Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

By Charles Chang, Diego Ocampo, Claire Yuan, Annie Ao, Stephen Chan, and Avery Chen

Highlights

China's global reach is growing behind minerals critical to a wide range of products that will shape the future.

Firms from upstream to downstream, from miners to makers of batteries and electric vehicles are jumping in this race across emerging markets.

The Chinese government is likely to take more actions in the sector, which will raise the country’s influence in these minerals and the industries that rely on them.

China’s reach is quietly growing behind minerals critical to a wide range of products that will shape the future. Facing more restrictive foreign investment policies in developed markets, Chinese firms are pursuing such key minerals as lithium and cobalt in other locations. S&P Global believes China will continue to build its influence over these minerals and the industries that rely on them as it works with governments keen on foreign investments across the developing world.

Chinese firms from upstream to downstream, from miners to battery-makers to electric vehicle (EV) manufacturers, are jumping into this race. Whether related to top-line growth, cost control, supply security, or backward integration, their motivations are compelling and are likely to last beyond temporary dips in these minerals’ prices.

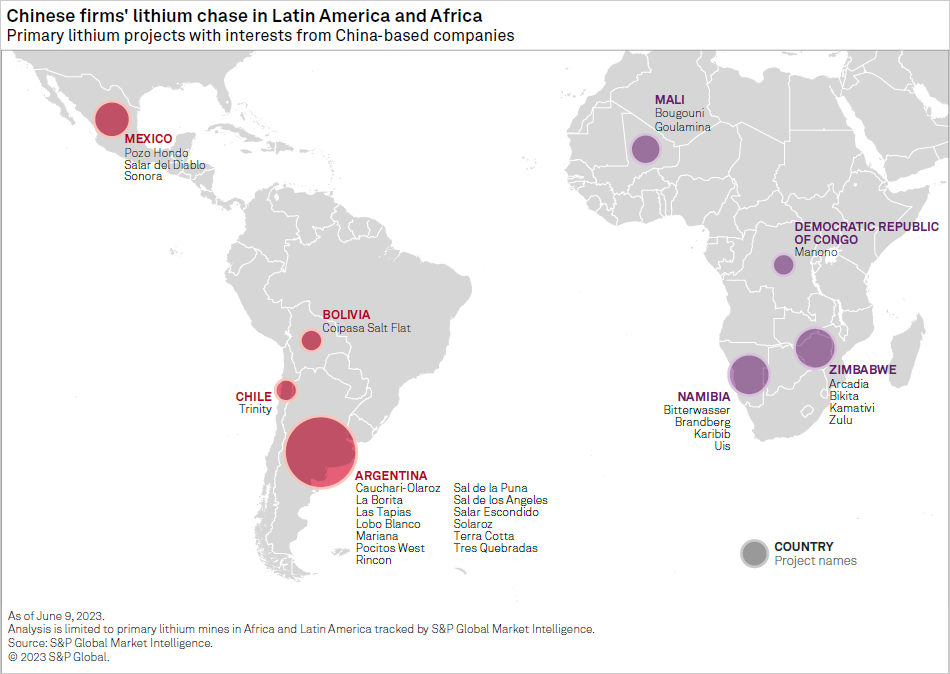

Although many countries are increasingly aware of these minerals’ importance, Chinese firms have been the most active in these pursuits. Emerging markets across Africa and Latin America are their next stops. While these ventures may bring benefits, they may also raise investment and execution risks for related sectors as more firms enter these new markets.

Heeding urgings from the industry, the Chinese government is likely to take more supportive actions, as it views these sectors as integral to the country’s core strategy. This alignment of interest will facilitate the development of China’s influence over these minerals and the industries that rely on them as more Chinese firms secure access and expand production capacity.

With the country’s dominant position in rare earth minerals firmly in place, Chinese firms are chasing the next critical mineral: lithium. Lithium is a key raw material needed for a wide range of industries crucial to the future, including mobile phones, EVs, renewable power and supercomputing.

