Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global 9 Apr, 2024 Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Gaming Industry Moves To Cut Costs as Growth Falters

The video game industry is a story of consoles and titles. In the longer term, consoles' introduction, maturity and obsolescence drive the industry. However, an innovative game can revive an old console or drive the adoption of a new one. In 2023, the PlayStation 5 and Xbox Series X seemingly exited their growth phase faster than anticipated, based on the life cycle of previous consoles. Game publishers are confronted with smaller potential audiences for their titles as these new consoles enter midlife with lower adoption numbers. Neil Barbour, an S&P Global Market Intelligence Kagan research analyst who specializes in gaming and the metaverse, joined S&P Global’s "MediaTalk" podcast to discuss these developments.

“Gaming companies found themselves in a position where they had overspent, and they need to pull back,” Barbour said. “They're going to continue to focus on their proven franchises, their core intellectual properties, probably at the expense of more speculative bets. And they're just going to hope whatever they have left resonates with consumers and can maintain healthy margins.”

At the beginning of the COVID-19 pandemic, publishers and console manufacturers saw a surge in demand for new titles. Some of the biggest publishers, including Microsoft, Sony and Electronic Arts, invested heavily in new projects, anticipating further growth. As disappointing sales numbers started to trickle in, these publishers pivoted to pull costs back and focus on margins. They have been mostly successful in those efforts, although staff reductions will impact an industry that depends on innovation and fresh ideas to fuel growth.

Console maturity continues to drive the bottom line for gaming. Nintendo’s Switch is a mature console, which means high-margin game and software sales have replaced low-margin software sales and advertising-driven growth. Eventually, the Switch will be replaced by a newer console. When that happens, Nintendo’s margins may compress as it invests in a new console life cycle.

One surprising development is the continued investments in metaverse technology by many gaming publishers. Roblox and Fortnite have been investing heavily in independent metaverse hub experiences. Disney invested $1.5 billion in Fortnite publisher Epic Games to reach kids on their preferred platforms. While that investment greatly exceeds the typical $200 million-$400 million cost of developing a new AAA video game, Disney views this partnership as a long-term investment in proven developers with a built-in audience.

“I think selling physical goods in digital space is definitely in play here,” Barbour said. “Key metaverse stakeholders have long promoted the metaverse as a new vector for e-commerce.”

Today is Tuesday, April 9, 2024, and here is today's essential intelligence.

Written by Nathan Hunt.

