Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 2 Apr, 2021

By S&P Global

Subscribe on LinkedIn to be notified of each new Daily Update—a curated selection of essential intelligence on financial markets and the global economy from S&P Global.

U.S. equities are making monumental moves upward, fueled by investor optimism over the vaccine rollout, a brighter outlook for the economic recovery, and supportive fiscal and monetary policy. The historic bull market has resulted in stocks recovering from the steep losses suffered during the depths of the collapse caused by the coronavirus crisis this time last year.

The S&P 500 index closed above 4,000 for the first time in history—up 46.98 points, or 1.2%, to 4019.87—on April 1. The record comes just after the U.S. benchmark gained 5.8% in the first quarter—a dramatic contrast to the 20% decline in same period last year. In fact, all major U.S. stock indexes set new record highs .

"The pace of the stock market recovery has been unbelievable," Edward Moya, a senior market analyst at the forex trading firm OANDA, told S&P Global Market Intelligence. "I think equities have surged enough for now ... A lot of the good news has already been priced in and it would be healthy for stocks to consolidate.”

Against this backdrop, the yield on benchmark 10-year Treasury notes is at its highest level since January 2020, and many analysts expect it to reach 2% later this year.

"Rates have already moved sharply and have likely priced in a significant amount of optimism, which should limit the move higher in rates going forward," Gennadiy Goldberg, a senior U.S. rates strategist with TD Securities, told S&P Global Market Intelligence.

And after three consecutive quarters of decline, the dollar has rallied on the back of rising bond yields, alongside positive projections for growth in the U.S.

To be sure, overwhelming optimism about market performance in the first quarter may be overblown.

Investors “seem to be assuming that earnings growth will somehow continue to rebound as if it were growing like wildfire before the pandemic, which was not the case," Peter Cecchini, CEO and founder of AlphaOmega Advisors, told S&P Global Market Intelligence, explaining that market participants could be overestimating the strength of the economy and earnings and not factoring in what might happen once the pandemic’s most impending implications recede. "Certainly, the reopening is key, but the enormity of the fiscal response is equally important … It's inorganic and temporary.”

Today is Friday, April 2, 2021, and here is today’s essential intelligence.

European Renewables Stocks Losing Edge Over Utilities After 2020 Rally

Equities in the European power and utilities sector have been a compelling story of late. Amid falling bond yields, a recovery in power prices, improved investment discipline, and more recently the growth of environmental, social and governance funds, European utilities have outperformed the broader market by more than 40% cumulatively since 2017, according to James Brand, utility research analyst at Deutsche Bank.

—Read the full article from S&P Global Market Intelligence

Metal Price Assumptions: Demand Surges but COVID-19, Trade, and ESG Concerns Flatten Output

S&P Global Ratings is further raising its assumptions for most metals prices for 2021-2023 as demand rebounds but supplies remain stubbornly tight. The output for most metals isn't keeping up with resurgent levels of consumption and restocking, which is causing prices to spike early in 2021. The downward pressure on producers' credit quality is abating after a difficult 2019 and 2020 and some credit stories are turning positive supported by several years of financial discipline and lower debt levels. Market conditions in 2021 could yield windfall profits and cash flow, potentially sparking greater shareholder returns, growth capital expenditure (capex), and acquisitions.

—Read the full report from S&P Global Ratings

Record Renewable RVO Price Moves U.S. Jet Fuel Market

A record rise in renewable volume obligationshas tied its price swings as tight as a school of fish to the spread of jet fuel and ultra low sulfur diesel in the first quarter of 2021.

—Read the full article from S&P Global Platts

A Quiet End to a Strong Quarter for Commodities

The S&P GSCI will commemorate its 30th anniversary in April 2021 following one of the better quarterly performances in its history. Despite giving up some of its recent gains in March, the S&P GSCI rose 13.5% in Q1 2021. A robust, if uneven, post-pandemic recovery in economic activity, ongoing supply dislocations, and the global push toward decarbonization have combined to point a spotlight on the commodities market.

—Read the full article from S&P Dow Jones Indices

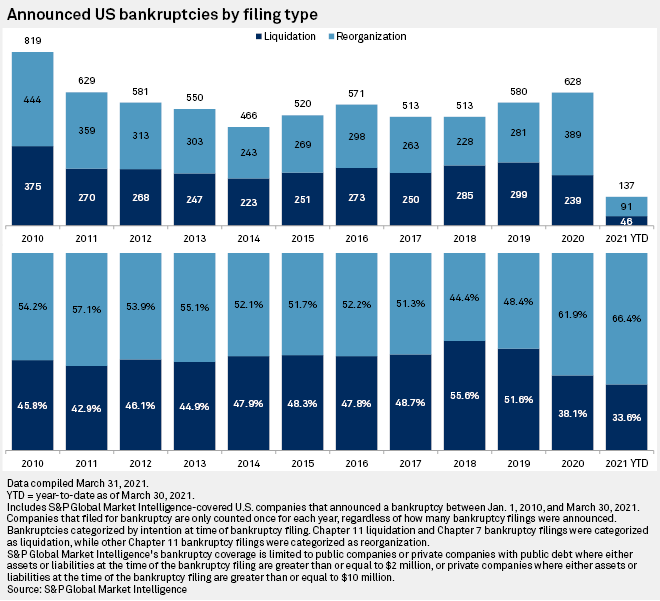

Coronavirus-Era Bankruptcy Surge Heavily Favors Reorganizing Over Liquidation

While 2020 was an exceptional year for U.S. corporate bankruptcies, a larger share of distressed companies upended by the COVID-19 pandemic is using court processes to restructure instead of close shop. Nearly 62% of U.S. corporate bankruptcy filings in 2020 sought reorganizations, the highest rate for any year going back to at least 2010, according to S&P Global Market Intelligence data. Companies were less likely to liquidate in 2020, a departure from 2019 and 2018 when corporate liquidations outpaced reorganizations in bankruptcy filings. As of March 30, the share of filings seeking restructuring is larger in 2021 than in 2020.

