Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 1 Aug, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Shifting Geopolitical Bonds Create Volatility

Back in 1992, political philosopher Francis Fukuyama published his influential book “The End of History and the Last Man,” in which he suggested that—with the end of the cold war and the fall of the Soviet Union—history had ended, and Western liberal democracy had won. In 2022, due to shifting geopolitical interests and renewed tensions, the future just isn’t what it used to be.

Dr. Lindsay Newman, Director of Economics and Country Risk at S&P Global Market Intelligence, recently published an overview of the geopolitical changes that are creating volatility in markets. She divides her analysis into the geopolitical ripple effects of global financial integration, supply chain vulnerabilities, global security, and migration.

“We expect the global political system, including trade and security alliances, to become more fluid and flexible as states co-operate across spheres of mutual interest and contest across spheres of national security,” Dr. Newman wrote.

Global financial integration has suffered a series of body blows since 2022 began. The sanctions that resulted from the Russian invasion of Ukraine has fractured global financial integration with some countries observing sanctions while others do not. Some individual companies have found themselves self-sanctioning to protect against real risksputation. In developing markets, inflation caused by the war in Ukraine, along with tighter monetary policy in the U.S. and E.U. is causing a drag on economic activity.

Supply chain disruptions are so pervasive at this point that it can be hard to distinguish which supply chains are bent and which are broken. The war in Ukraine has disrupted both agricultural trade and energy markets. While an agreement is in place to restore the agricultural exports from Ukraine, European energy markets seem to be turning away from Russia and toward a more permanent transition to renewable sources of energy. China’s zero-COVID policies have created havoc in global supply chains. Partly in response, the U.S. appears to be embracing near-sourcing for semiconductors, critical minerals, high-capacity batteries, and pharmaceuticals.

Global security alliances have moved to center stage as the U.S. and its allies attempt to contain what they perceive to be an aggressive Russia and an assertive China through intelligence-sharing, security guarantees, and trade. Meanwhile, continued economic shocks created political instability in countries around the world, notably Ecuador and Sri Lanka.

Finally, increased migrations due to war and climate are creating political tensions and economic hardship, and suggest that geopolitical volatility will continue. Even Fukuyama seems to agree that history is not quite done with us, yet.

Today is Monday, August 1, 2022, and here is today’s essential intelligence.

Written by Nathan Hunt.

Week Ahead Economic Preview: Week of 01 August 2022

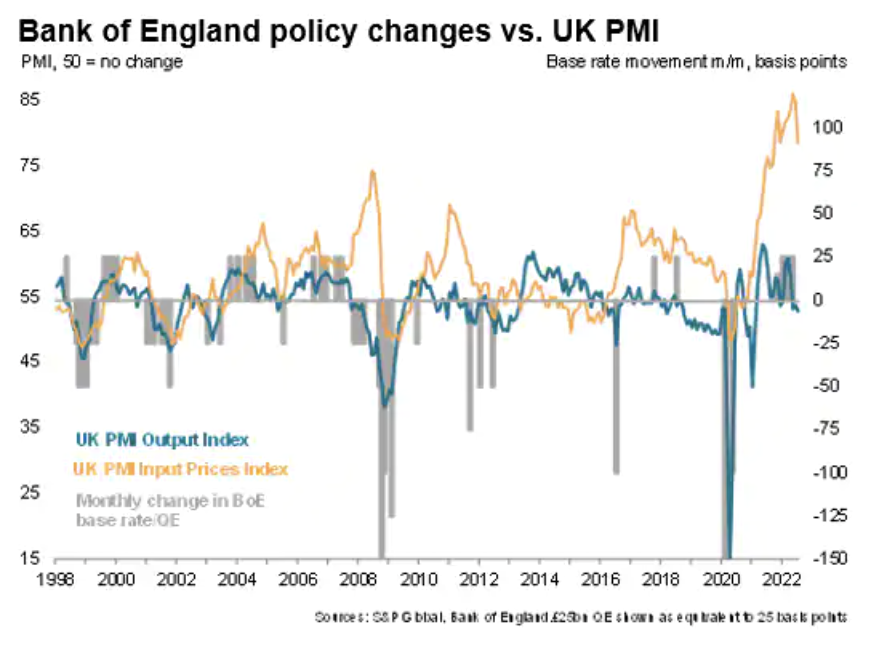

This week sees the release of worldwide manufacturing and services PMI data which will give an insight into global growth, inflation, and labor market trends in key economies for the first month of the third quarter. June's PMIs and their early July flash readings have hinted at a deteriorating economic environment, showing business activity falling in the U.S. and Eurozone as the cost-of-living crisis and tighter monetary policies hit demand.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Fundraising Slog Goes On; Private Equity's Share Of Canceled M&A Deals Ticks Up