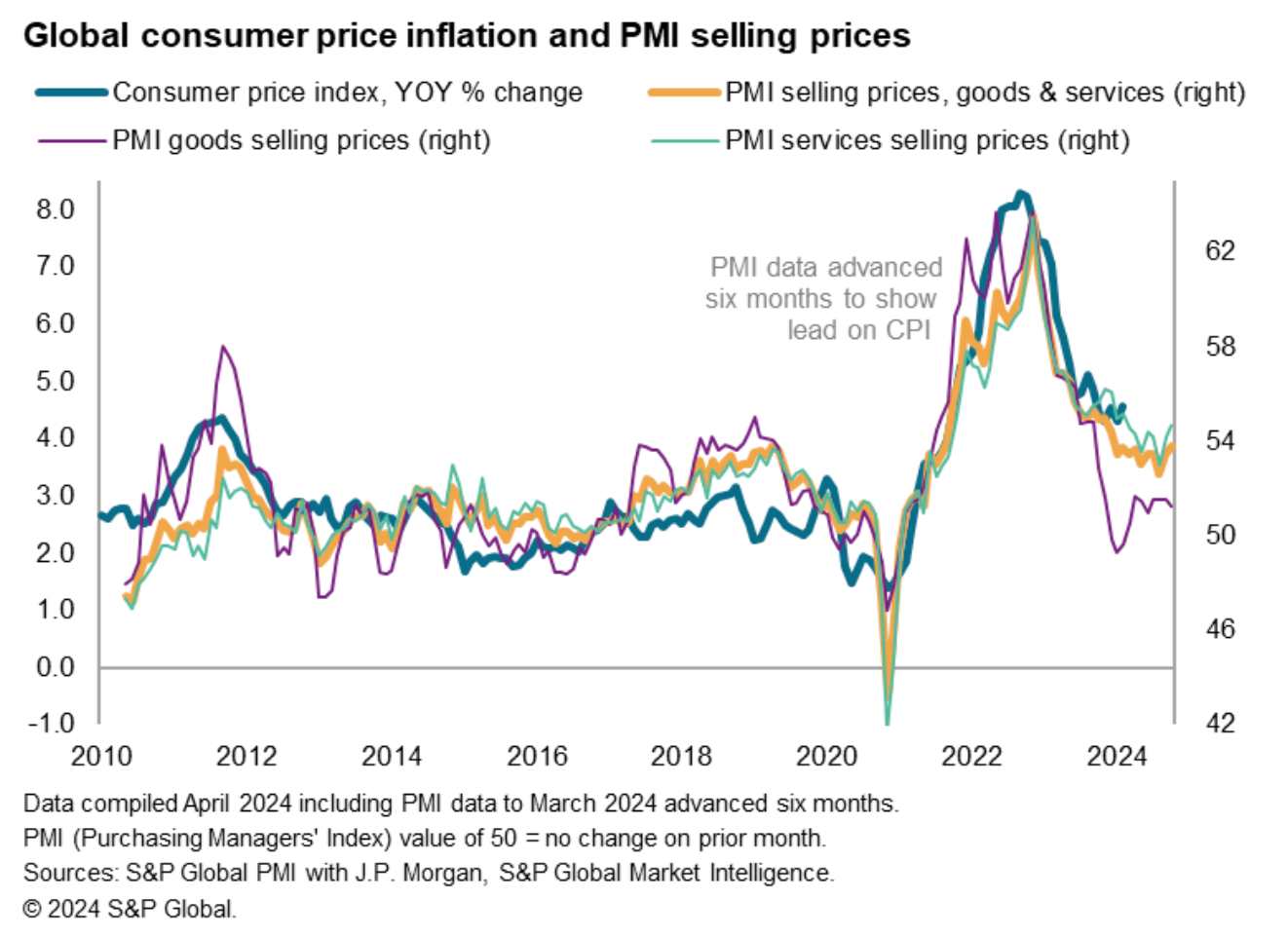

Global PMI Selling Price Inflation Accelerates To Ten-Month High

Average prices charged for goods and services rose worldwide at a steeper rate for a second consecutive month in March, according to S&P Global PMI business surveys, hinting at historically elevated stickiness of consumer price inflation at the global level in the coming months. Upward price pressures were primarily linked to increased labor costs, and were most evident in the UK and US.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

