Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 3 April, 2024

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Panama Canal's Drought Dilemma Threatens Supply Chains

Considered one of the greatest engineering marvels of the modern world, the Panama Canal has been a major shipping channel for more than a century. Since its completion in 1914, the artificial waterway has reshaped global trade by reducing travel distance, time and costs for shipping vessels that move commodities between the Atlantic and Pacific. But a prolonged drought that began in mid-2023 has put the canal’s operations under pressure, disrupting the normal flow of global trade and supply chains.

The approximately 82-km canal uses a sophisticated system of locks to lift large ships at one end, carry them over the isthmus of Panama and lower them at the other end. For the system to work, the locks need to be flooded with millions of gallons of water from nearby lakes. After experiencing one of the worst droughts in recent history, water levels have fallen to critical lows at Gatun Lake, which is the main body of water that feeds into the canal.

In response, Panamanian authorities tightened transit and draft restrictions at the canal. The number of daily transits gradually reduced in November 2023 before slightly improving to 24 from Jan. 16, and most recently to 27 through the end of March. Under normal conditions, the canal can handle up to 40 transits per day. The restrictions have resulted in longer wait times to pass through the canal, especially for tankers — vessels that carry petroleum products and other liquid cargo. As container ships are given priority to book slots, tankers have been participating in expensive auctions to skip the queue.

