Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Facing a flurry of mergers and acquisitions, the energy transition to renewable generation, obstacles to new construction, and security and regulatory risks, the global pipeline industry is weathering a storm of rapid change and demand.

Published: July 26, 2021

Updated: September 16, 2021

Subscribe to start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

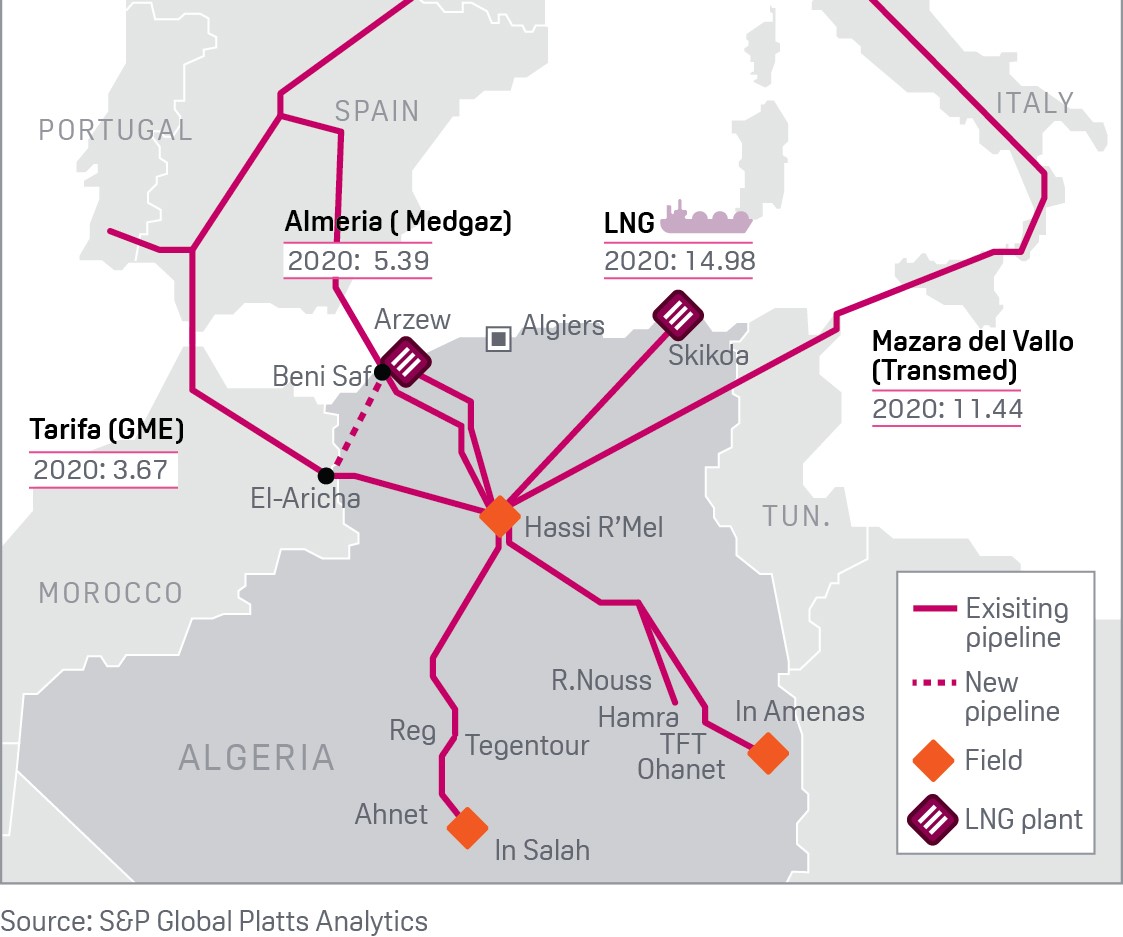

SUBSCRIBE TO THE NEWSLETTERThe current transit agreement for the GME link, which brings gas from Algeria to Spain through Morocco, is due to expire at the end of October. Between 2016 and 2020, Algeria used this route to transport 34.8 Bcm (entry at Tarifa), or 52% of its total exports to Spain.

While the contract is currently under negotiation for renewal, the prospect is clouded by the worsening relationship between Algeria and Morocco due to a dispute over the sovereignty of the Western Sahara. This conflict was on full display Aug. 24, when Algeria cut diplomatic relations with Morocco over what it called Morocco's "hostile actions."

Platts Analytics views Algeria's most recent action as the latest in the ongoing brinkmanship between the two countries, but does not believe it is narrative changing. Accordingly, we believe a deal to maintain flows through Morocco's portion of the GME pipeline is still the most likely outcome of ongoing tensions.