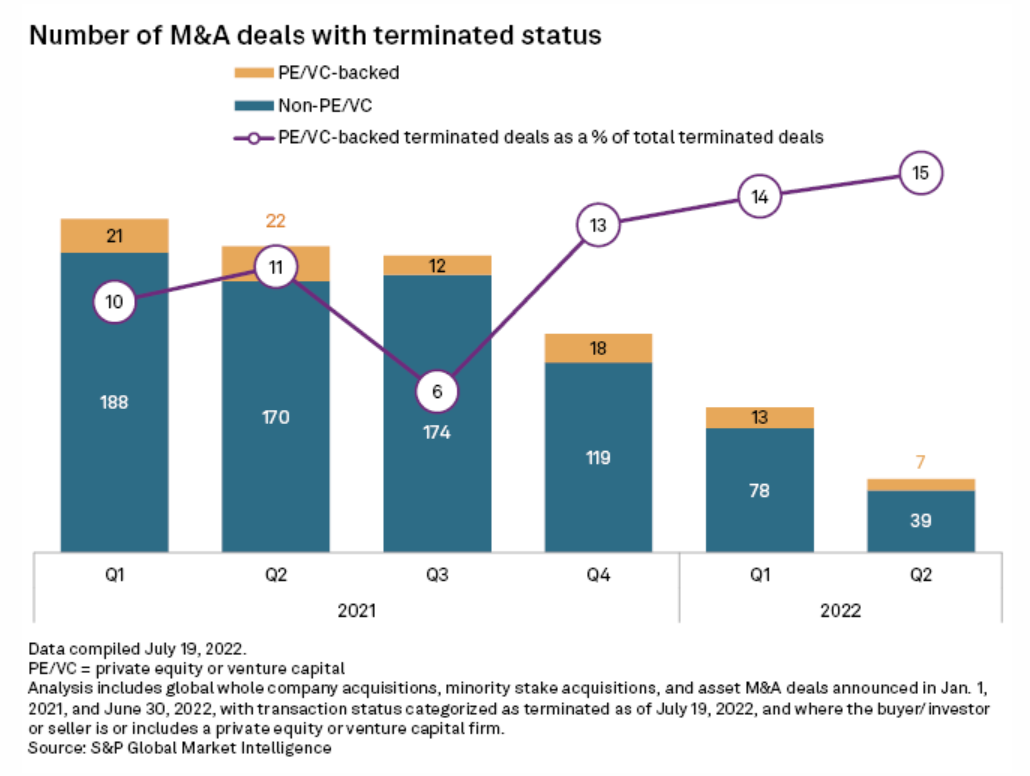

Private equity fundraising is stuck in a rut. We heard it last week on Blackstone Inc.'s second-quarter earnings call, and it came up again this week when it was time for Ares Management Corp. and The Carlyle Group Inc. to face analysts' questions. All three reaffirmed what they reported last quarter: The spigot has not run dry, but it definitely is not gushing like it did in 2021, a record fundraising year for the industry.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

