Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

In efforts of reducing emissions, many economies are prioritizing liquified natural gas (LNG) within their energy mix. As a result, global demand for the fuel has soared. But market participants are now confronting record high LNG prices and shipping constraints as a result of supply shortages and the high demand.

Published: October 11, 2021

Receive immediate insights on the individual market developments you need to know for a 360° perspective on the big stories shaping our world.

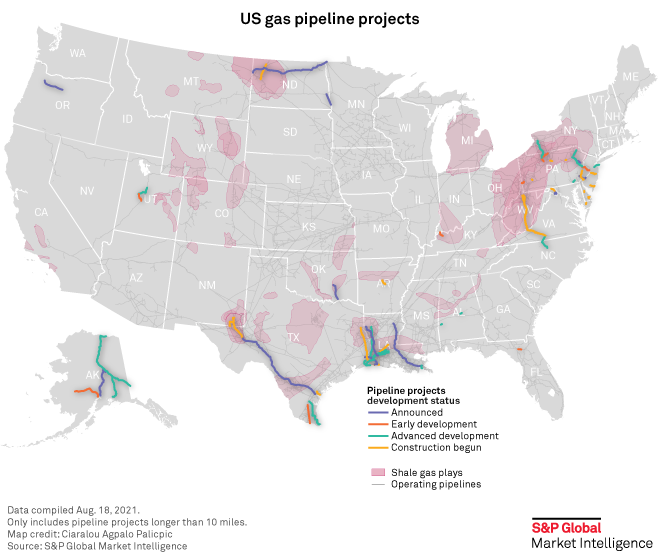

SUBSCRIBE TO THE NEWSLETTERSLNG export facilities and their demand for supplies will drive a large portion of U.S. natural gas pipeline construction through 2026, according to an analysis of S&P Global Market Intelligence data.

Of the 45 pipeline projects projected to come online over the next five years, at least 16 are tied to liquefaction terminals that are operating or under development on the Gulf Coast, with six export facilities expected to begin commercial service in 2024 alone. Other pipeline projects are designed to bring gas to utility distribution systems, power generation plants and other end uses.

Venture Global LNG plans to build just over 400 miles of gas pipelines to serve its proposed Calcasieu Pass, Plaquemines and Delta LNG terminals, which would have a combined production capacity of 50 million tonnes per year of LNG.

Tellurian Inc., meanwhile, has 323 miles of pipeline under development for the planned Driftwood LNG LLC terminal, anticipated to begin construction in 2022. The company also said it may buy up more acreage in the Haynesville Shale or enter into a business combination that would allow it to fill out its upstream portfolio.

LNG is the fossil fuel poised to have the biggest earnings advantage as the North American midstream sector's great pipeline build-out cycle winds down, according to a July Sanford C. Bernstein & Co. report. In 2022, capital expenditure for most midstream companies is expected to be minimal, and "in some cases, over 70% lower than 2019 levels for the company," analysts wrote.

With traditional natural gas maintaining a slower growth curve and facing minimal rate reduction risks as hurdles to new infrastructure construction get higher in the U.S., LNG will perform best when it comes to long-term volumes, Bernstein said. Overseas demand for gas supply in Asia and Europe is lifting the prospects for the fuel.

Other LNG projects putting pipe in the ground through 2026 will include NextDecade Corp.'s Rio Grande, Sempra's Port Arthur, and Exxon Mobil Corp. and Qatar Petroleum's Golden Pass. Delays in the development of Port Arthur, however, recently prompted Polish Oil and Gas Co. to end a deal for buying 2 Mt/y of LNG from the facility and to sign similar agreements to purchase the same amount from Venture Global terminals. Sempra executives also confirmed the expiration of a deal with Saudi Arabian Oil Co. to finalize a supply agreement for 5 Mt/y of LNG from Port Arthur LNG terminal and take a 25% stake in the project's first phase.

Several gas pipeline projects scheduled to come online by the end of 2026 have also faced permitting delays, including the Equitrans Midstream Corp.-led Mountain Valley Pipeline LLC and Williams Cos. Inc.'s Northeast Supply Enhancement project out of the Appalachian Basin.