The United Nations has called lithium-ion batteries the “critical pillar in a fossil fuelfree economy.” The US Energy Department has also identified lithium as a material “essential to the economic or national security of the United States.”

Despite that label, Chinese, not US, firms have been more active in lithium M&A. Acquisitions of lithium assets by China’s mining majors and lithium producers have gained pace since 2021 (Table 1), when lithium prices started to escalate. Although demand from downstream EV markets has softened recently on slowing global growth, we expect interest in these minerals to persist and acquisitions to continue as firms across related industries grapple with supply security and cost volatility.

Lithium producers such as Ganfeng Lithium Co. Ltd. and Tianqi Lithium Corp. are trying to secure upstream raw materials for the production expansion of their core business. Meanwhile, metal miners such as Zijin Mining Group Co. Ltd. are entering the lithium chase to diversify their exposure and to benefit from the mineral’s growth potential.

In addition to lithium, nickel and cobalt are also attracting investments from both Chinese upstream and midstream firms. However, these deals are smaller and are mostly in Indonesia and Australia. Lygend Resources & Technology Co. Ltd., Zhejiang Huayou Cobalt Co. Ltd. and Tsingshan Holdings Group, for example, have been setting up nickel smelters in Indonesia.

Most of these M&As were funded by internally generated cash. Large upstream miners have healthy operating cashflows, thanks to the recent commodity upcycle. Some midstream firms have also raised funds from equity markets, such as the IPOs of Lygend and Tianqi in 2022. Although these funding channels reduce the risk of excessive debt-funded ventures, investment risks remain. Past experience of overseas chase for coal and other energy resources have left some Chinese firms (e.g. CITIC Ltd.) with sizable losses. Such risks will require close monitoring, along with any benefits these projects may bring.

The vertical integration of Chinese battery-makers into the upstream mining sector is closely related to the pace of vehicle electrification in China and raw material price movement.

Before 2021, when the EV penetration rate in China was still low at about 5%, the supply and demand for both battery and raw materials were largely balanced. Battery-makers made small upstream investments by acquiring minority stakes in miners to strengthen their relationships and secure stable supply.

Wider product offerings, more widely available charging infrastructure and improving battery technology led to rising acceptance of EVs. Battery installations grew nearly fivefold in 2022 from the level in 2020, while EV penetration rates in the country rose to 15% in 2021 and 27% in 2022.

The robust demand, plus severe production disruptions during the COVID-19 pandemic, drove prices of major raw materials (e.g., lithium, nickel, cobalt) to skyrocket. From the beginning of 2021 to the end of 2022, the cost of lithium carbonate escalated by at least tenfold. This exerted material margin pressures on the battery producers (Chart 1), as raw materials contribute to 60%-70% of the total cost of battery cell manufacturing.

These cost pressures are exacerbated by intensifying competition in the battery market, which has limited the ability of battery players to fully pass through incremental costs to auto original equipment manufacturers (OEMs).

As a result, battery-makers’ profitability has deteriorated notably since 2021. For example, the reported EBITDA margins of Contemporary Amperex Technology Co. Ltd. (CATL), the world’s largest EV- battery maker, dropped to 12.4% in 2022 from 17% in 2021 and 20% in 2020.

In light of the significant supply shortages and surge in material costs in the last two years, more battery-makers are trying to manage costs by establishing stronger ties with upstream players not just at home, but also abroad (Table 2).

Battery-makers’ preferred approach includes acquiring minority interests in mining assets or forming mining and refinery joint ventures (JVs), especially in lithium. Such acquisitions and JVs can give battery-makers direct access to raw materials and secure stable upstream supplies, which is especially important during volatile market conditions.

Apart from lithium, battery-makers have also invested in other raw materials, such as cobalt and ferric phosphate, among others. Indonesia has banned nickel ore export since 2020. Facing surging demand for nickel amid accelerating EV penetration, Chinese battery players such as CATL, Sunwoda Electronic Co. Ltd. and EVE Energy Co. Ltd. have formed JVs with nickel miners and refinery businesses in Indonesia.