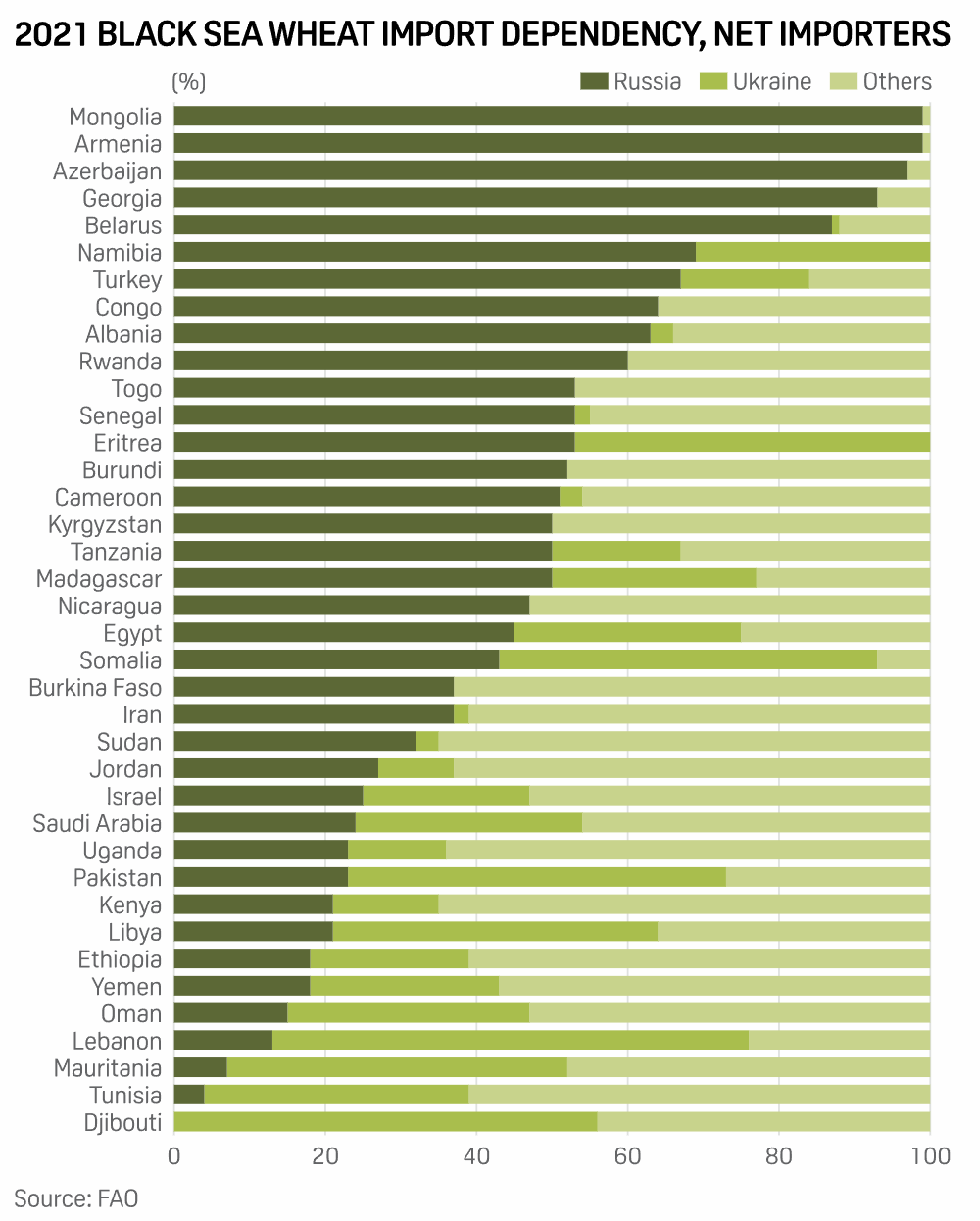

Beyond The Black Sea: How Russia’s War In Ukraine Is Exacerbating Food Insecurity

"When the rich wage war, it's the poor who die," Jean-Paul Sartre once said. How apt this sounds in the current circumstances when Russia's onslaught on Ukraine since Feb. 24 has disseminated misery and hunger throughout the East European nation. For millions of Ukrainians, the rattling vibrations of lethal ballistics have become a routine affair. But equally dreadful is the fact that children are sleeping hungry and vulnerable as countless people have lost their homes and source of income.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

