Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Lower- and lower-middle-income economies risk losing 12% of GDP to hazards such as storms, but investing up to 0.6% of GDP in adaptation will have high returns.

Published: January 10, 2024

By Marion Amiot and Paul Munday, Ph.D.

Highlights

The prospect of reaching net-zero by 2050 is fading, while the potential losses associated with climate change rise. Lower- and lower-middle-income economies risk losing 12% of their GDP to physical hazards, such as storms, floods and heat waves, by 2050 under a slow transition scenario if they do not adapt.

Investing the necessary 0.6% to 1% of GDP annually in adaptation is likely to have high returns in the face of rising climate-related losses, absent adaptation measures. But institutional and macropolitical volatility are barriers to investment in lower- and lower-middle-income countries.

International collaboration and a combination of public and private capital will be required to make the transition affordable globally, although increasing geopolitical fragmentation will make this more difficult.

Climate mitigation is the best form of adaptation in the longer term. A quicker transition to net-zero will help avoid the worst-case scenarios of global warming, reducing the need to adapt. The prospects of net-zero by 2050 are fading, however, and there is increasing evidence that more warming will be associated with rising potential economic losses globally.

Physical climate hazards increasingly affect economic activity and destroy capital. Chronic and acute physical risks reduce productivity, result in higher mortality rates and cause capital destruction. Lower- and lower-middle-income countries, often located in warmer climates, are more vulnerable to these shocks and are unprepared due to their economic structure, access to fewer resources and institutional weakness. Spillover effects of physical climate risks from one country to another, in the form of compounding or cascading events (when climate hazards compound with each other or with socioeconomic weakness and changes), are also increasingly likely.

