Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

As vaccines are rolled out at an increasing pace, activity rebounds, and the light at the end of the COVID-19 crisis tunnel becomes brighter, thoughts have turned to the shape and speed of the recovery. Recently, discussions have focused on the risk of rapidly rising inflation.

Market fears that overaggressive fiscal policies could stoke a return of too high inflation have pushed bond yields higher and led central banks to clarify their (for now, dovish) reaction functions. In some ways, these discussions harken back to the days when the central bank's job was seen as taking away the punch bowl before the party got started.

S&P Global Economics thinks inflation fears are overblown and that orderly reflation, around a return to sustainable growth, is a healthy development for both macro and credit outcomes. The recent rise in U.S. Treasury yields, and its spillover into corporate bond yields, indicates greater confidence in a sustained economic recovery, including a normalization of both market functioning and risk pricing. The risks relate to quick or uneven reflation and a reset in risk premia, which would hurt corporate entities at the lower end of the rating scale and some emerging markets.

Global Economic Outlook Q2 2021: The Recovery Gains Traction As Unevenness Abounds

The economic recovery from COVID-19 looks set to accelerate in mid-2021, particularly in the U.S. on the back of a massive fiscal stimulus plan, although a high degree of unevenness and uncertainty persists.

S&P Global Ratings has revised S&P Global Ratings’ 2021 global GDP growth forecast up by 50 basis points, to 5.5%, reflecting brighter prospects for North America, China, and India. 2020 growth was revised up as well.

Orderly reflation is a positive development for both the macroeconomy and credit, and U.S. inflation fears are overblown in S&P Global Ratings’ view; however, S&P Global Ratings is watching the fast rise in U.S. yields and the lack of convergence in vaccine rollouts, mobility restrictions, sector recoveries, and country growth prospects.

The economic data flow since S&P Global Ratings’ last report has been better than S&P Global Ratings expected into early 2021. Despite a longer and stronger wave of COVID infections in late 2020 (mainly in the West, as East Asia and Australasia continued their impressive outperformance in containing the pandemic), fourth-quarter GDP numbers came in almost universally above S&P Global Ratings’ forecast.