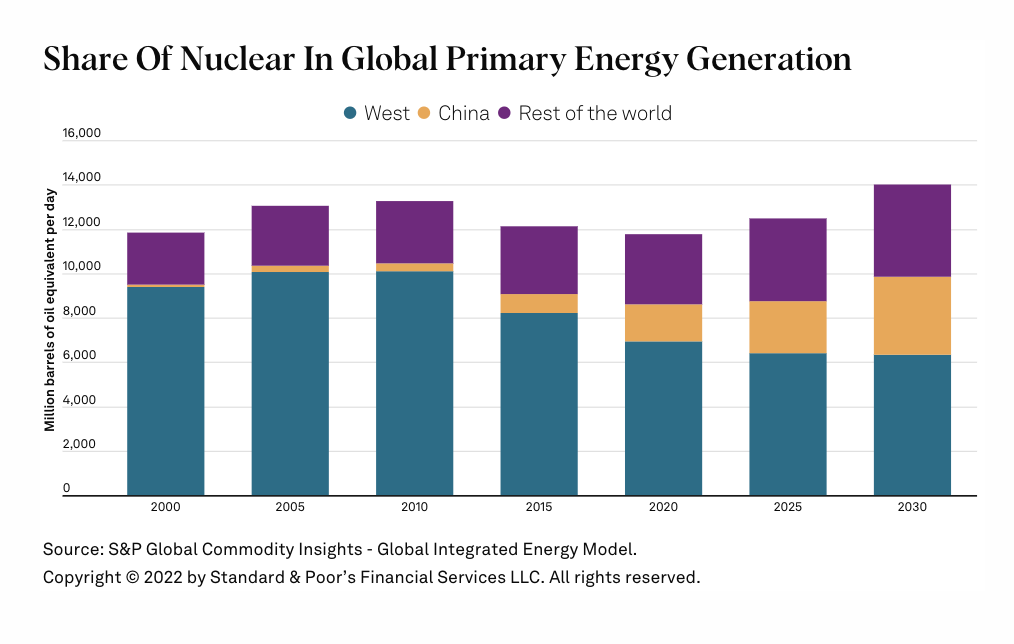

Energy Transition: Nuclear's Path Is Diverging In Developed And Developing Nations

China plans to double the share of nuclear in its power mix by 2035 to almost 10% of generation output, whereas in the U.S. and Europe the share of nuclear power will likely reduce to 15% by then from close to 20%, according to S&P Global Commodity Insights (Platts). The gas and power crisis in Europe has increased the focus on security of energy supply, possibly leading to greater support for nuclear; while in the U.S., various states have contemplated incentives to extend the lifespan of nuclear plants to support the reliability of the power grid.

