Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Chile Tilting toward Sustainability — 3 Mar, 2021

This article is reprinted from the Indexology blog of S&P Dow Jones Indices.

When investors think of sustainability, what often comes to mind first are progressive companies headquartered in Nordic nations, France, or Switzerland—but this is a dated view. Sustainability has moved beyond these regions, particularly into emerging markets like Latin America, where, one could easily argue, improvements in environmental, social, and governance (ESG) standards matter even more. There is simply more ground to gain.

In emerging markets, however, more tools are required to help investors make informed decisions. With this need in mind, the Santiago Stock Exchange and S&P Dow Jones Indices collaborated to launch the new S&P IPSA ESG Tilted Index to set the standard for sustainable investing for the Chilean equity market.

Defining a Sustainable Benchmark

The S&P IPSA ESG Tilted Index is a modern sustainable benchmark. ESG indices created in the early days of the sustainable investing movement tended to be narrow, focusing on the best ESG companies or a single theme, such as clean energy. Newer ESG benchmarks have forged a new path, still incorporating strict ESG criteria, but doing so in a way that retains a broad set of companies, which tends to result in less volatile, more benchmark-like returns. The S&P IPSA ESG Tilted Index fits this new mold.

The tilting of the parent index, the S&P IPSA, toward more sustainable companies is the defining characteristic of the index and ultimately drives improvements in sustainability. However, before this key adjustment, some basic exclusions are made in line with international norms.

First, companies are excluded that breach revenue thresholds related to business activities commonly viewed as undesirable by sustainable investors around the world. This includes meaningful involvement in controversial weapons (such as nuclear or chemical weapons), tobacco, coal extraction, or generating coal-powered electricity. Further, companies are excluded that are deemed non-compliant with the United Nations Global Compact due to violations related to human rights, corruption, labor rights, and the environment.

After these exclusions are implemented, constituents are tilted according to their S&P DJI ESG Scores, a holistic measure of sustainability based on the S&P Global Corporate Sustainability Assessment (CSA). The methodology spells this process out in detail, but in summary, companies are standardized within their industry groups by their S&P DJI ESG Scores and assigned a “tilt score.” The company’s original weight in the S&P IPSA is multiplied by this tilt score to achieve its new weight in the S&P IPSA ESG Tilted Index.

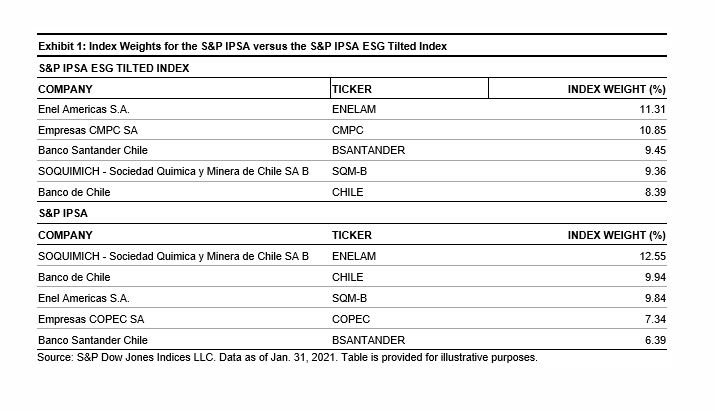

The S&P IPSA ESG Tilted index is superior from the perspective of the S&P ESG Scores, improving 4.4 points relative to the benchmark index. This is achieved by a reallocation of weights, which can be seen by reviewing the weights of the top five constituents of the S&P IPSA and its new ESG counterpart (see Exhibit 1).

Though improvements in composite S&P DJI ESG Scores are interesting to some, it’s difficult for many to get their minds around what this practically means. Reviewing the various topics of the CSA helps. Companies that score better tend to be stronger in their communication of codes of business conduct, enforcing these codes, and monitoring their impact on the environment and proactively managing their emissions, among many other ways. The S&P IPSA ESG Tilted Index increases the weights of companies that operate with sustainability in mind.

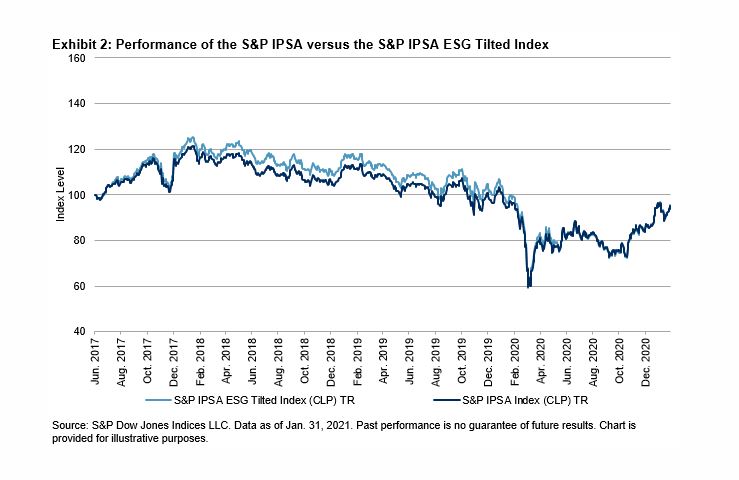

And after all these adjustments, how has the index performed? It has provided benchmark-like returns, in line with the S&P IPSA (see Exhibit 2). This can give investors comfort that this is an index with mainstream characteristics in line with their needs.

How will the S&P IPSA ESG Tilted Index help the Chilean market advance in sustainability-focused investing? Like no index before, it has the potential to connect investors concerned about sustainability with the corporate market. As companies see investors use this index more and more, they will likely seek to improve their ESG performance—as defined by the S&P DJI ESG Scores and CSA—and seek to do better not just for shareholders, but for the broad set of stakeholders affected by their businesses.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Content Type

Location

Segment

Language