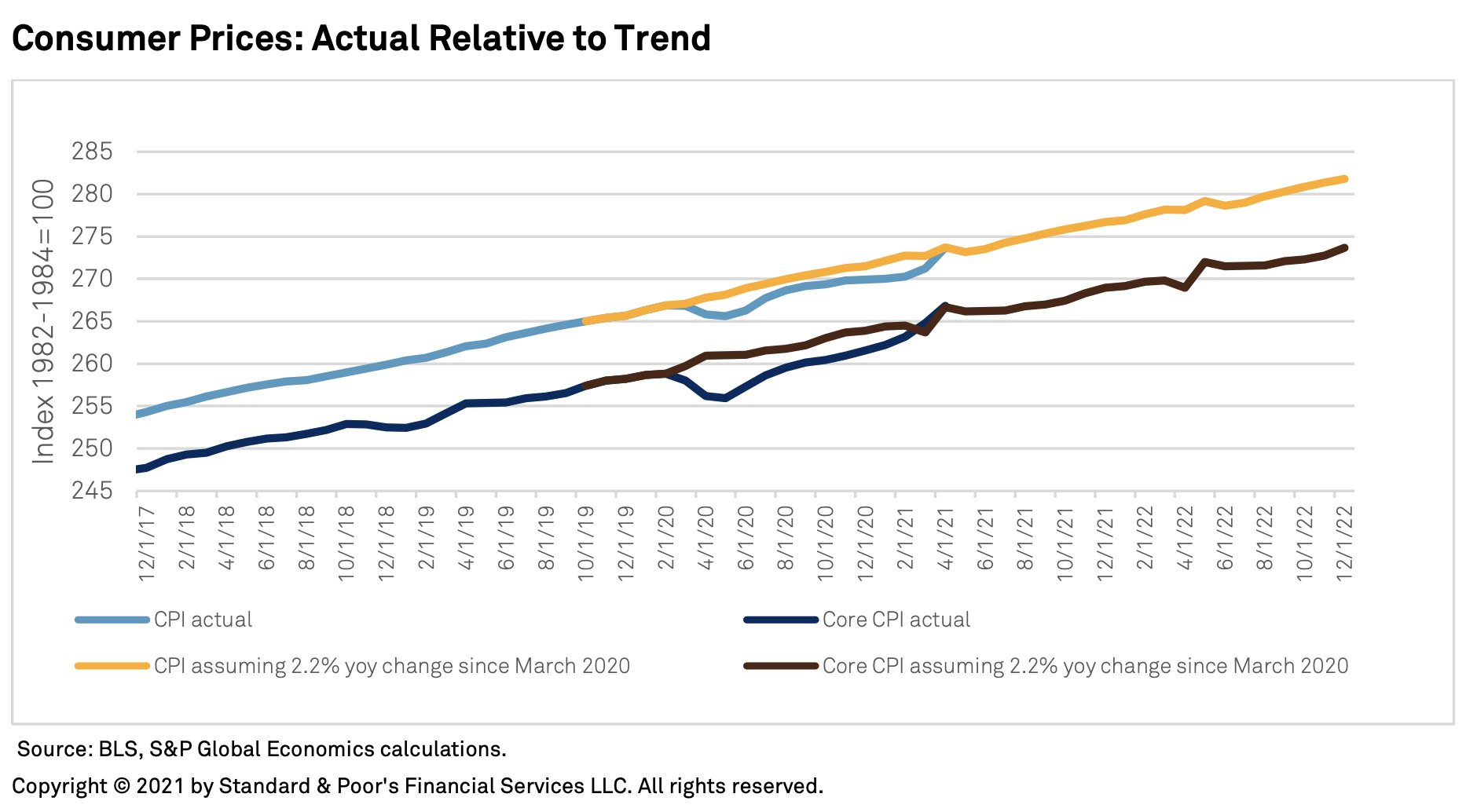

Watching the jump in April consumer prices at first blush was unnerving. Headline CPI topped 4.2% year-over-year (a 13-year high) and core CPI reached 3.0% year-over-year (a twenty-five-year high). In contrast to much of the market commentary, we were not surprised. Indeed, we expected to see a spike in inflation as the U.S. economy climbs the acceleration ramp onto the superhighway, as GDP jumped 6.4% in the first quarter and we expect a surge of 11.3% in the second quarter fueled by a, faster vaccination rollout and reopening schedule on top of sizable savings and pent-up demand.

U.S. Markets See Inflationary Ghosts; Macroeconomic Signs Disagree

As the U.S. economy looks set for its best year of growth since Beverly Hills Cop and the original Ghostbusters were battling for box-office dominance (that was 1984, for you young'uns), some financial market commentators are suddenly convinced that spiraling inflation is on the horizon—and that the Federal Reserve will be forced to tighten monetary policy sooner than it would like.

S&P Global Ratings disagrees.

Economic Outlook U.S. Q2 2021: Let The Good Times Roll

Although a blanket of snow covered much of the U.S. this winter, the country's economy has warmed. Signs show that a strong recovery, albeit delayed, is starting to take hold as strengthening sentiment readings indicate that people are ready to let the good times roll.

Read the Full Report

The Fed's current monetary policy stance is sufficiently accommodative, evidenced by deviations of the shadow federal funds rate from a policy rule estimated over a period of relative macroeconomic stability. This contrasts with the immediate aftermath of the Great Recession when policy was not sufficiently accommodative.

Forward guidance appears to be an effective mechanism to help stabilize markets.

S&P Global Ratings expects the Fed to sustain its accommodative policy over the near term. Tapering of asset purchases is likely to begin in 2022 and policy rate liftoff should occur in 2023 once maximum employment is achieved and inflation reaches 2% and is on track to moderately exceed 2% for some time.

U.S. Recovery Could Be Upended if Fed's Bet On 'Transitory' Inflation Proves Wrong

Inflation is on track to rise to levels not seen in 14 years and the Federal Reserve is betting heavily that the stay at these heights will be brief.

Read the Full ArticleU.S. Credit Markets Poised for a Bumpy Ride When Fed Eventually Tapers QE

Borrowing costs are rising for U.S. companies that gorged on debt during the COVID-19 pandemic, yet support from the Fed's liquidity programs means that for now, credit rating upgrades are more likely than downgrades.