Because surging costs motivated much of this investment, battery suppliers may slow their upstream expansion as input costs moderate and raw material supply normalizes. The price of lithium carbonate has declined by nearly half in the first half of 2023 on easing supply shortage and an anticipated slowdown in Chinese EV market growth (Chart 2a).

Prices of other key inputs for EVs such as nickel and cobalt sulfates are also moderating for similar reasons (Chart 2b). To avoid excess spending and asset impairments, battery-makers will likely become more cautious and selective in upstream expansions should these pricing trends persist.

That said, with tight supply and highly volatile prices, raising self-sufficiency upstream should help battery-makers control costs and avoid operational disruptions. Moreover, as mining enjoys higher margins than battery manufacturing (gross margins of about 50% or above vs. roughly 20%), upstream expansion may help support battery-makers’ profitability.

The ninefold surge in lithium prices between 2021 and 2022 only underscores this need. These factors will continue to drive appetite for upstream assets, especially if critical mineral prices stabilize or rise further in line with our expectations (Chart 3).

Chinese auto OEMs, especially those pursuing rapid electrification, face heavy spending needs for capital expenditures and research and development. Together with investments in autonomous driving, these outlays have weighed on their balance sheets, leaving limited room for additional investments.

In particular, firms with low EV penetration and slower progress on electrification tend to prioritize increasing product competitiveness and ramping up sales volume. For such firms, securing raw materials is often of secondary importance.

Yet, more auto OEMs are venturing upstream as part of a backward integration push that led them to develop in-house battery technologies. This trend is observable across some of the industry’s largest players, including BYD Co. Ltd. (BYD), Guangzhou Automobile Group Co. Ltd. (GAC), Great Wall Motor Co. Ltd. (Great Wall) and NIO Inc. (NIO) (Table 3).

These firms have been acquiring minority stakes or setting up JVs with lithium miners and refiners (Table 3). These investments initially focused on China, close to their battery production base, but more firms are venturing overseas. For example, BYD is negotiating with the Indonesian government to establish local battery production facilities leveraging the country’s nickel resources.

These upstream investments are generally small in scale, likely funded by internally generated cash flows or bank borrowings. They allow carmakers to establish strategic ties with miners without incurring heavy outlays. This measured approach is important, as carmakers must balance substantial funding needs for EV transition and battery technology development.

Through backward integration, carmakers can strengthen control over their supply chains. This helps improve cost management and margin protection and provides for more secure raw materials and components supply. That raw materials account for 60%-70% of battery production costs only makes these efforts more critical.

The benefits of this strategy have been demonstrated by BYD, which has been more aggressive in upstream expansion (Table 4). Being a pure EV producer, the company was more exposed to lithium prices than traditional OEMs. Yet, it managed to maintain the gross margins of its auto segment (including batteries) at 20.4% in 2022 despite a doubling of lithium carbonate prices in that year.

Upstream spending may slow in 2023 as decelerating EV momentum and intensifying price competition pressure auto OEMs’ margins and cash flows at home. That said, BYD’s upstream progress may continue to encourage more investments by other Chinese OEMs over time, directly or via JVs, especially if such projects deliver meaningful benefits.

So far, most auto OEMs that have ventured upstream have small investments that remain under development. EV startups, which have been loss-making in the past few years, may not be keen to pursue similar expansions. Cash-rich OEMs, however, may take advantage of the downturn to acquire more assets at better prices. The balance between operating and margin benefits versus investment and execution risks will continue to be an area that requires close monitoring.

Australia was initially the obvious destination for lithium seekers. The country produced 363,309 metric tons (Mt) of lithium carbonate equivalent (LCE) in 2022, accounting for 47% of global lithium raw material supplies. Chile was a distant second at 203,087 Mt LCE (26%) (Chart 4).

While Australia is expected to remain the largest lithium-supplying country, challenges on the ground have increased due to more restrictive foreign investment policies.

