Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

S&P Global — 14 May, 2020

By S&P Global

One month after OPEC+ agreed to a historic production cut, and some three weeks since the price of oil tumbled into negative territory for the first time ever, global oil markets are still in murky waters as the coronavirus crisis continues.

“From the current picture [and] if nothing changes, I believe there may be a need for further efforts coming from [oil] producing countries in order to make 2020 a bit less worse than what we thought of in the beginning of this crisis," International Energy Agency Executive Director Fatih Birol said in a Gulf Intelligence webcast. “Demand will not jump from one day back to levels we had before the crisis, and we still have a huge amount of surplus, plus a lot of floating oil around the world, so therefore one needs to be very careful if one doesn't want to change.”

Many OPEC+ delegates told S&P Global Platts they are waiting to see additional data on the pandemic’s effects before considering further production cuts, and that no discussions on output strategies are underway ahead of the upcoming June 10 meeting to evaluate the market.

OPEC revised its forecast for oil demand to 16.8 million barrels per day this quarter and 24.3 million barrels a day for the year, according to a report yesterday. (On April 12, the organization and its allies agreed to reduce crude output by 9.7 million barrels per day in May and June, and 5.8 million barrels per day in 2021 through April 2022.) While the organization would need to practically halve its production to balance the market, S&P Global Platts reports that OPEC is unlikely to take such aggressive action—yet looks to be hoping for a recovery toward the end of this year that will bolster demand and consumption.

This year “may well be the worst year in the history of oil industry, and April will remain the Black April,” Mr. Birol said.

Integrated oil and gas majors, including Exxon Mobil and Royal Dutch Shell, suffered greatly in the first quarter, with the former reporting its first loss in 30 years and the latter cutting its dividend for the first time since World War II. Additionally, beyond the bottoming-out of oil prices, April saw a continued slowdown of oil and gas deal-making. The sector reported only 20 whole-company and minority-stake deals, down 43.5% from that time last year, according to S&P Global Market Intelligence data.

The U.S. Commodity Futures Trading Commission issued an advisory yesterday to brokers, exchanges, and derivatives clearing organizations “in the wake of unusually high volatility and negative pricing experienced in the May 2020 physically delivered WTI contract, and related reference contracts, on April 20,” and reminded market participants of their “obligations to assess changing market conditions and take appropriate measures in response as contracts approach expiration.” The notice highlighted “the authority to liquidate or transfer open positions in any contract; to suspend or curtail trading in any contract; and to require market participants in any one contract to meet special margin requirements.” The notice also advised “to regularly assess whether their risk controls and related mechanisms are reasonably designed, fit for purpose, and appropriately implemented.”

S&P Global Ratings said oil prices would need to improve significantly next year for producers’ ratings to remain unchanged after downgrades of multiple oil and gas companies to ‘BBB-’ in light of their weakened financial performance. Contingent upon sustained OPEC+ production cuts and a strong recovery across global economies, S&P Global Ratings forecasts West Texas Intermediate crude to average $45 per barrel and Brent $50 per barrel next year.

Even under such assumptions, the current crisis will persist. World Health Organization Chief Scientist Soumya Swaminathan told the Financial Times that it will take four to five years to control the coronavirus pandemic. Mike Ryan, the WHO’s health emergencies program head, said at a news briefing that “this virus may become just another endemic virus in our communities” and that it “may never go away.”

Today is Thursday, May 14, 2020, and here is today’s essential intelligence.

Listen: Oil Markets extra: How do benchmarks cope in times of market stress?

In this special bonus episode of S&P Global Platts Oil Markets podcast, Dave Ernsberger, head of pricing and market insight, discusses with Joel how commodity and energy benchmarks are faring amid the coronavirus outbreak, and Platts' approach to dealing with recent market stress.