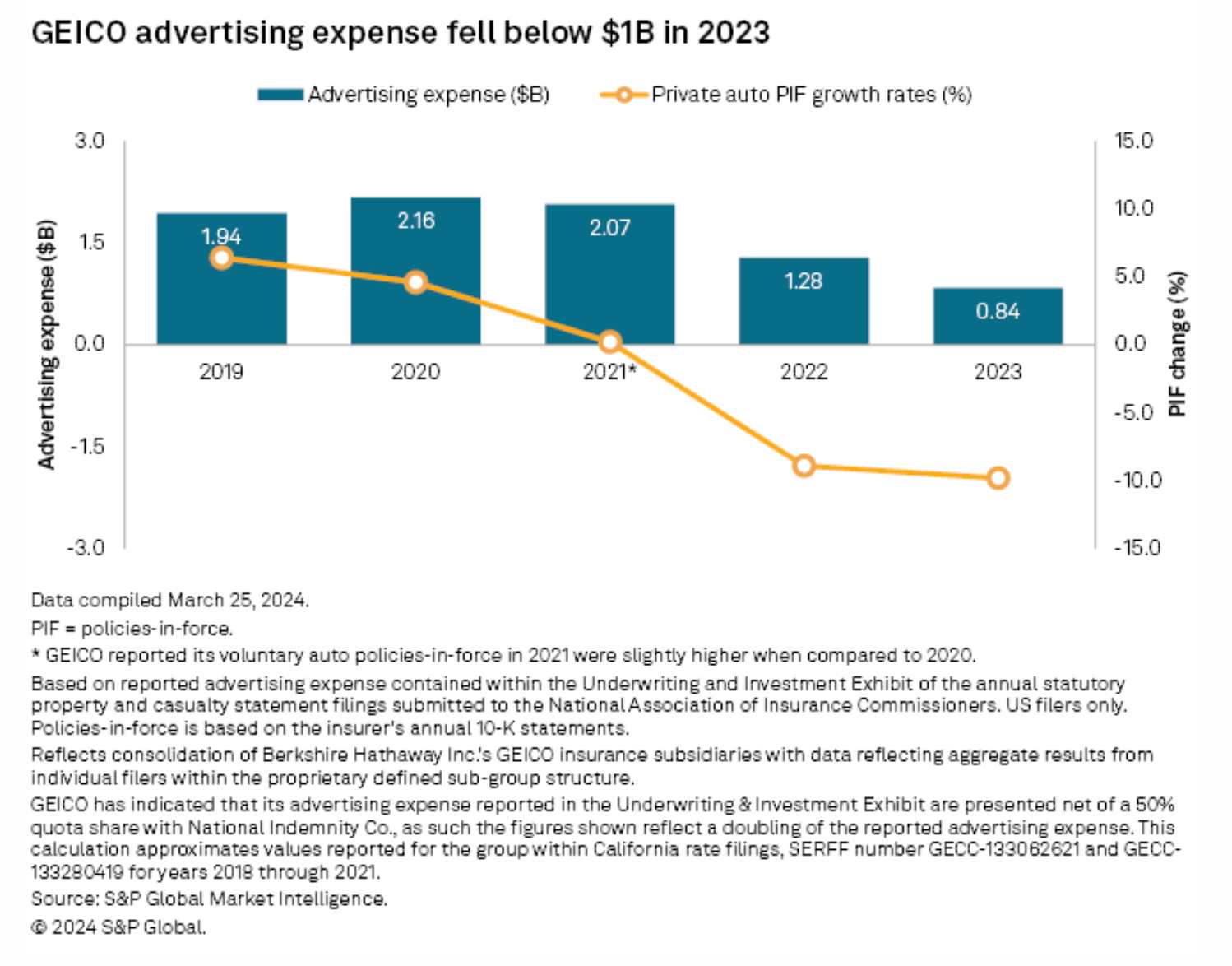

GEICO Leads Pack In Slashing Insurance Advertising Spend

The four largest personal lines property and casualty insurers in the US continued to slash their advertising spend in 2023, partly to offset the effects of loss-cost inflation. Berkshire Hathaway Inc.'s GEICO Corp. led the pack with a year-over-year decrease of nearly 35% in total advertising expense during 2023, the largest decline among the Big Four auto insurers, according to an S&P Global Market Intelligence analysis.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

