Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Latin America is performing better than expected in the second half of 2021. Households and businesses are adapting quickly to living in a pandemic, and lockdowns are having much less of an impact on activity than anticipated. The metals and mining industries are expected to boom as countries across the world look to Latin America to acquire necessary minerals for ESG initiatives. In the energy sector, crude production reached a new record and producers are increasing output.

Published: August 20, 2021

Subscribe to start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

SUBSCRIBE TO THE NEWSLETTERS&P Global Ratings has increased their 2021 GDP growth projections for the major economies in Latin America to 5.9% from 4.9%, due to better-than-expected performance of the services sectors so far this year. Households and business are adapting quickly to living in a pandemic, and lockdowns are having much less of an impact on activity than anticipated.

However, S&P Global Ratings has lowered their GDP forecasts for 2022 for most economies in the region, as monetary policy normalization, fiscal tightening, and less predictable policy actions will slow the recovery.

S&P Global Ratings' long-term macroeconomic assumptions are unchanged from last quarter, at roughly 2.5%, due to low levels of investment.

The pandemic has hit the middle- and lower-income households the hardest, and increased social and political tensions will generate a high degree of policy uncertainty in the post-pandemic years. This could further dampen investment and lower long-term potential GDP growth.

Default, Transition, and Recovery: One Default In Latin America Brings The 2021 Global Corporate Tally To 53

The 2021 corporate default tally increased to 53 after one issuer from the emerging markets defaulted the week of July 22nd. The defaulter is Mexico-based financial services provider Alpha Holding S.A. de C.V.

Read the Full ReportLatin American Equities Post a Strong Second Quarter, as Economic Activity Starts to Bounce Back

What a difference a year makes. Latin American equities had a strong Q2, outperforming most regions, as the S&P Latin America BMI gained 15.7%. As of June 2021, the index had its best 12-month return since June 2007, gaining 46.6%.

More than a year after the COVID-19 pandemic wreaked havoc on the global economy and public health, the S&P Latin America 40 was one of the best regional performers, up 51% for the one-year period ending in June.

Latin America Industries Most and Least Impacted by COVID 19 from a Probability of Default Perspective

S&P Global Market Intelligence leveraged the PD Model Market Signals (PDMS) for a point-in-time view of credit risk in Latin America.

Read the Full ArticleThe divide between companies and industries that benefited from the crisis and suffered from structural shifts will widen as the U.S.’s approach to work and leisure further evolves. In LatAm, the recovery has been uneven across countries and sectors.

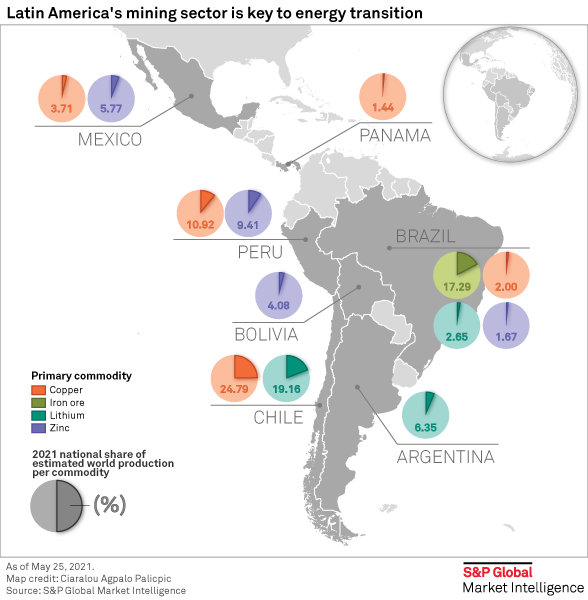

Latin America could be on the verge of a mining bonanza. Governments and businesses all over the world are rushing to cut their greenhouse gas emissions, and the region is a critical supplier of the minerals that underpin solar panels, wind turbines and electric vehicles.

But extracting those minerals is expensive and creates its own set of environmental and social consequences.

LatAm Steelmakers Push for Firm Decarbonization Agenda After Years of Planning

Latin American steel producers are evaluating decarbonization strategies to embark on a more declaratory sustainable agenda after decades of just making plans, the new executive director for the regional steel association, Alacero, said.

"Greater use of ferrous scrap, biomass and renewable sources are key for the regional steel decarbonization push. But clear and specific regulations and support from governments are just as important," Alejandro Wagner told S&P Global Platts in an interview.

Wagner said that access to renewable energy at competitive prices and public investment to develop disruptive technologies were necessary to continue reducing emissions.

