S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Investor Relations

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Investor Relations

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Emerging Trends and Analysis of the SDG Impact of Companies in the S&P 500®

Published: February 3, 2020

By Rochelle J March, Rick Lord, and Nikol Ioannou

Highlights

It has been four years since the 2030 Agenda for Sustainable Development with its 17 Sustainable Development Goals (SDGs) was adopted at the UN Sustainable Development Summit. During this time the SDGs have garnered widespread backing among companies and investors who have made modest progress towards aligning business strategies and capital allocation with the SDGs.

After four years since the 2030 Agenda for Sustainable Development with its 17 Sustainable Development Goals (SDGs) was adopted at the UN Sustainable Development Summit, the SDGs have garnered widespread backing among companies and investors who have made modest progress towards aligning business strategies and capital allocation with the SDGs. While challenges prevail in transitioning to transformative action on the SDGs, several trends have emerged that suggest this action is accelerating.

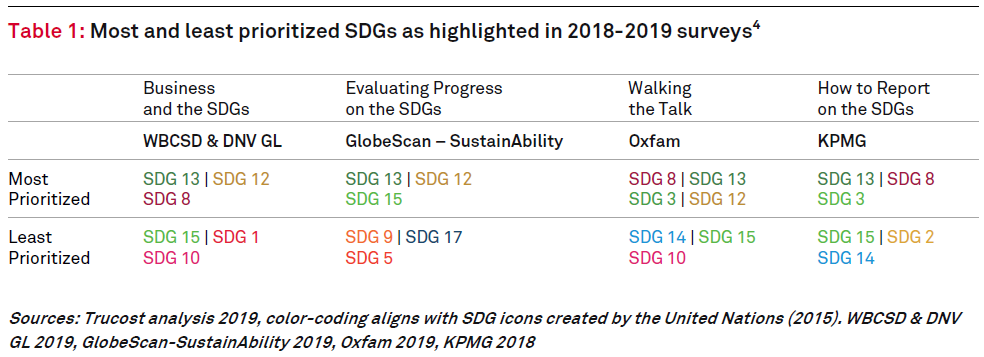

Growing Corporate Disclosure on SDG Alignment

Several global surveys have showcased the increased attention companies are giving to public reporting in line with the SDG framework. In 2018, KPMG analysis showed that 40% of the world’s 250 largest companies discuss SDGs in their reporting,1 while a 2019 report by Oxfam, Walk the Talk, found 62% of companies in an analyzed sample have made a public commitment to the SDGs.2 Better yet, a 2019 survey by World Business Council for Sustainable Development (WBCSD) and DNV GL found that among the 250 global companies surveyed, 82% have reported on the SDGs.3 A minority of companies report on all 17 SDGs; most prioritize a select few.

Movement Towards Ranking of Company SDG Performance

Investors have a growing appetite to benchmark companies against each other in terms of their SDG performance. Where disclosure is absent, other providers have built assessments, indexes and benchmarks to compare corporate action. Information providers increasingly offer investor-focused products for measuring a company’s portfolio towards the SDGs, while indexes have emerged to help investors gain exposure to companies identified as making a contribution to the Goals. The World Benchmarking Alliance has accelerated work in this arena by planning to build science-informed league tables, starting first with a Food and Agriculture Benchmark comprising 300 companies across the food and agricultural value chain.5

Increased Capital Allocation for SDG-Related Projects

Funding for SDG-related projects has carried over into the private sector as an increasing number of pension funds and banks choose to allocate funds towards sustainable development priorities. The funding gap in financing to achieve the SDGs is estimated to be $2-3 trillion per year, with the private sector expected to contribute $1-1.5 trillion.6

Several pension funds, linking the need for long-term performance with constituents’ values, have increased allocations to SDG investments, including the Danish SDG Investment Fund ($752 billion) and ABP ($68 billion by 2020); Australia’s Cbus Super Fund and CalPERS have announced plans to align investment strategies with the SDGs.