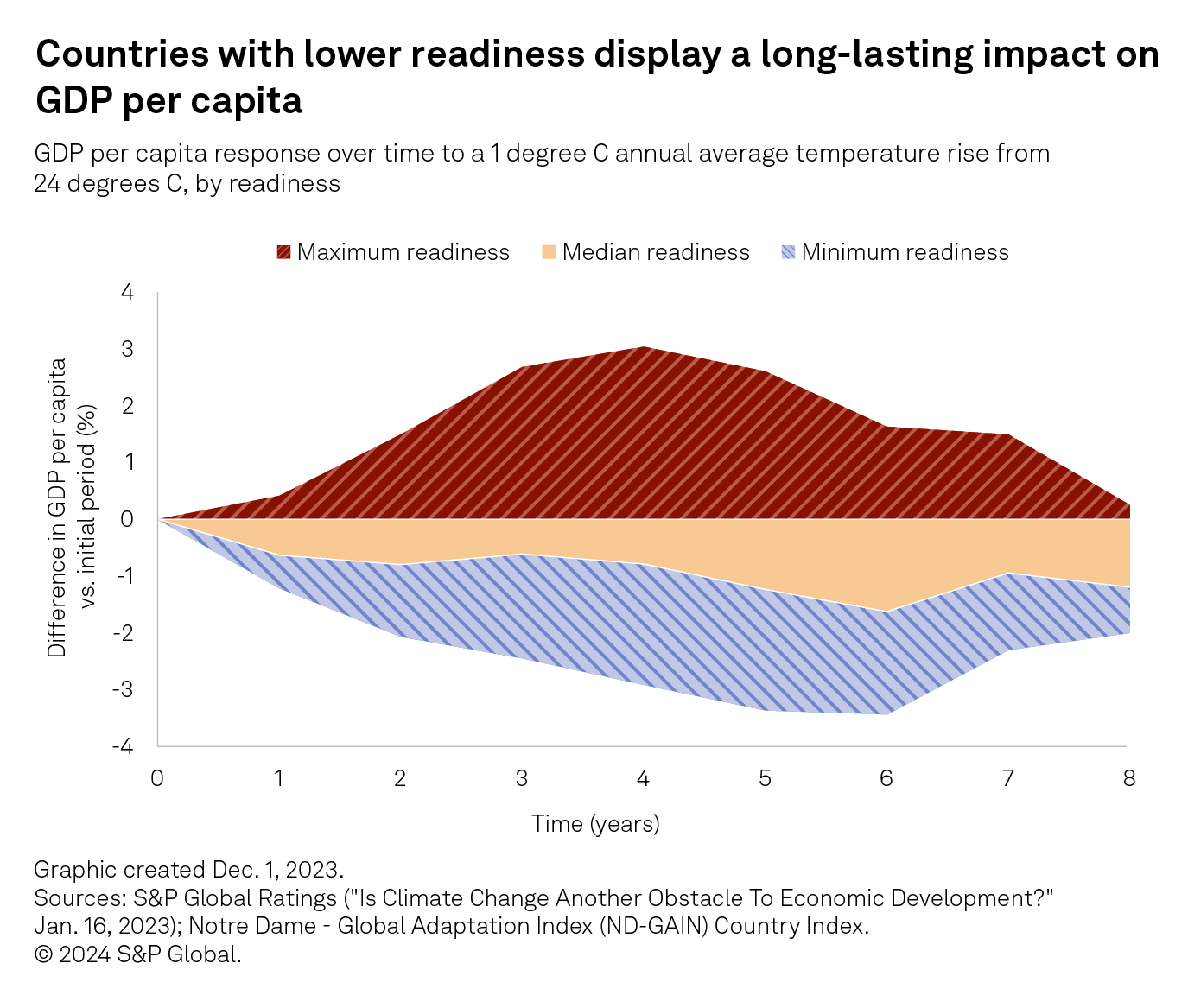

Adaptation is key to avoiding short- and long-lasting negative impacts on GDP. When readiness to adapt is high, temperature increases have no long-lasting impact on GDP per capita, even in warmer climates (see chart). However, scaling adaptation finance in the countries most impacted by droughts, extreme heat, storms, flooding and wildfires is challenging, as those countries often have less access to capital markets.

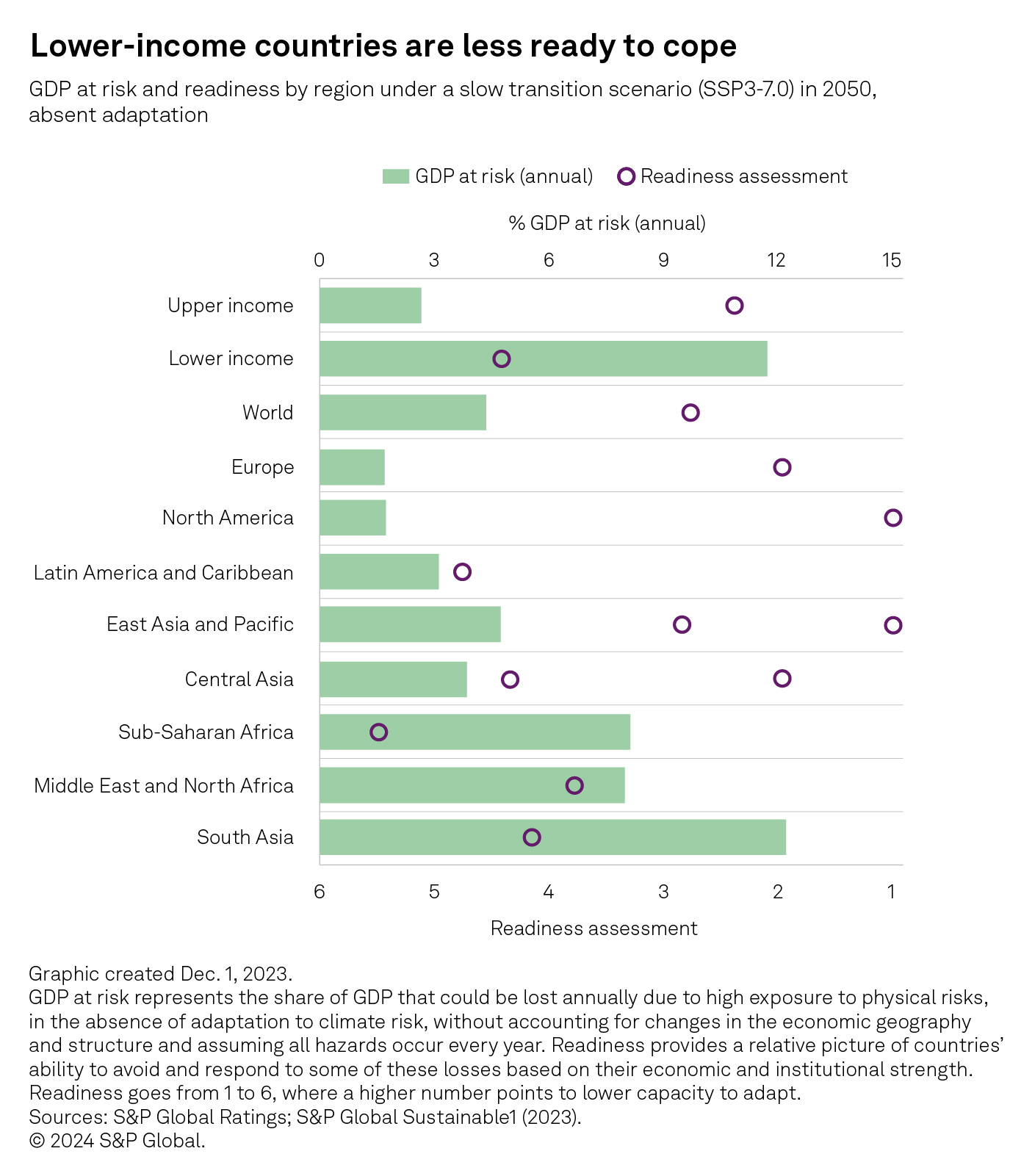

Rising losses from physical risks are increasingly likely with time, particularly if mitigation and adaptation efforts are not increased. Without adaptation, between 3.2% and 5.1% of world GDP could be wiped out by climate hazards annually by 2050 under a range of climate scenarios, according to a recent study by S&P Global Ratings. Considering global GDP obscures significant variability across income, region and hazard (see chart).

