Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

The Mexican government has recently issued a plethora of regulations in the midstream and power sectors that have had broad implications for the country’s energy industry. Now, the outcome of Mexico's June elections will be decisive for the future energy landscape as President Andres Manuel Lopez Obrador seeks to gain enough support to revise the country's constitution and implement a formal end to the country's energy liberalization. The counter-reform, which the government said is aimed at restoring order and reducing corruption, would reverse his predecessor’s opening of the public energy sector to investment, through which the private sector had hoped to modernize the country's infrastructure and secure some market share.

Published: June 14, 2021

Updated: June 25, 2021

S&P Global Platts looks at how Mexico's energy and commodity landscape is evolving, from oil and refined products to natural gas, power and renewables.

Access the Topic PageMexican authorities are expected to continue their crackdown on private refined products imports in order to give state Pemex more market share, according to market experts and observers.

"The government goals are very clear: they want all the hydrocarbons in the country to be supplied by Pemex, either through its own production or through its imports," independent consultant Susana Cazorla said July 7.

Mexico 'Wasting' Potential of Northeastern Region with Current Energy Policy: Industry

Mexico is not fully utilizing the potential of its northeastern region in both natural gas production and power generation with its current energy policy, which limits the involvement of private players, participants said on May 17 during a virtual panel.

Read the Full Article

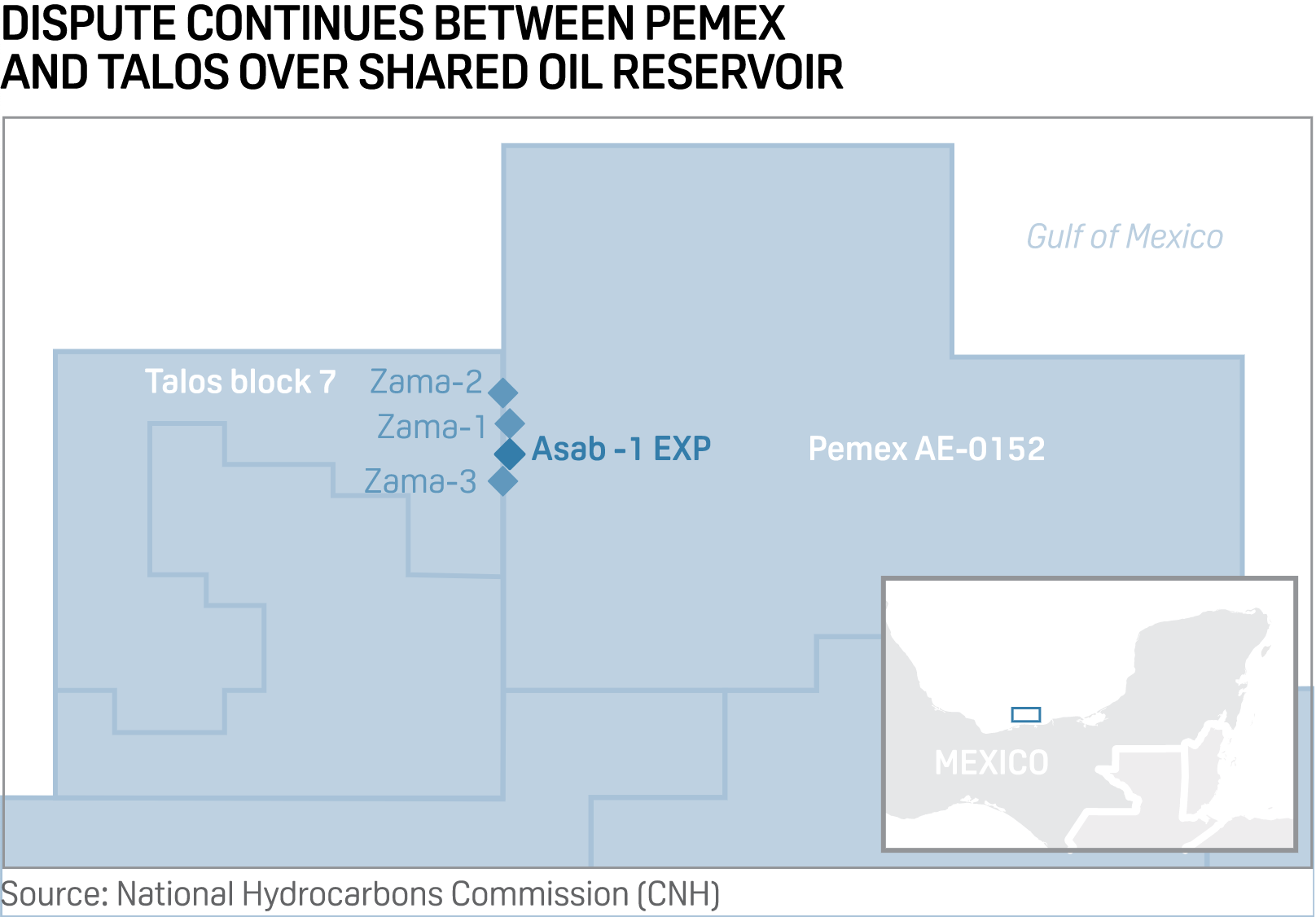

Mexico's Energy Secretariat, or SENER, has appointed state oil company Pemex as the operator for the 1 billion-barrel shallow water Zama field discovered by Talos Energy in 2017, after consulting with the ministry of finance that Pemex would be given enough resources for the project.

Both Talos and Pemex were notified of SENER's decision on July 2 through a letter, two people close to the process told S&P Global Platts. The notification came the same day a fire broke at Pemex's main production complex, arguably due to lack of maintenance.