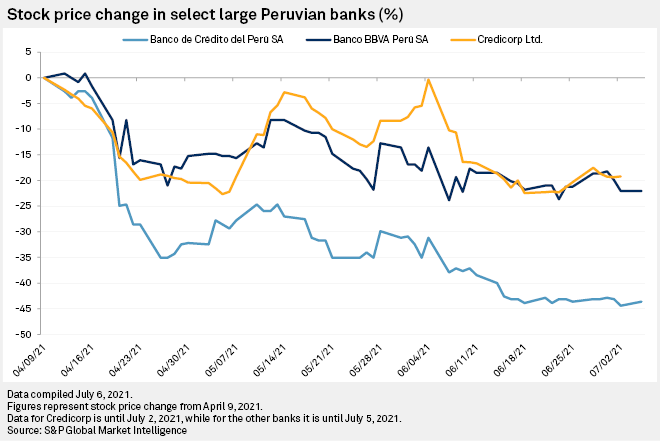

The shifting political winds in Latin America will be monitored closely by Spain's Banco Santander SA and Banco Bilbao Vizcaya Argentaria SA, which have come to rely on the region to offset weak profitability in their European businesses.

Peru has yet to declare a victor from its June 6 presidential election, but with attempts by right-wing candidate Keiko Fujimori to challenge the legality of left-wing outsider Pedro Castillo's narrow victory losing momentum, it appears to be a matter of time before the school teacher and union leader takes office.

Left-Wing Politics, Higher Taxes in Peru and Chile could Lead Miners Elsewhere

Left-wing nationalist politics and the prospect of higher taxes in Peru and Chile could divert the flow of mineral exploration and mine development spending to other countries, according to industry experts.

Read the Full ArticleLatin American Local Governments Face Financial Strains Despite Sovereign Aid

Latin American sovereigns provided financial assistance to local and regional governments (LRGs) in 2020 through extraordinary transfers, debt relief measures, and additional loans to diminish the pandemic's harsh impact.

Read the Full Report

Crude production by private operators in Mexico reached a new record in June as state oil company Pemex struggles to stop the decline of its own output, official data shows.

Independent exploration and production companies increased their crude oil output to little under 70,000 b/d in June, the largest reading to date, data from the National Hydrocarbons Commission showed July 22.

The increase came as Eni, Petrofac and Hokchi Energy, the three largest producers, raised their output, the data showed. The companies together account for almost 50,000 b/d, the data shows.

Mexican Tax Authorities Suspend Ferromex, KCS Imports of Fuel, Chemicals

Mexican tax authorities on July 19 announced they had suspended 58 companies, including the country's largest railroad operator Ferromex, and the local unit of US railroad operator Kansas City Southern, from importing specific products into the country, like chemicals and refined products.

Read the Full ArticleNew Fortress Begins Commercial Operations at LNG Receiving Terminal in Mexico

New Fortress Energy, a growing player in supplying LNG to power plants and industrial customers in the Caribbean and Latin America, has begun commercial operations at a receiving terminal on Mexico's Pacific Coast, the company said July 14.

Read the Full Article

Brazil's soybean exports fell in July as the hoarding of stocks by farmers raised supply concerns, sources told S&P Global Platts Aug. 3, which is expected to support demand for US beans.

Brazil, the world's top soy supplier, exported 8.66 million mt of soybeans in July, down from 11.12 million mt in June and from 9.95 million mt in July last year, the country's Secretariat of Foreign Trade, or Secex, said in a report Aug. 2.

Daily export shipments averaged 40,000 mt lower on the year at 393,897 mt, Secex said in the report.

Soybean exports over January-July were estimated at 66 million mt, down 3% on the year, the data showed.

With a delayed harvest in the current marketing year 2020-21 (February-January), Brazil's soy exports in June and July had been expected to emulate the record levels of April and May, but the reluctance of oilseed farmers to sell their stocks since early June has put the brakes on the country's exports.

Deja Vu for Brazilian Soybean and Corn Farmers Amid Historic Drought

In 2021, Brazil—the world's major soybean and corn supplier—is facing one of its most severe droughts for 90 years, according to the US Department of Agriculture, threatening a repeat of the disruption to the growing and harvesting seasons.

Read the Full ArticleBrazil's Parana 2020-21 Second Corn Output Cut to 6.1 Million mt from 9.8 million mt

Second corn production estimate in the Brazilian state of Parana – the second-largest producer of the cereal – has been cut to 6.11 million mt in 2020-21 from the previous estimate of 9.82 million mt, Parana's state agriculture department DERAL said in a report July 29.

Read the Full Article

Univision Communications Inc. is gearing up for the 2022 launch of its two-tiered, aggregate streaming service, and the Spanish-language programmer has big ambitions.

"Our vision for the offering is to grow significantly over the next three years and offer more Spanish-language content than any other streaming service globally," Pierluigi Gazzolo, president and chief transformation officer at Univision, said in an emailed interview with S&P Global Market Intelligence.

Televisa Makes 'Pure Play' Broadband Move in Mexican Market

Grupo Televisa SAB's recently announced decision to merge its content unit with Univision will create a Spanish-language content giant and leave a very different company bearing the Televisa name in Mexico: a heavily focused broadband and pay TV operation looking to expand its domestic market share.

Read the Full Article