Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 24 Aug, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The Complex Reality of the Energy Transition

There are no easy answers when it comes to the energy transition from carbon-intensive fossil fuels. During a conversation at S&P Global’s 2019 CERAWeek conference with S&P Global Chief Energy Strategist Atul Arya, Vaclav Smil, distinguished professor emeritus at the University of Manitoba, had this to say: “As you look at the civilization we are right now … we are fundamentally a fossil fuel civilization. Everything that we have, everything around us has been created by fossil fuels.”

In a five-part series, analysts from S&P Global Ratings, S&P Global Commodity Insights and S&P Global Market Intelligence looked at the complex realities of the energy transition. While some of their analysis focused on the more celebrated renewable energy sources such as wind and solar, they also looked at the role played by coal, oil, natural gas and nuclear.

According to an analysis by S&P Global, renewable energy sources will account for only 18% of global energy demand by 2030, but renewables will provide 60% of power generation in Europe and as much as 40% in China and the U.S. This suggests the future of energy is already here, but it’s not evenly distributed. Supportive policies, such as the Inflation Reduction Act in the U.S., will be necessary to achieve a transition to renewables. The projected adoption of renewables at 18% of global demand will not be consistent with preventing a 2-degrees Celsius rise in global temperatures under the Paris Agreement on climate change.

Most analysts agree that thermal coal cannot play a role in any net-zero energy transition. However, coal remains widely used for energy generation. India and China account for 70% of global coal demand, and demographic trends indicate a significant increase in these countries’ energy requirements. The ongoing construction of coal-powered energy plants in India and China means coal is not disappearing any time soon. For these countries to achieve their emissions reduction targets, carbon capture and sequestration technology must become technically and economically feasible.

Oil demand is also projected to continue expanding, at least for the next decade. While changing consumer and investor behaviors could accelerate the advent of a downward trend in oil demand, current projections place demand far too high for Paris-aligned benchmarks. Even if investors turn away from oil, S&P Global Ratings believes the effects on the oil sector could be mitigated by OPEC’s ability to adjust supply.

Demand for natural gas will also continue to increase through 2030. U.S. demand looks to remain steady, and European demand has been rendered uncertain due to Russia’s invasion of Ukraine. Demand in Asia will continue to grow, even as natural gas struggles to compete with coal and nuclear generation on price. Natural gas emits roughly two times less carbon dioxide per unit of energy than coal when burned and has traditionally been considered a “bridge fuel” in the energy transition. Europe and the U.S. have started to look at developing natural gas as a feedstock for blue hydrogen, or hydrogen produced from natural gas where greenhouse gases are captured, to further limit emissions.

Despite its lack of carbon emissions, one of the most controversial sources of energy is nuclear. China has plans to double its nuclear energy generation by 2035 to approximately 10% of total output. Europe and the U.S. are looking to reduce their dependence on nuclear by decreasing its share of total output to 15% from 20% over the same period. The ongoing controversy over nuclear power is likely to limit investment, according to S&P Global Ratings.

It’s apparent that carbon-intensive technologies continue to be widely used, and the consistent picture from this five-part series is of an energy transition that’s moving slowly relative to Paris-aligned benchmarks.

Today is Wednesday, August 24, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