In February, Yuxiao Fund failed to win approval of its application to the Foreign Investment Review Board (FIRB) to raise its stake in rare earth miner Northern Minerals Ltd., on the grounds of “national interest.”

Tianqi Lithium scrapped a A$136 million bid to acquire the Australia-listed Essential Metals Ltd. in April 2023. Tianqi failed to gain the support of the majority of Essential’s shareholders, and the deal raised concerns about whether it could win approval from the FIRB.

Chinese firms are facing similar challenges in Canada — not just for future projects, but also for existing investments.

In October 2022, Canada introduced new rules under the Investment Canada Act to govern foreign investment in the country’s critical minerals sector. Given this, certain “significant transactions” by foreign state-owned enterprises (SOE) in the sector will be approved only on an “exceptional basis.” Cases that followed show that the application of these new rules may lead to orders to divest existing investments, which substantially raises the financial risks for affected firms.

Chinese firms are starting to look for critical minerals elsewhere amid stricter foreign investment policies in developed markets. The alternative destinations, however, are limited, as reserves are concentrated among a small number of emerging markets. These markets could raise execution and regulatory risks for new entrants, particularly if local authorities ask for bigger shares of the economic benefits of their natural resources.

Despite these challenges, Zijin Mining Chairman Chen Jinghe said in March 2023 that the company will continue to make more investments at home as well as abroad. In 2022, Zijin bought controlling interests in two projects in China and completed the acquisition of Tres Quebradas in Argentina.

Other Chinese firms are doing the same. Ganfeng is expanding its footprint in Argentina, China, Mali and Mexico. BYD is looking to invest in lithium projects in Chile, Argentina and Africa. CATL is leading a consortium to invest US$1.4 billion in Bolivia to build lithium extraction plants. Aside from industry giants, private interests are also joining the chase. In Africa, for example, many such parties have acquired interests across key projects (Table 5, Table 6).

In Africa, “China has recently moved quickly to secure mining assets, often in conjunction with infrastructure development projects,” noted Len Kolff, interim CEO of Atlantic Lithium Ltd. Although this race has just begun on the continent, other countries may already be too late. In July 2022, a British Geographic Society report pointed out that China controls most of the lithium offtake agreements in Africa.

In Latin America, more governments are starting to take action in the sector. Mexico has nationalized its lithium industry under a presidential decree that established a state-owned lithium company. Chile is also planning to nationalize its lithium reserves, putting a freeze on new foreign investment. Meanwhile, total cash costs for lithium mining in the country almost doubled in 2022 because of the government’s lifting of royalty payments.

Other key Latin American markets, however, may remain less restrictive. These include two of the three countries that make up the “Lithium Triangle” — Chile, Bolivia and Argentina — which together account for nearly 60% of the world’s reserves as of 2021.

Bolivia may require more time for entry, as the country has yet to start commercial lithium operations due to political uncertainties and a lack of technical know-how. Yet despite these risks, CATL is leading a consortium that will invest US$1.4 billion in infrastructure in the country, aiming to produce 25,000 Mt of battery-grade lithium carbonate per annum (tpa).

By comparison, Argentina has a more developed mining industry and has become the leading destination in the lithium race (Table 6), as it holds some of the world’s most cost-competitive lithium assets and offers more mining-friendly policies and lower royalty rates. These and other locations across Latin America will continue to attract Chinese interest as the global EV market continues to grow.

The case of Argentina perhaps best illustrates why Chinese firms have been more actively investing in certain emerging markets. Local governments in the country have been receptive to foreign investors amid an unfolding economic crisis with large fiscal deficits driving runaway inflation and a depreciating currency.

The country shows an evident need for additional mining investments. Among the world’s top lithium-producing countries, it shows the most apparent disparity between production and reserve levels (Chart 5). The missing ingredient? Additional investments.

Argentina’s lithium reserves are in the deserts of three provinces: Jujuy, Salta and Catamarca, where mining has a long history and is a key sector in the local economy.