Brazil's Appetite for U.S. LNG Grows in Third Quarter as Prices Help Alter Trade Flows

When the Asia Vision tanker docked in Brazil in March 2016, it was carrying the first LNG produced in the US from shale gas -- a cargo that was described at the time as being sold at a market price.

READ THE FULL ARTICLEPakistan May Import Fuel Oil After Years as LNG Prices on Fire

Pakistan is likely to import fuel oil after a gap of three years as the country looks to cushion the shock from surging LNG prices at a time domestic appetite for fuels from the industrial sector is growing fast due to improving economic growth prospects, sources and analysts said.

Read the Full ArticleSpot and Term, Australian Supply and Asian Demand: Indelible Links in the LNG Market

As the LNG market matures, the commodity's spot price has emerged as the driving force behind prices of all contract types, including long-term contracts.

Read the Full ArticleShale Gas Stocks Chase Natural Gas Futures Prices Higher, As LNG Drives Demand

Shares in most pure-play shale gas producers posted double-digit gains in value over the past month, alongside the one-third increase in the October futures price for natural gas, according to Sept. 14 data from S&P Global Market Intelligence.

Read the Full ArticleCOVID-19 Curbs China's Trucked LNG Sales, Casts Shadow Over Gas Demand

New outbreaks of COVID-19 in some Chinese cities and provinces recently have raised concerns over the country's mobility restrictions, casting a shadow over its natural gas demand in the third quarter of this year, according to trading sources and market analysts.

Read the Full ArticleChina Imports More U.S. LNG But Still Poised to Miss 2020 Trade Pact Goals

Chinese imports of U.S. LNG have surged in recent months, helping to keep U.S. export facilities running close to full bore. But the purchases are short of the levels called for under the truce that ended a year-long freeze in the LNG trade between the two countries.

Read the Full Report

Asia's LNG importers expect high spot prices this winter on the back of tight demand-supply fundamentals, which could derail procurement plans and increase power prices, especially if temperatures drop sharply similar to cold snaps seen in the previous winter season.

The key difference in 2021 is that LNG demand surged much earlier in the year on the back of the Chinese economy rebounding sharply from COVID-19 and spot LNG prices never dropped below $5.50/MMBtu, while last year they languished in the low single digits for several months. As the northern hemisphere summer kicked in, spot LNG spot prices soared to an eight-year seasonal high, almost touching $18/MMBtu last week. The S&P Global Platts JKM for October was assessed at $17.460/MMBtu on Aug. 25.

JKM LNG futures on ICE peaked at nearly $20/MMBtu last week for cargo deliveries during the coming winter through to January, reflecting broad-market expectations of tight market conditions persisting till the end of this year.

"Asia's spot LNG trade has moved into unchartered territory from this summer, trading for an extended time above oil-parity prices," Jeffrey Moore, Asia LNG manager for S&P Global Platts Analytics, said.

"Demand growth in China is expected to more than offset loss from Japan, Korea and Taiwan entering this winter with higher inventories. The market is running out of mechanisms to counter higher demand and higher prices," Moore added.

Trading activity

Trading activity has also started to reflect concerns about a steep price trajectory for the winter months, with market participants, who would have typically sold their oil-linked term cargoes to benefit from high spot prices, adjusting to the winter contango and pulling back from spot purchases. JKM futures indicate January prices of nearly $18/MMBtu.

The buying interest from Chinese importers is being closely watched.

Most Chinese national oil companies have covered their winter positions via strip tenders issued earlier in the year, such as state-run trader Unipec's procurement of around 40-50 cargoes for delivery in the second half of 2021 and February 2022, through a strip tender in April, traders said.

"The Chinese will have to buy more to inject for winter. I doubt they have fully prepared for winter due to higher demand throughout this year. They will likely buy October, the cheapest part of the winter period," a trader said, while a Beijing-based source said that Chinese importers are likely to see their long-term contractual volumes max out.

Other market players pointed out that taking a firm position could backfire if demand fizzles out.

One trader said that China's winter supply security is usually dependent on imported pipeline gas, and supplies have been stable this year. Another Beijing-based source said that Chinese importers were not ramping up purchases yet as they did not want a repeat of 2018 when there was an oversupply of cargoes and a warmer-than-usual winter.