Read the Full ArticleInvestors Flood Into Inflation-Protected Bonds as Fed Lets Economy Run Hot

Record amounts of money continue to pour into inflation-protected government bonds despite deeply negative yields and no guarantee for just how hot the Federal Reserve will let the post-pandemic economy run before raising interest rates.

Read the Full Article

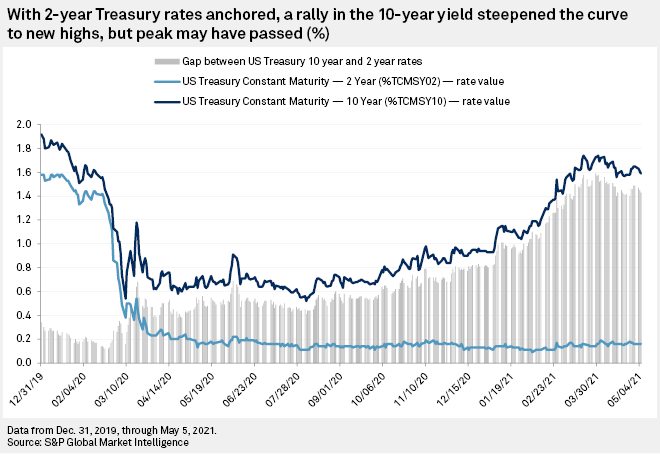

A stagnant U.S. government bond market in the face of a warming economy in recent days has fixed-income analysts wondering if the peak in yields has already come and gone.

Less than a month ago, analysts expected record supply and rapidly improving economic data to push the 10-year Treasury yield to 2% for the first time since July 2019. The benchmark 10-year yield serves as both a broad indicator of investor confidence and a proxy for mortgage rates.

Treasury Yields Plunge as Bond Markets Shrug off Inflation Expectations

The Federal Reserve's grand experiment to let inflation run above 2% has begun to play out in government bond markets and the yield response so far seems to be defying expectations.

Read the Full ArticleBond Market Braces for Treasury Yield Surge Following Record Auctions

Government bond yields could surge to their highest levels since January 2020 as Treasury begins to this week to auction off a record amount of supply.

Read the Full Article10-Year Treasury Yield Climbs Toward 2% with Few Reasons to Knock It Down

The benchmark 10-year Treasury yield is trading at its highest level since January 2020 and there are only a few valid arguments for a looming retreat.

Read the Full Article

The average price at which U.S. leveraged loans entered the secondary trading market jumped for the second consecutive month in January amid extremely strong conditions in the segment.

The average break price hit 100.34% of par in January, from 99.91 in December, according to LCD, with a wave of loan repricing transactions gripping the market as investor demand in the floating-rate asset class soared and the share of loans in the secondary priced at par or better reached its highest point since the start of the market turmoil, just before the onset of the COVID-19 pandemic in early March.

Leveraged loan issuance was extremely strong to start off the new year, with the volume of new institutional term loans allocating to the secondary reaching $29.4 billion, up from $26.3 billion in December.

Leveraged loan, High Yield Investors Weigh Push/Pull of Inflation

Inflation has not been a lead story in the U.S. financial press for many years. But with the Treasury yield curve steepening, commodity prices rising and stimulus money filling consumer pockets, it is now a front-page topic.

Read the Full ArticleLeveraged Loan Issuer Earnings Rebound in Q4'20, Further Easing Debt Ratios

U.S. leveraged loan issuers regained operational altitude heading into 2021, after the sector last fall pulled out of the steep nosedive for earnings through the early months of the COVID-19 pandemic, earnings data show.

Read the Full ArticleDefaults Edge Higher; Credit Quality a Concern

Rising Treasury yields and the rollout of $1.9 trillion in fiscal stimulus bolstering the corporate outlook has, after the struggles of 2020, provided a compelling tailwind for the floating-rate leveraged loan asset class.

