Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 14 Apr, 2022 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

Bigger Problems Pressuring Banking Performance

Following a banner year in 2021, banks around the world look likely to suffer pressures on performance in 2022.

The robust global economic recovery, favorable financing conditions, and record-low interest rates contributed to bank revenues throughout 2021. But conditions in the first few months of 2022 have changed. The likelihood of lower global growth, the prospects of central banks’ aggressive monetary policy tightening, and changing geopolitical dynamics are affecting the outlook for banks’ performance in the rest of the year.

"These things are going to collide at one point, probably sometime next year. And no one actually knows what's going to turn out," JPMorgan Chase Chairman and CEO Jamie Dimon said this week during the U.S. bank’s first-quarter earnings call of how tighter monetary policy and shockwaves from the war in Ukraine are two "very powerful" countervailing forces despite the underlying U.S. economy remaining strong. “So, I'm not predicting a recession, but is it possible? Absolutely."

S&P Global Ratings anticipates that the uncertainty of current geopolitical shocks alongside central banks’ sooner-and-stronger monetary policy tightening may push capital markets revenue to drop approximately 10% from last year's elevated level, with risk to the downside. Additionally, the pressure is likely to hurt investment banks' underwriting and deal advisory revenues in at least the first half this year—with year-to-date M&A and debt and equity capital market transaction volumes already having declined to their lowest levels in five years, according to an S&P Global Market Intelligence analysis.

“After a stellar 2021, capital markets revenue will likely decline in 2022 as geopolitics and rising interest rates push advisory and underwriting fees lower. Indeed, volatile markets have led companies to pause coming to market—weighing on investment banking revenues. These same market conditions, though, could support sales and trading activity if banks can navigate the associated risk,” S&P Global Ratings said in a report this week. “Changing market conditions underscore the importance of banks having a diversified capital markets business so they can capitalize as conditions change.”

More than 80% of Russia’s commercial banking sector is subject to international sanctions, according to S&P Global Market Intelligence. And the perfect storm of Russia’s ongoing invasion from sanctions and exposure to the conflict itself, rising inflation, and central banks’ actions to get conditions back under control is weighing on banks beyond the battle zone.

Fifteen of Europe's 20 largest banks saw their market capitalization decline from January-March against the backdrop of Russia's invasion of Ukraine, according to S&P Global Market Intelligence data. Banks in the U.K. are now confronting challenges to their share buyback plans from the effects of the continuing conflict.