Starting in 2017, the World Bank issued bonds (US$23.5 billion) managed by BNP Paribas that directly link to the performance of companies advancing SDG priorities. HSBC made headways in late 2018 when it issued its first SDG bond for $1 billion, allocating proceeds towards green building, social housing, renewable energy and other sustainability categories. In the first half of 2019, $10.3 billion in SDG bonds and $5.5 billion in social bonds were issued, with 50% of volumes comprising financial and non-financial corporates.7

On September 26th, 25-30 CEOs of large companies around the world will launch the Global Investors for Sustainable Development Alliance (GISD) at the UN General Assembly with the intention of implementing an investment plan for sustainable development.8

Renewable Energy and Buildings Projects Receive the Most Attention

While SDG-related financing is diverse, green building and renewable energy projects lead the bulk of investment among financing by the private sector. Two of the largest allocations of the HSBC SDG Bond are for green building (38%) and renewable energy (18%), while the Danish SDG Investment Fund intends to invest in a number of sectors, including sustainable energy and infrastructure. Green bonds, majorly allocated towards renewable energy and green construction, are steadily increasing with over $100 billion issued in the first half of 2019. 9

Measuring SDG implementation is specific to geography and also to industry, as different countries are at varying stages of SDG attainment, and industries vary in how their activities affect their area of operation. In addition to the industry a business operates in, there is also the geographic distribution of its value chain – where it sources its materials and sells its products – that will have its own impact on a broad range of issues related to the SDGs.

Modeling can assist in filling gaps when there is lack of data or detailed information on the range of SDG issues that may occur within a business’s value chain. Accordingly, Trucost developed an inputoutput model approach to evaluate the baseline exposure of a company to each SDG. Trucost’s SDGExtended Multiregional Input-Output Model (SDGI-O) models economic flows and associated exposure to SDG-related risks across countries and sectors globally. Trucost considers SDG risk as the risk that a company may be directly or indirectly causing a negative impact on the SDGs (such as greenhouse gas emissions in the supply chain) or the risk that a company may be dependent on practices and activities that conflict with the SDGs (such as underpayment of wages or child labor). The SDGI-O model contains 45 metrics based off the 169 SDG targets that are then aggregated on the Goal level. These metrics were selected due to their direct application to the private sector and adequate data availability.

Using this approach, Trucost underwent an analysis of the baseline risk of all companies listed on the S&P 500.10 This evaluation does not take into account company-specific actions to mitigate risks, but rather captures a level of baseline risk directly related to private sector activities when operating in specific industries and countries. The methodology, assumptions and limitations of the analysis are included in the Technical Appendix on page 17.

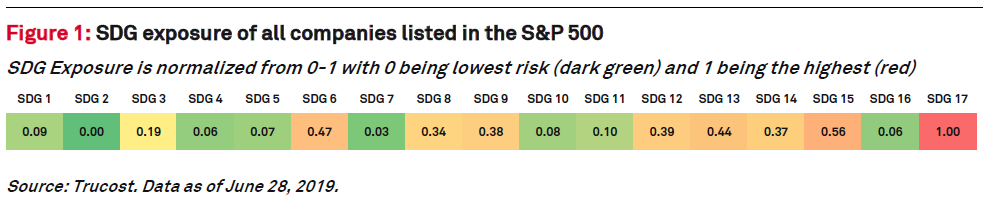

Largest SDG Exposure for S&P 500 Companies

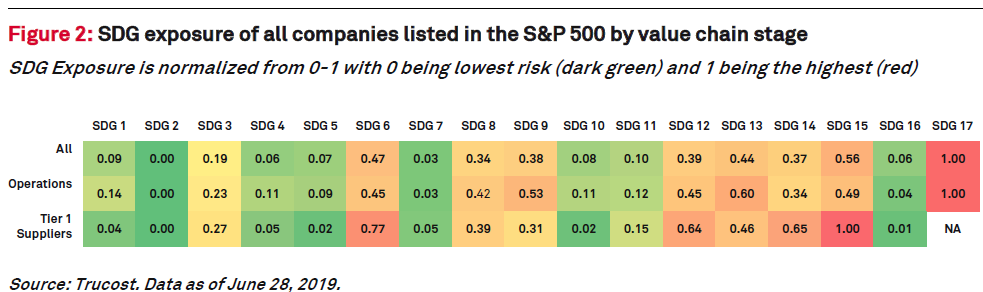

Figure 1 refers to the total SDG exposure for all companies listed on the S&P 500 across all operating geographies and value chain stages, which includes all suppliers (direct and indirect), operations and downstream impacts. SDG 17: Partnership for the Goals notably has the highest risk for these companies. SDG 17 target 17.1 calls for countries to strengthen their capacity for domestic tax collection to finance actions to address the SDGs, an effort that can be hindered by opaque corporate tax policies. The underlying metric in the SDGI-O model linked to SDG 17 with the highest SDG Exposure is Fair Share Taxation, which takes into account the level of financial secrecy and scale of offshore financial activities by country. This metric is also only counted in the operations value chain stage since it is directly within a company’s operational control and does not relate to a company’s suppliers or customers.

