Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 5 May, 2020

By S&P Global

Market participants and observers are watching how the banking sector, tasked with supporting short- and long-term recovery efforts while exposed to sensitive industries, is handling the current state of low profits, high loan demand, and surging corporate defaults.

In the U.S., community banks’ commercial lending is surging due to the federal government’s emergency lending Paycheck Protection Program, according to S&P Global Market Intelligence. Commercial and industrial lending by small and medium-sized banks, excluding the 25 banks with the most assets, increased 10.7% (or $82 billion) in the week ended April 22, according to Federal Reserve data. In the previous week, lending expanded 6.7% (or $48.18 billion).

Additionally, April saw a widespread rally of U.S. banking stocks, signaling that investors have looked beyond banks’ weak first-quarter earnings, stock buyback suspensions, and calls for cash dividend suspensions.

Of the approximately 125 borrowers S&P Global Ratings rates in the retail and restaurant sectors, approximately 30% are now rated 'CCC+' or lower. This indicates at least a 1-in-2 chance that they will default and suggests a default rate among retailers of almost 20% for speculative-grade issuers. S&P Global Ratings traditionally expects a 10% default rate across the broader corporate rated landscape.

Five of Spain's largest lenders reported dramatic profit decreases in the first quarter, according to S&P Global Market Intelligence data. This week, Spain began the first phase of its economic reopening, allowing restaurants, hotels, bars, and places of worship to operate at 30% capacity—but political agreements within the country may see a reversal of the re-opening. S&P Global Ratings expects Spain’s GDP to shrink 8.8% this year as both household consumption and the external sector suffer from the pandemic’s fallout. Likewise, the outlook for the banking sector remains dismal. S&P Global Market Intelligence reports that declining demand for mortgages and consumer finance, and rising provisions for bad loans, will continue to crush Spanish banks’ profits in the coming months.

Analysts agree that South Africa’s largest banks have built up sizable capital buffers to withstand a likely spike in loan defaults. The South African Reserve Bank projects the country’s economy to contract 6.1% this year due to the pandemic. The central bank has waived capital charge increases for household, small and medium-sized enterprise, and corporate loans that are restructured as a result of the impact of the pandemic. These regulatory measures will likely help South African banks navigate a crisis-caused recession. The country began easing its lockdown this week after five weeks of restrictions.

J. Crew, the New York-based fashion retailer, filed for bankruptcy yesterday, marking what S&P Global Ratings sees as the first of many firms that will likely restructure in or out of court in the next 1-2 years. J. Crew's debt totaled $2 billion, according to S&P Global Market Intelligence, which also reports that three Asia-based clothing-makers, each with claims of more than $10 million, are among the top creditors with unsecured claims in the retailer’s Chapter 11 bankruptcy filing. Eight retail and restaurant issuers rated by S&P Global Ratings have defaulted since the start of this year, including U.S. retailers J.C. Penney and Neiman Marcus in April.

As shelter-in-place orders have transformed behaviors worldwide, prompting populations to consume less outside of their homes and focus more on their personal health and wellbeing, companies that produce packaged foods and household products in the U.S. will continue to benefit from the crisis. S&P Global Ratings believe that large packaged-food companies that sell shelf-stable products, and companies selling cleaning supplies and personal-care products such as toilet paper and paper towels, are seeing the greatest boosts. Cosmetics and beauty companies may face declines in the second quarter if specialty and department stores remain closed.

Today is Tuesday, May 5, 2020, and here is today’s essential intelligence.