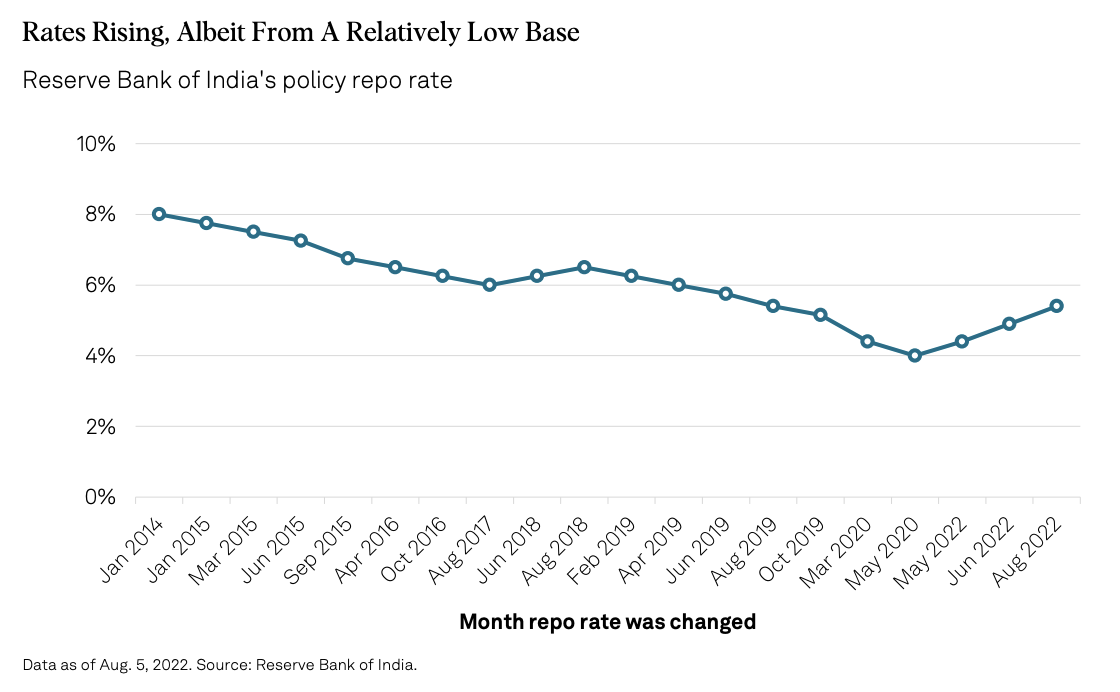

Inflation And Rate Hits Won't Knock Out India Inc.

India's companies and banks could feel the bite of rising rates and inflation. Credit profiles could deteriorate for up to 20% of Indian corporate debt, according to S&P Global Ratings’ stress test of more than 800 (mostly unrated) companies in India, representing US$570 billion in debt. But it does not expect large-scale defaults even in its stress scenario due to buffers in the economy and companies' financials.

—Read the report from S&P Global Ratings

Access more insights on the global economy >

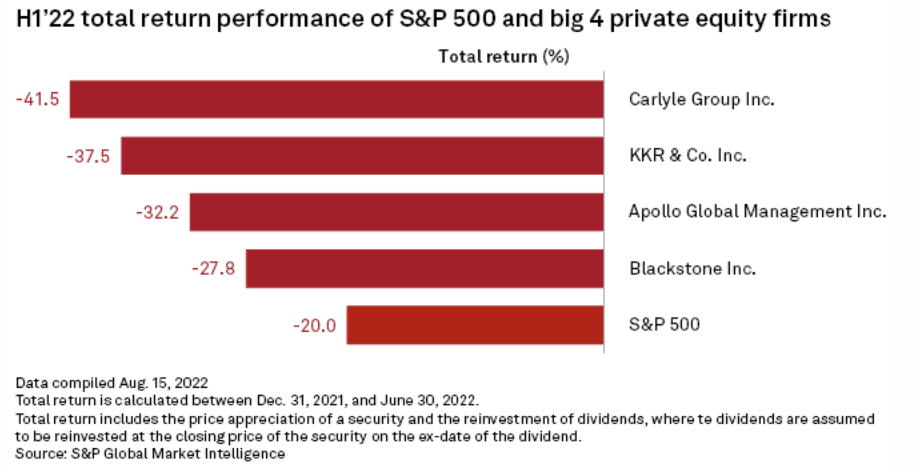

Listed Private Equity Firms Target Discounted Investments As Share Prices Fall

The four largest publicly traded alternative asset managers aim to take advantage of the same market turbulence that curbed investment performance and sent their stocks tumbling in the first half of 2022. Each of the four — Apollo Global Management Inc., Blackstone Inc., The Carlyle Group Inc. and KKR & Co. Inc. — turned in a worse total return performance than the S&P 500 for the six months ended June 30. The index shed 20% of its value during that time, heading into bear market territory.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