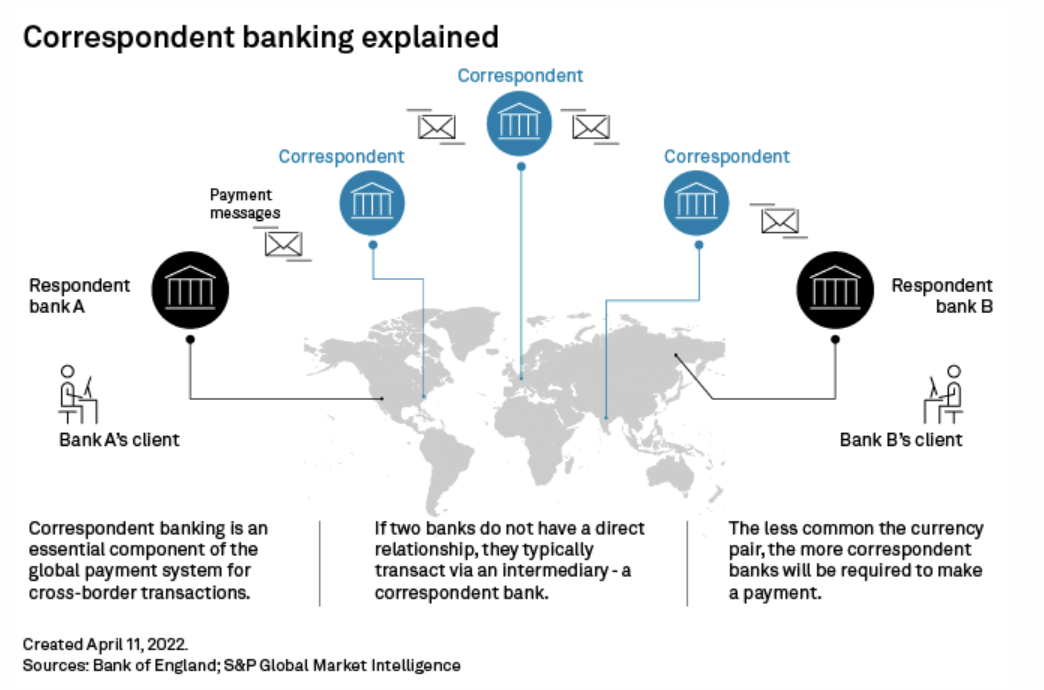

Considering that foreign banks' exposure in monetary terms and as a proportion of total assets to Russia fell substantially following the 2014 sanctions in response to Russia's annexation of Crimea, S&P Global Ratings sees global banks’ direct exposure to Russia as limited. But financial institutions that don’t have any exposure to Russia still face significant indirect sanctions risk due to the correspondent banking services that they provide, by acting as the middle parties in cross-border transactions between banks that lack formal ties and their reliance on so-called respondent banks to conduct due diligence on customers, according to S&P Global Market Intelligence.

Conversely, tighter monetary policy will bolster some banks’ earnings. S&P Global Ratings anticipates that the net interest incomes of banks in the eurozone, Saudi Arabia, UAE, and the U.S. will benefit from rising policy rates.

Today is Thursday, April 14, 2022, and here is today’s essential intelligence.

Written by Molly Mintz.

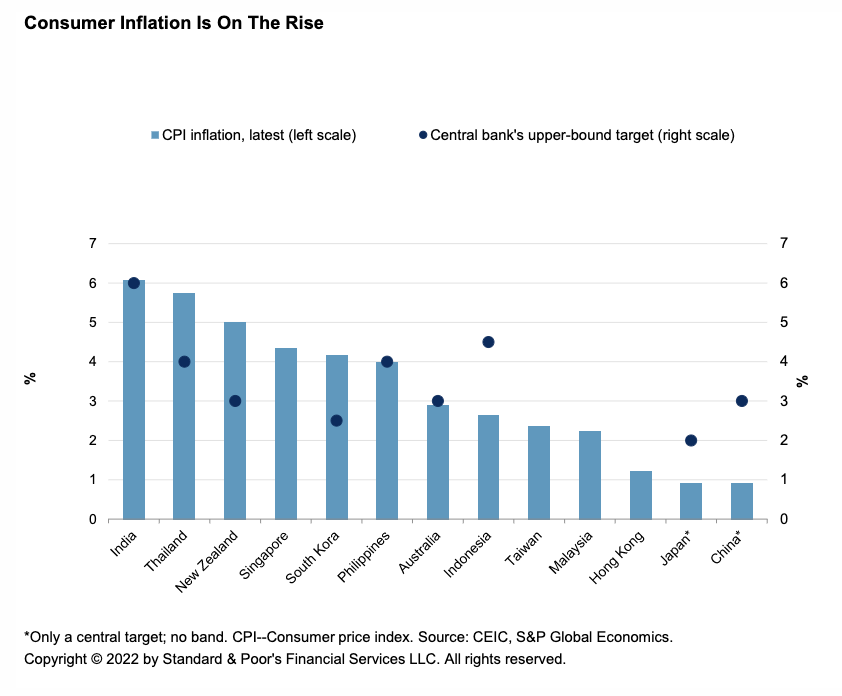

Economic Research: Interest Rates To Rise Across Asia-Pacific

Higher inflation and rising U.S. interest rates are weighing heavily on Asia-Pacific economies. S&P Global Ratings expects that in regions where inflation already exceeds targets, or which are vulnerable to capital flight, central banks will be forced to raise interest rates. This describes most regional economies. However, where neither inflation nor capital flight is a major issue, central bankers will focus on growth, it expects. This will result in a three-speed policy setting across Asia-Pacific. Many economies are likely to see significantly higher rates, some may lift rates moderately, while the rest (China and Japan) probably will not tighten at all.

—Read the full report from S&P Global Ratings

Access more insights on the global economy >

Banks Face Hidden Sanctions Risk Amid Complex Correspondent Banking System

Financial institutions with no Russian exposure still face significant indirect sanctions risk through the so-called correspondent banking services they provide to other banks. Correspondent banks act as go-betweens in cross-border transactions between banks that lack formal ties, and they rely on "respondent" banks to conduct due diligence on customers. They risk facilitating illicit payments if respondent banks knowingly or unknowingly breach sanctions. "You trust that your correspondent banking clients' anti-money laundering systems will detect the risk—but what if they don't, and you unknowingly process these funds?" said Eric Li, research director at Coalition Greenwich, an S&P Global-owned research company.

