Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global 16 Apr, 2024 Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Natural Gas Remains a Concern for Europe 2 Years Later

Before the Russian invasion of Ukraine in February 2022, the majority of European natural gas arrived from Russia in pipelines. When most European countries chose to support Ukraine following the invasion, Russia began to throttle supplies of natural gas to Europe. Despite expectations that the loss of inexpensive Russian gas would damage European economies and force them to curtail their support, two years of mild winters and an aggressive pivot toward LNG have minimized the impact of the reduced supply. However, concerns remain that Europe might run short during winter, as reflected in prospective LNG prices.

Another underwhelming winter has cooled European natural gas demand just as many countries look to replenish supply ahead of next winter. Temperatures in the short term are expected to remain above average, reducing heating demands and depressing natural gas markets. European stocks of natural gas stood at a healthy 58.34% on March 31, the traditional end of the European heating season.

However, the Northwest European LNG forward curve, which prices LNG 11 months out, has steadily risen over the last month and a half. The bullish price sentiment appears to be based on an assumption that European countries will look to spread their natural gas buying across the second and third quarters ahead of winter.

While Russian natural gas trickles through existing pipelines, Russia continues to supply the European markets through LNG. Imports of Russian LNG to Europe have risen year over year due to continued demand. In the long term, industry analysts believe that US or Qatari LNG will replace Russian LNG. Despite this, European policymakers are struggling to reduce their dependency on Russian gas due to the need for political unanimity to impose a ban.

To break the policy deadlock, the European Parliament voted through a new gas package on April 11 that will allow member countries to restrict Russian LNG and natural gas at the country level. The primary aim of the package is to encourage the decarbonization of the European energy sector while allowing restrictions on gas imports from Russia and Belarus.

Meanwhile, European countries continue to encourage the reduced use of gas despite increasing LNG flows from the US and Qatar. French gas grid operators GRTgaz and Teréga have asked consumers and companies to use less gas whenever possible so storage can be refilled ahead of winter. France has become a point of entry for natural gas supply to the rest of Europe due to its LNG regasification facilities.

Today is Tuesday, April 16, 2024, and here is today’s essential intelligence.

- Written by Nathan Hunt.

