S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Investor Relations

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Investor Relations

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Governments around the world are racing to achieve carbon neutrality—but the path to net-zero is not without its challenges. Faith in natural gas as a bridge fuel is faltering, European oil majors are outpacing the U.S. on climate goals, and globally, investors are pressuring the mining sector to decarbonize.

Published: August 16, 2020

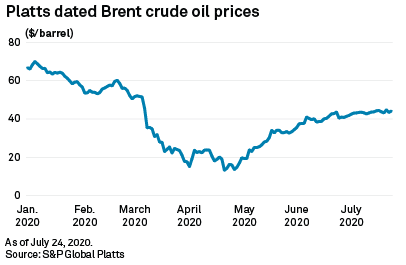

The strong and growing pressure on oil and gas companies to dramatically reconfigure their core businesses to accept a lower-carbon agenda could soon lead to irreversible changes in the energy commodity markets.

Investors and policymakers worldwide are rapidly increasing their focus on environmental, social and governance, or ESG, factors. Oil and gas companies risk losing billions of dollars in investor capital if they do not adapt. (opens in a new tab)

(opens in a new tab)

Key Takeaways

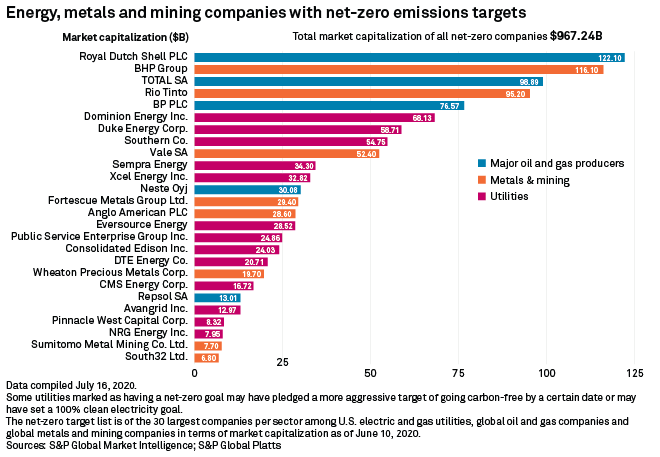

Energy and mining companies are grappling with how to respond to growing pressure from investors, local and national governments, and the public to develop decarbonization strategies.

While some of the biggest corporations in each sector have responded by setting ambitious net-zero emissions targets, not all have made the leap and decarbonization strategies vary greatly. Moreover, each sector, and even each company, faces its own set of challenges in navigating the clean energy transition.  (opens in a new tab)

(opens in a new tab)

Key Takeaways

To facilitate long term, sustainable growth, it is imperative to analyze the environmental, social and governance (ESG) performance of companies and examine how activity in the markets influences the world in which we live.

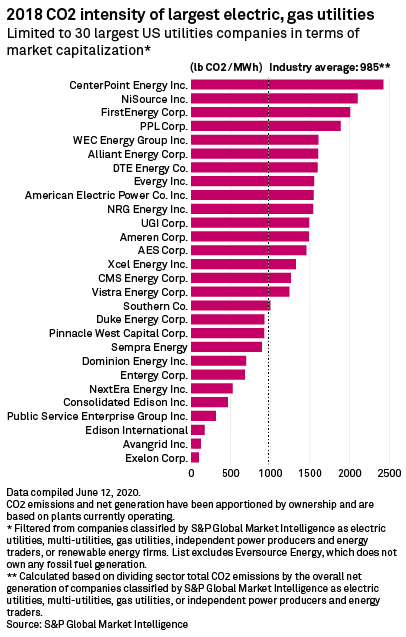

Learn more about our ESG Capabilities(opens in a new tab)Cracks are starting to show in utility support for using natural gas as a bridge fuel to a low-carbon future.

Some signs that the narrative is shifting include a recently canceled major gas pipeline project and a raft of utilities setting net-zero emissions targets amid changing customer preferences, new state mandates, and investor concerns that the recent glut of gas generation and pipeline investments could result in stranded assets.  (opens in a new tab)

(opens in a new tab)

Key Takeaways

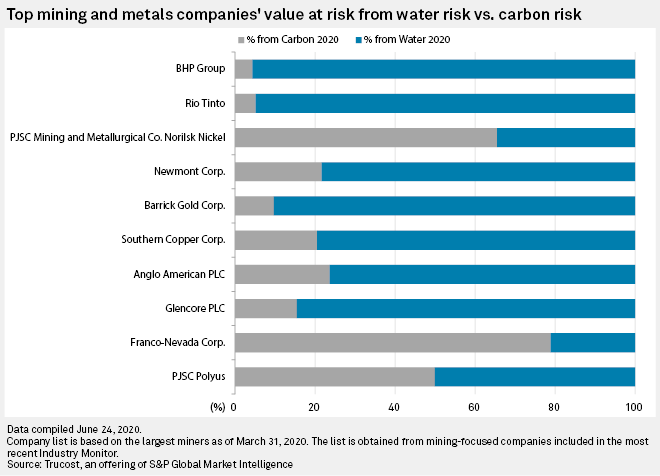

Mining companies worldwide are working to slash greenhouse gas emissions, but many of the largest have yet to align their goals with international targets to reach net-zero emissions by 2050.