—Read the full article from S&P Global Market Intelligence

Access more insights on capital markets >

Trade Review: Alumina Faces An Uncertain Q2 As Russia-Ukraine War Continues, Disrupts Trade

The global alumina market is set to be in a state of flux and uncertainty in the second quarter of this year as ripples from the Russia-Ukraine war and a confluence of inter-connected factors could tip supply and demand fundamentals. In the first quarter of 2022, the benchmark Platts Australia alumina daily assessment rose to heights unseen since the U.S. sanctions against Russian aluminum giant Rusal and refinery output cuts at Brazil's Alunorte in 2018. Platts FOB Western Australia alumina assessments peaked at $533/mt in Q1, surpassing the $484/mt high in Q4 2021. The alumina market expected global prices to ease in Q1, after the Beijing Winter Olympics, but this was not to be. China's domestic prices were the exception as curtailed refining capacity in northern China was gradually increased post-Games.

—Read the full article from S&P Global Commodity Insights

Access more insights on global trade >

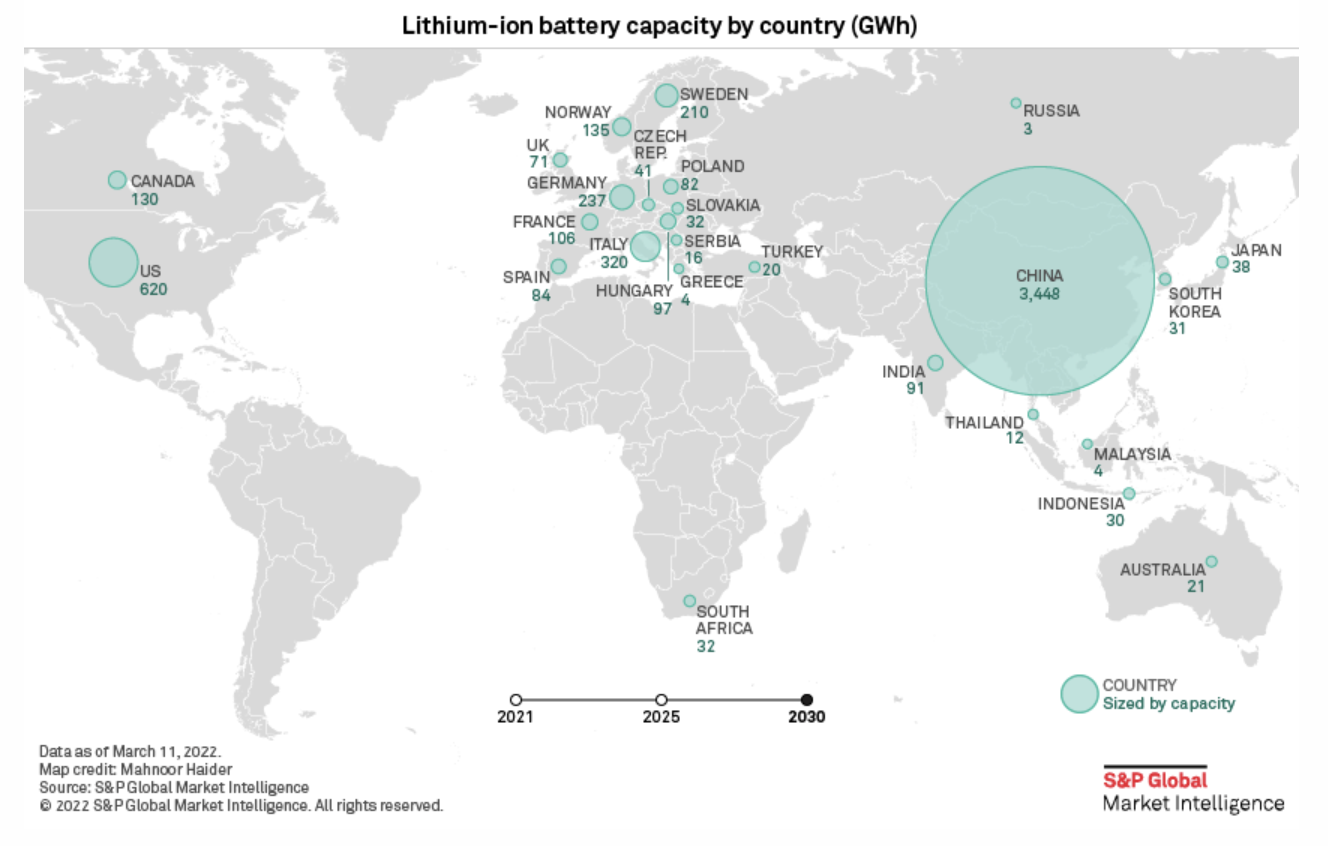

Investment In Lithium-Ion Batteries Could Deliver 5.9 TWh Capacity By 2030

The transition to electromobility plays a leading role in reducing carbon emissions and achieving carbon neutrality. The long-term switch from internal combustion engines, or ICE, to plug-in electric vehicles, or PEV, is boosting demand for traction lithium-ion batteries, or LIB. This article focuses on the drivers of LIB capacity growth in the PEV sector. A small portion of this capacity also serves the energy storage market, which is another factor powering the transition to greater renewable generation—an aspect not covered by the article. LIB capacity investments accelerated in 2021 as more carmakers stepped up their commitments to PEVs, with decarbonization becoming a top global priority. S&P Global Market Intelligence expects LIB capacity to increase more than threefold to 2.8 TWh in 2025 from 0.8 TWh in 2021, with the potential to surpass 5.9 TWh in 2030. The growth is led by expansion in China's locally integrated LIB supply chain, while Europe and the U.S. are building up their capacities to gain greater self-sufficiency.