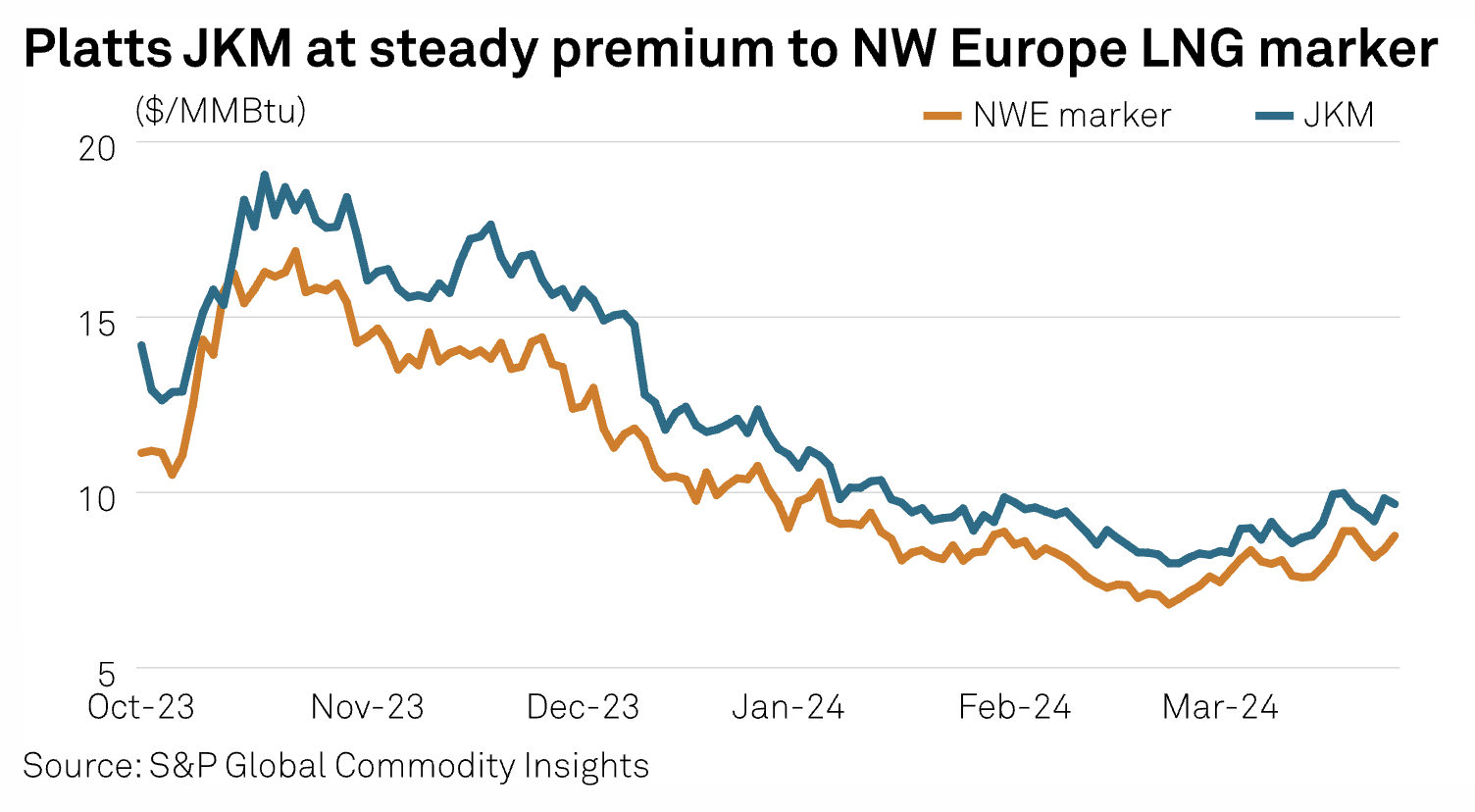

The Panama Canal's navigation restrictions have shifted global shipping routes. Shipowners have started circumventing the canal, opting for lengthy and treacherous alternatives. The Suez Canal in Egypt, which connects the Mediterranean Sea to the Red Sea, was the main alternative route for LNG tankers in November 2023. After Houthi attacks on shipping vessels in the Red Sea intensified in December 2023, more Asia-bound US LNG vessels have taken the longer route around Africa’s Cape of Good Hope. LNG voyages from the US to Asia via the Panama Canal fell 7% year over year at the end of 2023. So far in March, no LNG volumes have been delivered from the US to Asia via the Suez or Panama canals, while deliveries via the Cape of Good Hope remain high.

Capacity constraints at the Panama Canal are starting to snarl supply chains. The longer voyages have resulted in “tighter supply, increased costs and delayed deliveries" for commodities ranging from refined petroleum products and LNG to agriculture, S&P Global Commodity Insights analysts wrote in a February report. In the clean tanker market, refined product exports from the US Gulf Coast to the west coast of South America were down 57% year over year in October 2023, according to S&P Global Commodity Insights’ “Platts Oil Markets” podcast. Container ships have yet to see an impact given their priority status, although the situation is shifting as authorities are “heavily looking now at one's ranking when deciding who goes to the canal where, especially when,” Catherine Rogers, S&P Global Commodity Insights’ Americas tankers reporter, said on the podcast.

The bottleneck at the canal, along with climate change’s deepening effects and war risks in the Red Sea, puts into focus shipping logistics and the likelihood of higher prices for consumers as freight and other costs are eventually passed on to seaborne products.

“As more ships opt to take longer voyages, supply in each sector could weigh on rates; the more ships that are laden and carrying cargoes across longer distances, the fewer there are available to pick up cargoes at a given moment,” S&P Global Commodity Insights said in its report. “A sudden need to export a product, such as LNG or oil products, out of the key [US Gulf Coast] region could mean ship supply to carry those products could tighten quickly, potentially spiking rates again.”

The Panama Canal’s drought dilemma and the resulting transit restrictions have raised questions about the waterway’s long-term viability as a conduit for global trade. A proposal is in the works to mitigate the impact of future droughts.

Today is Wednesday, April 3, 2024, and here is today’s essential intelligence.

Written by Pam Rosacia.

Economic Research: Global Economic Outlook Q2 2024: Still Resilient, With Gradual Rate Cuts Ahead