European Economic Snapshot: Large Risks To Growth Ahead

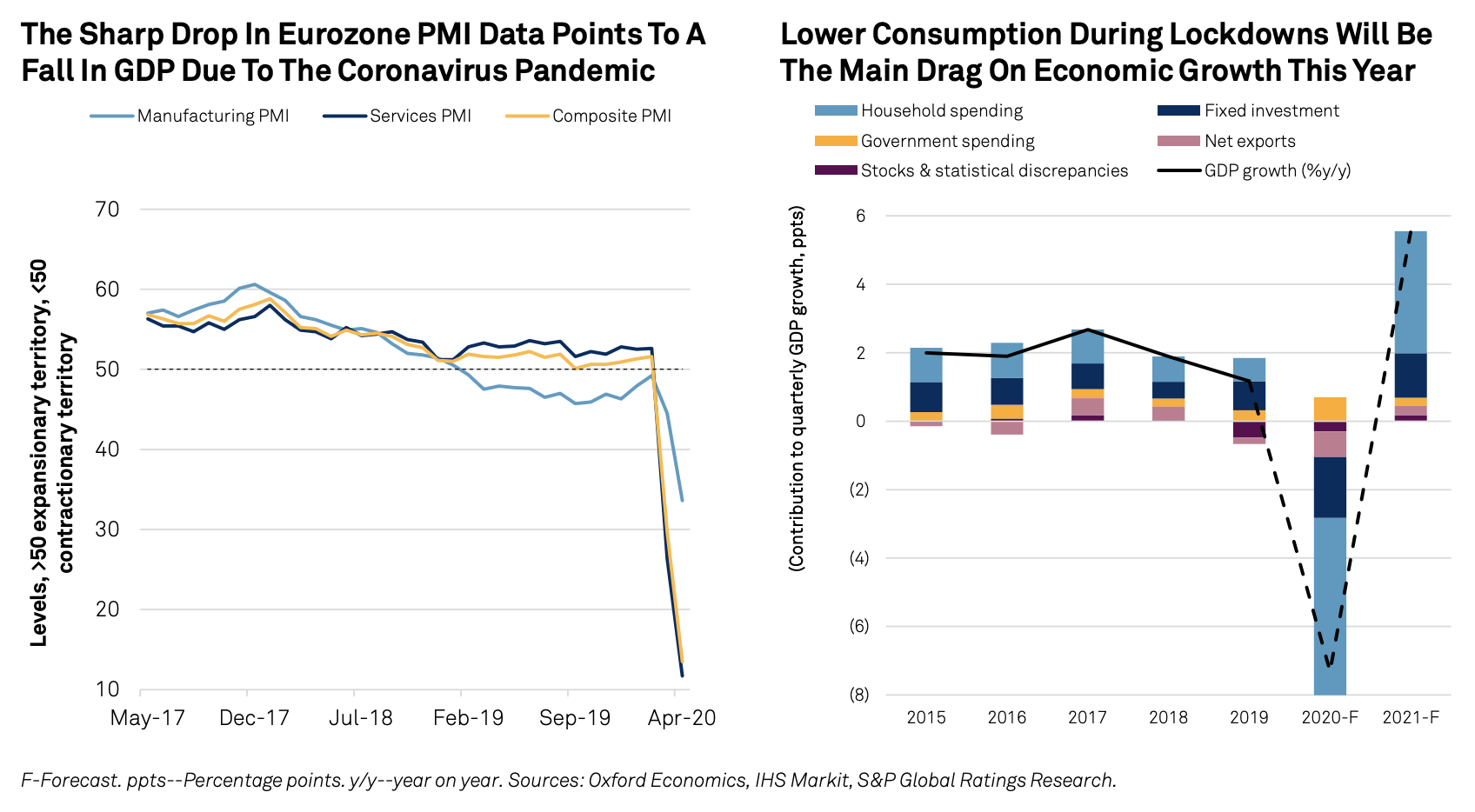

S&P Global Ratings' economists forecast about a 7.3% fall in GDP in the eurozone for 2020, but economic risks could increase if public health concerns call into question loosened lockdowns across the globe. The demand shock to consumption will be the biggest drag on growth. Supply factors such as supply chain disruptions and labor shortages linked to lockdowns will also constrain industry and trade activity. Uncertainty about the timing and shape of the recovery, which is tied to containment measures, will weigh on investment and consumer spending as the economy restarts. Monetary and fiscal policy measures should limit the damage as firms’ access to credit is guaranteed and workers keep their jobs via partial unemployment schemes.

—Read the full report from S&P Global Ratings

Shakeout In Retail, Restaurant Sectors Begins With J. Crew

J. Crew Group Inc.'s announcement that it filed for bankruptcy should not come as a surprise. (S&P Global Ratings lowered the rating to 'CCC-' last September). In S&P Global Ratings’ view, this is the first of many that will likely restructure in- or out-of-court in the next one to two years. Of the approximately 125 issuers S&P Global Ratings rates in the retail and restaurant sectors, about 30% are now rated 'CCC+' or lower, implying at least a 1-in-2 chance they will eventually default. Which retailers will survive the coronavirus pandemic in some shape or form is the big question. S&P Global Ratings believes the economic shutdown and lingering social distancing behaviors will trigger a broad shakeout of retail as the industry will be forced to meaningfully reduce its physical footprint and rapidly evolve to reach the post-pandemic consumer. In particular, if there were any doubts about the eventual demise of many American malls, the impact of the pandemic will likely dispel them. In addition to J. Crew's filing, missed interest payments by both J.C. Penney Co. Inc. and Neiman Marcus Group Ltd. LLC in April is further evidence that iconic brands are also at risk with onerous, legacy capital structures and dated, traditional retail models in need of change.