—Listen to this episode of Global Oil Markets, a podcast from S&P Global Platts

OPEC revises down global oil demand forecast again, with production cuts in focus

OPEC would have to nearly halve its crude oil production in the second quarter to balance the market, according to the organization's latest analysis, as the COVID-19 outbreak continues to force massive downward reassessments of the global economy. Even with a historic global supply cut accord in force, OPEC is unlikely to take such drastic measures, but it appears to be banking on a rapid pandemic recovery in the back half of the year to salve its short-term pain. OPEC, which pumped 30.41 million b/d in April, now sees the market's demand for its crude coming in at 16.77 million b/d this quarter, it said in its closely watched monthly oil market report Wednesday. The outlook brightens considerably in the back half of the year, the analysis shows, with the call on OPEC crude rising to 27.89 million b/d in the third quarter and then a robust 31.18 million b/d in the fourth quarter, for a full-year average of 24.26 million b/d.

—Read the full article from S&P Global Platts

IEA's Birol says producers may need to do more to lift the oil market

Oil producers may need to exert more efforts to lessen the coronavirus impact on the oil market because demand is not expected to recover quickly, given the amount of surplus and large volume of crude held in floating storage, the executive director of the International Energy Agency said Wednesday. "From the current picture [and] if nothing changes, I believe there may a be need for further efforts coming from producing countries in order to make 2020 a bit less worse than what we thought of in the beginning of this crisis," Fatih Birol said in a Gulf Intelligence interview that was webcast. "Demand will not jump from one day back to levels we had before the crisis and we still have a huge amount of surplus and plus a lot of floating oil around the world so therefore one needs to be very careful if one doesn't want to change."

—Read the full article from S&P Global Platts

Potential Fallen Angels: U.S. Oil And Gas Companies Walk A Thin Line Between Investment Grade And Speculative Grade

Following a recent sector review, S&P Global Ratings downgraded several oil and gas companies to 'BBB-' due to weaker financial performance after we lowered our crude oil and natural gas price assumptions. For companies to maintain ratings at that level, crude oil prices will need to significantly improve in 2021. S&P Global Ratings’ assumptions for next year are $45 per barrel WTI and $50 per barrel Brent, which is highly dependent on maintenance of OPEC+ production cuts, combined with a solid recovery in U.S. and global economies following the coronavirus pandemic. S&P Global Ratings plans to review our price assumptions in the third quarter of 2020. S&P Global Ratings has looked at the potential risks these companies face as they teeter on the threshold of fallen angel status.

—Read the full report from S&P Global Ratings

UK's Premier Oil lowers output, spending guidance, as BP deal in doubt

London-listed Premier Oil has lowered its production guidance for this year and further reduced its spending plans after a glitch at its flagship Catcher field, adding that it is having fresh discussions in a battle over its planned purchase of BP assets. In a trading statement, Premier reported its UK oil and gas production in the first four months of 2020 had dropped 18% year on year to 47,000 b/d of oil equivalent, with its overall production, including in Indonesia and Vietnam, also down 18% at 70,000 boe/d. As a result it lowered its full year guidance to 65,000-70,000 boe/d, from 70,000-75,000 boe/d previously.

—Read the full article from S&P Global Platts

Iraq in talks with oil companies on postponing payments, cutting costs: official

Iraq, OPEC's second-largest oil producer, has begun negotiations with international oil companies on postponing payments to them and cutting costs as OPEC's second largest oil producer grapples with the crude price crash, Mudher Saleh, an economic adviser to new Prime Minister Mustafa al-Kadhimi, told S&P Global Platts Wednesday. "At this moment, there are negotiations with IOCs to reduce costs as a priority," Saleh said. "There are negotiations with the ministry of oil and IOCs at this moment to find a way to postpone payments. We have to pay IOCs around $1 billion a month."

—Read the full article from S&P Global Platts

Oil majors prepare for more intense pain after dismal Q1 earnings season

The first-quarter earnings season proved to be brutal for the integrated oil and gas majors, and the pain is only expected to intensify in subsequent quarters as the coronavirus-induced hit to the economy continues to keep oil prices depressed, analysts said. In the first three months of 2020, Exxon Mobil Corp. posted a loss for the first time in more than 30 years and Royal Dutch Shell PLC took the market by surprise, cutting its dividend for the first time since World War II as oil prices plunged in response to a supply glut and demand destruction caused by shelter-in-place orders around the globe.

