Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

The COVID-19 pandemic has accelerated global banks’ technological disruption—creating new customer expectations, new forms of competition, and new opportunities. Increasing investments in sustainable finance, a surge of mergers and acquisitions, and crypto entrants are further shaping this new landscape.

Published: May 3, 2021

Malaysia has an unprecedented opportunity to digitalize its banking services with new lenders poised to enter the market. S&P Global Ratings doesn't expect an immediate shakeup to the competitive landscape; instead, incremental changes are likely to lead to a more dynamic, diversified industry.

But not all players will benefit equally. Of the eight local banking groups and a handful of foreign banks that dominate the market, the two largest appear best placed to fend off the new competition.

That's because Malayan Banking Bhd. (Maybank) and CIMB Group Holdings Bhd. already have established digital infrastructure, diversified earnings profiles, and large customer bases.

One-Click Deposits (Risks Included)

Traditional banks and online savings platforms are seeing record levels of household deposits during the pandemic.

Read the Full ReportThe Incumbents Strike Back

The pandemic is accelerating traditional banks' digitalization drive, challenging virtual banks.

Read the Full ReportBank Cloud Adoption Goes From Blue Sky Thinking to Economic Necessity

Banks are keenly aware of the digital potential of the public cloud—in which they contract an on-demand third-party provider over the public internet to get computing services and infrastructure that are managed by the provider and shared with multiple organizations.

Read the Full ReportEven as signs of normalization from the coronavirus-caused economic downturn sprout across countries, the pandemic is pressuring global banking sectors as they balance declining asset quality & creditworthiness with increasing demand for lending.

Access the Topic PageBanks in Central and Eastern Europe (CEE) are progressing well in digitalizing their business models, but disruption risks are uneven between the countries and within the banking industry.

The key factors behind the digital push differ across markets between demanding customers, regulatory pressure, or the availability of new technology used to offer innovative product solutions.

UK Banks Speed up Plans to Ax Branches and Switch Focus to Digital

British high street banks' planned branch closures for 2021 already outstrip total closures for 2020, as lenders focus on boosting their provision of digital services to customers.

Read the Full ArticleIndian Banks Need to Spend More to Enhance IT Systems as Consumers Go Online

Indian banks need to step up spending on technology as more customers shift to digital channels, straining their IT systems that have often been found to be lacking, including a series of glitches at the biggest private sector lender in the country that invited a rare rebuke from the regulator.

Read the Full Article

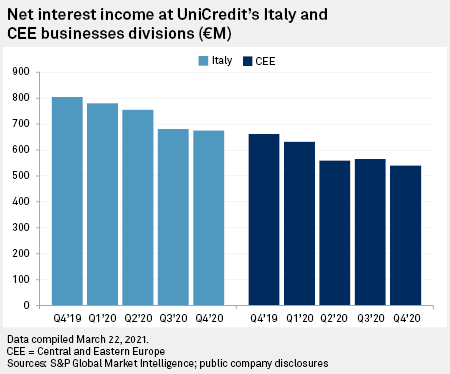

For UniCredit SpA, central and Eastern Europe has been a key growth market in recent years. But countries in the region, particularly Hungary, Poland and the Czech Republic, have been in the grip of a particularly devastating third wave of COVID-19 infections so far in 2021, resulting in new lockdowns.

Industry observers say that while the situation is bleak, the economies of the CEE region should be relatively resilient in the face of lockdowns thanks to their low reliance on the services sector compared to other European countries. Because of this, UniCredit is unlikely to suffer a high level of defaults, even though it currently has a large number of loans under moratoriums.

Over the past year, the CEE region has accounted for almost as much of UniCredit's net interest income as its home market, Italy. In the fourth quarter of 2020, the CEE business reported €540 million of net interest income to Italy's €674 million. Before the pandemic hit, the CEE region had been showing considerable resilience to the economic slowdown that hit Western Europe.