Regional differences in potential losses are stark. Under a slow transition scenario, approximately 12% of South Asia’s GDP could be lost annually by 2050 without adaptation. This potential economic loss is three times more than the world average. Sub-Saharan Africa and the Middle East and North Africa follow with roughly 8% of GDP at risk, while Europe and North America tend to be less exposed with about 2% of GDP at risk. These estimates represent the annual share of GDP that could be lost due to high exposure to physical risks, in the absence of adaptation to climate risk. They do not account for changes in economic geography and structure and assume all hazards occur annually.

Lower- and lower-middle-income economies are more exposed, suggesting that they need greater relative amounts of investment to build resilience. These countries already face higher average temperatures and more climate extremes than their developed peers, and as temperatures rise, they have a larger share of physical risk-related damages. We estimate that about 12% of GDP of lower- and lower-middle-income countries is at risk of climate hazard-related losses annually by 2050 under a slow transition scenario. This is 4.4 times greater than their wealthier peers.

When expressed as a proportion of countries’ GDP, adaptation costs are much greater for lower-income countries (about 3.5% per year) than for lower-middle (0.7%) or upper-middle (0.5%) income countries, according to the UN Environment Programme. Investments are likely to become increasingly important as the impacts of climate change become more extreme, both in terms of intensity and frequency, with some risks becoming hard to adapt to entirely.

Less developed economies already face relatively more losses from climate hazards. More developed countries are better placed to soften the impact of physical risks and recover, given their greater financial means and stronger institutions. This explains why current economic losses from physical risks can appear relatively low in some, typically more developed, economies, even though exposure to physical risks is high or GDP at risk is significant.

Reduced long-term visibility, less developed infrastructure and weaker social safety nets, along with lower capabilities to carry out some long-term projects, all weigh on countries’ ability to adapt to risks in general, while less flexible labor and product markets make it harder to prepare or relocate production after a shock. Our assessment of readiness to cope with climate hazards shows that the regions with greater GDP at risk will have a harder time coping (see chart).