In the 2018 Secrecy Ranking in the Financial Secrecy Index11 the U.S. ranked as number two in secrecy, only behind Switzerland. Given that the S&P 500 must contain common stocks of only U.S. companies, this metric has a high risk exposure. Corporations can take steps to ensure that tax policies are transparent, provisions are made for whistle-blowers to highlight unethical practices, and information on the effective tax rates paid across a corporation’s operations are disclosed, including any tax concessions granted to the business.12

Other SDGs with high SDG exposure include SDG 15: Life on Land, SDG 6: Clean Water and Sanitation, and SDG 13: Climate Action. When broken out by operations and Tier 1 suppliers, the analysis reveals how these SDGs have higher exposures at different stages of the value chain. Tier 1 suppliers, or a supplier that provides products and services directly to a company without the involvement of other suppliers, has the highest exposure related to SDG 15: Life on Land. This exposure is driven by the level of land pollution and deforestation related to Tier 1 sectors operating in their respective geographies.

Water availability is a growing concern among corporations as water scarcity rates increase. Recent research by the World Resources Institute13 reveals that 17 countries are close to running out of water due to existing arid conditions, non-efficient usage or relying too heavily on groundwater, which can take decades to replenish.14 Companies in the S&P 500 have a high exposure to SDG 6: Clean Water and Sanitation, particularly within the supply chain. With over half of the world’s companies’ water use stemming from their supply chains,15 tackling water consumption, pollution and access to clean water will require companies to extend solutions across their value chains.

Companies are increasing their efforts to lower greenhouse gas (GHG) emissions, but GHG emissions intensity is still high for many countries where the S&P 500 companies conduct business activity. The exposure for SDG 13: Climate Action will likely increase as these companies may experience growing vulnerability to climate-related issues such as extreme weather events, sea level rise and carbon taxes.

SDGs where the S&P 500 has the lowest SDG exposure are SDGs 2: No Hunger and 7: Affordable and Clean Energy. Given the ubiquity of U.S. companies on the S&P 500 with a large proportion of operations and likely Tier 1 suppliers located in developed countries, these SDGs emerge with a lower exposure. Using the U.S. as an example, while challenges remain related to adult obesity (U.S. has current rate of 36.2% prevalence),16 the U.S. is close to achieving SDG 2: No Hunger in terms of undernourishment. With SDG 7: Affordable and Clean Energy, 100% of the U.S. population has access to electricity and clean fuels; however, exposure relating to energy consumption levels and access to renewable energy (only 8.7% renewable energy in final consumption)16 is higher and increases this overall SDG exposure value.