Portuguese Banks Brace for Worsening Asset Quality in 2021 as Loan Moratoria End

Loan moratoria and other policy measures have protected Portuguese banks' asset quality so far during the COVID-19 pandemic, but this may change in 2021 as many programs are unwound, DBRS Morningstar said in a report April 8.

Read the Full ArticleHow GCC Banks Will Perform Amid Further Potential COVID-19 Shocks

Rated GCC banks set aside $10.9 billion of new loan-loss provisions in 2020 because of the expected hit from COVID-19 and low oil prices on their asset-quality indicators.

Read the Full ReportHow COVID-19 is Affecting Bank Ratings

Slightly less than one-third of S&P Global Ratings bank ratings globally carry a negative outlook or are on CreditWatch with negative implications, mainly due to rating actions S&P Global Ratings took closer to the onset of the pandemic after S&P Global Ratings lowered their economic forecasts.

Read the Full Report

Despite an opening up of China's wealth management industry, estimated to be worth at least U.S. $17 trillion, foreign managers continue to have a problem: entrenched local players with much wider distribution networks and loyal customers oftentimes lured by promises of unrealistically high returns.

The question of how best to tap into China's growing wealth has been brought to the fore again, after HSBC Holdings PLC and Citigroup Inc. recently unveiled plans to beef up their wealth management operations in the world's second-largest economy, as they seek stronger fee-income growth in Asia-Pacific to mitigate the slowdown in the U.S. and Europe.

Partnering with a Chinese bank, wealth manager or online fintech platform remains an attractive, perhaps realistic, strategy for foreign wealth managers, even though the Chinese government has allowed them to establish wholly owned onshore operations since April 2020 as part of the nation's financial-market opening, experts say.

Japan Banks Face Volatility, Default Risks Offshore in Hunt for Higher Returns

As returns-hungry Japanese banks may lend or invest even more abroad after a record year of 2020, the lenders face rising risk of defaults and market volatility in their growing overseas operations, analysts warn.

Read the Full ArticleNomura Aims to Rebuild U.S. Wholesale Business After Archegos Loss

Nomura Holdings Inc. said it is committed to rebuilding its U.S. wholesale business, once its fastest-growing segment, after a loss tied to the collapse of Archegos Capital led the largest Japanese brokerage to post its steepest quarterly loss in 12 years.

Read the Full Article

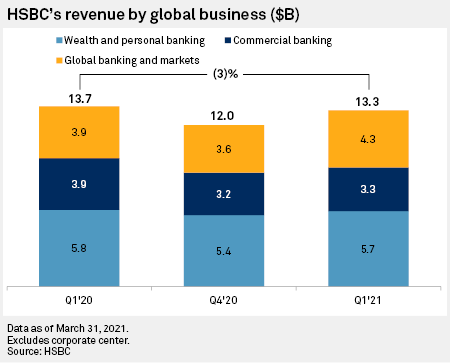

HSBC Holdings PLC is looking to use extra capital for acquisitions to boost its wealth management capabilities, according to CEO Noel Quinn.

The U.K.-based bank's primary focus within its wealth and personal banking business is to grow the wealth part of the division, Quinn said on an April 27 earnings call, noting that the group is on the lookout for both organic and bolt-on inorganic opportunities to drive that growth. "We will look at opportunities as they emerge," said Quinn.

HSBC is particularly considering acquisitions that will boost its product or distribution capabilities in wealth management, insurance and private banking, and deals would largely be in Asia, where Quinn is looking to move the heart of the business in a bid to chase higher returns. Adjusted revenue at the group's wealth division reached $2.38 billion in the first quarter, up 65% from $1.45 billion in the same period a year ago. Meanwhile, adjusted revenue at HSBC's commercial banking arm fell 14% on a yearly basis to $3.33 billion, which Quinn attributed mainly to the impact of low interest rates on global liquidity and cash management.