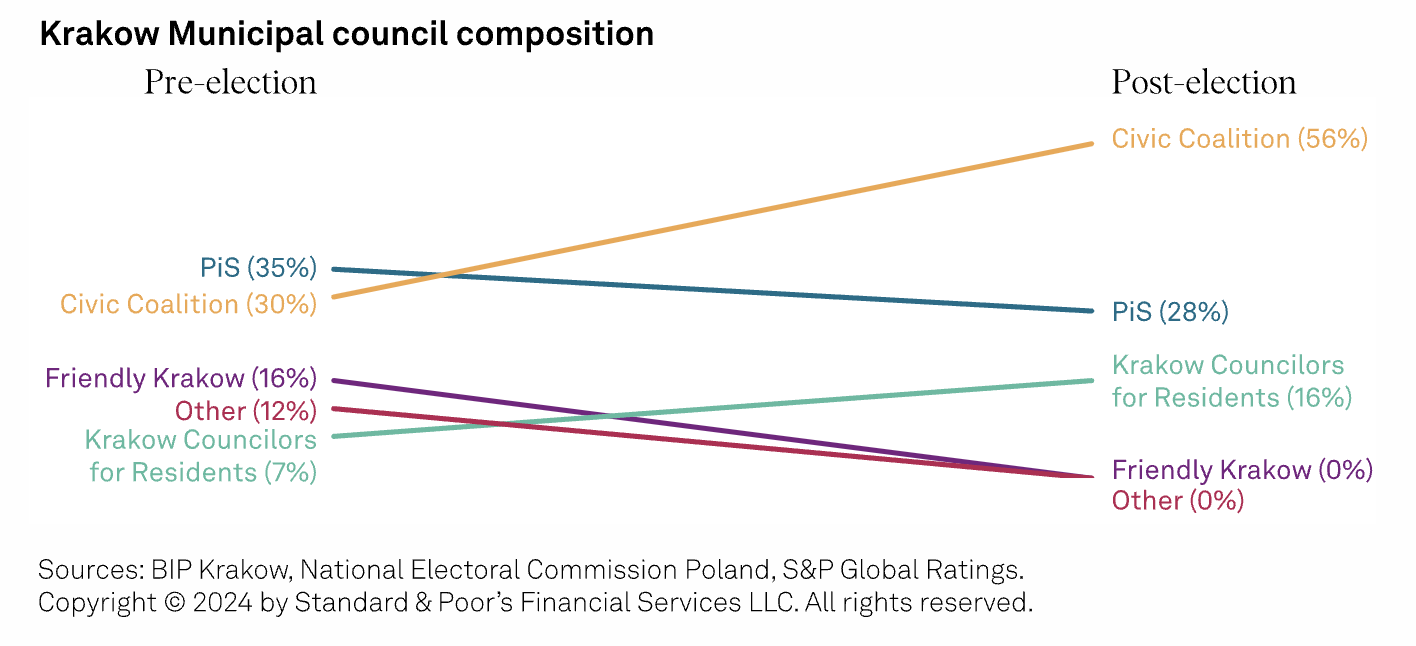

Polish Municipal Elections Will Trigger Changes In The Public Finance System

Local and regional government (LRG) elections took place in Poland on Sunday, April 7, at which mayors and municipal councils were elected. Following the elections, we don't anticipate any changes in Lodz's financial policy or strategy, as incumbent mayor Hanna Zdanowska of the Civic Coalition secured her fourth term, with 59.3% of the votes. The composition of the municipal council did not change much compared with the previous term, as the Civic Coalition kept its majority.

—Read the article from S&P Global Ratings

Access more insights on the global economy >

CreditWeek: Why Is EBITDA Addback Analysis Critical For Investors?

Our latest analysis of company-adjusted EBITDA continues to show that U.S. speculative-grade corporate issuers typically present unreliable and overly optimistic earnings, debt, and leverage forecasts in their marketing materials when launching deals. In the absence of a standardized definition of EBITDA, addbacks can create challenges for investors by inflating EBITDA, which can understate debt leverage and expand the flexibility embedded in debt documents to add debt or make restricted payments. S&P Global Ratings bases its ratings on its independent projections of a company's expected earnings.

—Read the article from S&P Global Ratings

Access more insights on capital markets >

Iran Drone Attack On Israel Raises Regional Concerns For Oil Market

Iran launched a barrage of drones at Israel, officials said April 13, in a significant escalation of tensions in the oil and gas rich Middle East, after earlier impounding an Israeli-linked cargo vessel near the Strait of Hormuz. "A direct Iranian attack on Israel is very alarming, especially for the oil market," said Jim Burkhard, S&P Global Commodity Insights' head of crude oil, energy and mobility research. "The war is not about oil, but oil flows could be impacted in a major way. But it is too early to tell for sure."

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

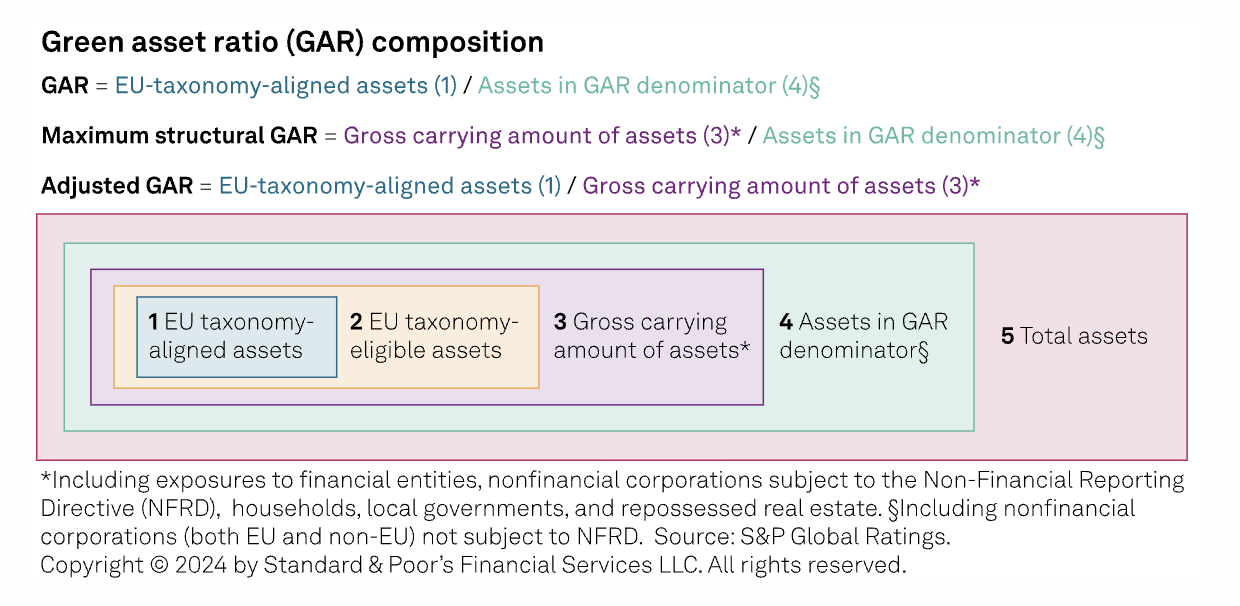

Your Three Minutes In Climate Disclosure: Benefits And Limitations Of The Green Asset Ratio For EU Banks

From 2024, EU banks must disclose a Green Asset Ratio (GAR), showing the share of EU Taxonomy-aligned assets in selected financial assets, in their Pillar 3 reports. The GAR's primary goal is to enhance the understanding of banks' contribution to the EU's environmental and climate objectives. However, due to methodological limitations and the GAR's complexity, it is challenging to form a clear view without qualitative information.