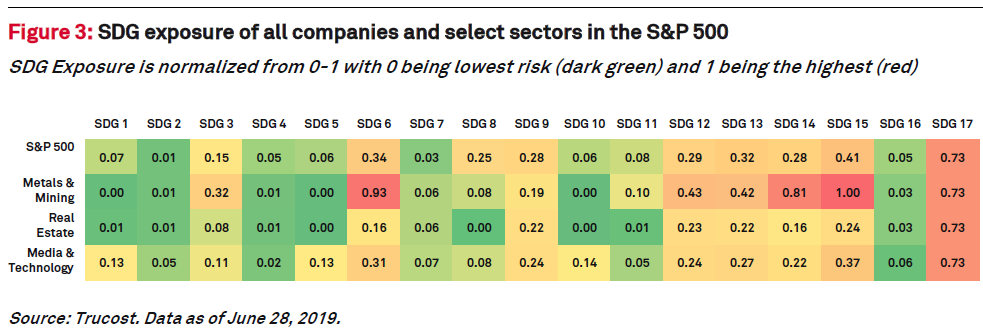

Largest Exposure for Select Sectors

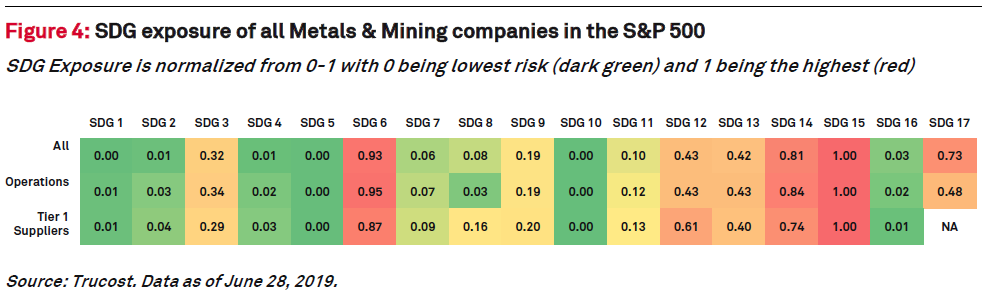

Select sectors, including Metals and Mining, Technology and Media and Real Estate, were investigated to explore the differences of SDG Exposure by industry. While SDG 17 is still high among all sectors, Metals & Mining contains the highest relative exposure associated with SDGs 15: Life on Land, 6: Clean Water and Sanitation, and 14: Life Below Water.

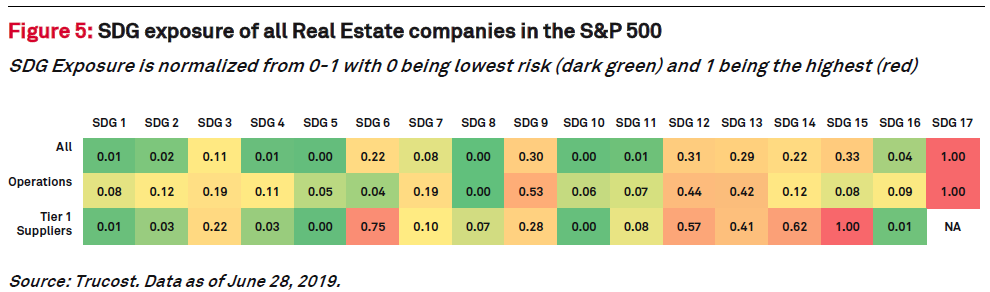

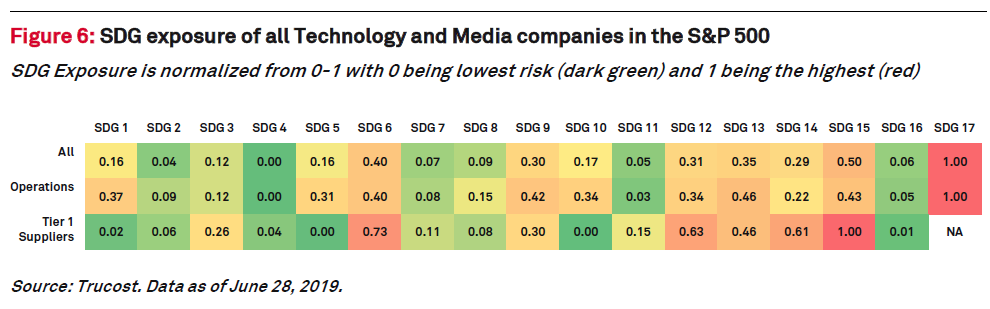

Real Estate and Media and Technology also have exposure related to these SDGs, likely related to construction activities and the manufacturing of technology hardware, but their exposure is considerably lower than that of Mining and Metals. Notably, Media and Technology appears to have a higher exposure related to SDG 5: Gender Equality, potentially highlighting a larger presence of gender pay gaps for companies within this sector (figure 3).

The value chain view of SDG exposure for Mining & Metals companies shows less variation among value chain stages, which reflects the intensive activity of the industry in both operations and among Tier 1 suppliers (figure 4).

Meanwhile, Real Estate and Technology have larger exposures of particular SDGs (6: Clean Water and Sanitation, 12: Responsible Consumption and Production, 14: Life Below Water, 15: Life on Land) among their Tier 1 suppliers than in operations, suggesting intensive activities such as manufacturing and extraction predominantly occur in the supply chain (figures 5 and 6).