—Read the full article from S&P Global Market Intelligence

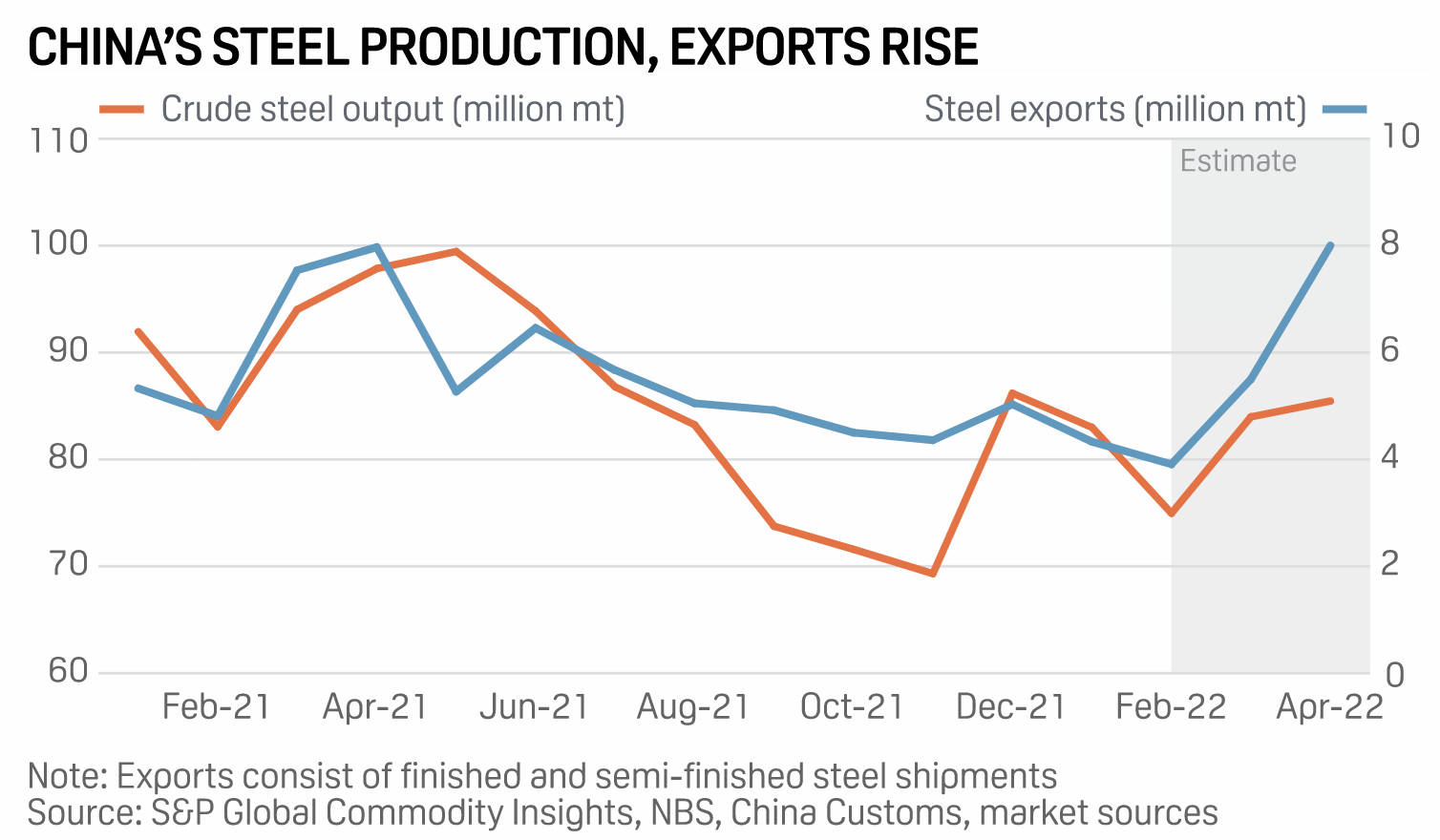

6 Key Drivers Shaping China’s Steel Market Amid The Latest COVID-19 Surge

Markets have been highly anticipating steel demand recovery and more economic stimulus in the coming months, driving China's steel prices up since mid-March. However, the latest wave of COVID-19 infections in the country poses more challenges to domestic steel demand than steel production. China's steel production is expected to rise in April, but supply chain disruptions and logistics hurdles across may parts of the country could continue to undermine end-user steel demand.

—Read the full article from S&P Global Commodity Insights

