 12 European storage sites were 62% full, compared with storage sites being 81% full during this time last year. Such conditions prompted the European Commission on Dec. 15 to propose market measures that would allow member states to voluntarily and jointly purchase gas by to help keep storage levels high as record high gas prices persist.

"The proposal enables voluntary joint procurement by member states to have strategic stocks in line with the EU competition rules," the European Commission said, according to S&P Global Platts. "The measures will help ensure a high filling level of storage at the beginning of the heating period in the EU. The larger the volume of gas 'in stock,' the more the EU can compensate for temporary shortages of gas supplies.”

Decarbonizing the EU’s gas market by transitioning from the unabated natural gas fossil fuel, on which European economies are currently heavily reliant, to low-carbon gases like hydrogen could not only lower the bloc’s emissions but also support its energy mix through diversification. As part of the proposals introduced yesterday on gas market reform, the European Commission introduced measures to long-term gas import contracts from extending beyond 2049—alongside a provisional deal to end support for new fossil fuel gas and oil projects under its subsidized Projects of Common Interest program starting from year-end 2029.

"This is the message that market participants know already," EU energy commissioner Kadri Simson said, according to S&P Global Platts. " All our member states have committed to becoming climate-neutral. That means by 2050 our gas market has to be decarbonized.”

Today is Thursday, December 16, 2021, and here is today’s essential intelligence.

2022 Gray Swans: Market Braces For War, Supply Chain Woes, Fed Mistake

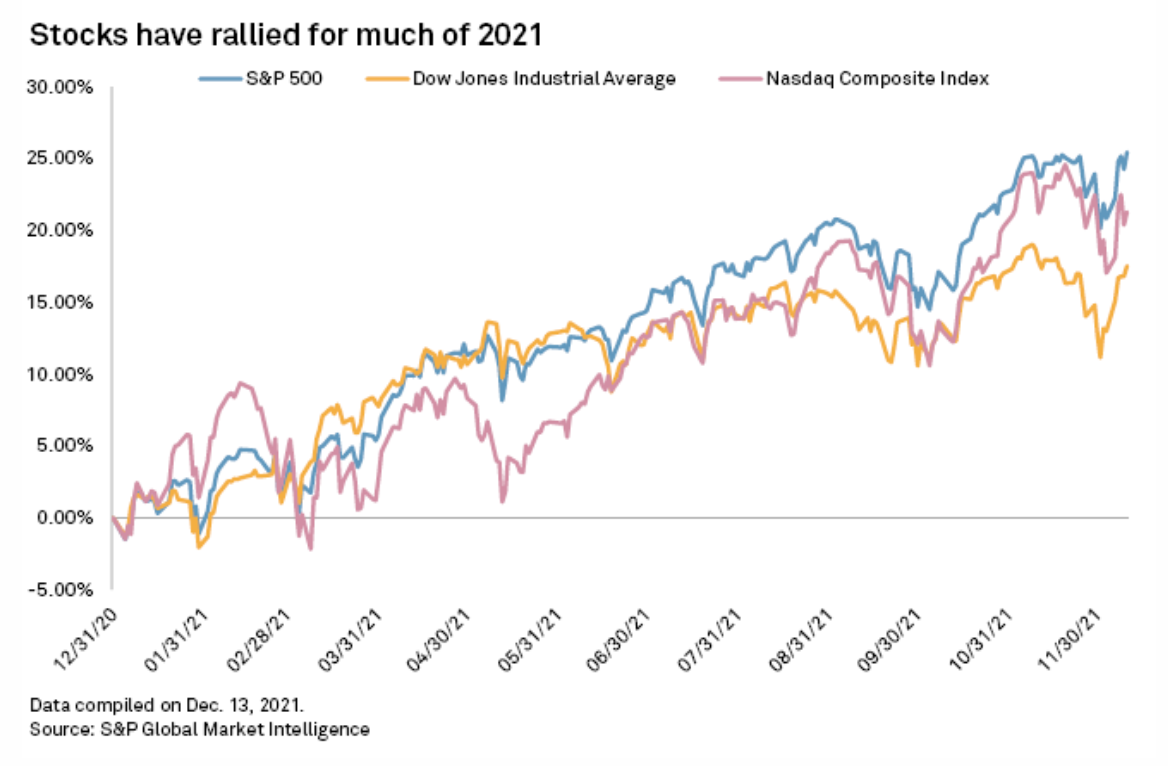

The U.S. stock market rally charged into mid-December with good odds to end 2021 at record highs after a year of soaring inflation, COVID-19 variants, and an increasingly unstable labor market. Investors may need to add the risk of war, a potential misstep in monetary policy, and a cyberattack to their list of concerns for 2022.