Mined materials are the starting point in the supply chain for much of the global economy. Decarbonizing the sector is critical to meeting global emissions targets, particularly as a growing energy transition increases the demand for critical raw materials. While governments in places such as Europe are solidifying net-zero goals in laws and regulations, shareholders everywhere are pushing companies to take more significant action on climate change.  (opens in a new tab)

(opens in a new tab)

Key Takeaways

Subscribe to ESG InFocus, a monthly newsletter from S&P Global Market Intelligence that captures news, insights, trends, commentary into ESG developments driving change across business decisions. Additionally, stay informed on upcoming ESG related webinars, conferences and networking events.

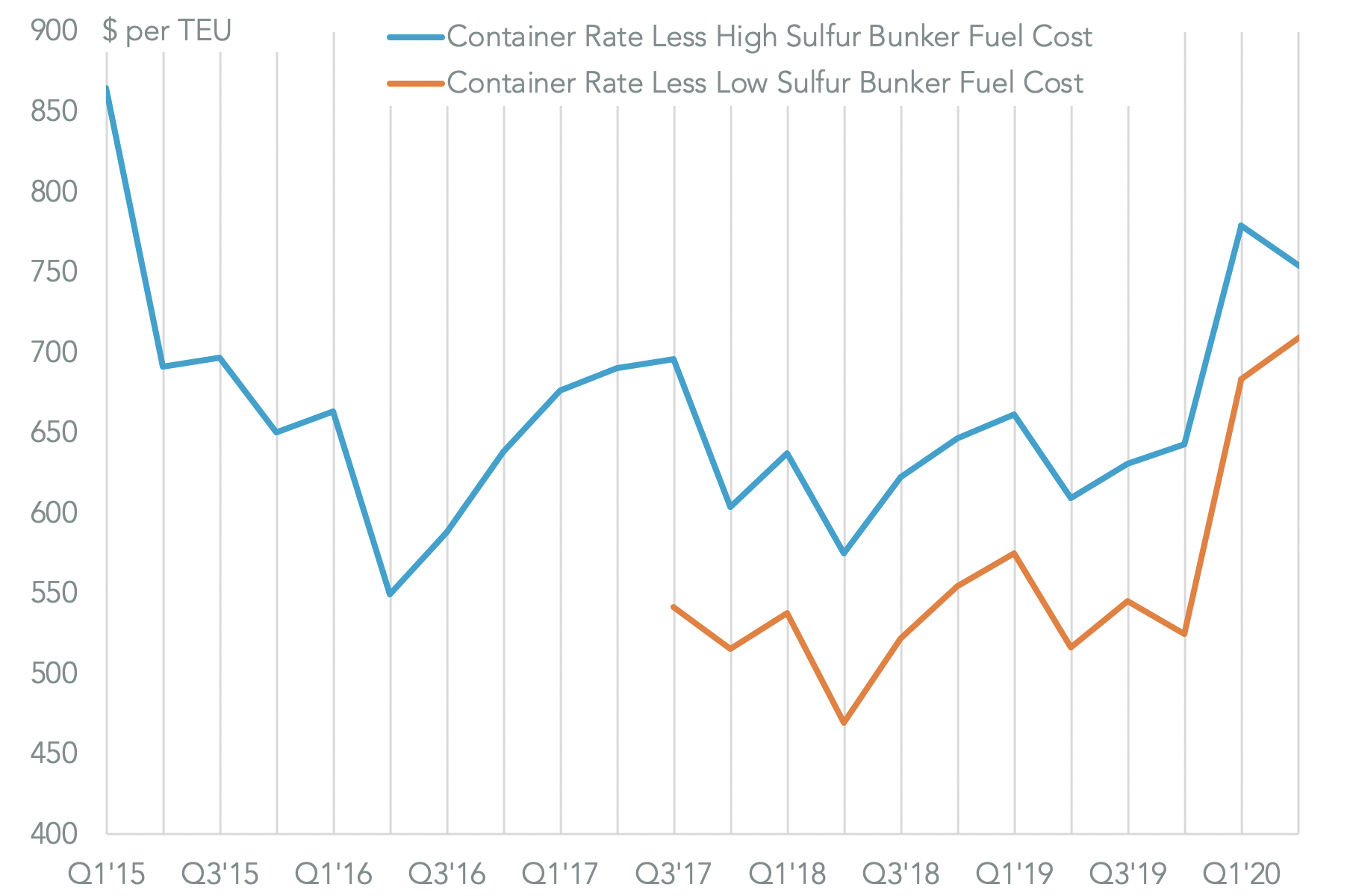

Subscribe to ESG InFocus(opens in a new tab)Container-line Maersk is one of nine founding firms in the new “Transform to Net Zero” environmental initiative to cut greenhouse gas emissions to a net zero by 2050. The group is drawn from a variety of industries and includes manufacturers as well as services firms.

A shift to reduced GHG emissions by the shipping industry has been inevitable for some time, as discussed in Panjiva’s research of Jan. 20. In the near-term the European Parliament has also voted to include shipping in the Emissions Trading Scheme.  (opens in a new tab)

(opens in a new tab)

IEA Official Says Reaching 2050 Net-Zero Emissions to Require Technology Development Acceleration

If governments and companies want to move more quickly toward net-zero emissions, progress on early stage technologies needs to be accelerated, the head of the energy technology policy division at the International Energy Agency said during a July 22 webcast.

In a recent report, Timur Gul said, the IEA presented a "faster innovation case" on how net-zero emissions could be achieved globally in 2050, "by assuming that technologies currently only in the laboratory or at the stage of small prototypes today are quickly made available for commercial investment."