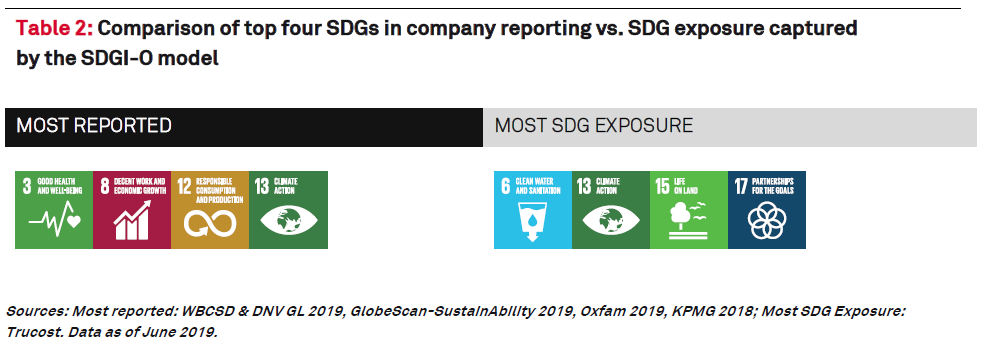

Differences in Companies’ Reporting and their Greatest SDG Exposure

Interest in reporting on the SDGs has been rising in recent years;17 however, challenges remain in utilizing information on the SDGs in business and investment decisions. Most companies do not address all SDGs in their reporting, often choosing to prioritize effort on the SDGs that are most relevant to their business or disclose only on the positive impacts they contribute to the SDGs. The Trucost SDGI-O model provides a data-driven, quantitative estimation of which SDGs may need the most prioritization from companies and where along the value chain this exposure is most prevalent.

When comparing the top SDGs reported from companies, based on surveys in the past two years and with results from analysis of SDG exposure of the S&P 500, the strongest divergence is with SDG 17: Partnership for the Goals. While often the least reported within company disclosure, the analysis of the S&P 500 found this SDG to have the highest exposure due to the level of financial secrecy and lack of fair share taxation in the geographies where these companies conduct business. Companies may also not regularly associate SDG 17 with issues related to taxation.

Another divergence is the lack of SDG 8: Decent Work and Economic Growth as a high SDG exposure in the S&P 500. The indicators underlying this SDG in the SDGI-O model are important aspects of business operations, including upholding strong labor rights, enabling freedom of association, avoiding the use of forced labor and limiting workplace accidents. Many of the companies listed have likely implemented effective policies and procedures to limit exposure to these types of risks, in addition to operating in areas with lower exposure to these risks.

An alignment in company reporting and the S&P 500 analysis is the prioritization of SDG 13: Climate Action. Companies are increasingly disclosing data, with more than 2,500 companies worldwide providing climate change responses, a 31% increase from 2017 and a 70% increase in the APAC region alone.18 Continued action to significantly limit emissions and increase resiliency of business operations will be important in order to lower current temperature trajectories of 4⁰C of warming above pre-industrial levels19 to a safer, but still challenging, 2⁰C by 2050.

According to the S&P 500 analysis, SDG 15: Life on Land has a greater SDG exposure than those SDGs related to climate, water or unethical labor practices, but is often the least reported on by companies. Issues related to biodiversity, natural land loss and deforestation are accelerating at unprecedented rates. A recent IPBES report stated that over 1 million of the world’s 8 million species are currently threatened with extinction due to changes in land and sea use by humans, direct exploitation, climate change, pollution and the spread of invasive species.20 The report also states that the SDGs cannot be met by current trajectories and these negative trends will undermine progress towards 80% of the other SDGs, including those related to poverty, hunger, health, water, cities and climate. Decreasing pollution, avoiding deforestation and remediating and reforesting altered land may become an additional imperative for the private sector.

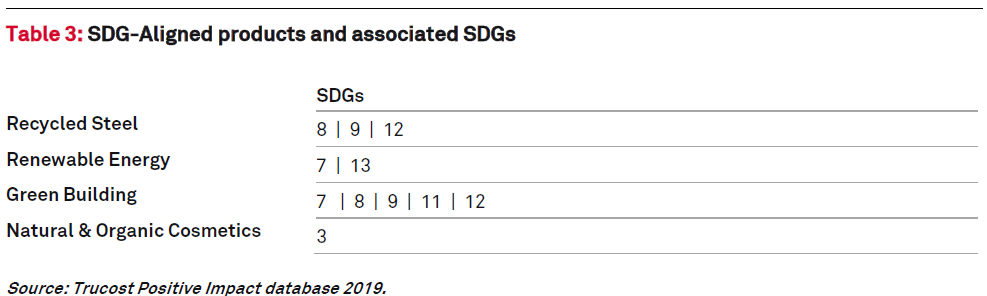

SDG-Aligned Products: Route for Business Growth

It is useful for companies to be aware of the risks across their operations and value chains that relate to the SDGs. By identifying these risks, business can prioritize action, mitigate these risks and benchmark performance over time. Companies can also contribute to the SDGs through the sale of SDG-aligned products and services.21

There may be business opportunities by serving the needs of the SDGs. Analysis from a cohort of 13 companies who underwent a Trucost SDG Evaluation revealed these participants were already capturing over $232.98 billion in revenue, or 87% of overall revenue, from SDG-aligned products, services and technologies. Growth in green and sustainability-oriented products has risen steadily in past years and is projected to continue. While companies can aim to mitigate the majority of their impact, ultimately businesses need to generate revenue streams that contribute to sustainable outcomes.