—Read the full article from S&P Global Market Intelligence

Cathay Pacific Braces For Omicron Headwinds After A 'Challenging' November

Hong Kong flag carrier Cathay Pacific carried 70,047 passengers in November, up 85.2% year on year, but down 97.3% compared with the pre-pandemic level in November 2019, the airline said Dec. 14, showing that it was still miles away from recouping lost business, with the omicron coronavirus variant threatening to derail the sectors' fragile recovery.

—Read the full article from S&P Global Platts

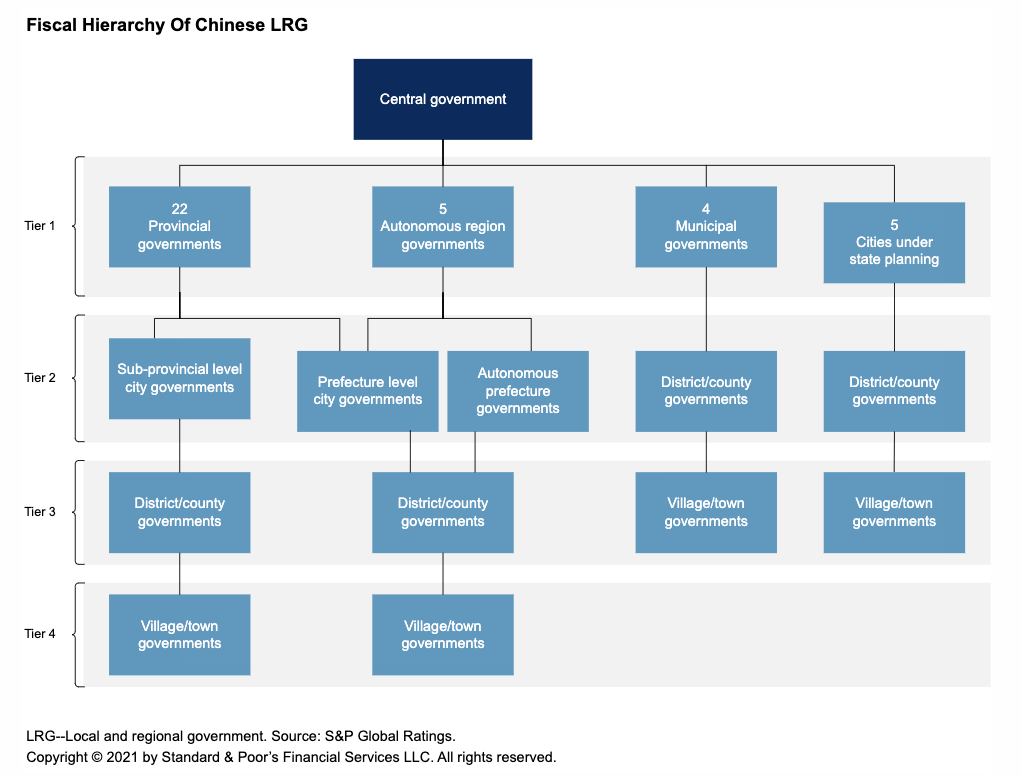

Fiscal Positions Of China's City Governments Are On A Divergence Path

The credit standing of China's tier-two local governments is diverging—the strong are getting stronger and the weak are getting weaker. S&P Global Ratings believes this gap will widen in the next couple of years, when it expects stretched tier-two finances to weigh particularly heavily on the weaker city/district governments.

—Read the full report from S&P Global Ratings

Although U.S. Regulated Utilities' Operating Cash Flows Are Set To Rebound From COVID-19, Credit Quality Remains Pressured

Despite the many risks and challenges that COVID-19 presented to the U.S. regulated utility industry, S&P Global Ratings believes the industry was successful in offsetting most of these risks and preserving credit quality. Throughout the COVID-19 pandemic, operating cash flows for many investor-owned utilities in the U.S. were pressured given the economic challenges the pandemic introduced.

—Read the full report from S&P Global Ratings

Italian Corporate Outlook 2022: Recovery Widens, With New Risks

75% of rated Italian companies currently display stable outlooks. Negative outlooks have dropped to a low 4% from 40% at end-2020, a strong rebound reflecting recovered business conditions. Revenues in 2021 are already back to 2019 levels, on average, moderately outperforming Italy’s 6% GDP growth. S&P Global Ratings also anticipates healthy revenue growth in 2022-2023, again better than GDP growth.