Read the Full Article

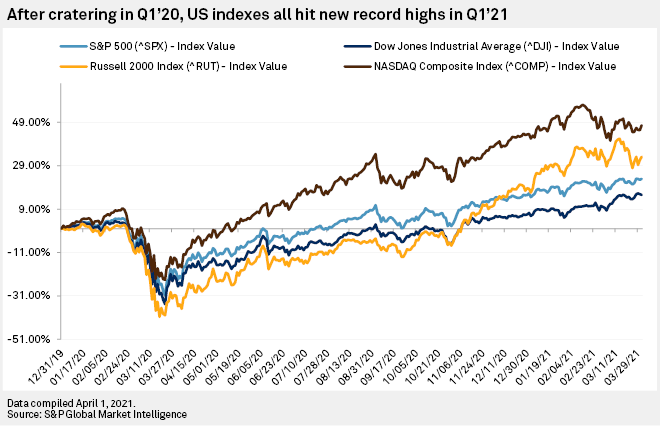

U.S. stock markets reached dizzying highs in the first quarter of 2021 in stark contrast to the same period in 2020 when the COVID-19 pandemic pushed equities to gut-wrenching lows.

"Within about a one-week window in March [2020], traders collectively realized that we would have a deep recession through the middle of the year at least, but once we reached the summer and the infection numbers improved, traders then rushed back the other way to bet on a coordinated 'reopening trade,'" said Matthew Weller, global head of research at GAIN Capital, in an interview.

That reopening trade came into full view in the first quarter of 2021, which served as a counterweight to the first quarter of 2020 when lockdown measures were put into place and equities quickly dipped.

Concerned About Inflation? Here’s a Tip

The newly launched S&P GSCI (U.S. 10-Year TIPS) TR was designed with inflation protection in mind. This index takes the renowned broad commodity market benchmark, the S&P GSCI, and aims to add boosted return potential from an exposure to on-the-run U.S. 10-Year Treasury Inflation-Protected Securities (TIPS).

Read the Full ArticleThe Essential Podcast, Episode 35: Building Blocks of the Real Economy — Thirty Years of the GSCI

Thirty years is an eternity in market terms, particularly if the market in question is the commodities market. Fiona Boal, Global Head of Commodities and Real Assets for S&P Dow Jones Indices, joins the Essential Podcast to talk about the 30th anniversary of the GSCI, supercycles, the energy transition, and the idiosyncratic nature of commodities markets in general.

Listen to the Podcast

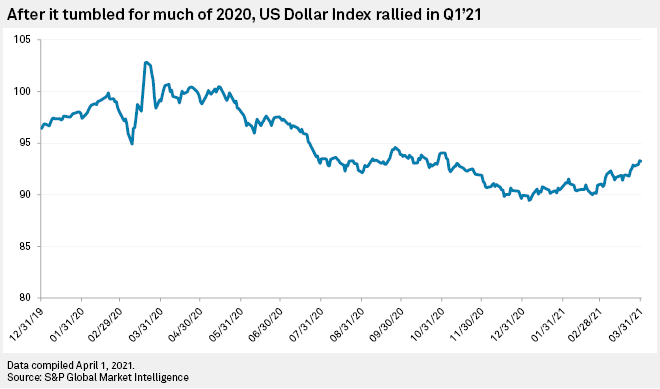

After three consecutive quarters of losing ground to all its G10 peers, the U.S. dollar rallied in the first quarter of 2021 on climbing bond yields and expectations for strong U.S. economic growth.

Analysts expect the dollar to rally in the coming months as bond yields continue to rise and U.S. vaccinations climb in support of the broader domestic economy.

The dollar "will be king in 2021," said Andreas Steno Larsen, chief global strategist with Nordea Research, in an interview.

S&P Global Ratings views the recovery in commodity prices worldwide as generally good news for emerging markets. However, a fast rise in commodity prices, in particular oil, brings important challenges for some of these economies. Commodity prices have surged worldwide over the last few months on the back of governments' pandemic-related stimulus policies and supply constraints.

Commodities in Upside Pressure Push, Not Supercycle: Analysts, Economists Say

Commodities including metals aren't experiencing a supercycle, but a short period of upside price pressure backed by pandemic-driven government stimulus, analysts and economists said in a series of commodities webinars this week.

Growing demand for renewable energy will nonetheless be a fundamental driver of metals markets in the green industrial revolution now starting, they concurred.

"There's a massive wall of money and momentum in the US economy driving demand for commodities," said Andrew Busch, economist with BPI, speaking on a webinar organized by Commodities People.