—Read the full report from S&P Global Ratings

Packaged Food, Household Products Manage Coronavirus Pressure; Not So Pretty For Cosmetics

Packaged food companies will continue to benefit from the coronavirus pandemic. Household products and personal care companies will also benefit, but with some slowdown in certain personal care categories. Cleaning supplies and paper products continue their positive growth trends. Cosmetics companies will run into unprecedented challenges because of retail store closures. Investment-grade issuers will sustain ample liquidity. Speculative-grade issuers have less flexibility, and those rated in the 'B' and 'CCC' categories may experience more difficulty accessing the debt markets.

—Read the full report from S&P Global Ratings

US banks with lowest price-to-adjusted tangible book values after April rally

After severe losses in February and March, U.S. banking stocks staged a widespread rally in April. Investors piled into the financial sector last month, looking past weak first-quarter earnings, stock repurchase suspensions and calls for cash dividend suspensions. The market capitalization-weighted SNL U.S. Bank and Thrift index advanced 11.0% on a total return basis last month. The median return in April for the 320 banks in the S&P Global Market Intelligence analysis was 7.5%.

—Read the full article from S&P Global Market Intelligence

Small bank balance sheets swell with COVID-19 relief loans

Commercial lending has continued to surge outside of the largest U.S. banks — growth that analysts attribute to the funding of hundreds of billions of dollars of federally backed small business loans under the government's coronavirus relief effort. Excluding the 25 banks with the most assets, commercial and industrial lending increased by 10.7%, or $82 billion, during the week ended April 22, according to seasonally adjusted data in the Federal Reserve's most recent H.8 report on commercial banks operating in the U.S. That represents an acceleration from growth of 6.7%, or $48.18 billion, during the week ended April 15. "The spike in the small bank trend likely reflects [Paycheck Protection Program] loan funding, a trend which we expect will continue to skew the data next week" because a second round of funding under the program is underway, Compass Point analyst David Rochester said in a May 1 note. Loan growth in the first quarter had been driven by corporate line draws from large banks, but "there has been a shift in leadership to the small banks as small [and medium-sized] enterprises begin to receive payouts from the Paycheck Protection Program," analysts at Keefe Bruyette & Woods wrote in a May 3 note.

—Read the full article from S&P Global Market Intelligence

Banks give deal status updates as pending MOEs lose more than $1B in value each

As the COVID-19 pandemic continues to weigh on pending bank M&A activity, participants in pending mergers of equals provided updates on the status of their deals during first-quarter earnings calls. There are three pending deals classified as MOEs where the target is a publicly traded U.S. bank: a tie-up between Memphis, Tenn.-based First Horizon National Corp. and Lafayette, La.-based IBERIABANK Corp.; a pending deal between McKinney, Texas-based Independent Bank Group Inc. and Dallas-based Texas Capital Bancshares Inc.; and the combination of Winter Haven, Fla.-based CenterState Bank Corp. with Columbia, S.C.-based South State Corp.

—Read the full article from S&P Global Market Intelligence

Spain's banks to take further profit hit as COVID-19 slashes consumer lending

Spanish bank profits are expected to continue falling sharply in the coming months as demand for mortgages and consumer finance slump, and provisions for bad loans rise amid the coronavirus pandemic. Five of Spain's largest lenders posted a sharp drop in profits in the three months to March 31, according to S&P Global Market Intelligence data. Analysts anticipate a bigger hit in the coming quarters as the depth of the crisis, which has struck Spain particularly hard, becomes clearer. The country had 218,011 confirmed cases and 25,428 deaths as of 8:52 a.m. Madrid time May 5, according to U.S.-based Johns Hopkins University. Strict lockdown measures have been in place since March 14, almost halting the economy and raising concerns of rising bad loans and a capital crunch for Spanish banks.

—Read the full article from S&P Global Market Intelligence

South African banks are tactical investments despite crisis' regulatory impact

South Africa's largest banks have built up sizeable capital buffers to withstand a likely spike in loan defaults, while regulatory moves to aid lenders should help them navigate a looming recession. Although analysts are divided over the long-term impact of easing certain banking regulations in Africa's largest banking sector by assets, there is agreement over the need for bank liquidity to deal with the effects of the coronavirus. President Cyril Ramaphosa has imposed a strict lockdown and the country had, as of May 4, reported 138 deaths due to COVID-19. The South African Reserve Bank, or SARB, forecasts that the pandemic would cause South Africa's economy to shrink 6.1% in 2020 and amid the economic shutdown, the central bank has taken numerous measures to help fortify banks.