Sonatrach has said it would be able to supply Spain in case of a non-renewal, and our calculation confirms Sonatrach's statement. However, there are risks around this strategy, as we highlighted in our in-depth analysis, including frequent outages at key LNG export facilities.

Oil, Gas Pipeline M&A Bounces Back as Sector Approaches Critical Mass

Large-scale midstream dealmaking rebounded in the first half of 2021 amid soaring momentum for sector-wide consolidation, according to an analysis of S&P Global Market Intelligence data.

Read the Full ReportKinder Morgan Kicks Off Potential Renewables M&A Wave Among Gas Pipeline Firms

Kinder Morgan Inc.'s announced acquisition of renewable natural gas developer Kinetrex Energy for $310 million could convince other gas pipeline operators to follow suit as securing supplies becomes a lucrative part of the fuel's value chain, industry experts said.

Read the Full ArticleDominion Seeks New Buyer for Questar Pipelines after Berkshire Hathaway Sale Falls Through

Dominion will find an alternative buyer for its Questar Pipelines after a planned sale to Berkshire Hathaway was scrapped due to regulatory concerns, the companies said on July 12.

Read the Full ArticleExecs Highlight DT Midstream Spinoff's Strong Contracts, Decarbonization Plan

DTE Midstream is positioning itself as a best-in-class gas pipeline operator with solid contracts and a commitment to net-zero carbon emissions by 2050 ahead of a spinoff from Michigan utility DTE Energy Co.

Read the Full Article

When asked how big he wants his company to be in the renewable gas market, Chesapeake Utilities Corp. President and CEO Jeff Householder offered an observation: "You're the 95th person that's asked me that question in the last two days."

It makes sense that Householder fielded the inquiry during the American Gas Association's Financial Forum in May. The company began entering a string of renewable natural gas, or RNG, investments and tie-ups last year. In November 2020, executives outlined a strategy to integrate RNG into their businesses transporting gas in pipelines and tube trailers. In February, they announced plans for a hydrogen pilot project, and by early May, they were updating investors about additional RNG investment opportunities.

In a pair of interviews with S&P Global Market Intelligence, Chesapeake Utilities executives discussed the RNG opportunity — one of five key strategic initiatives through 2025 — and their plans to establish a foothold in the emerging hydrogen economy.

They expect that the plans could help Chesapeake grow and decarbonize its business and see the company expand its geographic footprint. However, when evaluating RNG opportunities, the company will continue to think locally, Householder said.

Watch: Market Movers Europe, Sep 13-17: Germany’s Pathway to 2030 Targets in Focus; International Shipping Week Kicks Off

In this week's highlights: oil demand recovery remains at the fore; the now completed Nord Stream 2 gas pipeline examines next steps; the German energy industry meets for its annual conference; and London International Shipping Week kicks off.

Read the Full ReportESG Financing Takes Flight in North American Oil, Gas Pipeline Sector

Enbridge Inc.'s sustainability-linked bond framework could represent the next frontier in pipeline sector finance as investors look for management teams to deliver on environmental, social and governance commitments, industry observers and credit rating experts said.

Read the Full ArticleMidstream Sector's ESG Push Under Spotlight for Q2 Earnings

Investors will be watching second-quarter midstream earnings for signs that accelerating commercial activity is sufficient to support new infrastructure growth opportunities.

Read the Full ArticleCanadian Pipeline Operators Propose Carbon Transportation, Sequestration Network

Two of Canada's largest pipeline operators are partnering to develop a network of infrastructure to carry and sequester carbon emissions in Alberta as early as 2025.

Read the Full ArticleNatural Gas in Transition: Midstream Sector Must Prepare for Norms to be Upended

This is the fourth in a multipart series exploring the natural gas industry's role and prospects in the energy transition — a globe-spanning movement to cut greenhouse gas emissions across the energy industry.

Read the Full Article

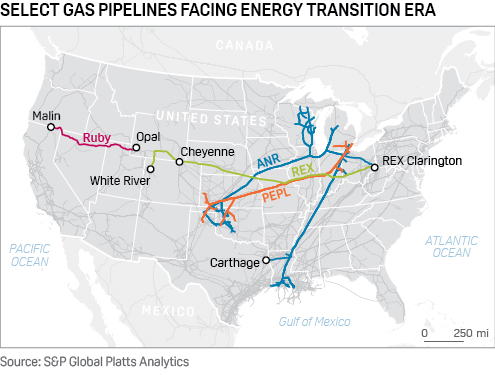

As the energy transition gathers pace, mounting political and financial barriers to new natural gas pipeline infrastructure threaten to end the midstream industry's years-long spending and building boom.