—Read the full article from S&P Global Market Intelligence

Oil, gas deal tracker: M&A slowed to a trickle in April amid crude collapse

The pace of oil and gas deal-making continued to taper off in April as the energy industry braced for widespread shut-ins amid tanking crude prices, according to S&P Global Market Intelligence data. During that month, the sector announced 26 fewer whole-company and minority-stake deals than in April 2019 — unveiling 20 deals, compared to the prior year's 46. In the same period, the combined value of these deals fell from $63 billion to $876 million. The aggregate value of announced asset transactions fell from $11.4 billion to $341 million as the number of deals fell from 51 to 16.

—Read the full article from S&P Global Market Intelligence

Shale gas drillers promise to restrain spending despite higher futures prices

Heading into the first quarter earnings season, analysts were clear. They wanted no surprises from pure play shale gas drillers — no new spending, no new debt, no mergers and acquisitions — just cash discipline, despite the temptation of commodity prices set to rise near the end of the year. The analysts mostly got what they wanted. SunTrust Robinson Humphrey Inc. shale analyst Welles Fitzpatrick summed it up with his note on Range Resources Corp.'s Range Resource's results April 30: "Thankfully boring quarter."

—Read the full article from S&P Global Market Intelligence

Listen: There are bright spots for commodities: Jim Rogers

Will commodity markets ever be the same again? Global investor Jim Rogers, chairman of Beeland Interests Inc., talks to Sambit Mohanty, S&P Global Platts senior editor, to discuss what lies ahead for commodity markets, where the silver linings are as the coronavirus pandemic continues to trample markets, and the pains of recession.

—Listen to this episode of Commodities Focus, a podcast from S&P Global Platts

Listen: Battery technology to play an important part of broader energy transition

Battery technology for electric vehicles and energy storage will play an important part of the broader energy transition. Key topics include understanding cost trends and competitivenes of these technologies and challenges ahead for alternative storage technologies. Roman Kramarchuk, head of energy scenarios, policy and technolgy analytics at S&P Global Platts, talks with Christina Lampe-Onnerud, founder and CEO of Cadenza Innovation.

—Listen to this episode of Commodities Focus, a podcast from S&P Global Platts

INTERVIEW: Green hydrogen's voice needs to match that of blue: ITM's Cooley

The green hydrogen industry must strive to match the lobbying power of the blue hydrogen-extolling oil and gas industry, according to ITM Power CEO Graham Cooley. Speaking to S&P Global Platts from Sheffield, UK, where ITM is building the world's largest PEM electrolyser manufacturing plant, Cooley said green hydrogen (made by splitting water in an electrolyser using renewable power) was competing with blue hydrogen (the reforming of natural gas with carbon capture) in one key area: finance.

—Read the full article from S&P Global Platts

Hydrogen retrofits for EU gas system cheaper than newbuild: GIE

Retrofitting existing EU infrastructure to accommodate hydrogen and other low-carbon gases will be cheaper than building from scratch, according to the executive leading trade body Gas Infrastructure Europe's work on future LNG terminals. The EU's natural gas and LNG industry is looking to avoid stranded assets and stay relevant as the European Commission pushes for more decarbonized gases such as hydrogen in the mix to help the EU become climate neutral by 2050.

—Read the full article from S&P Global Platts

Wind turbine maker CEOs point to long-term upsides amid COVID-19 hit in Q1

Wind turbine manufacturers are feeling the sting of the COVID-19 pandemic, in large part due to disruptions in their internationalized supply chains. Despite the longer-term tailwinds for the industry, Denmark's Vestas Wind Systems A/S, Spain's Siemens Gamesa Renewable Energy SA and Germany's Nordex SE all withdrew their full-year financial guidance in the first quarter due to poor business visibility. While Nordex booked strong earnings growth in the first three months and all three companies observed solid demand from developers, the long lead times in the wind sector — especially in offshore wind — mean certain impacts from the downturn may only materialize later in 2020. The three turbine makers saw factories in Asia, Europe and the Americas close because of lockdown measures, and the sourcing of components has become more challenging and expensive as a result of the crisis. "The whole world is in a force majeure right now," Vestas CEO Henrik Andersen said on the company's May 5 investor call.