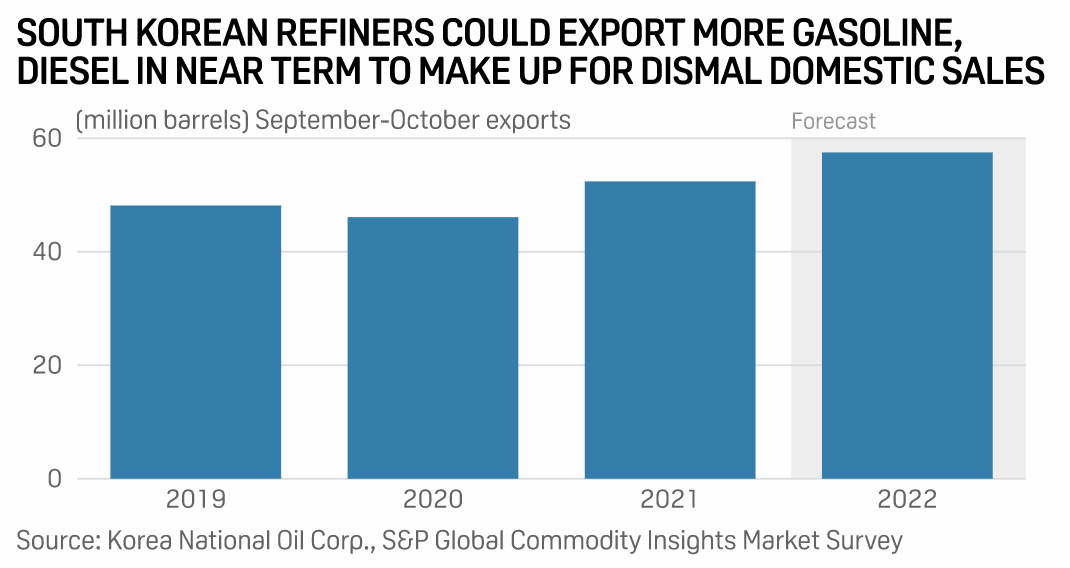

Asian Traders Anticipate Surplus Middle Distillates From South Korea After Seoul Floods

Record downpours in South Korea are expected to hit August auto fuel demand significantly and prompt local refiners and trading firms to release large volumes of surplus gasoline and diesel into the regional spot market, putting pressure on near-term Asian middle distillate crack spreads. Middle distillate traders across Asia and Oceania indicated that the regional market is closely monitoring South Korea's gasoline and diesel export volumes for the next few trading cycles as Asia's major oil products supplier is poised to witness its domestic summer automotive fuel demand sharply undershoot expectations after heavy rains battered the country, triggering massive floods the past two weeks.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