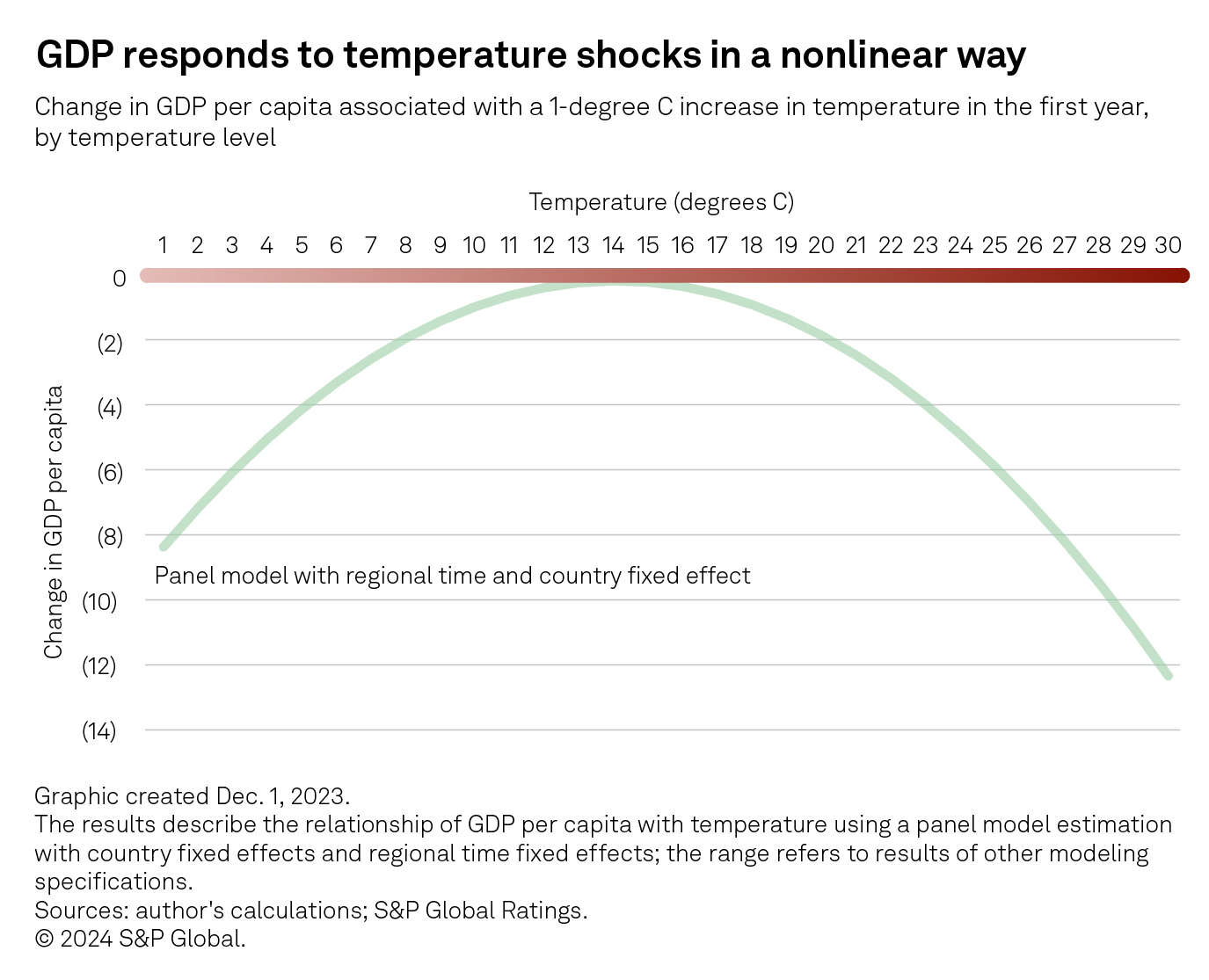

The impact of climate change is already nonlinear — the marginal increase in temperature is more detrimental as it gets hotter (see chart) — but could become increasingly so as climate hazards compound one another’s effects within and across countries. Physical risks can also add to ongoing economic weakness or be a source of systemic stress when interdependencies are high. For example, an increased likelihood of simultaneous crop failure in global breadbaskets could have a larger impact on global food security and prices, also affecting consumers in countries not exposed to those risks.

Lower- and lower-middle-income countries have less access to financial markets and borrow at a higher cost. Financing debt in these countries poses greater credit risk for investors, as higher macroeconomic and policy volatility increase uncertainty. In 2023, less than 9% of green bonds were issued outside developed economies. Although rising, climate finance to developing countries totaled $89 billion in 2021, according to the Organisation for Economic Co-operation and Development, or 0.03% of global debt. Most of that finance goes to mitigation, leaving adaptation funding relatively tiny.

The gap between existing climate adaptation finance and the investment need is big and likely to grow in the short term as financing conditions tighten and growth slows. The Intergovernmental Panel on Climate Change estimates that limiting global warming to 2 degrees C by 2050 will require $3 trillion each year in investment for climate adaptation and energy transition infrastructure. However, higher borrowing costs and other growth priorities are likely to push climate change down the list. According to the United Nations, the adaptation finance gap is already 10-18 times above current international flows. Estimated annual adaptation needs range from $215 billion to $387 billion per year, or 0.6%-1.0% of developing countries’ GDP, for this decade alone. Meeting adaptation needs likely has high returns in developing countries.

Despite this, it is difficult for developing countries to attract investors. Mobilizing sufficient resources to unleash multiplier effects would likely depend on partnerships between the public and private sectors as well as between private investors and international institutions, such as multilateral banks. Some investments will provide sufficient immediate and direct financial returns to make them profitable for private investors. An increase in insurance coverage could also help households buffer the costs of physical risks when they occur, where social safety nets are not very large.

Investments that fall in the public good category, such as education or infrastructure, may not offer enough financial returns for private investors. Many investments for adaptation or for addressing physical risk, which are socially profitable for the country, would depend upon public funding. Governments may partner with multilateral lending institutions and the private sector to obtain more funding, share the risks and lower the risk premium to attract more private capital inflows into less developed economies. Other international mechanisms could emerge to transfer resources to fund impactful projects in developing countries. The voluntary carbon market has also been flagged as a source of potential revenue for lower- and lower-middle-income countries that could help fill the adaptation funding gap.

Joydeep Mukherji

Sector Lead,

Sovereign Ratings, Americas,

S&P Global Ratings

joydeep.mukherji@spglobal.com

Joydeep Mukherji

Sector Lead,

Sovereign Ratings, Americas,

S&P Global Ratings

joydeep.mukherji@spglobal.com

Next Article:

The multidimensional path to net-zero

This article was authored by a cross-section of representatives from S&P Global and in certain circumstances external guest authors. The views expressed are those of the authors and do not necessarily reflect the views or positions of any entities they represent and are not necessarily reflected in the products and services those entities offer. This research is a publication of S&P Global and does not comment on current or future credit ratings or credit rating methodologies.

Content Type

Language