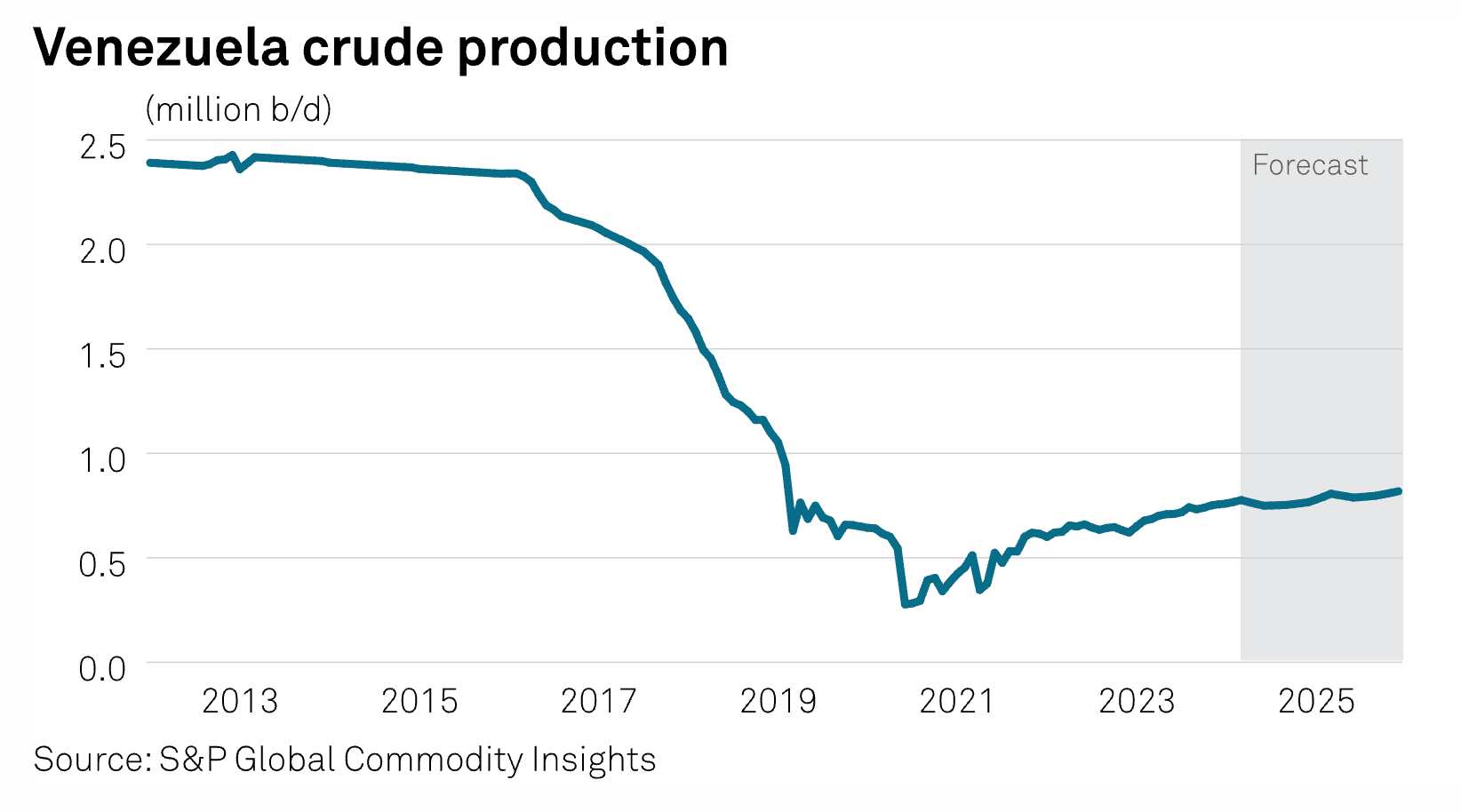

Former Officials Urge US To Restore Sanctions If Venezuelan Opposition Candidate Remains Barred

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated a near steadying of global trade in March. Although export orders for goods and services have now fallen continually for just over two years, the pace of decline eased further in March to the slowest in the current 25-month sequence to indicate a near-stabilization of conditions.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Listen: National Grid, Portland General Electric CEOs Share Thoughts On The Energy Transition

Energy Evolution continues to showcase interviews with influential leaders in the energy transition after co-host Taylor Kuykendall returned from CERAWeek 2024 by S&P Global, the company's flagship energy conference. In this episode of the Energy Evolution podcast, Maria Pope, president and CEO of Portland General Electric, and John Pettigrew, CEO of National Grid, discuss the future of energy and the challenges facing the industry in the coming years. PGE provides electricity to a service area with a population of about 1.9 million people. National Grid is a large investor-owned utility with operations in the UK and in the northeastern US.

—Listen and subscribe to Energy Evolution, a podcast from S&P Global Commodity Insights