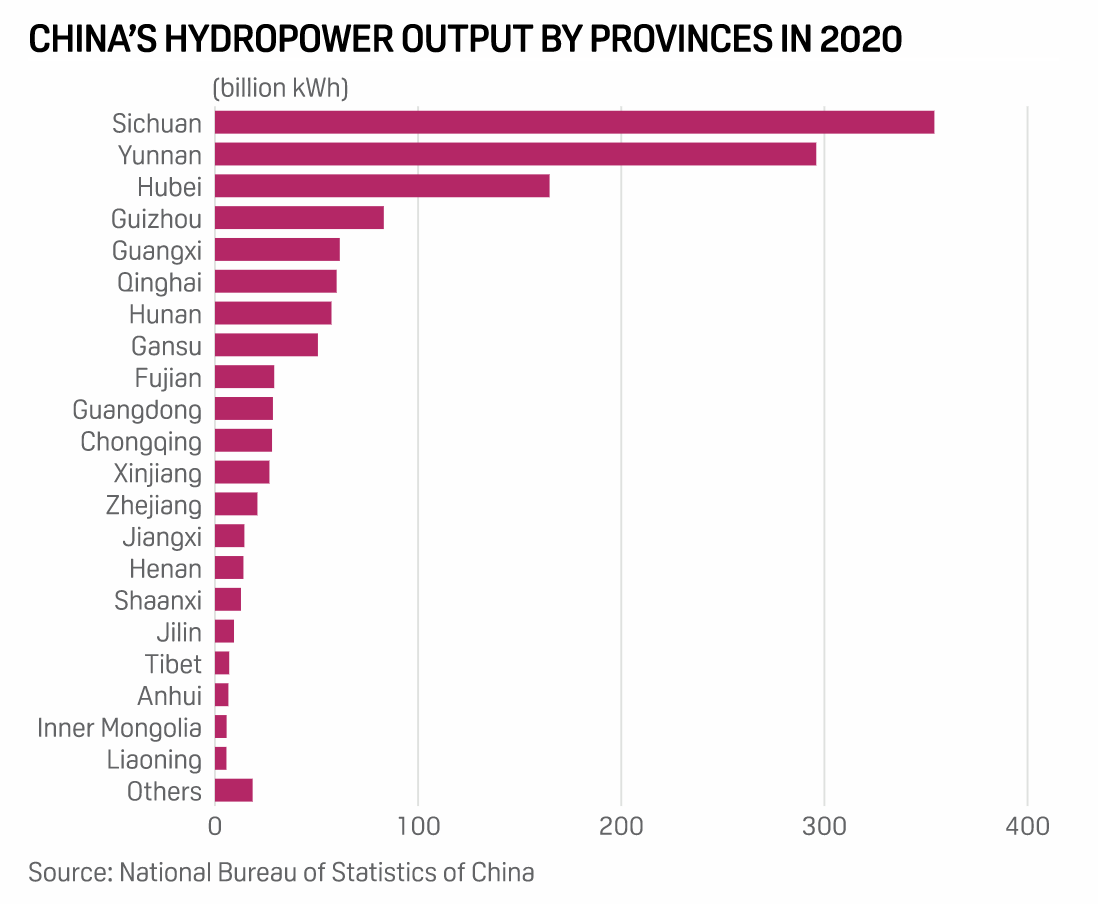

Sichuan Drought Jeopardizes Hydropower In China's Decarbonization Roadmap

China's Sichuan province, long vaunted for its panda conservation and abundant hydropower exports, is suffering from the province's most severe drought on record, raising concerns over the reliability of hydropower as a pillar for China's decarbonization. The drought has caused power shortages which have impacted electricity supply to other eastern coastal provinces and snowballed into a crisis as critical clean technology and manufacturing industries have shut capacity to divert electricity for residential use.