Bullish U.S. LNG Export Activity Buoys Pipeline Operator Williams' Growth Forecast

Williams will keep annual growth project spending steady at about $1.2 billion through 2026 as it seeks to leverage the scale and strategic location of its pipeline network to benefit from an expected rise in LNG feedgas demand, CEO Alan Armstrong said Sept. 8.

Read the Full ReportTellurian to Prepare Driftwood LNG Site for Full Construction, Build New Pipeline

Tellurian will soon sign a long-term lease with the port authority where its proposed Driftwood LNG facility is to be built in Louisiana so it can begin preparing the site for full construction, executive chairman Charif Souki said in a message to investors June 22.

Read the Full ArticlePipeline Developments to Shake Up Pacific Northwest Gas Inflows, Spot Gas Prices

The GTN, Kingsgate-Stanfield, Ore., spread could close early next week as the Pacific Northwest receives more gas from West Canada, replacing some supply from the Rockies.

Read the Full Article

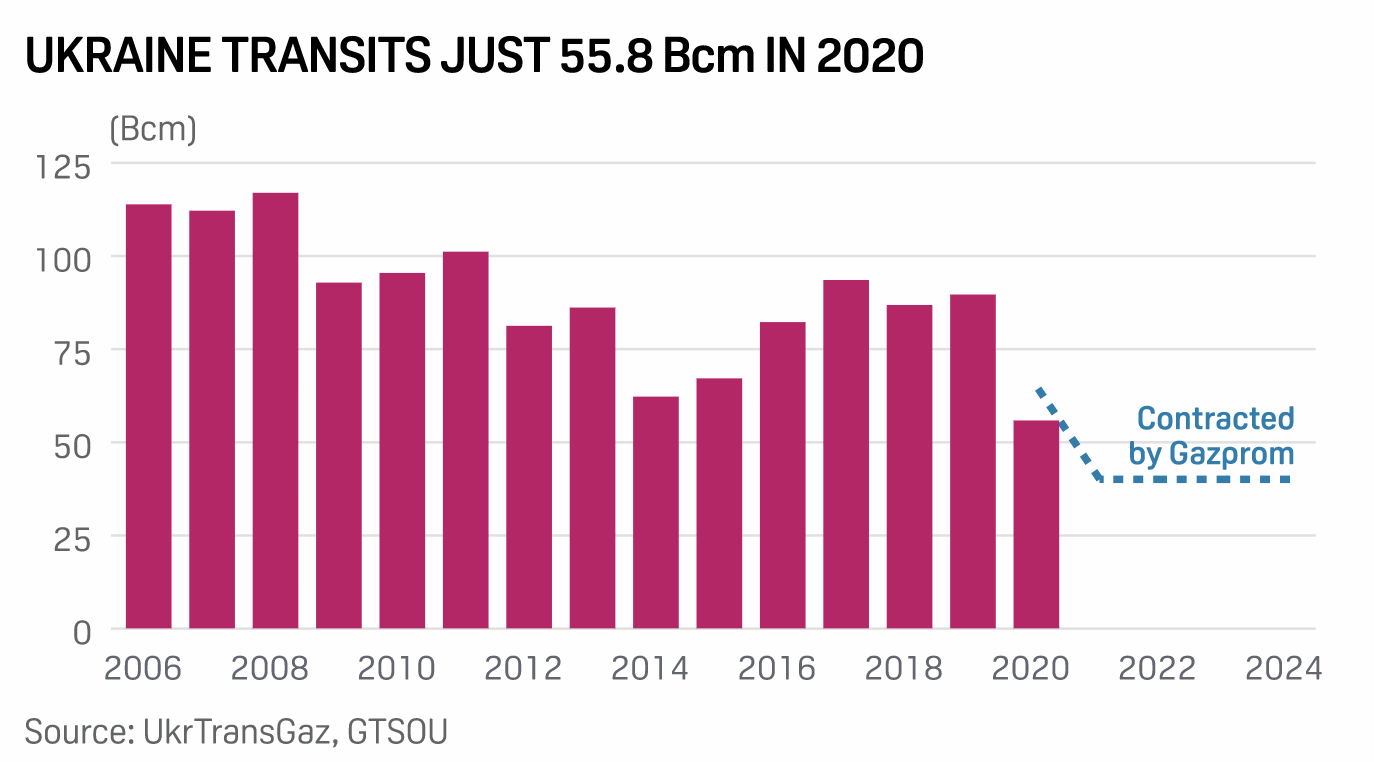

Construction of the Nord Stream 2 gas pipeline from Russia to Germany is expected to be completed by the end of August and the link operational this year, the CEO of the pipeline development company said July 11.