—Read the full article from S&P Global Market Intelligence

Coronavirus could delay portion of 300-MW Ameren wind project

The coronavirus may delay construction of part of an Ameren Corp. wind project to 2021, Chairman, President and CEO Warner Baxter said on the company's May 12 earnings call. Ameren has received all requisite regulatory approvals related to its acquisition of a pair of Missouri wind projects totaling 700 MW, according to Baxter. While construction has commenced and is "well underway," at least one of the facilities may be delayed in coming online.

—Read the full article from S&P Global Market Intelligence

European EV registrations double in Q1 to 6.8% of market: ACEA

Electric vehicle sales more than doubled their market share year on year across Europe in the first quarter to 6.8%, or 167,132 cars, against the backdrop of an overall decline in registrations, manufacturers' association ACEA said Tuesday. "In reality, the statistics are skewed by the drop in sales of traditional internal combustion engines [because of COVID-19]," one trader said. "Once ICE sales start picking up again, as Europe comes out of respective lockdowns, then you would imagine that [EV] market share will take a substantial hit.”

—Read the full article from S&P Global Platts

Global carbon offsets market could be worth $200 billion by 2050: Berenberg

The value of the global market for carbon emissions offsets could increase to $200 billion by 2050, German bank Berenberg said in a note Wednesday. Although now relatively small, the carbon offsets market has grown quickly in recent years and could be set for further rapid growth as countries hit the limits of decarbonization, meaning they will have to rely on offsetting projects to achieve national and corporate climate targets. "The global carbon offset market is tiny at $0.6 billion (2019) versus the much larger global carbon permit market at $44 billion (2018)," Berenberg said in the note.

—Read the full article from S&P Global Platts

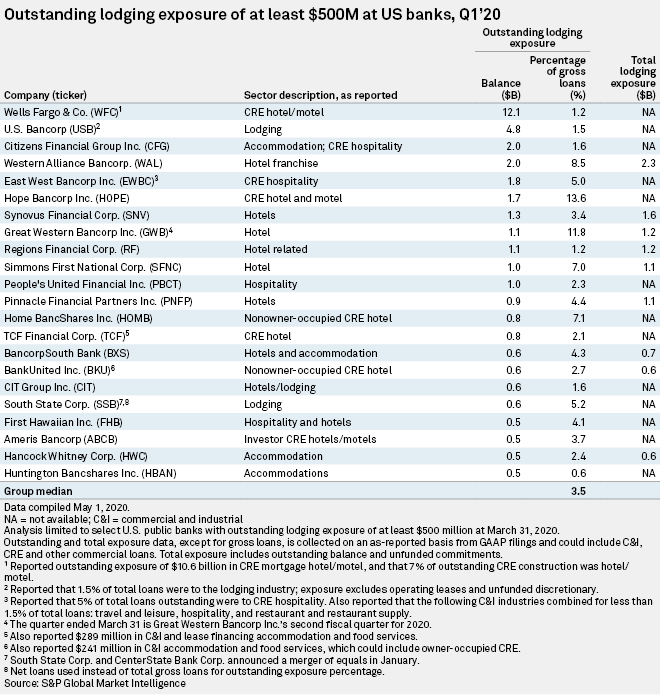

US banks detail hotel exposure as lodging industry struggles through pandemic

Hope Bancorp Inc. and Great Western Bancorp Inc. are among the large banks with the greatest exposure to the hotel industry, while Bank7 Corp. has the highest percentage of hotel loans among smaller banks reporting exposure. Los Angeles-based Hope's $1.7 billion in outstanding commercial real estate hotel and motel loans account for 13.6% of its total gross loans, while Sioux Falls, S.D.-based Great Western's $1.1 billion in outstanding hotel loans equate to 11.8% of gross loans. Among hotels with at least $500 million in outstanding lodging exposure, the newly reported first-quarter figures put the banks well ahead of other hotel-exposure leaders such as Western Alliance Bancorp. and Home BancShares Inc. Oklahoma City-based Bank7's $176 million of outstanding hospitality loans account for 22.3% of the bank's gross loans.