The ruling was being watched closely by the oil and gas industry as most of the shallow water blocks operated by private companies are bordered by Pemex blocks and many believe the decision will set the tone for private investments in the near future.

Mexico Readies Constitutional Amendments In Power Sector After Election

The Mexican Federal government will present an initiative to Congress to modify the constitution to restrict participation of private companies in the electricity market, President Andres Manuel Lopez Obrador said June 15 in his daily morning conference.

Read the Full ArticleJune 6 Elections Decisive for Mexico's Power Sector

Mexico's June 6 elections will be decisive for the future of the energy sector as President Andres Manuel Lopez Obrador seeks to gain enough support to revise the country's constitution and put a formal end to the country's energy liberalization.

READ THE FULL ARTICLEListen: Mexico's Federal Elections to Have Broad Impact on Energy

The upcoming federal elections in Mexico, the largest in recent history, are expected to have broad implications across many energy sectors.

Listen to the PodcastMexico's Pemex will invest $2.64 billion to complete a coking plant at its Tula refinery as the country seeks to reduce its dependence on imported fuels, the state company's CEO said May 12.

The project, which Pemex expects to finish by 2023, will allow Pemex to process 90% of the fuel oil produced at Tula and at neighboring Salamanca, Octavio Romero Oropeza said during the daily press conference held by Mexican President Manuel Andres Lopez Obrador.

Mexico Set to Pass Bill Likely to Increase Pemex's Refined Products Market Share

Mexico's federal government is expected to soon pass a controversial bill that will likely increase the dominance of state oil company Pemex in the refined markets market.

The Mexican Senate on April 22 approved a bill presented by President Andres Manuel Lopez Obrador that toughens the rules for private companies to request and keep permits to import, export, transport and distribute liquid fuels in the country. The bill, approved by 65 votes to 47, had already been passed by the lower house and is expected to be signed into law by Lopez Obrador in the coming days.

The government claims that the bill targets fuel theft and contraband, which are problems that need an immediate response. However, observers have highlighted the bill is aimed at reducing competition.