—Read the full report from S&P Global Ratings

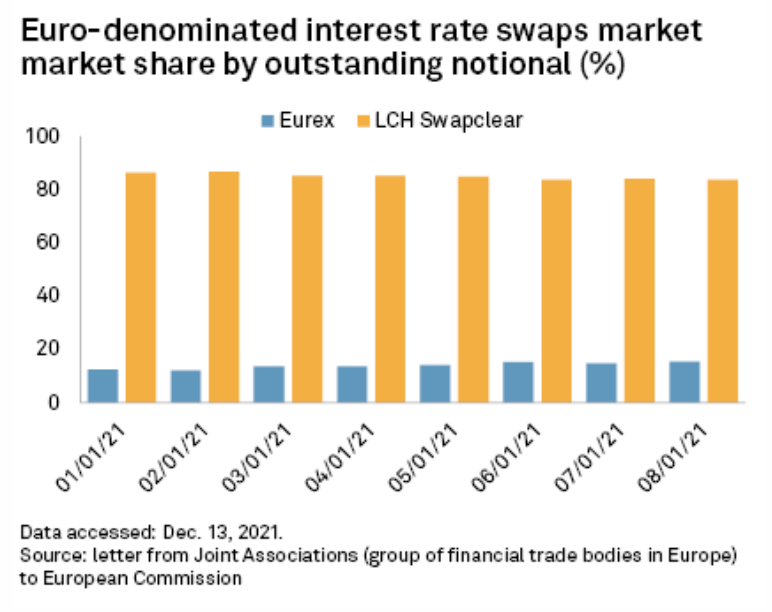

EU's Next Temporary Regime For U.K. Clearing Houses Must Be Longer, Say Experts

British clearing houses, despite no longer being in the bloc following Brexit, are allowed to serve EU customers until June 30, 2022. The U.K., led by LCH Group Holdings Ltd.'s SwapClear arm, clears the bulk of interest rate derivatives—financial instruments designed to protect against changes to interest rates—in Europe, with an 82% share of notional, or the underlying amount an investor has contracted to buy and sell, in 2019, according to the EU's securities regulator.

—Read the full article from S&P Global Market Intelligence

China's Daily Carbon Trading Volume Hits Record High 14.88 Mil MtCO2e Dec 14

The daily traded volume of China Emission Allowances or CEAs in China's national compliance carbon market hit a record high of 14.88 million tons CO2e Dec. 14 as companies rushed to buy carbon credits before a year-end deadline to meet emission targets. The national environment ministry had asked provincial authorities to ensure that 95% of eligible companies meet their emissions compliance obligations by Dec. 15 and all companies by Dec. 31.

—Read the full article from S&P Global Platts

Listen: Next In Tech | Episode 44: The Big Picture, Part 1 – The Future Of Work

The pandemic laid bare problems with the set of assumptions organizations have been making about work. Few have thought strategically about how work gets done. The future of work is one of topics in the recently released Big Picture reports, and research director Chris Marsh returns with host Eric Hanselman to discuss better ways to approach work and employee engagement. Technology alone won’t fix it.

—Listen and subscribe to Next in Tech, a podcast from S&P Global Market Intelligence

Pricing Out Youtube's Potential $15 Price Decrease Amid Disney Carriage Battle

If YouTube, LLC's YouTube TV drops Walt Disney Co.'s networks as threatened, the streaming service has promised a $15 price drop, with a bulk of that savings likely coming from losing just ESPN (U.S.). Disney and YouTube's virtual multichannel service are continuing to negotiate terms for a new affiliate contract before their current pact expires at 11:59 p.m. ET on Dec. 17.

—Read the full article from S&P Global Market Intelligence

Listen: How 2 New Technologies Could Pave The Road To Net-Zero

The final episode of the S&P Global miniseries on emerging technologies that can help companies achieve net zero emissions by mid-century examines two cutting-edge projects for the agricultural, mining, and road construction industries. THIS episode of ESG Insider explores how scientists in California are using a new technology called enhanced weathering to help the farming and mining industries become part of the climate solution.