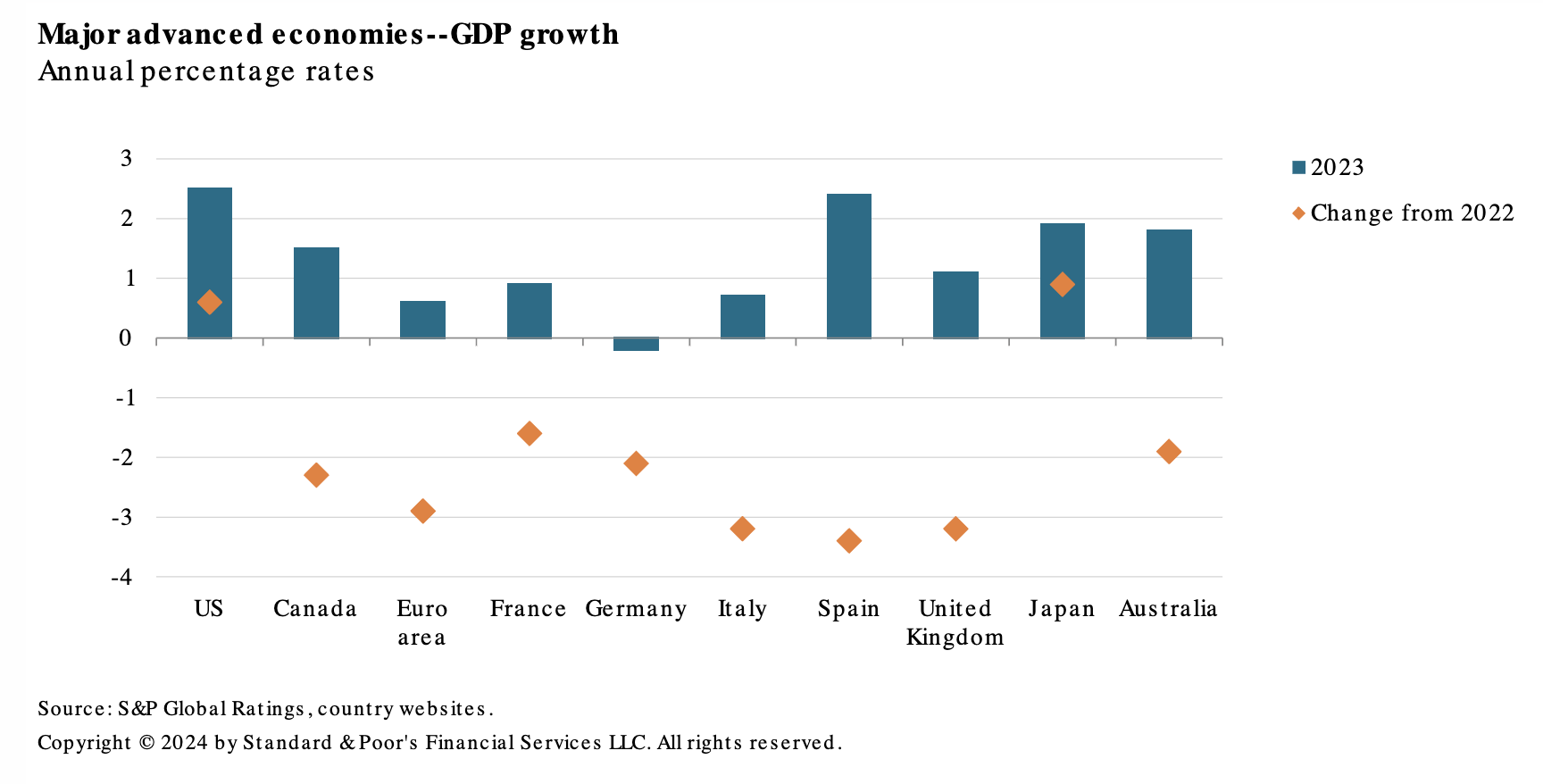

Growth slowed dramatically across the major economies in 2023. The major exceptions were the US and Japan. This reflected tighter financial conditions as the effects of policy rate hikes transmitted through lending and asset price channels. It also reflected negative fiscal impulses as primary fiscal deficits declined, further crimping demand. Compared with 2022, GDP growth fell more than two percentage points across the advanced economies. The US was a clear outlier, where GDP rose last year.