Surging Asia LNG Spot Prices Point to Sustained Volatility Over Winter

Surging Asia spot LNG prices point to sustained market volatility in the coming months despite a slim chance of cold weather this winter, an executive with Vitol, the world's largest energy trading firm, said at the APPEC 2021 conference. developer Evergrande, and a shift in China socioeconomic policy have introduced uncertainty to the credit outlook of Asia-Pacific issuers.

Read the Full ArticleLNG Spot Price Volatility Key Focus for Market Players

The current spot LNG price volatility is a key focus for the industry, market players said Sept. 23, as uncertainty over supply and demand continues to drive market fundamentals.

Read the Full ArticleBullish Prices for Suppliers Could Temper Long-Term LNG Demand

Short-term supply needs versus long-term demand uncertainty — and how new projects will be able to secure financing absent the right balance — set the stage as the largest in-person gathering of gas market participants since the pandemic got underway in Dubai.

Read the Full ArticleBangladesh Frets Over LNG Spot Price Spike as Domestic Demand Doubles

Bangladesh is increasingly concerned about the surge in LNG spot prices as its domestic demand is set to double from the current level of 4 million mt/year within two years.

Read the Full ArticleBangladesh to Tap into Costlier Asian Spot LNG Market Amid Acute Energy Shortages

Bangladesh has reversed its decision to skirt the expensive spot LNG market following a surge in demand for natural gas in industries and power plants, and signs of energy shortages that are forcing its importers to procure gas at record high prices.

Read the Full ArticleJKM LNG Benchmark Hits Record High on Global Gas Supply Tightness, Winter Demand

Spot Asia-Pacific LNG prices hit a record high on Sept. 30. on persistent supply constraints in global gas markets and strong winter restocking demand among Asian end-users.

Read the Full Article

The biggest U.S. LNG exporter, Cheniere Energy Inc., discussed commercially sanctioning an LNG growth project in 2022, and other LNG infrastructure developers have signed supply deals that could push projects forward after a dearth of final investment decisions in the last few years.

"There is a renewed enthusiasm, and you have got a group of American projects filled with people that are good at getting creative and solving problems," said Michael Webber, an independent LNG analyst and managing partner of investment research firm Webber Research & Advisory. "They've had a long runway to adjust their models, and the window looks like its opening, at least for a couple."

The next several months could be pivotal for determining whether new U.S. LNG production capacity will make it to the construction stage. The global gas market appears likely to continue its recovery from pandemic-driven disruptions that muted investors' appetite for new multibillion-dollar LNG infrastructure. But this may also be a time when projects that have struggled for a long time finally fade away.

Petronas Warns Customers of More LNG Cargo Deferrals for Winter

Malaysia's national oil company Petronas has sounded out customers on the possibility of more LNG cargoes being deferred for the winter months from its nine-train LNG complex at Bintulu, Sarawak, traders and end-users told S&P Global Platts.

Read the Full ArticleQatar Orders Four LNG Carriers From China, its First Shipyard Deal with Beijing

State-owned Qatar Petroleum has ordered four new LNG carriers from Hudong-Zhonghua Shipbuilding Group Co. (Hudong), a unit of China State Shipbuilding Corp., its first LNG vessel deal with a shipyard from the Asian country.

Read the Full ArticleVenture Global LNG's Calcasieu Pass Said to be Nearing Completion

Venture Global LNG's Calcasieu Pass export terminal in Louisiana is nearing completion and will begin production within months, Chief Commercial Officer Tom Earl said Sept. 22 at the Gastech conference in Dubai.

Read the Full Article

Singapore-based Pavilion Energy is building an emission business that taps carbon offsets initially to drive decarbonization across the LNG value chain, its interim chief executive, Alan Heng said at the Asia Pacific Petroleum Conference.

"Until we can get to the point where we can mitigate [emission from] every single molecule [of LNG supplies], what is important is to find a way to offset it and supply what is deemed as carbon neutral LNG so as to allow market forces around these offsets to drive the improvements along the entire value chain," Heng said during a CEO conversation session with S&P Global Platts President Saugata Saha Sept. 27.

"Some efforts include taking carbon offsets from specific, high-quality suppliers that can be packaged with our LNG cargoes," he added.

Pavilion Energy, which is owned by Singapore's state-backed investment group, Temasek Holdings, was the first to import a carbon neutral LNG cargo to its home country in April.