Crédit Agricole Banks on Long Game in Price Face-Off with Creval Shareholders

In the latest development in what is surely one of 2021's most enthralling pass-the-popcorn M&A sagas, major Credito Valtellinese SpA shareholder Denis Dumont came out to publicly oppose Crédit Agricole SA's takeover offer for the Italian bank, after which the French bank improved its offer.

Read the Full ArticleItaly Shows Most Promise as Europe's Domestic Bank M&A Wave Continues in 2021

Italy is shaping up to be the busiest market for bank mergers in Europe in 2021 amid a wave of domestic consolidation across the continent that has been accelerated by COVID-19.

Read the Full ArticleAfter 2020 Surge, European Bank M&A Poised to Enter 'Bull Market'

Bank shares are cheap, interest rates are low, regulators are keen and the COVID-19 pandemic has increased the need for digitalization and restructuring — all in all, the perfect confluence of factors to boost M&A activity in European banking over the next few years, according to market observers.

Read the Full Article

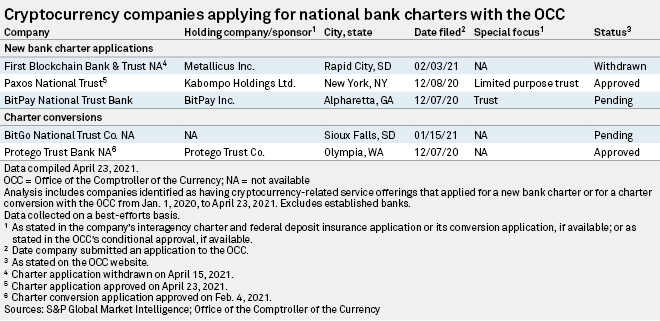

The Office of the Comptroller of the Currency on April 23 conditionally approved Paxos Trust Co.'s application to form Paxos National Trust, a de novo national trust bank.

Paxos is the first cryptocurrency-focused company to receive approval to form a de novo national trust bank following a string of applications in the final months of 2020. Two other companies, Anchorage Trust Co. and Protego Trust Co., have already received approval to convert their state charters to national trust bank charters.

Cryptocurrencies are Still Mostly About Speculation, Not Payment

Financial markets are getting excited again about cryptocurrencies—especially bitcoin after prices rallied to record highs in February.

However, S&P Global Ratings believes cryptocurrencies continue to be speculative instruments, which investors mostly use as a store of value rather than a means for commerce, despite some moves toward broader adoption. Indeed, after its spectacular rise, bitcoin prices pulled back in what some market watchers believe is a sign of caution.

Read the Full Report

The greener investment strategies of Nordic banks' asset management units compared with their lending businesses underscores a sustainability gap that lenders will want to close to meet their climate targets and to manage reputational risk.

As investors, analysts, regulators and the public increasingly prioritize environmental, social and governance issues, major Nordic banks have signed up to the Principles for Responsible Banking and have committed to bringing their financing in line with the Paris Agreement on climate change, which among other things requires carbon dioxide emissions to reach "net zero" by 2050.

Supranational Banks' New ESG Goals May Boost Private Investment in Green Finance

Multilateral development banks in Europe have new criteria and higher medium-term targets for green and sustainable investments, which is likely to have a knock-on effect on the wider market and draw more private capital to green finance.

Read the Full LinkIndia Banks Need to Account for Climate Risk with $84B at Stake, Warns Nonprofit

Global sustainability disclosure platform CDP says Indian banks and policymakers need to plan for the country's move away from its reliance on carbon and the recovery from the COVID-19 pandemic offers an opportunity for a reset.

Read the Full LinkRussian Banks Face Conundrum of 'Dirty' Borrowers as Embrace of ESG Tightens

ESG has a new fan. The early weeks of 2021 have seen the Russian banking sector show love for the ethical investment philosophy that is slowly transforming the global financial sector.

Read the Full Link