Read the Full Article

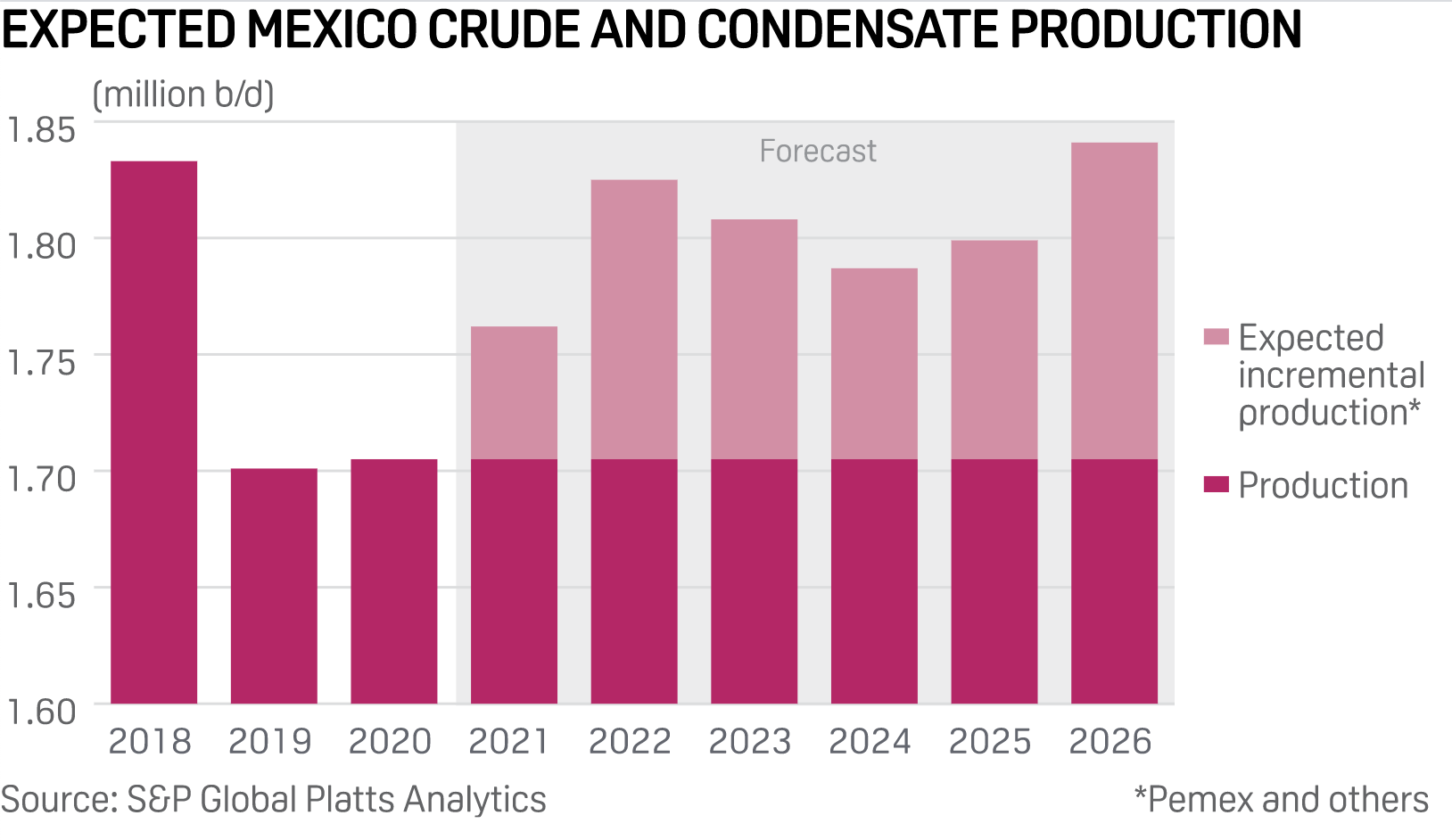

Confidence that Mexico's upstream sector will be able to meet its production goals over the next few years has been boosted by PetroBAL's recent success in securing a financing deal based on oil and gas reserves, with more such deals expected to follow for private companies that hold licenses in the country.

PetroBAL, the upstream arm of Mexican conglomerate GrupoBAL, recently secured a $250 million development finance facility, a first for a production sharing contract in the country, and also a first for an offshore field.

Prior to this deal, only two companies had obtained financing using the international reserves-based lending model. The first was the loan obtained by Cheiron's Mexican subsidiary PCS for Cardenas Mora, a mature onshore block that was farmed out by state oil company Pemex. The second was for a service contract, also with Pemex, and also onshore. The borrower was Mexico-based Grupo Diavaz.

Premier Oil Gets Go-Ahead to Increase Exploration at Second Block in Mexico Shallow Waters

Premier Oil has been allowed to increase exploration activities at a second block in the shallow-water Gulf of Mexico as the company aims for a new geologic formation.

Read the Full ArticleIncentives Needed to Increase Local Content in Mexico's Oil and Gas Supply Chain: Panelists

Exploration and extraction activities in the oil and gas sector can develop local economies in Mexico, but incentives are needed to increase the participation of companies in the supply chain, panelists said April 28.

Read the Full ArticleU.S. Gas Exports to Mexico Trend Near Record Highs on Temperatures, Capacity Gains

US gas exports to Mexico could hit record highs over the next two weeks, fueled by rising temperatures south of the border and by recent capacity additions on cross-border and downstream pipelines.

Read the Full ArticleMexico is "many steps behind" the US and Canada in the energy transition and needs to build more infrastructure to allow natural gas to serve as a bridge to a future with greater use of renewables in power production, IEnova CEO Tania Ortiz Mena said May 18.

During a summit sponsored by Columbia University's Center on Global Energy Policy, Ortiz Mena characterized the dynamic as more of an opportunity than a challenge for a country that imports from the US about 70% of the gas it consumes.

Mexico Eyes Solar Parks in Yucatan Amid Financing Doubts, Environmental Concerns

Mexico is putting together a scheme to develop at least 500 MW of solar generation capacity, first in the Yucatan Peninsula as part of a larger development project, and erase the public belief that the government is against renewables, people close to the situation have told S&P Global Platts.

The program, which will be run by Mexican tourism agency Fonatur, will also involve the state utility CFE as operator and the national development banks, they said.

Read the Full Article