Inward investment supports these regions’ finances and reduces their reliance on the weakening fiscal position of the central government. Associated projects also employ local expertise and skilled labor and use the existing infrastructure of the metals and mining and oil and gas industries that have been operating there for decades.

This reduces the required investments for both local authorities and foreign investors. The power usage of lithium projects is typically manageable, hence lessening the need to build more generation capacity. Also, as Argentina is already expanding its oil and gas production and transportation capacity, the new projects will not require much additional logistics investment.

These factors help reduce the financial, execution and operational risks of new lithium projects in these regions, which also offer fewer regulatory risks under the more receptive local authorities.

Chinese companies have actively invested in these regions with firms such as Ganfeng, Zijin, and others committing at least US$3 billion over the next three years (Table 7). Their projects are earmarked to enter into production as early as the second half of 2023.

Other Chinese companies such as Tsingshan Holding Group Co. Ltd., Shaanxi Coal Group and Jinyuan Co. Ltd. are investing in LCE projects. Meanwhile, companies such as Tianqi Lithium and Gotion High Tech have announced their intention to partner with local companies to produce lithium batteries and components.

With the influx of investments, Argentina’s lithium production is set to reach record levels within the next few years. The country currently has two projects in production whose combined output is set to expand sixfold (6.7x) from about 12,000 tpa in 2022 to roughly 80,000 tpa by the end of 2023.

Beyond these two projects, a long list of new lithium projects is underway (Table 7), including nearly 40 in different stages of development. Most of these projects are in the pre-feasibility or feasibility phase, but six are currently under construction and are scheduled to come online over the next few years. Based on these six projects, Argentina’s total lithium production could expand from 33,950 Mt in 2022 to 200,000 Mt to 250,000 tpa by the end of 2025.

Considering global lithium raw material supply stood at roughly 767,000 Mt in 2022 (Chart 4), Argentina’s share could triple from the then 4.6% to more than 15% by 2025.

This estimate does not take into account that most of these projects are by design expandable to two to three times their initial output.

The Chinese government is becoming increasingly cognizant of critical mineral issues as more of the country’s firms face restrictive actions abroad.

Regarding Canada’s new foreign investment rules, the foreign ministry spokesperson Zhao Lijian urged Canadian policymakers against such curbs and promised to “continue to protect the legitimate rights and interests of Chinese companies.”

Chinese firms called for support during March 2023 around the annual “two sessions” meeting of the National People’s Congress (NPC), China’s top legislative body. These calls came from the industry’s most influential leaders.

Ganfeng Lithium Chairman Li Liangbin, for example, urged Beijing to provide policy support for Chinese companies looking to invest in overseas mining resources, including establishing cooperation mechanisms for trade, investment, and technology with resource-rich countries.

Chery Automobile Co. Ltd. Chairman Yin Tongyue also called on Beijing to list battery metals lithium, nickel, and cobalt as national strategic mineral resources. He also encouraged the promotion of related development and investment in countries taking part in China’s Belt and Road Initiative, encompassing emerging markets where much of these minerals are located.

Li and Yin are both members of the NPC. Their calls echo voices from the industry urging Beijing to support not just domestic but also overseas investments in critical minerals. More such calls may come as more governments take actions in the sector, Japan being a recent example (see below).

Japan is targeting a 20% share of global battery markets by 2030, and the government is pursuing this goal with its own global chase of critical minerals.

In March 2023, a Japanese delegation of officials and 16 battery-focused firms visited Canada to discuss possible investments. In the same month, a Japanese consortium led by the government-owned Japan Organization for Metals and Energy Security, made an additional A$200 million investment to increase its stake in Australia’s Lynas Rare Earths Ltd., the largest rare earth processor outside China.

This was followed in April by Japan’s Ministry of Economy, Trade and Industry’s plan to subsidize up to half the cost of Japanese firms’ mine development and smelting projects for key minerals. The plan aims to secure the supply of raw materials needed for electric vehicle batteries and high-performance engines, including lithium, manganese, nickel, cobalt, graphite and rare earths. It will draw funds from a ¥105.8 billion fund established for this purpose by the Japan Organization for Metals and Energy Security.