—Listen and subscribe to ESG Insider, a podcast from S&P Global

Data And Technology Will Fuel The Energy Transition

World leaders are doubling down on an energy transition that will rely more heavily on renewable sources of energy as we move closer to key climate commitments. Investment in the energy transition is well underway, with daily news reports announcing new projects for wind, solar, hydro-generation, battery and other storage technologies, hydrogen, bio-based fuels, and carbon capture and storage.

—Read the full article from S&P Global Platts

Path To Net-Zero: Drive To Lower Emissions Pays In Metals, Mining Sector

Mining and metals companies that have established tough carbon reduction goals are hoping to cash in on the burgeoning market for sustainably produced raw materials. S&P Global Market Intelligence found that 21 of the 30 largest metals and mining companies by market capitalization have set some level of net-zero greenhouse gas emissions target or are already claiming carbon neutrality, hoping to prove their commitment to reducing their emissions.

—Read the full article from S&P Global Market Intelligence

Japan-Flagged Suiso Frontier Set For World's First Marine Transport Of Liquefied Hydrogen

The Suiso Frontier, loaded with some 75 mt of hydrogen in Japan, is set to leave Kobe in western Japan by the end of the year and arrive in Hastings in southeastern Australia in mid- to late January to verify the marine transport technology for liquefied hydrogen, a source said. The liquefied hydrogen tanker is scheduled to return to Kobe in mid- to late February after loading some 2 mt of hydrogen at Hastings, which is produced from brown coal, to fill up the boil-off volume, the source said.

—Read the full article from S&P Global Platts

Emissions Study Finds EPA's Proposed Methane Rule Might Not Go Far Enough

An environmental study found 40% of all the oil and natural gas sites analyzed in the Permian Basin were leaking significant amounts of methane as the U.S. Environmental Protection Agency pursues a new rule to crack down on emissions. The Environmental Defense Fund study, conducted via helicopter between Nov. 12 and Nov. 21, detected "significant plumes" of methane from about 40% of the 900 sites surveyed.

—Read the full article from S&P Global Platts

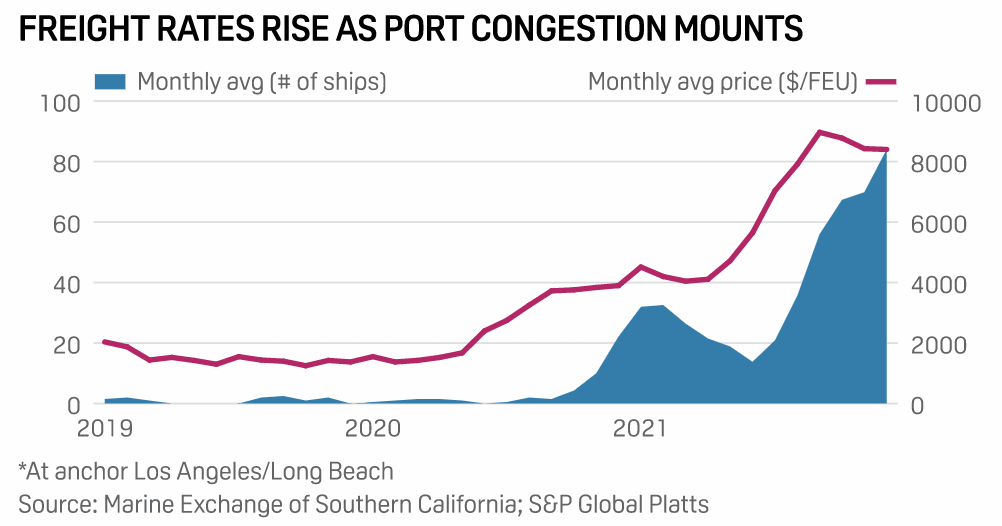

Commodities 2022: USWC Longshore Labor Negotiations Could Further Disrupt U.S. Freight Markets

At the height of global port congestion brought on by record-setting container volumes, importers utilizing Pacific Coast gateways are looking towards U.S. West Coast port worker negotiations next year with little hope that a suitable contract will be struck in time to avoid renewed slowdown. Although some metrics indicate that the worst congestion may already be past, few players expect market fundamentals to find their balance in the first half of 2022.

—Read the full article from S&P Global Platts

Concerns Abound In U.S. South As Rice Planting Decisions Approach

As the end of 2021 quickly approaches, the U.S. South's rice market will start the new year with various concerns on the horizon. The most talked about and the most immediately pressing is the recent hike in fertilizer prices. Fertilizer costs have hit all-time highs in recent months, with it widely believed this will limit planting.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language