That LNG cargo was delivered one year after Pavilion Energy launched a request for proposal calling on potential bidders to supply up to 2 million mt/year of LNG supplies to Singapore and jointly develop a methodology to measure greenhouse gas emissions tied to the cargoes to be supplied.

In November, Pavilion signed a deal with Qatar Petroleum's trading unit to buy up to 1.8 million mt/year of LNG for 10 years from 2023 that will be delivered to Singapore with a statement from the supplier specifying the greenhouse gas emissions tied to the cargoes, from wellhead right to the discharge port.

Its first carbon neutral LNG cargo drew on carbon credits on forestation projects in Peru and China certified by two recognized not-for-profit standard-setting bodies, Verified Carbon Standard (VCS) and Climate, Community and Biodiversity Standard (CCB).

"We undertook the import of the carbon neutral LNG cargo at our cost [because] it is important for the industry to recognize that we have the capability to do it," Heng said.

Gas to help in energy transition

Trading activity has also started to reflect concerns about a steep price trajectory for the winter months, with market participants, who would have typically sold their oil-linked term cargoes to benefit from high spot prices, adjusting to the winter contango and pulling back from spot purchases. JKM futures indicate January prices of nearly $18/MMBtu.

Pavilion Energy, which was named one of Singapore's first licensed term LNG importers, has ventured into Europe through acquiring the LNG assets there previously held by Spanish group Iberdrola.

The deal was completed last January. It encompassed long-term sale and supply contracts for around 4 million mt/year, access to regasification capacity at the Grain LNG terminal in the UK and in Spain as well as the Spanish-France border pipeline capacity.

In Europe and the US however, investments have ramped up on renewable energy capacity while financial institutions have pulled back support extended to LNG and natural gas projects.

Heng described Southeast Asia as one emerging "hot spot for energy transition" with "great opportunities for solar, wind and geothermal energy projects."

"Aside from these, there's still a need for gas [to] help in energy transition [by buffering] the intermittency of renewables."

Back in Singapore, Pavilion Energy is working with authorities to boost resilience in gas supply network to complement its home country's efforts in building solar energy capacity.

"Natural gas remains a fossil fuel but it is the cleanest fossil fuel we have [and] represents the best chance we have to help with the energy transition," Heng said.

Low-Carbon RNG Producer Clean Energy Fuels Says Enters LNG bunker Market

Clean Energy Fuels is making its first foray into the liquified natural gas bunker market with its contract to supply World Fuel Services with LNG to fuel two Jones Act Hawaiian container ships, Clean Energy Fuel said Sept. 21.

Read the Full ArticleBHP Cxplores LNG, Biofuels, Collaborates to Boost Greener Shipping

Global resources company BHP is tapping LNG's and biodiesel's potential as a marine fuel choice to advance sustainable shipping as the maritime industry explores a gamut of fuel options to meet its emissions cuts targets.

Read the Full ArticleVietnam to Start LNG Imports in 2022 as Key Step in Lowering Emissions, Energy Security

Vietnam aims to start importing LNG in 2022 and sees LNG among its solutions for lowering carbon emissions and ensuring the country's energy security, Vietnam's Minister of Industry and Trade Nguyen Hong Dien said.

Read the Full ArticleLNG Bunkers Promising Option Among Many Alternatives

LNG as a marine fuel presents a viable and immediate solution to expedite decarbonization as shipping explores other options like biofuels, ammonia and methanol to meet stricter environmental regulations, experts said at an industry event.

Read the Full ArticleTransparency Will Be Key to Growth of Carbon-Neutral LNG Market, Study Finds

The budding trade of carbon-neutral LNG cargoes could play an important part in determining the role of the fuel in the energy transition, but improved transparency about climate-warming emissions by LNG buyers and sellers will be a key component of developing a "robust and trusted" market, according to a new study out of Columbia University's Center on Global Energy Policy.

Read the Full ArticleLNG Seen Having Key Role in Energy Transition Despite Record High Prices

Lack of investments and supply disruptions are helping drive LNG and natural gas prices to record highs but LNG is still expected to play a significant role in the energy transition, delegates at the 10th LNG Producer-Consumer Conference said Oct. 5.

Read the Full Article