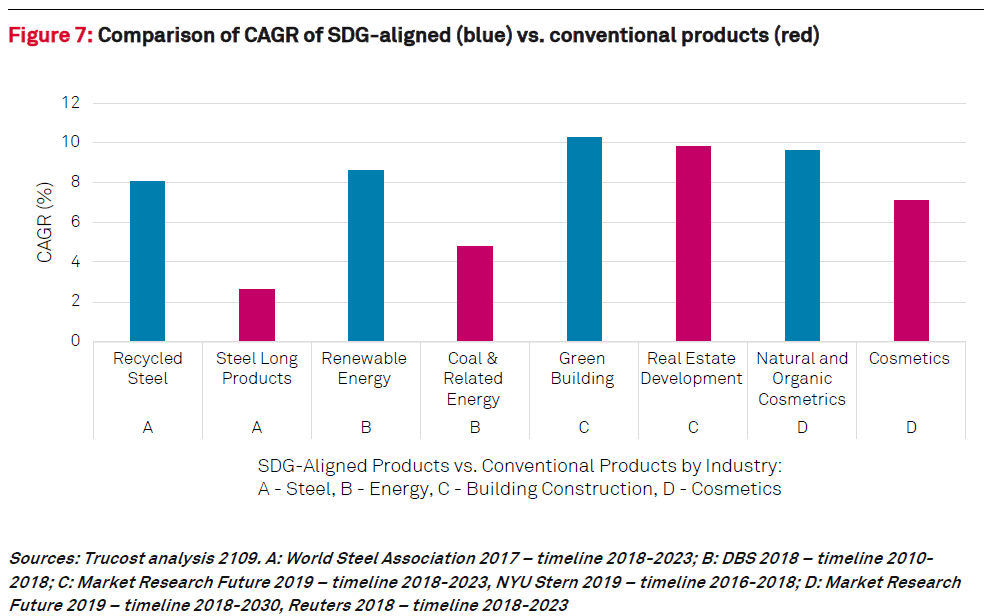

A brief comparison of the compound annual growth rates (CAGR) of SDG-aligned products versus conventional products in the same industry shows the potential for pursuing innovation and market opportunities in line with the SDGs.

The SDGs were launched as a blueprint for a more just, sustainable and prosperous future. The private sector has begun to understand its role in contributing to their attainment, as seen by increasing rates in corporate disclosure on the SDGs. Investors are also increasingly interested in benchmarking the performance of companies on the SDGs, and different mechanisms to compare and rank companies are emerging in the form of indexes, benchmarks and, in the case of the World Benchmarking Alliance, league tables.

Capital allocation in line with SDG priorities is also on the rise with the emergence of SDG Bond issuances by major banks and institutions and pension funds proactively allocating funds towards sustainable development prerogatives. The SDGs are a way to communicate a company’s efforts and businesses can provide informed reporting to potentially attract capital allocation and unlock innovation opportunities.

There is a divergence, however, in what SDGs report on and deem the highest priority versus those SDGs where companies have the highest exposure. An analysis of the baseline risk exposure of companies listed on the S&P 500 shows that issues related to financial secrecy (SDG 17), land pollution and deforestation (SDG 15) and water overconsumption and pollution (SDG 6) have the highest level of exposure. These topline SDGs differ significantly from the most common SDGs that are included and prioritized in current company disclosures. There is a difference in what companies disclose on the SDGs versus what may be important SDG-related risks and responsibilities.

Pursuing data-driven analysis for understanding the full impact of a business across its value chain can be useful in understanding where to minimize risks and maximize both SDG and financial returns. Leveraging the SDGs as not only a framework for sustainable development but also for innovation towards generating new, more future-ready revenue streams can help identify business opportunities that simultaneously serve the needs of the SDGs.

Download to read the full report.

Content Type

Theme

Language