The global chase for more control over critical minerals will raise China’s influence over industries that rely on these minerals as inputs. This reach may deepen and broaden as Chinese firms build sizable market positions as owners, producers, or offtakers.

This phenomenon is the most striking in rare earths. Bolstered by government help in the ‘80s, Chinese firms gained a dominant upstream position in the ‘90s (Chart 6) and leveraged it to develop similar positions downstream, noted the Center for Strategic and International Studies in Washington, DC. This has led the country to now account for roughly 60% of rare earths mining, 91% of refining, and 94% of magnet production, according to the Center for European Policy Studies in Brussels. Such figures and studies have driven, and will continue to drive, policy actions from the US and Europe.

Another example is unfolding in the nickel market. China’s “going out” strategy under the Belt and Road Initiative and Indonesia’s nickel ore export ban in 2020 have prompted Chinese firms to pour billions of dollars into Indonesia’s nickel supply chain in recent years.

These investments include some of the biggest industrial parks in the country, such as Tsingshan Holdings Group’s Indonesia Morowali Industrial Park and Weda Bay Industrial Park. As a result, Indonesia has become the world’s largest nickel producer and will account for more than 40% of global primary nickel supplies in 2023 (Chart 7).

Indonesia’s expanded output will fuel further growth of China’s battery and EV industries, as China is the dominant offtaker of Indonesia’s nickel (Chart 8). Between 2017 to 2021, China accounted for 90% of Indonesia’s nickel exports. In 2022, that percentage rose to 97%.

With increasing government involvement in lithium and other critical minerals across developed and emerging markets, the Chinese government may also take more direct actions in related industries. Although its objectives and approach remain unclear, its past actions in natural resource sectors ranged from providing financing support and funding access to setting up state-owned firms to facilitate or undertake investments or purchases.

As recently as July 2022, Beijing established the state-owned China Mineral Resources Group to centralize iron ore purchasing and oversee the development of overseas mines. The government set up the agency to address input costs and supply security issues for the country’s steelmakers. Although China is the world’s largest steelmaker, its steel industry relies on imports to meet 80% of its iron ore needs.

China already has a wide range of policies to support EVs and renewable energy, both of which rely on lithium as a core input. The government’s highest levels have specified goals in these areas in the country’s long-term plans, and top ministries and state organs have been pushing a series of initiatives to promote these industries throughout their supply chains (see the S&P Global report “Cutting China From Supply Chains — Easy To Say, Hard To Do,” published June 1, 2022).

Securing critical mineral supplies is vital for these plans, ensuring an alignment of interest between the government and industry over the medium to long term. As the global chase continues, China is likely to heed calls from the country’s firms and look to leverage its diplomatic and economic clout to further advance its influence over these minerals.

Jenny Chan

Research Assistant

April Pascual

Senior Editor

Shirley Gil

Lead Designer

Claire Sun

Research Assistant

James Mantooth

Senior Editorial Manager

Glimmers Of Winners Emerge In Asia’s EV Push, May 15, 2023

Panelists Debate Risks And Opportunities Along The EV Value Chain, June 7, 2023

The Promise And Pitfalls Of Indonesia’s Nickel Boom, March 13, 2023

Miners benefit as Indonesia’s resource nationalism drives EV supply chain, Jan. 4, 2023

China – Mining by the numbers, 2022, Nov. 2, 2022

Geopolitical fears, soaring prices spur lithium M&A frenzy in China, June 9, 2022

Cutting China From Supply Chains — Easy To Say, Hard To Do, June 1, 2022

China mining, battery companies sweep up lithium supplies in acquisition blitz, Nov. 1, 2021

This article, by S&P Global Ratings and S&P Commodity Insights, is a thought leadership report that neither addresses views about ratings on individual entities nor is a rating action. S&P Global Ratings and S&P Commodity Insights are separate and independent divisions of S&P Global.