—Read the article from S&P Global Ratings

Access more insights on the global economy >

Stock Rally Extends To 5th Straight Month In March As S&P 500 Rises 3.1%

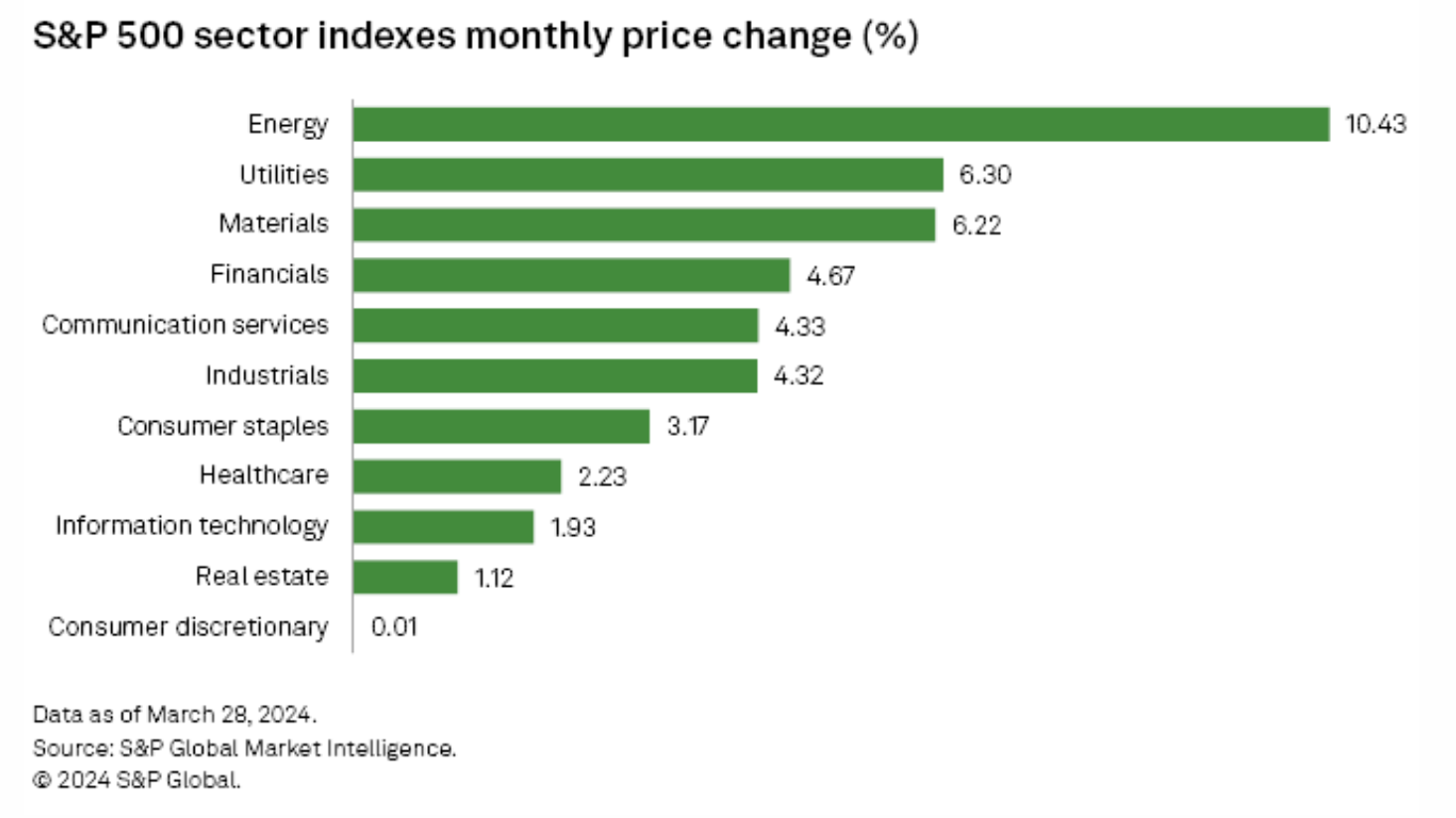

Major US stock indexes rose in March as the S&P 500 extended a run of monthly gains. The large-cap S&P 500 rose 3.1% during the month, marking the fifth straight month that the index has closed in positive territory. The Dow Jones Industrial Average and small-cap Russell 2000 also notched another month of gains at 2.1% and 3.4%, respectively.

—Read the article from S&P Global Market Intelligence

Access more insights on capital markets >

QatarEnergy Bolsters LNG Fleet With 19 New Ships

QatarEnergy has signed new contracts with international companies to operate 19 more LNG vessels, bringing to 104 ships being added to the company's fleet over the next few years. The latest agreements bring to an end the expansion of the company's conventional-size fleet, QatarEnergy said in a March 31 statement. The addition of 104 ships overall is the largest shipbuilding and leasing program ever for LNG, the company said. Of the 19 new ships, six of them will be operated by CMES LNG Carrier Investment, six by Shandong Marine Energy (Singapore) and three by MISC Berhad.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

