Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

In CRISIL Research's May 26, 2020, GDP outlook, India’s worst recession in decades was at hand. Come September, CRISIL now foresees it contracting further by a rate not seen since the 1950s. GDP growth in fiscal 2021 will dive deeper as risks coalesce.

Published: October 8, 2020

CRISIL cut through the clutter to analyse four important metrics related to the pandemic – the number of daily cases reported, the rate of recoveries, the state-wise patterns, and the rate of growth in new cases (India and state-wise).

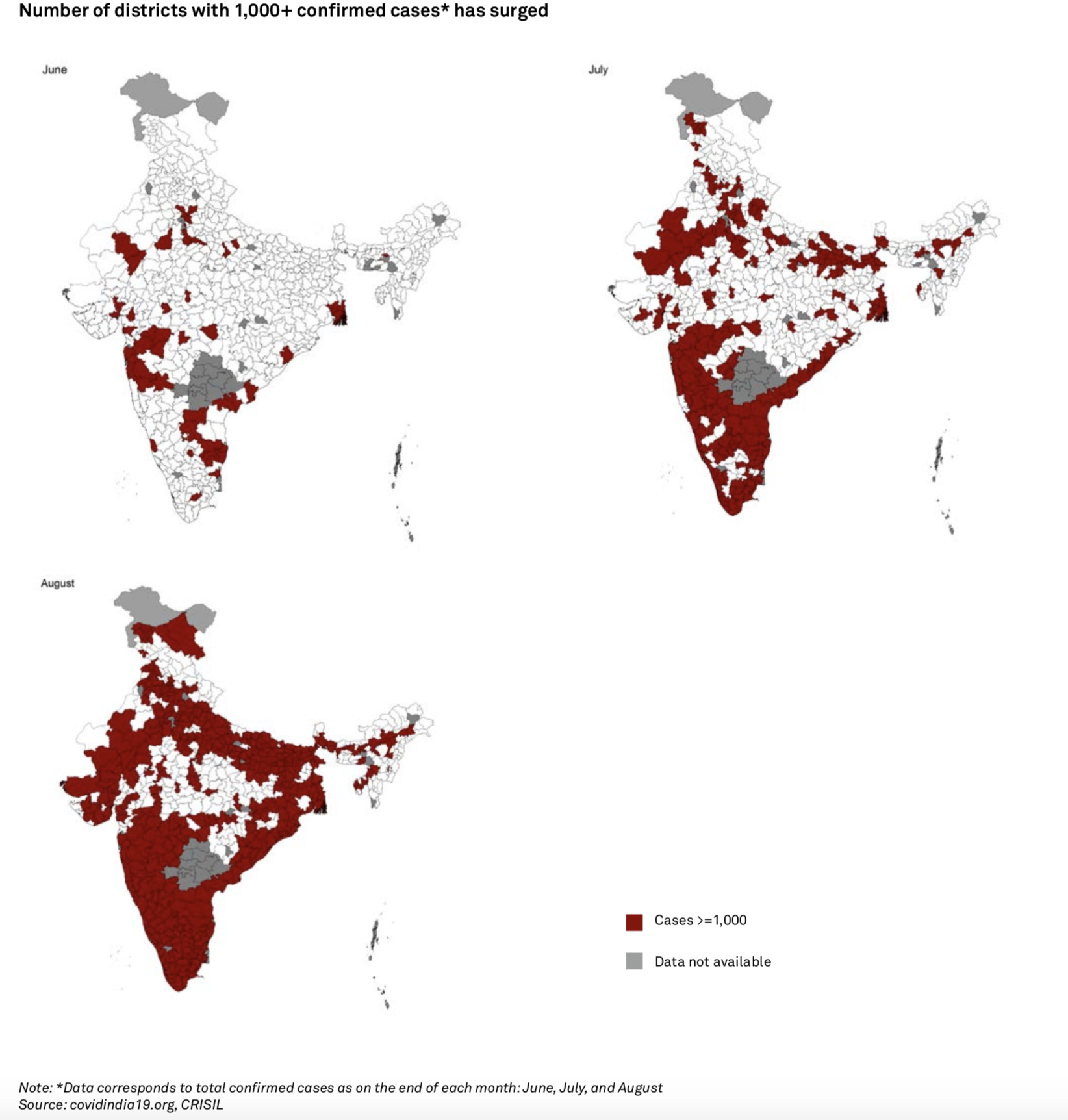

The number of confirmed Covid-19 cases in India crossed 42 lakh as on September 7. In the last week of August, India reported ~5 lakh new cases and the highest numbers of new cases globally. Early predictions by various agencies of the number of cases in India peaking in the early part of the July-September quarter have come to a naught. Even if recoveries have risen to 77.3% as on September 7, the daily rise in cases continues to surpass the daily number of recoveries. Globally, too, the virus is rearing its head again, with Japan, South Korea, Europe and Hong Kong, seeing new cases lately.