—Read the full article from S&P Global Market Intelligence

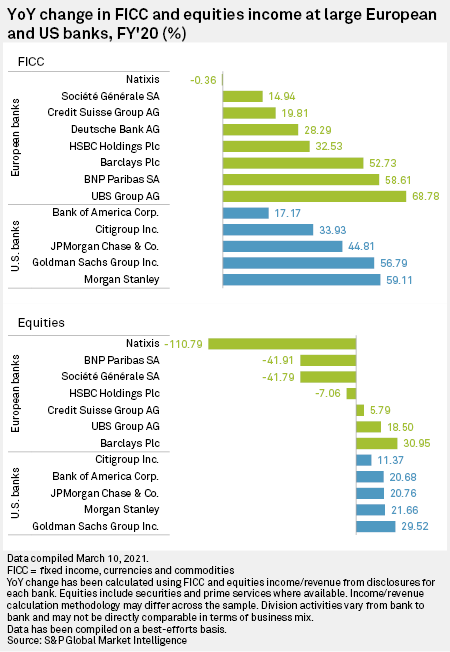

U.S. i-Banks Assert Dominance In 2020 Trading Despite Big Gains by European Peers

U.S. investment banks extended their reign over global capital markets trading in 2020, although two European banks booked the strongest year-over-year revenue growth, S&P Global Market Intelligence data shows.

—Read the full article from S&P Global Market Intelligence

What Will Credit Suisse's Wealth Management Unit Look Like Post-Greensill?

Credit Suisse Group AG's asset management business will be split from its wealth management unit as the Swiss bank grapples with the fallout of its exposure to Greensill Capital (UK) Ltd. The asset management operations, which contributed 22% of wealth management's total revenues in 2020, could be carved out from the rest of the group, according to CEO Thomas Gottstein.

—Read the full article from S&P Global Market Intelligence

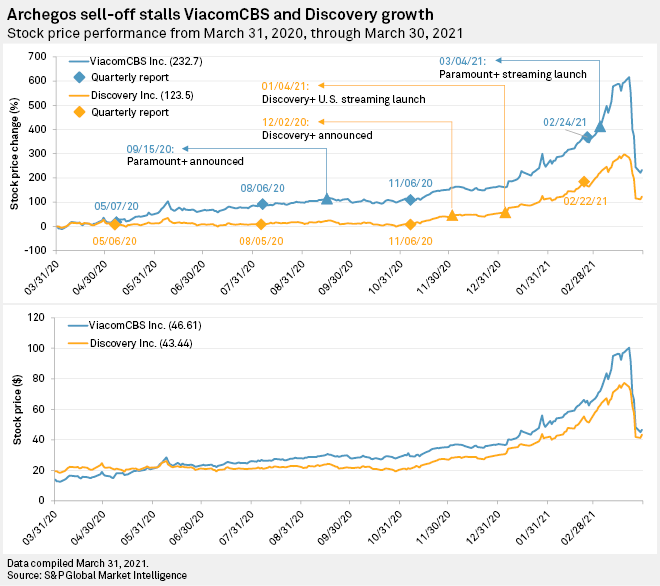

Discovery, ViacomCBS Victims of Streaming Exuberance In Shady-Money Sell-Off

For months, investor enthusiasm around the new streaming services from Discovery Inc. and ViacomCBS Inc. seemed too good to be true. And in fact, some of it was.

—Read the full article from S&P Global Market Intelligence

Watch: Market Movers Americas, March 29-April 2: Suez Blockage Impacts Brent-WTI Spread

In this week's Market Movers Americas, presented by Joe Fisher: Brent-WTI spread widens amid Suez closure; traders watch US-Northwest Europe jet fuel arbitrage amid Suez blockage; US LNG output remains robust amid Suez blockage; US gas storage injection season set to start early; Kansas legislation unlikely to deter fuel switching.

—Watch and share this Market Movers video from S&P Global Platts

OPEC+ Throws Caution to the Wind With Deal To Unwind Oil Production Cuts

After months of preaching caution and saying the time was not right to raise oil production, OPEC and its partners abruptly agreed April 1 to loosen their quotas and add more than 2 million b/d into the market by July.

—Read the full article from S&P Global Platts

OPEC+ Seeks Clearer Signs of Oil Recovery, as Saudi Arabia Urges Continued Caution

The OPEC+ alliance's conservativeness in maintaining tight control over oil supply has been "proven right," Saudi energy minister Prince Abdulaziz bin Salman said April 1, urging his counterparts to stay disciplined in their mission to bring the market back to its pre-pandemic health.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language