Access more insights on energy and commodities >

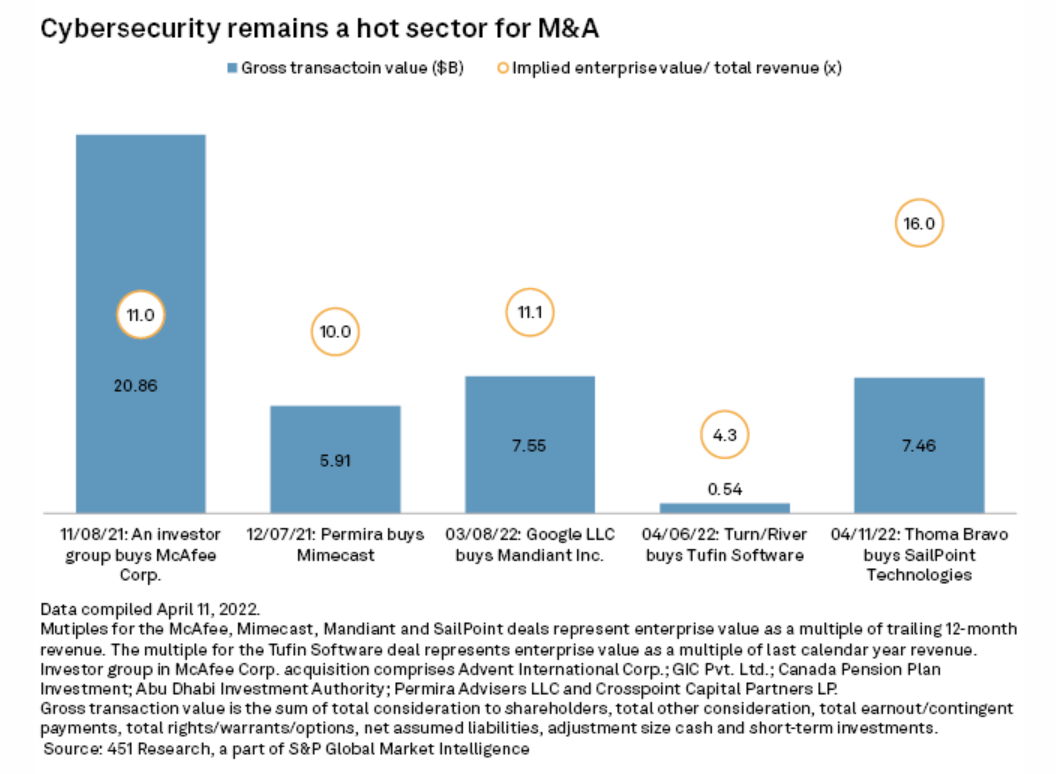

SailPoint, Tufin Go Private In Run Of Cybersecurity Acquisitions By PE Firms

The highly fragmented cybersecurity sector continues to consolidate, with acquirers, both financial and strategic, willing to pay a high premium for a business with plenty of expected growth. The frothy pace of cybersecurity acquisitions continued in the first months of 2022, even as M&A in other sectors slowed down or saw values compress sharply. Five cybersecurity companies announced deals since the last months of 2021, with transaction sizes running the gamut.

—Read the full article from S&P Global Market Intelligence