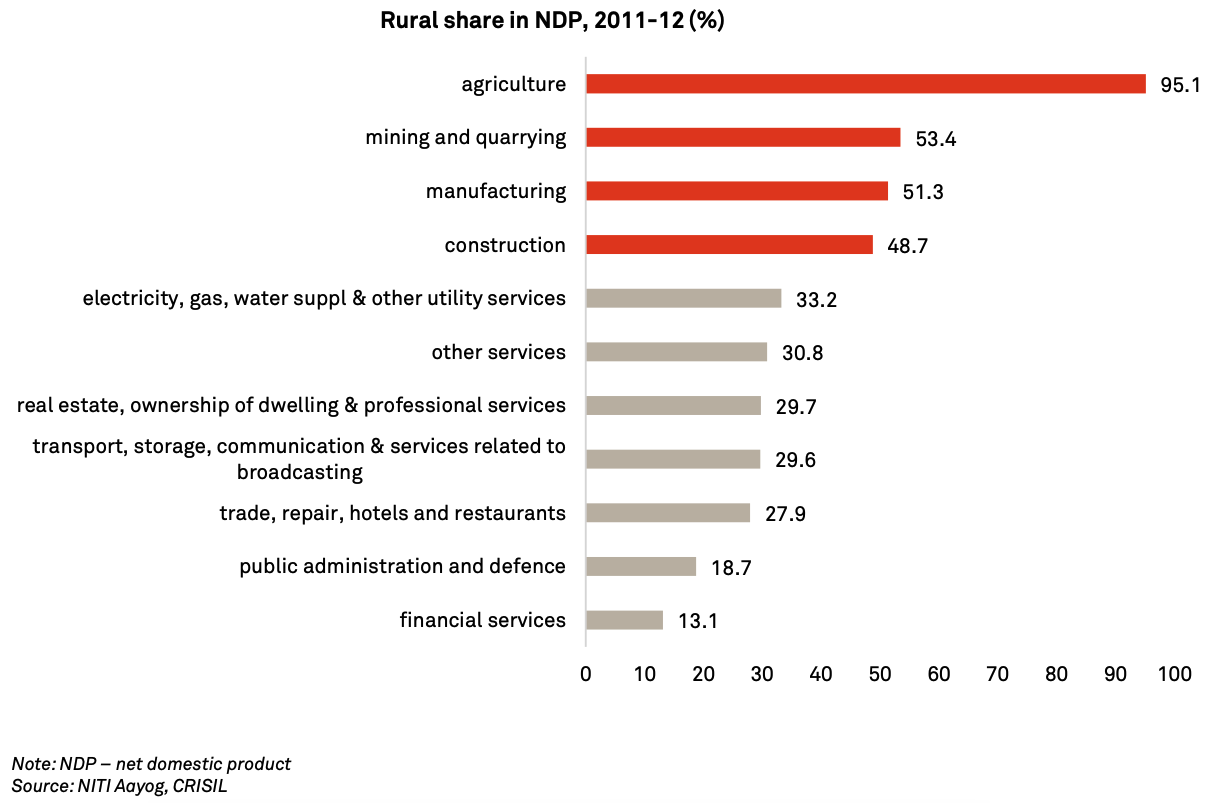

Agriculture was the only major sector that registered positive growth in the first quarter of fiscal 2021 – a sole bright spot. But that is only part of the rural story, as non- farm activities contribute a much larger chunk. As per NITI Aayog, agriculture’s share in the rural economy was only 39.2%. Hence, what happens to the non-farm sector is equally or more important.

Key Takeaways:

Private final consumption expenditure (PFCE), or consumption expenditure of households, and gross fixed capital formation (GFCF), or investments, are the largest and second largest demand side components of the Indian economy, respectively. Their shares in GDP in fiscal 2020 were 57.2% and 29.8%.

The pandemic only magnified the pre-existing weakness in private consumption and investments. While GFCF was falling even before the pandemic, PFCE growth turned negative for the first time, in the new (2011-12) GDP series. The fall in GFCF has been much steeper than that in PFCE. Despite some support from the rural economy, private consumption is expected to sink this fiscal. A rising number of cases in rural areas could complicate and delay return to normalcy. This means continued uncertainty about employment prospects and incomes.

Consumption of some services, especially contact- based such as travel, sports and entertainment will also remain muted till such time a Covid-19 vaccine is mass produced. High retail inflation at a time when incomes are falling, is a double whammy to disposable incomes.