—Read the cross-divisional report from S&P Global

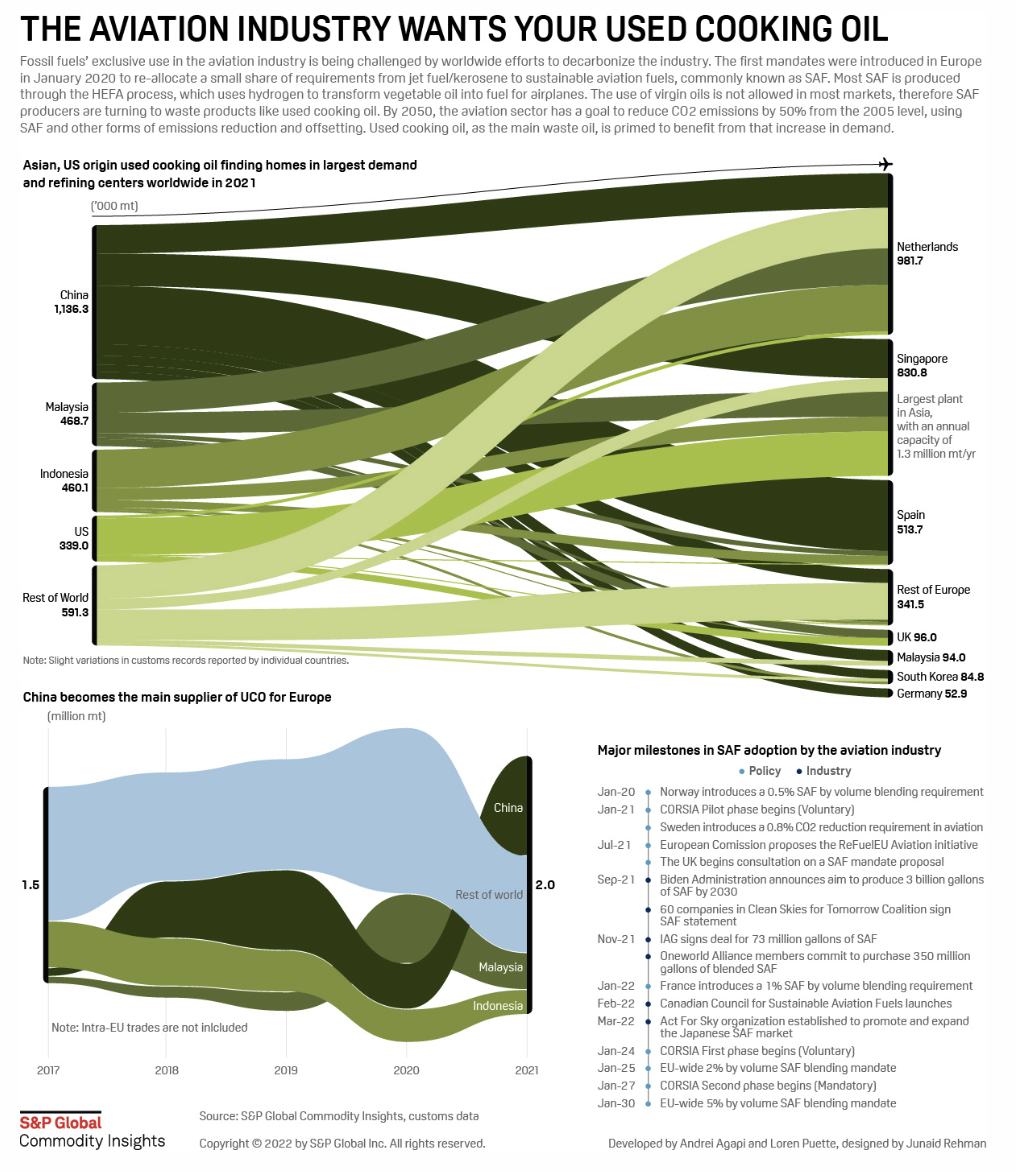

Demand Heats Up For Asia’s Used Cooking Oil

With temperatures rising across the globe, the search for alternative fuel to reduce carbon emissions is getting more imperative. Sustainable aviation fuel and marine biofuels, which both count used cooking oil as one of their feedstocks, are among the available alternatives as a drop-in fuel utilizing existing technologies and infrastructure.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

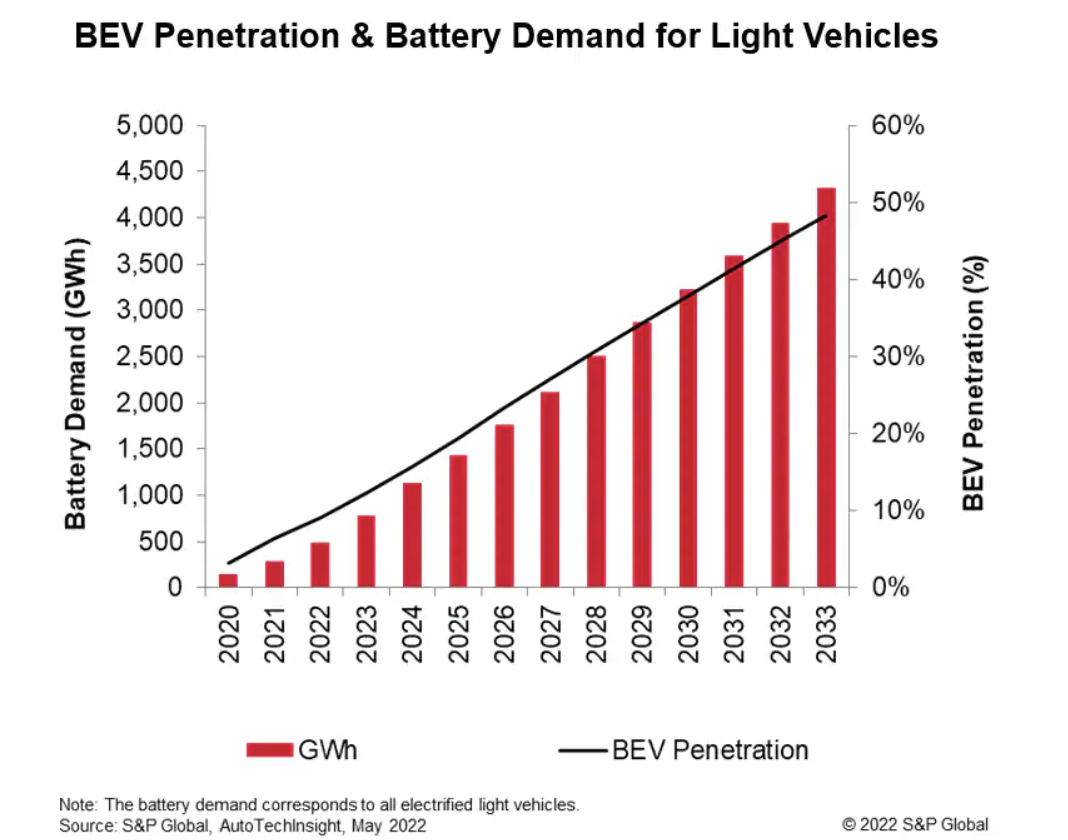

Fuel For Thought: What Can OEMs Do To Ensure A Robust And Economical Supply Of Batteries?

Navigating the opportunities within the comparatively nascent EV industry will see winners and losers emerge. But how real are the concerns around the battery upstream market and could this genuinely be the next automotive supply chain crisis? In what way can automakers achieve economies of scale while feasibly navigate fluctuating commodity prices to deliver competitively priced EV offerings? This challenge will fundamentally define how the competitive landscape of the automotive industry transpires this decade.

—Listen and subscribe to Fuel for Thought, a podcast from S&P Global Mobility