—Read the full article from S&P Global Market Intelligence

COVID-19: While Most Of The U.S. Is Shut Down, Utilities Are Open For Business

Despite the economic downturn stemming from COVID-19, the North American regulated utility industry remains open for business and continues to provide essential services. The industry has proactively taken steps to reduce risk by effectively managing liquidity, contrasting positively to the financial crisis of 2008. Reflected by record levels of long-term debt issued during the first quarter of 2020, the industry continues to operate with essentially full access to the public long-term debt markets. S&P Global Ratings expects the industry's capital spending to remain robust provided it maintains consistent access to the long-term debt markets and S&P Global does not materially revise downward its economic outlook forecast. Even with the industry's aforementioned strong performance, many companies are already strategically operating with minimal financial cushion at current rating levels. When combined with the risks of COVID-19 (e.g., persistent volatility in the equity markets, lower volumetric sales, delayed rate case filings, and higher bad debt expense), the industry may experience a weakening of credit quality.

—Read the full report from S&P Global Ratings

Virus-induced recession, city budget crunches could squeeze public utilities

A recession caused by restrictions to control the coronavirus is likely to put pressure on U.S. public power utilities as cities grapple with budget shortfalls and struggling customers foreclose options such as rate increases or service disconnections. Government-affiliated utilities have historically been "very stable and largely immune to pronounced effects from changing economic conditions" due to their consistent financial performance and typically autonomous rate-setting authority, S&P Global Ratings credit analyst David Bodek said.

—Read the full article from S&P Global Market Intelligence

Mexico frees capacity in natural gas pipelines, but questions remain

Mexican state natural gas pipeline operator Cenagas will soon make capacity available in five states in a move that, sources said, was related to the freeing of capacity by the September 2019 start of the Sur de Texas-Tuxpan marine pipeline. Cenagas, in a posting on its website, said it had more than 380,000 GJ/d (360.2 MMcf/d) of new available gas capacity, but it did not provide an explanation behind its announcement. Mexican gas pipeline capacity has been sought by market participants for years. But the lack of transparency from Cenagas regarding the origins of this additional capacity and the decision to allocate it using the premise of "first in time, first in right," instead of holding an open season, creates legal uncertainty that could endanger contracts, sources told S&P Global Platts.

—Read the full article from S&P Global Platts

Argentina's fracking activity in Vaca Muerta slowed to zero in April

Fracking activity in Argentina's Vaca Muerta shale play slowed to zero in May, as low demand, low prices and limited storage capacity discouraged new developments, a report showed Tuesday. The number of fracking stages in the play was down from 430 in March and 350 in April 2019, according to data compiled by Houston-based services company NCS Multistage. The pullback in activity came as the federal government locked down the economy on March 20 in an effort to contain the spread of the coronavirus. With most businesses out of action and the 45 million population under strict stay-at-home orders, oil demand fell by more than a half to around 200,000 b/d, according to most estimates. This led refiners to scale back crude runs as diesel and gasoline demand fell by 60% to 80%, the estimates show.

—Read the full article from S&P Global Platts

Oil prices rally as production cuts mount

Crude futures rallied Tuesday as more producers announced output cuts, while an easing of lockdowns was expected to bolster refined products demand. NYMEX June crude settled at $24.56/b, up $4.17, while ICE July Brent settled at $30.97/b, up $3.77. In refined products, NYMEX June ULSD settled at 89.60 cents/gal, up 9.29 cents, and June RBOB settled 7.98 cents higher at 90.13 cents/gal.

—Read the full article from S&P Global Platts

Did Gulf Coast crudes go negative on oil’s most historic day?

When one of the world’s most prolific oil futures contracts plunged deeply into negative territory April 20, S&P Global Platts’ pricing team was faced with the question of whether physical crude outside of Cushing, Oklahoma was also worth less than zero. With no ambiguity, Platts’ methodology answered with a resounding “no”. With the exception of May WTI at Cushing, Platts did not assess any North or South American crudes at negative values that day. CME Group’s NYMEX Light Sweet Crude Oil Futures contract, known as NYMEX WTI, is the world’s most liquid and actively traded oil contract and has long been regarded as the de facto pricing benchmark for a plethora of crude grades with various qualities and locations around North, Central and South America. But May NYMEX WTI collapsed on April 20, settling at a record low of -$37.63/b. That settle price and the events that led to it exposed some major cracks in the system – raising some important questions about how crude oil is priced in the Americas. However, three key pillars of Platts’ methodology led to assessments that day that reflected tradable value for physical oil at key distribution hubs outside of Cushing – values that in Platts’ view were not negative.

—Read the full article from S&P Global Platts

Listen: Cobalt in the time of Corona: refining, mining and pricing

S&P Global Platts Battery Metals podcast looks at how cobalt markets are faring during the current coronavirus pandemic. Emmanuel Latham is joined by Battery Metals editor Melvin Goh to discuss the impact of COVID-19 on Chinese cobalt sulfate refining, the developing situation in the DRC, anticipated market developments and what this all means for cobalt prices.

—Listen to this episode of Battery Metals, a podcast from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Location

Language