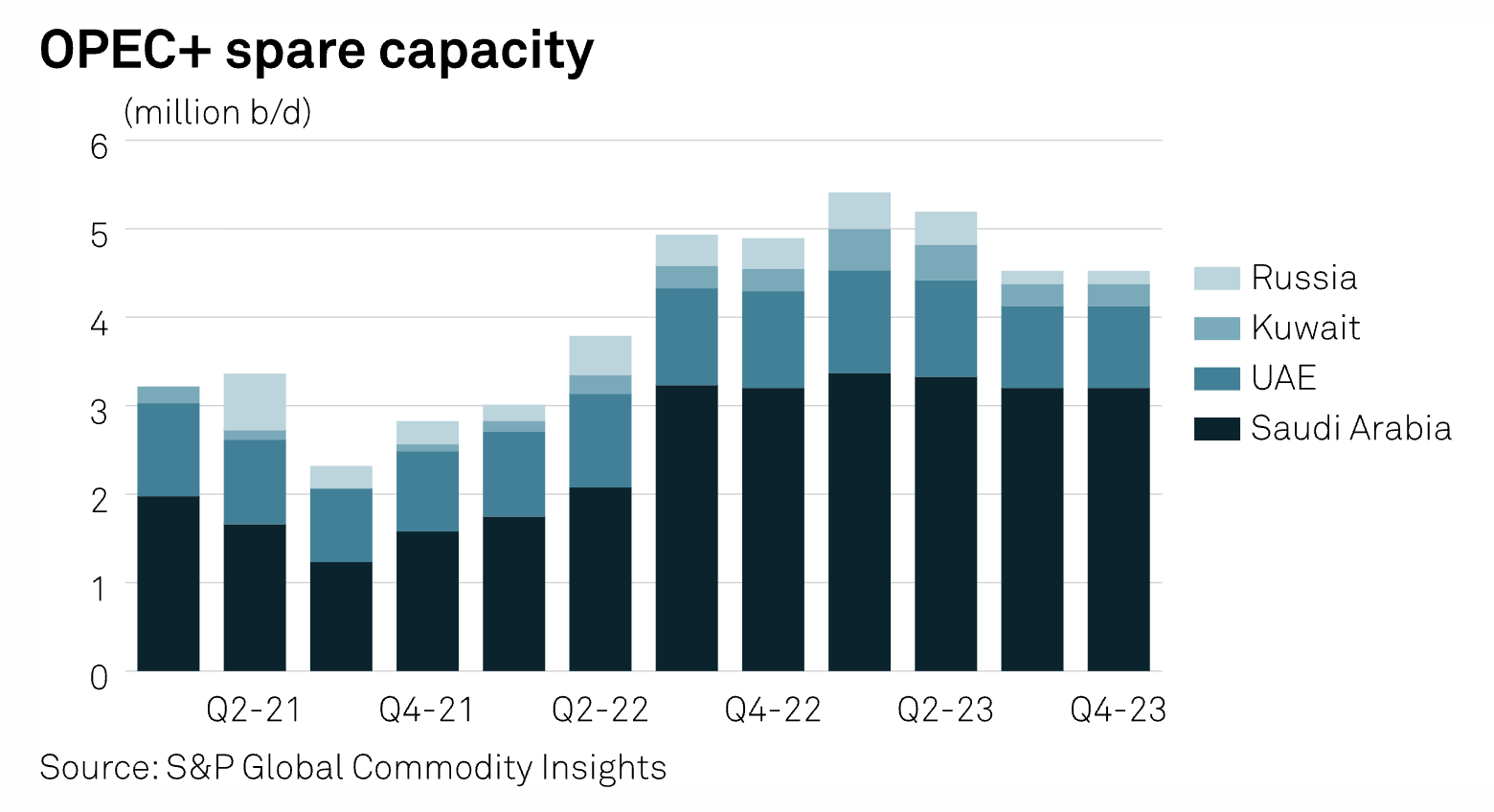

Listen: Oil Production And Carbon Capture Takeaways From CERAWeek

The 2024 CERAWeek by S&P Global conference just wrapped up in Houston, where oil industry executives were talking up, often aggressively, the need for oil and gas to remain in the mix during the transition to cleaner energies. They also discussed environmental solutions which will be needed to keep that oil flowing, namely the need for large-scale carbon capture projects. Jeff Mower talks with upstream oil editor Starr Spencer and midstream oil editor Binish Azhar about the outlook for oil production in the US, as well a roadblocks for CCS projects that are hinging on lengthy regulatory approvals.