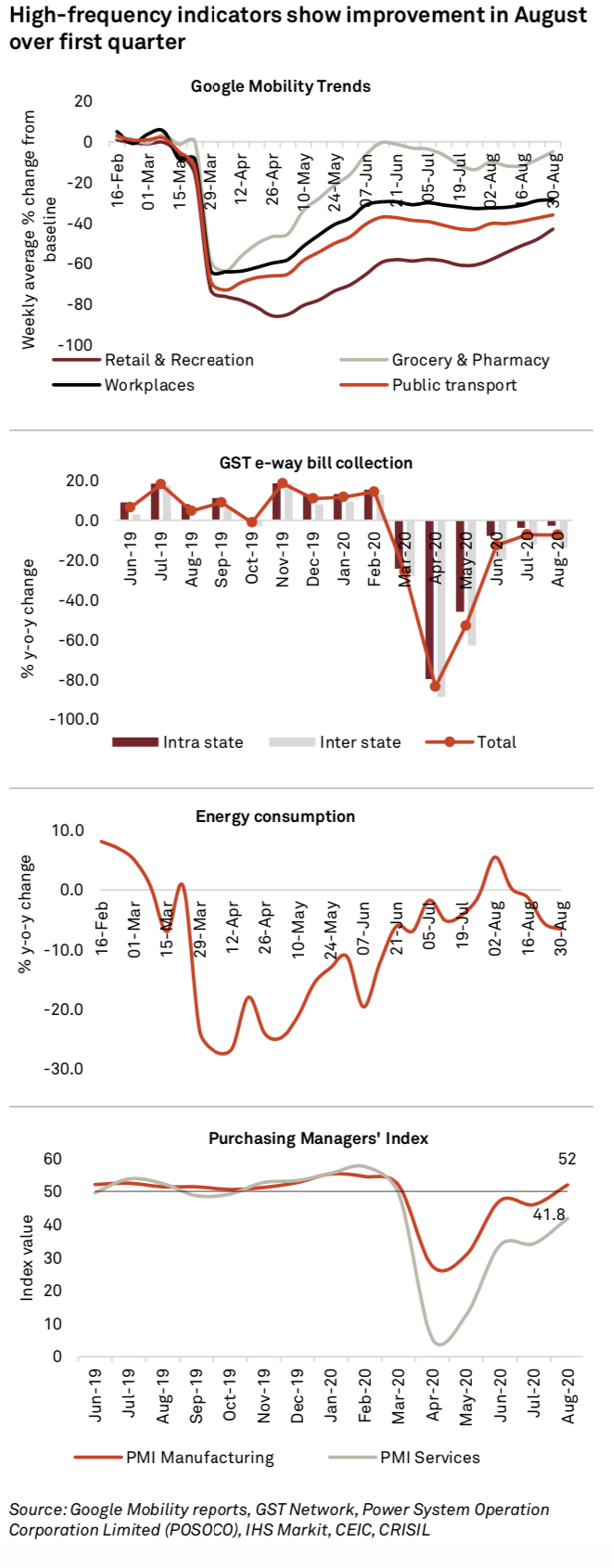

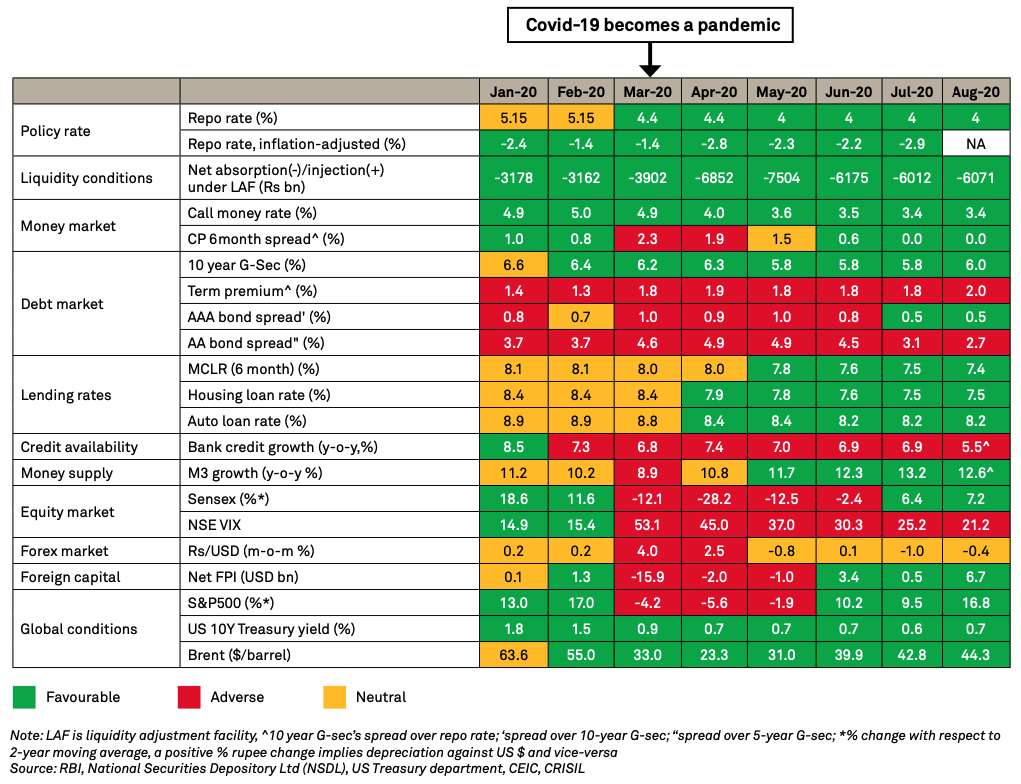

Monetary policy has done most of the heavy-lifting so far in supporting the economy. This was needed since financial conditions had seen a severe tightening in India and via spillovers from rest of the world. Recent months have shown that RBI’s monetary easing, coupled with improving global sentiment, helped ease financial conditions. However, some