In an interview with Handelsblatt, Nord Stream 2 AG CEO Matthias Warnig also said he was certain that Ukraine would retain a role in the transit of Russian gas to Europe.

Warnig said Nord Stream 2 was now 98% complete, with one 27.5 Bcm/year string already finished and the remaining 2% of work to be carried out on the second 27.5 Bcm/year string.

"We expect the construction work to be finished by the end of August," Warnig said.

Gazprom Can Deliver First Gas via Nord Stream 2 Before Year-End: Miller

Gazprom CEO Alexei Miller said Sept. 2 that first gas flows via the almost-complete Nord Stream 2 gas pipeline from Russia to Germany could start before year-end, with all preparations made on the Russian side.

Read the Full ReportTiming of Nord Stream 2 Gas Link Startup Dependent on German Regulator: Official

The start date for commercial gas flows through the Nord Stream 2 gas pipeline from Russia to Germany will be dependent on approval from the German regulator, a senior Russian official said Sept. 9.

Read the Full ReportNord Stream 2 Proposals Insufficient to Counter Security Threat: Ukraine, Poland

US and German measures designed to help prevent Russia from using the almost-complete Nord Stream 2 gas pipeline as a "weapon" are insufficient to counter the project's security threat, the foreign ministers of Ukraine and Poland said late July 21.

Read the Full ArticleUkraine's Naftogaz Warns Against 'Compromise' Deal on Nord Stream 2

The head of Ukraine's state-owned Naftogaz Ukrayiny has warned against any kind of "compromise" deal regarding the operation of the Nord Stream 2 gas pipeline from Russia to Germany.

Read the Full Article

The total value of U.S. interstate natural gas transportation and storage assets reported to the Federal Energy Regulatory Commission crept up in 2020, but year-over-year growth lost momentum, continuing a trend that showed up in 2019 after an active year in 2018.

Slowing growth could partly reflect the growing opposition to new natural gas infrastructure among environmental advocates and some regulators and policymakers.

The total value of gross gas transmission plant assets — a term that covers pipelines and supporting infrastructure — hit almost $187.9 billion in 2020, according to an analysis of FERC Form 2 data by S&P Global Market Intelligence. This was an increase from almost $180.0 billion in 2019 and about $170.4 billion in 2018. Growth in total asset value from the preceding year was 4.4% in 2020, compared to 5.6% in 2019 and 12.2% in 2018. Form 2 collects financial and operational information for a calendar year from interstate gas pipelines under FERC jurisdiction.

The total value of storage plant assets inched up to almost $18.8 billion in 2020, increasing from $18.2 billion in 2019 and $17.1 billion in 2018.

Pipelines push forward in tough market

As the world fell under the grip of the COVID-19 pandemic in 2020, some pipeline projects were affected by the crisis. But more were affected by legal challenges from environmental groups, landowners and other opponents of fossil fuel use and industrial development.

Still, acquisitions and new projects continued to add to the number of reported assets. North American pipeline companies expect to add nearly 33 Bcf/d of gas transportation capacity from 2020 through 2025, according to a January report from the INGAA Foundation, the research arm of pipeline trade group Interstate Natural Gas Association of America.

Pipeline Repairs, Maintenance Work to Keep Pressure on Permian Basin Gas Prices

Natural gas basis prices at the West Texas Waha Hub could undergo sustained pressure through September as pipeline repairs and maintenance work in Arizona and Southern California continue to push back on westbound gas transmissions from the Permian Basin.

Read the Full ReportState AGs, Environmentalists Press FERC to Alter Pipe Policy After Spire Decision

A recent appeals court ruling means the US Federal Energy Regulatory Commission must update its certificate policy to ensure rigorous review of whether proposed interstate natural gas pipelines are needed, state attorney generals, environmental groups.

Read the Full ArticleBiden Executive Order Could Hinder Canadian National-Kansas City Southern Merger

A broad anti-competition executive order US President Joe Biden signed July 9 could hinder the pending merger of Canadian National Railway and Kansas City Southern because of the White House's growing concern over US railroad consolidation.

Read the Full ArticleSupreme Court Sides With Penneast In Dispute Over Powers to Condemn State Land

The decision marks an advance for the stalled 116-mile, 1.1 Bcf/d PennEast Pipeline project, which would link Marcellus Shale dry gas production with markets in Pennsylvania, New Jersey and New York, although the project still faces significant hurdles.

Read the Full Article