—Read the article from S&P Global Commodity Insights

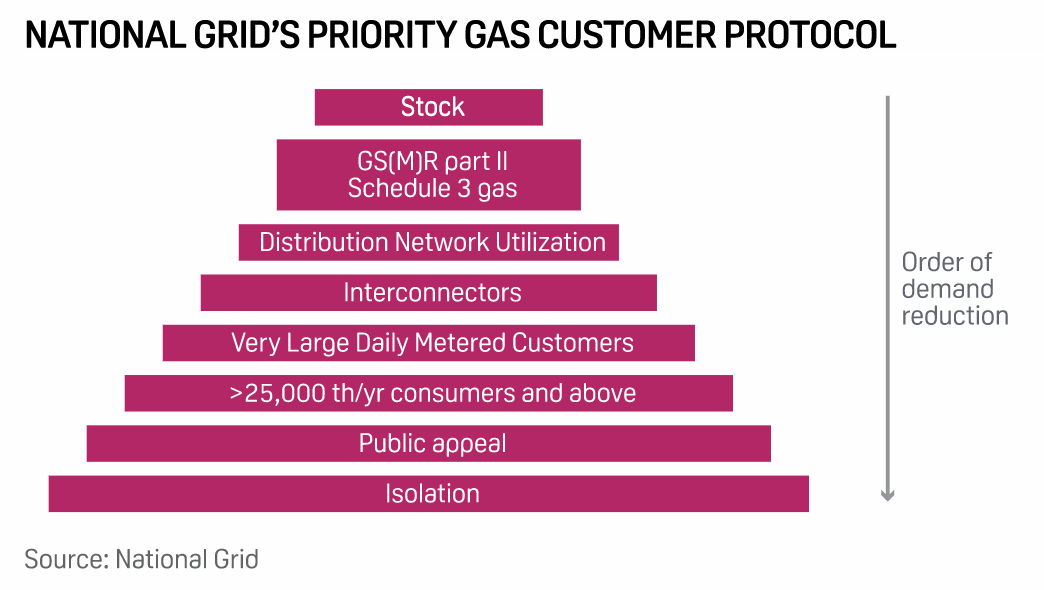

National Grid Doubles Length Of This Year's U.K. Gas Emergency Test

U.K. gas system operator National Grid has set aside four days for its annual emergency simulation in September and October, double last year's exercise period, information from the company showed Aug. 23. Last year, two days were set aside to run a scenario of high gas demand (400 million cu m/d, as seen Feb. 11, 2021) with gas forming 45% of the power generation mix.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

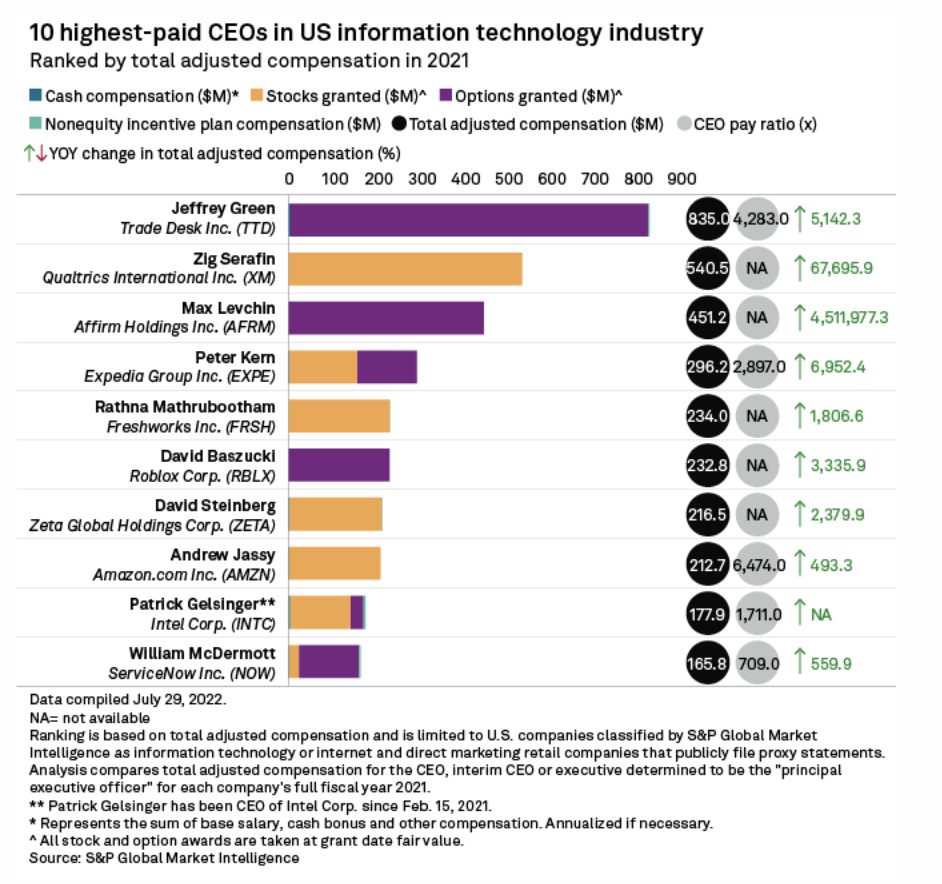

Digital Ad Company CEO Out-Earns Big Tech Peers In 2021

The head of a digital ad-buying platform ranked as the highest-paid CEO in the U.S. information technology sector in 2021, thanks to a large stock option award. The Trade Desk Inc.'s Jeffrey Green earned total adjusted compensation of $835 million in 2021. The vast majority of that compensation consisted of a long-term stock option award, granted in October 2021, for 16 million shares of common stock valued at $828.4 million.

—Read the article from S&P Global Market Intelligence

Access more insights on technology and media >