segments of the financial sector are facing growing stress fundamentally, which could bite back once the excessively easy monetary policy normalises.

Key Takeaways:

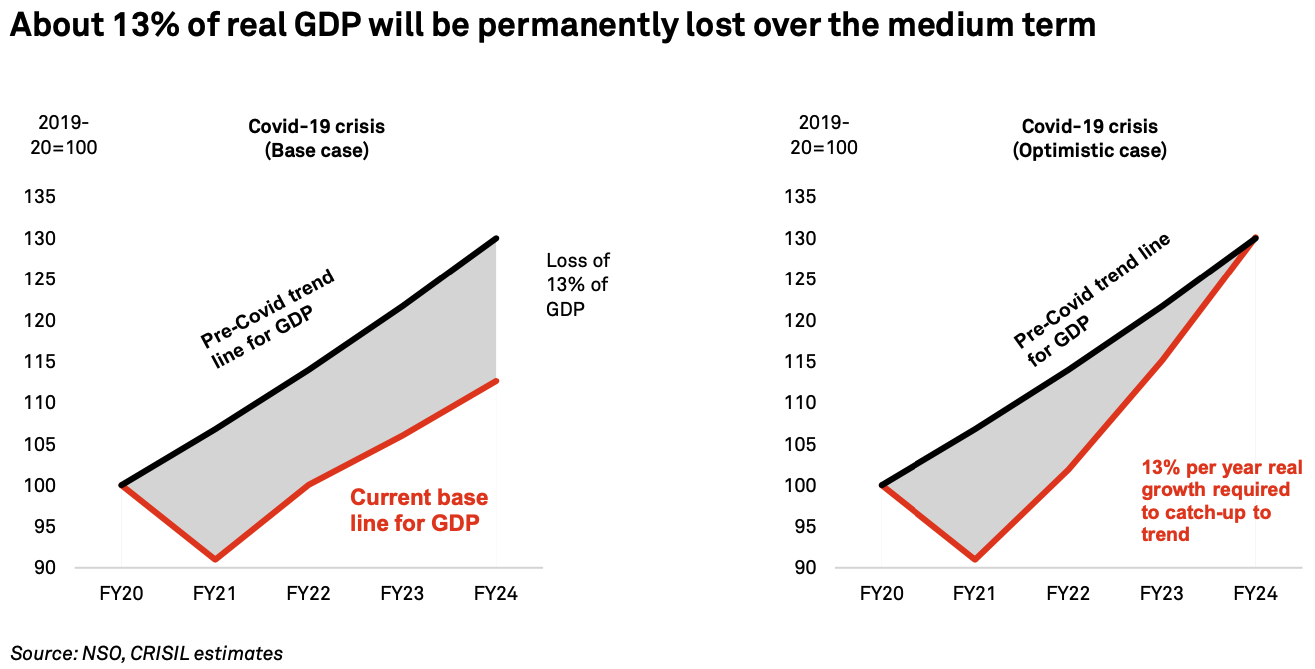

S&P Global foresees, on average, a 3% permanent hit to GDP in Asia-Pacific economies (ex-China and India) over the medium run. For India, however, we estimate the permanent loss at 13% of real GDP.

Key Takeaways: