Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

As political and social pressures grow to transition away from carbon intensive sources of electricity, utilities find themselves torn between the need to produce cheap power and the need to meet the challenges of a changing climate.

Published: March 2, 2020

Do you need to stay on top of environmental, social and governance (ESG) developments and consider the risks and opportunities across financial decision-making? Subscribe to ESG InFocus, a monthly newsletter from S&P Global Market Intelligence that captures news, insights, trends, commentary into ESG developments driving change across business decisions. Additionally, stay informed on upcoming ESG related webinars, conferences and networking events.

Subscribe to the NewsletterExecutives at U.S. utilities embraced the industry's pledge to more forcefully advocate for natural gas during earnings season, dedicating a significant portion of quarterly conference calls to enumerating the fuel's benefits after a year of mounting challenges.

The industry has lately acknowledged it has done too little to convey the benefits of the nation’s distribution system, allowing anti-gas sentiment to evolve into organized efforts to block pipeline projects and prohibit gas use in new buildings. In contrast, industry captains started 2020 by trying to get investors to focus on their environmental, social and corporate governance records and by making the case for natural gas.

Key Takeaways:

U.S. utilities are increasingly highlighting growing clean energy portfolios and greenhouse gas emission reductions on earnings calls to appease investor concerns within and beyond the industry.

Several utilities embracing the clean energy transition through the retirement of uneconomic coal plants in favor of cheaper renewables have a $64 billion spending opportunity on top of double-digit earnings accretion, Morgan Stanley & Co. LLC said in a recent research report.

Expanding renewables is also working in conjunction with the sector's growing number of targets to cut emissions. Additionally, the banks and investment firms providing crucial capital to these utilities are taking a harder stance on ESG issues and climate change.

Key Takeaways:

The National Association of Regulatory Utility Commissioners anticipates tensions will run high among electric utilities, state regulators and environmentalists as they try to negotiate mutually agreeable solutions to manage coal ash.

Over the next two decades, the industry will be digesting the U.S. Environmental Protection Agency's regulations on coal combustion residuals, or CCR, said Maria Seidler and Ken Malloy, two independent consultants hired by NARUC to study the EPA's recent rulemaking and its impact on U.S. public utility commissions. The consultants released a white paper on the issue ahead of NARUC's Winter Policy Summit in Washington, D.C., scheduled to run Feb. 9-12.

Regulators may find themselves between a rock and a hard place as utilities face astronomical costs in pond closures and ash removal across their coal fleet and activist organizations fight attempts to pass those compliance costs onto ratepayers, Malloy said Feb. 6.

Key Takeaways:

In July 2018, an energy lobbyist emailed three New Mexico state lawmakers to urge them not to give utility companies a free pass to recoup their investments in abandoned coal-fired power plants. Environmentalists were drafting a bill to shield utility shareholders from the cost of closing coal plants in the state, and Bruce Throne, a lawyer and, at the time, a lobbyist for power producer Southwest Generation Operating Company LLC, warned that ratepayers could pay a steep price if regulators were stripped of their authority to "balance the interests of [utility] customers and investors." Unswayed, lawmakers cleared the way for utilities to recover their coal investments by selling bonds that are paid off by ratepayers, a process known as securitization.

The fight in New Mexico over how to finance coal-plant retirements highlights one of the biggest obstacles to quickly eliminating the fuel from the U.S. power system. Over the past two years, utilities have accelerated their shift away from coal in order to take advantage of cleaner and cheaper alternatives. However, given the potential financial benefits, analysts at CreditSights questioned why utilities are not moving faster.

Of the 50 largest U.S. coal plants by generation, only about a dozen are scheduled for retirement, some a decade or more in the future, according to CreditSights. Often, millions of dollars in unrecovered investments are standing in the way. Now, environmental groups are pushing policymakers for tools like securitization to help ease utilities' concerns about the cost of shuttering coal generators early. The initiative is raising thorny questions about who should foot the bill and creating awkward alliances between environmentalists and utilities accused of blocking efforts to fight climate change.

US utilities race to slash emissions as ESG reporting takes off

The year 2019 may come to be seen as pivotal in the transformation of the US electricity sector.

A drive by dozens of US electricity utility holding companies to provide ESG reports has brought to the forefront numerous new commitments to zero carbon emission goals, and an accompanying surge in plans to install thousands of megawatts of wind and solar generation over the next few decades.

The increase in this supplemental information has brought with it a material increase in CO2 emissions reduction goals that foreshadow a major reshuffling in utility business models with dramatic implications for the US power generation mix, and a potentially large reduction over the next few decades in fossil fuel usage for generation.

Read the Full Article

Some analysts see a merger transaction as the likely path for Evergy Inc. to pursue in its strategic review with Elliott Management Corp. as the hedge fund pushes to boost shareholder value at the midwestern utility.

Evergy and Elliott on March 2 announced an agreement to improve the utility's value proposition two months after the hedge fund pressured the company to abandon its share buyback program and consider alternative business plans. Options include a merger transaction and "standalone operating plan and strategy" to "unlock" up to $5 billion in value at Evergy.

Listen: The Leading Edge of Infrastructure: North American Utility Sector Outlook

In this third episode of The Leading Edge of Infrastructure, a podcast by S&P Global Ratings, we look share our views on the outlook for the North American utilities sector.

Listen to the Podcast

The Midcontinent ISO said it is working on ways to accommodate an evolving industry, including a look at updating the investment approach for transmission and enhancing coordination and communication.

Both are a part of the action plan included in the MISO Forward 2020 report that was released March 3. The report focused on five hypothetical utility personas — conventional, new mix, high wind, distributed and wireless — to show what utilities might look like in the future and what they would need from a grid operator.

According to the report, those utilities "need market structures and planning approaches that include a more granular assessment of risk and value contribution for core system needs, as compared to the legacy approach that often bundled multiple capabilities into one priced component, such as energy."

The report described a conventional utility as one with a resource mix largely made up of gas and coal. A new mix utility is one focused on reducing carbon emissions, with investments in distributed energy resources and utility-scale wind and solar. The high wind and distributed energy utilities rely on those respective resources, while the wireless utility does not own certain traditional assets such as distribution or transmission wires but does have significant control over customer demand and timing of energy use through digital controls.

Key Takeaways:

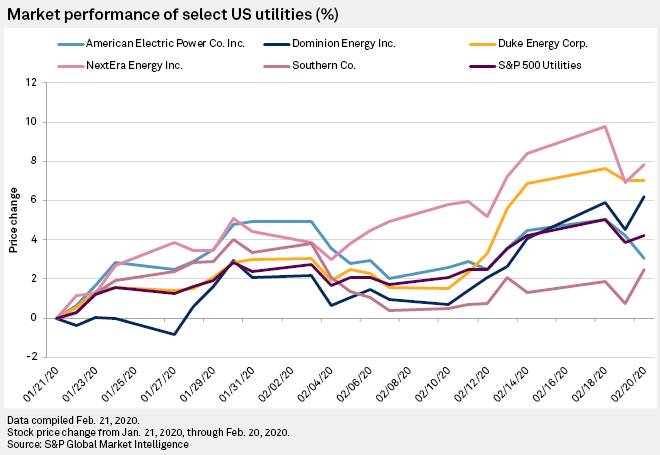

U.S. utilities still offer a safe haven for investors despite the turbulence in equity and bond markets driven by an oil price collapse and coronavirus fears, according to analysts that track the sector.

U.S. utility stocks plunged along with the broader sell-off on March 9 amid fears of a recession sparked by an oil price war between Saudi Arabia and Russia, along with mounting concerns over the global spread of the novel coronavirus.

The S&P 500 Utilities sector finished 5.64% lower on March 9 at 319.67, while the S&P 500 Energy sector ended the day down 20.08% at 254.65. The S&P 500 tumbled 7.60% to close at 2,746.56 and the Dow Jones Industrial Average fell 7.79% to 23,851.02, marking their worst single-day losses since 2008.

Key Takeaways:

— ESG Industry Report Card: Regulated Utilities Networks

— ESG Industry Report Card: Power Generation

— ESG Industry Report Card: Midstream