—Read the full article from S&P Global Market Intelligence

Retail sector defaults soar to record high in US leveraged loan market

Two prominent retail chains — J.Crew Group Inc. and Neiman Marcus — helped push the U.S. leveraged loan default rate in that struggling sector to 10.34%, a record high that, amid the catastrophic impact of the coronavirus pandemic, will almost certainly continue to climb. By comparison, the default rate of the broader, $1.2 trillion leveraged loan asset class remains below historical averages, at just 2.53%, according to the S&P/LSTA Loan Index.

—Read the full article from S&P Global Market Intelligence

BoE and US Fed's moves in face of virus heap pressure on timetable to end Libor

The Bank of England's decision to extend the London interbank offered rate transition and its use to underpin the U.S. Federal Reserve's coronavirus lending puts the 2021 deadline to end its use under pressure. The BoE has said it will delay to April 2021 from October 2020 moves aimed at encouraging banks to use its favored replacement interest rates for Libor. It said it will delay plans to increase so-called haircuts, which are applied to banks using Libor-linked collateral to borrow, to incentivize them to switch to the regulators' favored alternative risk-free rates.

—Read the full article from S&P Global Market Intelligence

Market abuse risk rises due to 'relaxed' teleworking, monitoring hitches

As suits are replaced by sweatpants and client meetings are moved into the living room or garden, the coronavirus crisis has led to a more relaxed work environment for many investment bankers. But for compliance departments, it is causing new headaches. The combination of volatile markets, margin pressures and teleworking bankers is creating an environment ripe for market abuse, including insider trading and unlawful disclosures, experts warn. There have been behavioral changes since the pandemic outbreak that could have legal and reputational repercussions, Behavox, a New York-headquartered artificial intelligence company that helps money managers monitor staff communication, has found.