Access more insights on sustainability >

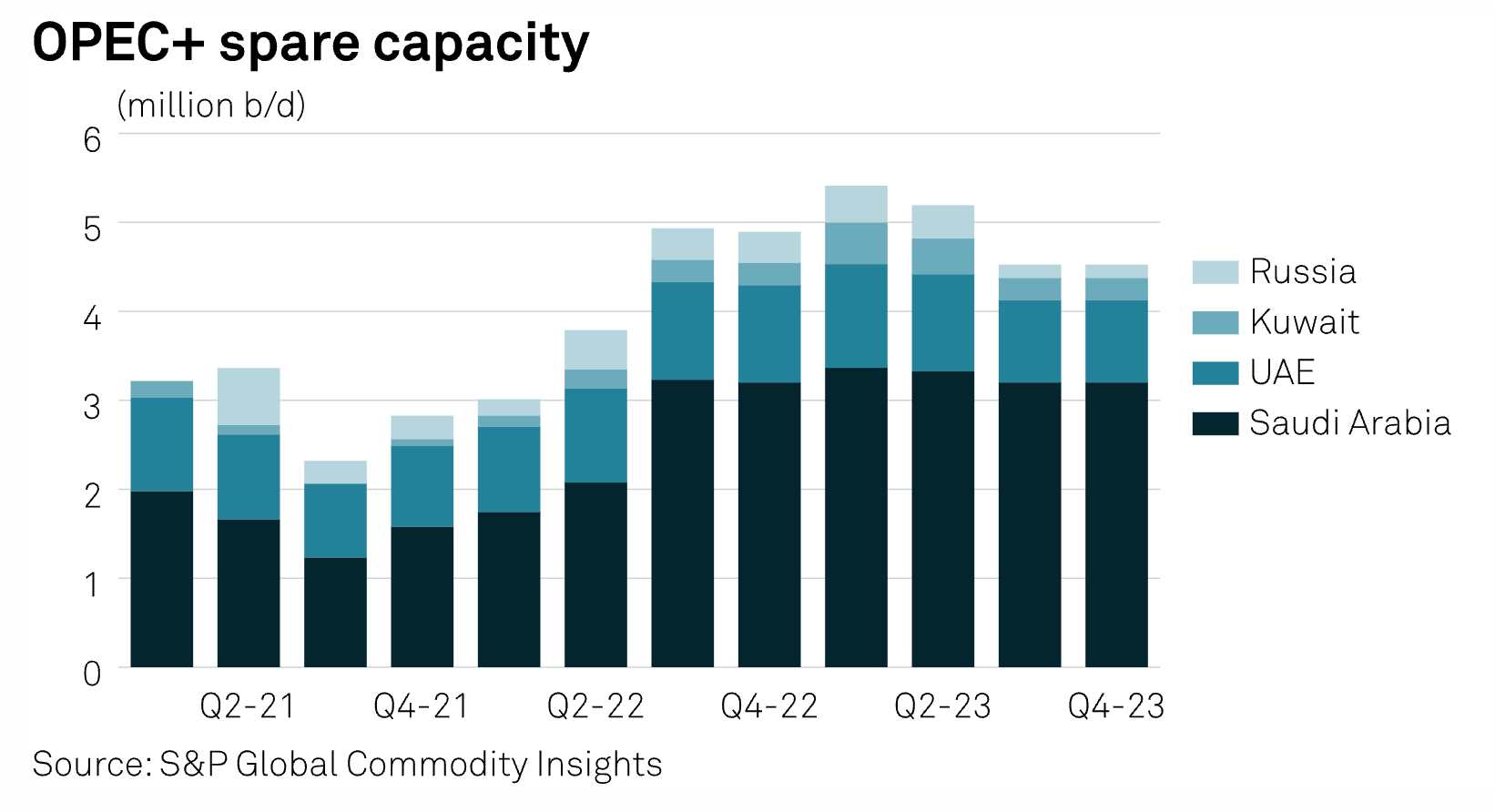

Financial Markets Now Consider Oil A 'Buy', Vitol's Asia Head Says

Investors in the financial markets are convinced that crude oil is a "buy" now with $100/b in sight, Vitol Asia's head Mike Muller told a podcast on April 7. "Fundamental physical changes in the oil markets have taken a second tier back seat to the money flows, and financial markets have convinced themselves this one is a buy," Muller told the daily Gulf Intelligence energy markets podcast.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Listen: Truckin’: The Long, Strange Trip Of Electric Pick-Ups

Americans love pick-up trucks, and the original equipment manufacturers (OEMs) that make them rely on their relatively high profit margins to fuel earnings. Darragh Punch joins EnergyCents with hosts Hill Vaden and Sam Humphreys to discuss North America’s love affair with pick-up trucks and why electrifying them could be so important to mass EV adoption in the United States.

—Listen and subscribe to EnergyCents, a podcast from S&P Global Commodity Insights