—Listen and subscribe to Oil Markets, a podcast from S&P Global Commodity Insights

Access more insights on sustainability >

Top 10 Issues For Global Oil Markets And Mobility In 2024

The global oil and mobility sectors stand at a critical juncture in 2024, grappling with a complex interplay of geopolitical, technological and economic forces that promise to reshape the industry's landscape. S&P Global Commodity Insights delves into the top 10 issues that are poised to define the trajectory of oil markets and mobility, offering insightful analysis of the challenges and opportunities ahead.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

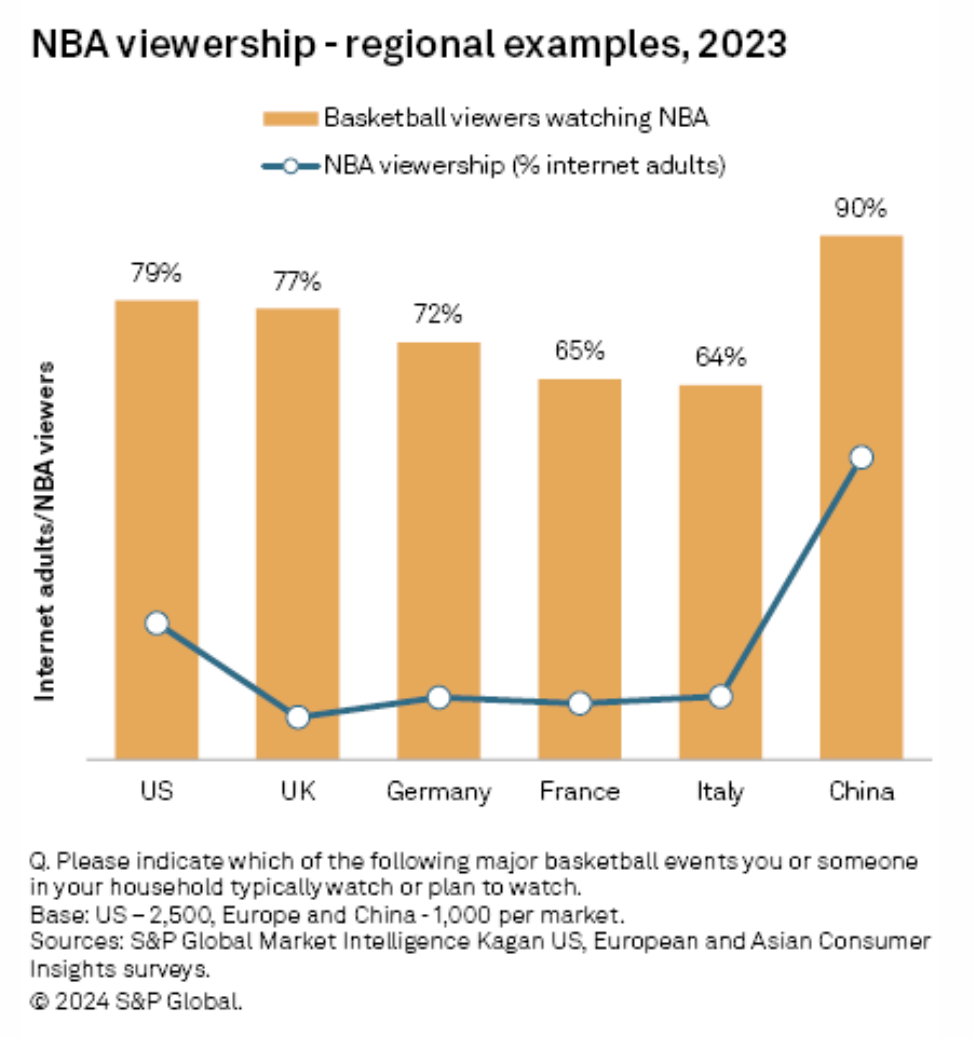

Global NBA Basketball Viewers, 2024

S&P Global Market Intelligence Kagan Consumer Insights surveys found little commonality between NBA fans in the US and how they access games versus those experiencing the NBA internationally. However, the data shows that, regardless of the continent on which one resides, being a basketball fan is generally synonymous with being a fan of NBA basketball.

—Read the article from S&P Global Market Intelligence