—Read the full article from S&P Global Market Intelligence

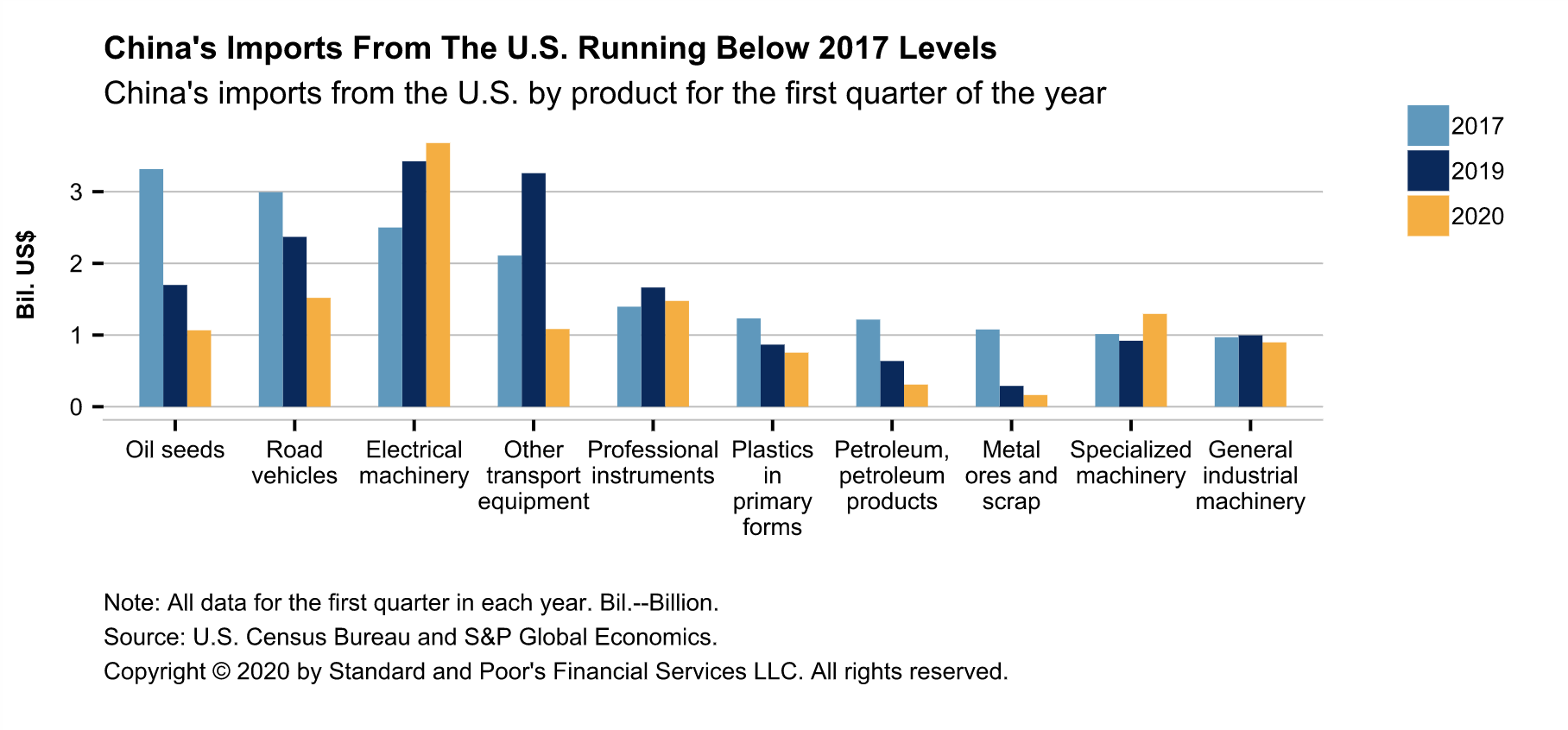

Economic Research: U.S. And China Kick Trade Deal Can Down The Road

Add a flare-up in the U.S.-China trade relationship to risks. The U.S., along with other countries including Australia, is questioning China's handling of the coronavirus, from its sharing of information to trade policies related to medical equipment and supplies. China has defended its actions and suggested that mismanagement explains the outbreaks outside its borders. The dispute has implications for growth. U.S. officials have remarked that COVID-19 has encouraged them to redouble efforts to reduce supply-chain dependency on China. President Trump has suggested that the U.S. government could impose additional tariffs on Chinese imports as the "ultimate punishment" for China's handling of the coronavirus. The U.S. has continued to tighten rules governing the transfer and trade of technology products.

—Read the full report from S&P Global Ratings

Retroactive business interruption cover would make pricing 'astronomical'

Washington Insurance Commissioner Mike Kreidler has been one of the most active regulators in dealing with the new needs of policyholders and insurers as they deal with the COVID-19 pandemic. S&P Global Market Intelligence spoke with Kreidler to discuss his priorities, his perspective on business interruption coverage and the prospect of a federal backstop program to help deal with business interruption in the future.

—Read the full article from S&P Global Market Intelligence

Food in Focus: April grocery prices race higher due to COVID-19

Grocery margins likely widened in April as consumer prices for beef, eggs and other staples increased at their fastest rate in decades and outpaced wholesale price changes because of impacts from the ongoing coronavirus pandemic. The food at home index of the Consumer Price Index, or CPI, rose 4.1% during the month, its largest monthly advance since February 1974. The final-demand food category of the Producer Price Index, or PPI, meanwhile, rose just 0.3%. The Bureau of Labor Statistics, or BLS, gathered data by phone and online instead of through in-person visits due to work-from-home requirements prompted by the coronavirus. That difference meant that data for many consumer goods and services were based on fewer data points than in surveys conducted pre-pandemic, BLS said.

—Read the full article from S&P Global Market Intelligence

Uber's potential takeover of Grubhub could kick off more delivery consolidation

A potential takeover of Grubhub Inc. by Uber Technologies Inc. could jumpstart additional consolidation in the growing meal-delivery business, though any future deal would likely raise antitrust concerns as the industry gains momentum during the coronavirus pandemic, experts said. The companies, which both offer meal delivery from a range of restaurants, are reportedly in talks over a possible all-stock combination, though they have yet to agree to a price, multiple media outlets reported May 12. And while neither company has confirmed the particulars of those reports, Grubhub said following the reports that consolidation could make sense.

—Read the full article from S&P Global Market Intelligence

Written and compiled by Molly Mintz.

Content Type

Location

Language