—Read the article from S&P Global Ratings

Access more insights on sustainability >

Listen: Catching Up With Innovators Throughout The Battery Materials Supply Chain

Wrapping up the series of episodes featuring interviews gathered at CERAWeek by S&P Global, co-host of Energy Evolution Taylor Kuykendall shares bits of conversations with executives from new, innovative companies across different parts of the battery materials supply chain.

—Listen and subscribe to Energy Evolution, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

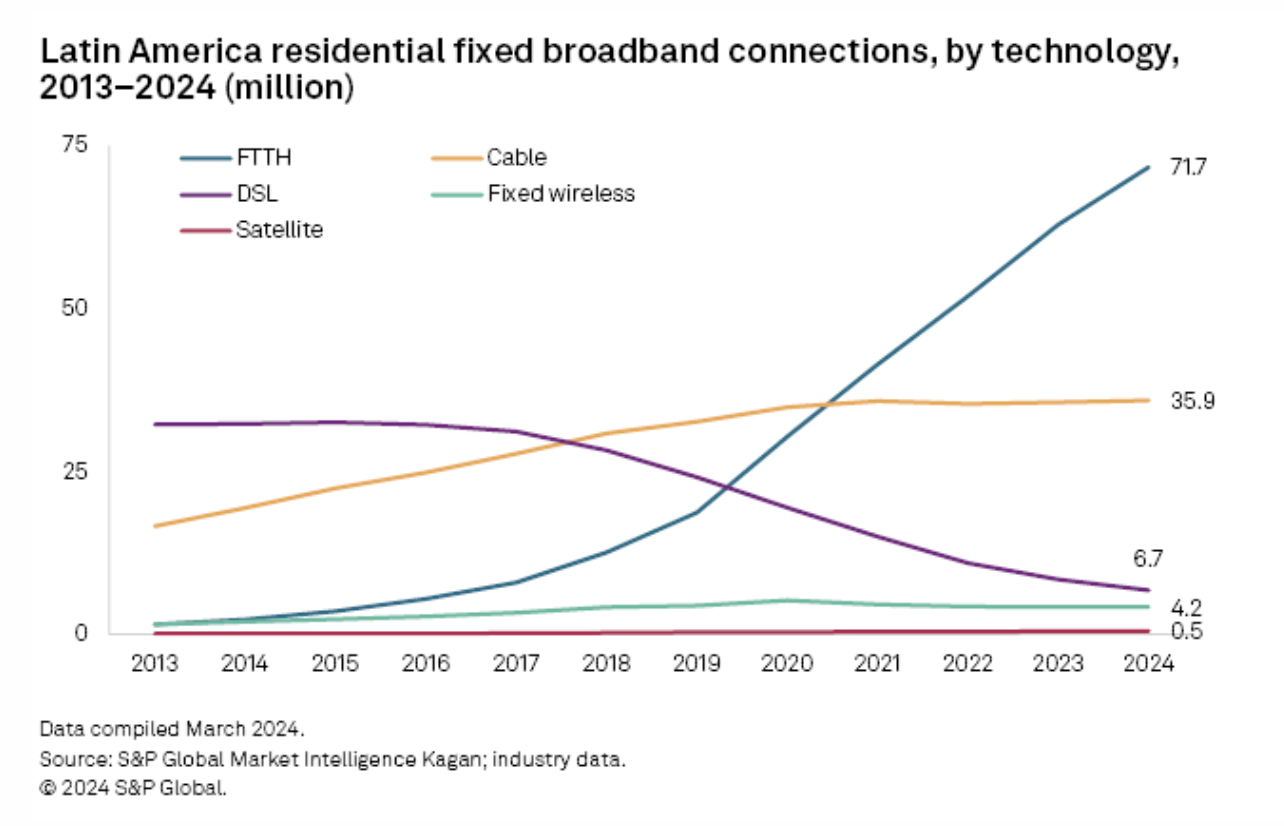

Latin America Fixed Broadband And Multichannel 2023–2024: The Rise Of Fiber

Latin America and the Caribbean saw fixed residential broadband connections increase 8.4% in 2023, reaching 53.7% of occupied households in the region. Growing connectivity needs and internet service providers' push to reach new markets in large countries such as Mexico and Brazil led to a faster deployment of services. According to S&P Global Market Intelligence Kagan's forecast, the penetration will expand to 56.4% of occupied households by 2024.

—Read the article from S&P Global Market Intelligence