Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 29 Aug, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

California Car Law Draws the Ire of the Oil Industry

On Aug. 25, the California Air Resources Board adopted new regulations that will allow the state to phase out gasoline-powered vehicles by 2035. Groups representing oil refiners, biofuel producers and some automakers are loudly criticizing the move, insisting that it is impractical, will eliminate consumer choice and will limit innovation.

California leads the U.S. in electrical vehicle adoption. The market share of EVs in California stands at around 18%, versus 6.3% for the rest of the country. Under the new regulations, automakers would be required to sell increasing percentages of zero-emission vehicles between 2026 and 2035, culminating in nearly 100%. Analysts project that the EV fleet would reach 50% of all cars in California by 2035, since it will take time to retire old gasoline-powered vehicles. The law would reduce gasoline consumption by 40% or 535,000 barrels per day by 2035.

Oil refiners and ethanol producers are opposed to the new regulations.

"This is a deeply flawed plan that will eliminate consumer choice, limit innovation and jeopardize progress towards our shared climate goals," the American Petroleum Institute said in a statement, according to S&P Global Commodity Insights.

Renewable Fuels Association President and CEO Geoff Cooper was also critical of the new regulations. He has argued that the ban on gasoline-powered vehicles will limit innovation and burden the electrical grid.

"While we support the state's goal of achieving carbon neutrality by 2050, we strongly disagree with the notion that electric vehicles are the only way to get there," Cooper told S&P Global Commodity Insights. "Policies that dictate technology winners and losers often backfire and rarely deliver the desired results."

Members of the California Air Resources Board have argued that the historic measure is necessary for tackling climate change, reducing greenhouse gas emissions from passenger vehicles by more than 50% by 2040, and lowering smog-forming emissions by more than 25% by 2037. Despite the fact that the ban is more aggressive than those proposed by President Joe Biden, the move is consistent with the goals of the administration, making it unlikely that the president or the U.S. Environmental Protection Agency will withhold approval.

Californians typically pay the highest gasoline prices in the U.S., and the state accounts for nearly 20% of U.S. gasoline demand.

Today is Monday, August 29, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

Week Ahead Economic Preview: Week of August 29, 2022

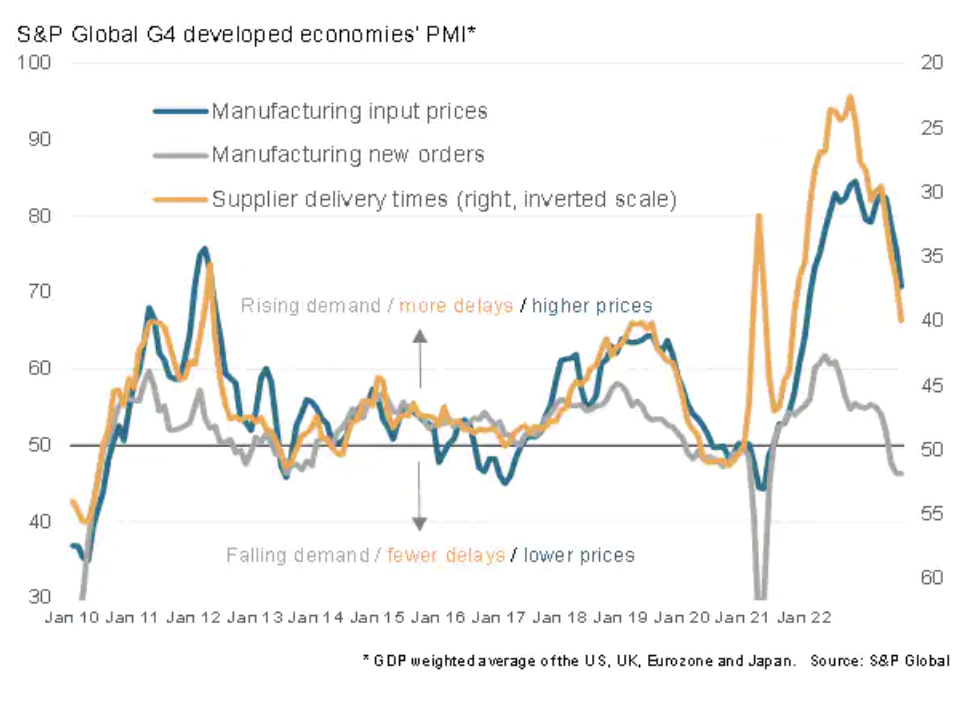

A wealth of economic data will be released in the coming week with S&P Global Worldwide Manufacturing PMIs set to dominate headlines and the week closing off with U.S. non-farm payrolls. In addition, Q2 GDP updates for India, South Korea, Italy, Canada, Poland and the Czech Republic will be watched for signs of slowdowns, as the global economy continues to face drawbacks from high inflation, growing uncertainty and rising interest rates.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Private Equity Investments In Blockchain, Cryptocurrency In Decline

Rapidly falling cryptocurrency prices, impending industry-specific regulation and macroeconomic headwinds are taking a toll on global private equity and venture capital investments in blockchain and cryptocurrency. Aggregate global deal value across the two assets tumbled 48.1% quarter on quarter in the three months to June 30, to a combined $2.7 billion, according to S&P Global Market Intelligence data.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

Listen: Burned Out: Has A Sizzling Economy Actually Fizzled Out U.S. Metals And Polymers?

U.S. steel and polymer producers rode a wave of soaring prices for their products in 2021 as the economy roared back from the coronavirus pandemic and construction activity boomed. The hot building market brought with it an uptick in demand for steel and polymers. But the fun couldn't last forever. Rising interest rates are tamping down inflation, and the construction industry is feeling the pain. S&P Global Commodity Insights global polymer lead Kristen Hays and U.S. metal news editor Nick Lazzaro dive into recent trends in U.S. construction activity, and how the price swings in polymer and steel markets illustrate that after two red-hot years, the economy might be finally cooling down.

—Listen and subscribe to Commodities Focus, a podcast from S&P Global Commodity Insights

Access more insights on global trade >

How The EU Aims To Transform Its Energy Mix And Boost Investment In Renewables

The European Commission, the EU’s executive arm, presented in May a plan to increase the roll-out of renewables to counter a spike in energy prices and to drastically reduce the EU’s dependence on Russian supplies of fossil fuels. The REPowerEU plan aims to achieve EU independence from Russian fossil fuels “well before” 2030 and to reduce Russian natural gas imports by nearly two-thirds before the end of 2022, the Commission said.

—Read the article from S&P Global Sustainable1

Suspension Of EU Carbon Market Not Feasible: IETA

Carbon markets industry group the International Emissions Trading Association has dismissed suggestions that the EU Emissions Trading System should be suspended temporarily due to the energy price crisis. The comments follow recent statements by Poland's climate and environment minister calling for the EU carbon market to be suspended until it is reformed.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Gaming Industry Gold Rush Targets Popular Software Developer

A software developer that builds the scaffolding for many popular video games is the latest target of this year's gaming M&A gold rush. Unity Software Inc. showed no love for an unsolicited merger offer from mobile app-monetization company AppLovin Corp. Given a growing industrywide interest in video-game advertising, analysts expect this may not be the last unsolicited offer to tempt Unity's management.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >